A Richmond developer has gobbled up more than 900,000 square feet of suburban commercial real estate space in a $100 million transaction announced Thursday.

A Richmond developer has gobbled up more than 900,000 square feet of suburban commercial real estate space in a $100 million transaction announced Thursday.

In a deal that has been generating buzz for months, Lingerfelt Development acquired 14 suburban office buildings from Liberty Property Trust in and around Innsbrook.

“We are delighted,” said Alan Lingerfelt, principal of Lingerfelt Development. “It was a long and complicated transaction.”

Lingerfelt first considered the deal after Liberty said it wanted to sell much of its property in several markets, including Richmond.

“Liberty made an announcement about a year ago that it was going to start exiting some its suburban office products,” Lingerfelt said. “So we discussed it with them for six to eight months and finally closed on the deal [Thursday].”

The purchase is a huge boost to Lingerfelt’s portfolio and will make it one of the top dogs of local suburban office space.

The purchase is a huge boost to Lingerfelt’s portfolio and will make it one of the top dogs of local suburban office space.

“My son and I and together have bought and built about 1 million square feet,” Lingerfelt said. “This will take us up to about 2 million.”

The deal allows Liberty to carry out its plan of exiting the Richmond suburban office market and gives Lingerfelt a chance to strike while the market is still down.

Lingerfelt said the transaction was financed with the help of a lender, although he would not disclose the name. Lingerfelt said the space in the 14 properties is 98 percent leased and is all Class A.

Liberty Property, located just outside Philadelphia, is a publicly traded REIT that owns about 77 million square feet of real estate. It still has a few local office properties under its control, according to Lingerfelt.

Despite its exit from local office space, Liberty said in a news release that it would continue to invest locally in industrial space.

“We are seeking to decrease our exposure to suburban office properties,” Craig Cope, head of Liberty’s Virginia operations, said in a prepared statement. “Going forward we will focus on increasing our industrial footprint in the Richmond market.”

Lingerfelt and Liberty have a bit of a history.

Lingerfelt and Liberty have a bit of a history.

In 1995, Lingerfelt sold itself to Liberty. Alan Lingerfelt, now 56, then worked locally for Liberty for 12 years until he retired. He then re-launched Lingerfelt Development.

He said this is the second-largest transaction his company has carried out.

This Richmond deal is Liberty’s second huge transaction this week. On Wednesday it closed on a $124 million sale of 32 properties for 1.4 million square feet of space in Lehigh Valley, Pa.

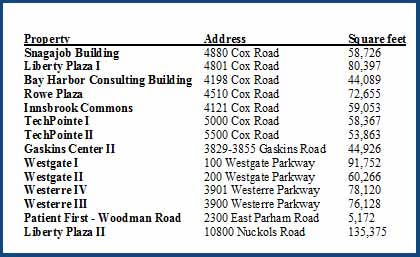

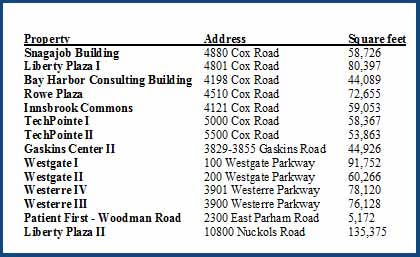

Here’s a list of the Richmond properties Lingerfelt purchased in the deal with Liberty:

A Richmond developer has gobbled up more than 900,000 square feet of suburban commercial real estate space in a $100 million transaction announced Thursday.

A Richmond developer has gobbled up more than 900,000 square feet of suburban commercial real estate space in a $100 million transaction announced Thursday.

In a deal that has been generating buzz for months, Lingerfelt Development acquired 14 suburban office buildings from Liberty Property Trust in and around Innsbrook.

“We are delighted,” said Alan Lingerfelt, principal of Lingerfelt Development. “It was a long and complicated transaction.”

Lingerfelt first considered the deal after Liberty said it wanted to sell much of its property in several markets, including Richmond.

“Liberty made an announcement about a year ago that it was going to start exiting some its suburban office products,” Lingerfelt said. “So we discussed it with them for six to eight months and finally closed on the deal [Thursday].”

The purchase is a huge boost to Lingerfelt’s portfolio and will make it one of the top dogs of local suburban office space.

The purchase is a huge boost to Lingerfelt’s portfolio and will make it one of the top dogs of local suburban office space.

“My son and I and together have bought and built about 1 million square feet,” Lingerfelt said. “This will take us up to about 2 million.”

The deal allows Liberty to carry out its plan of exiting the Richmond suburban office market and gives Lingerfelt a chance to strike while the market is still down.

Lingerfelt said the transaction was financed with the help of a lender, although he would not disclose the name. Lingerfelt said the space in the 14 properties is 98 percent leased and is all Class A.

Liberty Property, located just outside Philadelphia, is a publicly traded REIT that owns about 77 million square feet of real estate. It still has a few local office properties under its control, according to Lingerfelt.

Despite its exit from local office space, Liberty said in a news release that it would continue to invest locally in industrial space.

“We are seeking to decrease our exposure to suburban office properties,” Craig Cope, head of Liberty’s Virginia operations, said in a prepared statement. “Going forward we will focus on increasing our industrial footprint in the Richmond market.”

Lingerfelt and Liberty have a bit of a history.

Lingerfelt and Liberty have a bit of a history.

In 1995, Lingerfelt sold itself to Liberty. Alan Lingerfelt, now 56, then worked locally for Liberty for 12 years until he retired. He then re-launched Lingerfelt Development.

He said this is the second-largest transaction his company has carried out.

This Richmond deal is Liberty’s second huge transaction this week. On Wednesday it closed on a $124 million sale of 32 properties for 1.4 million square feet of space in Lehigh Valley, Pa.

Here’s a list of the Richmond properties Lingerfelt purchased in the deal with Liberty:

Good to see a local company take control of local space. They see the value in the property over the long term.