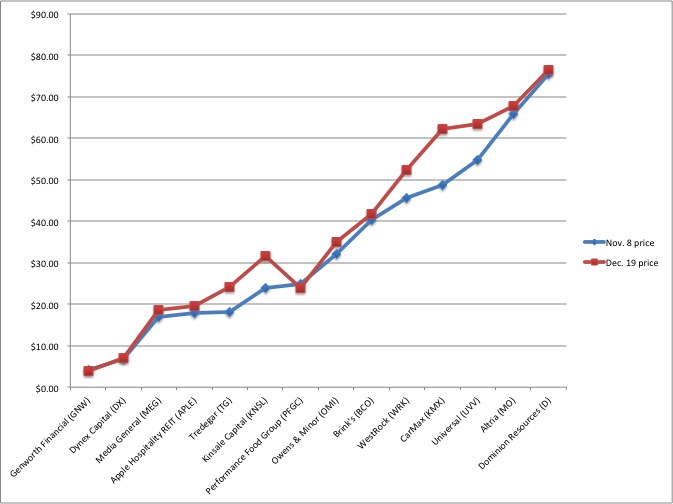

Stocks of the 16 non-bank companies headquartered in the Richmond market are up an average of 11 percent since Nov. 8. Not included: NewMarket ($396.71 to $426.64) and Markel ($856.07 to $896.34).

The U.S. stock market’s upward momentum since Election Day has brought most Richmond-based public companies along for the ride.

Stocks of the 16 non-bank companies headquartered in the Richmond market and traded on major indexes are up an average of 10.64 percent since Nov. 8, according to a BizSense tally. That’s compared to local bank stocks, which have risen an average of nearly 18 percent since the election and prompted local bankers to throw around the term “Trump Bump.”

Three big winners jump out from the local numbers, based on Monday’s closing bell.

Tredegar Corp., an industrial plastic and aluminum manufacturer headquartered in the Boulders office park in Chesterfield, moved the most since the election. Its stock closed Monday at $24.05, up 33 percent since Nov. 8.

CarMax share prices rose 28.1 percent, from $48.68 on Nov. 8 to $62.36 at the end of trading on Monday.

It was followed closely by Kinsale Capital, a local insurer already on a steady upward ride since going public this summer that has enjoyed an extra push since Trump’s victory. Its share price closed Monday at $31.54, up 31 percent since Election Day.

Not far behind is CarMax, thanks to a 28.1 percent bump in its share price – from $48.68 per share on Nov. 8 to $62.36 at the end of trading on Monday.

The only stragglers are Henrico-based insurer Genworth Financial and Goochland-based food distribution giant Performance Food Group, whose share prices have declined since Nov. 8, by 3.96 and 3.62 percent, respectively.

Share prices of Genworth, which has struggled with nine-figure losses in its long-term care insurance division and is being acquired by a Chinese conglomerate, had tanked in the days leading up to the election and hasn’t caught onto the “Trump Train.” It closed at $3.88 per share on Monday.

Performance Food Group, which returned to the stock market about a year ago after going private, fell nearly 18 percent between Nov. 8 and Dec. 1, bottoming out at $20.45. Since then, its stock price has jumped back up 17 percent, to close at $23.95 on Monday.

Two of Richmond’s biggest companies in terms of revenue, Altria and Dominion, have registered modest growth in their share prices during this stretch, after each experienced a downward spike for a few days after the election but have since ticked up steadily with the rest of the market.

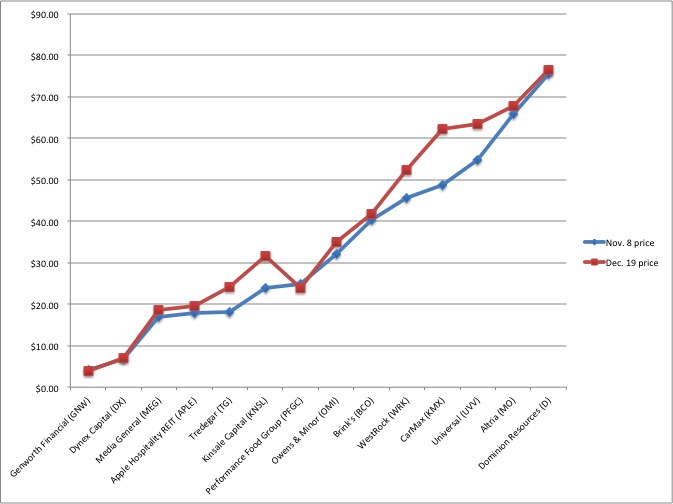

Stocks of the 16 non-bank companies headquartered in the Richmond market are up an average of 11 percent since Nov. 8. Not included: NewMarket ($396.71 to $426.64) and Markel ($856.07 to $896.34).

The U.S. stock market’s upward momentum since Election Day has brought most Richmond-based public companies along for the ride.

Stocks of the 16 non-bank companies headquartered in the Richmond market and traded on major indexes are up an average of 10.64 percent since Nov. 8, according to a BizSense tally. That’s compared to local bank stocks, which have risen an average of nearly 18 percent since the election and prompted local bankers to throw around the term “Trump Bump.”

Three big winners jump out from the local numbers, based on Monday’s closing bell.

Tredegar Corp., an industrial plastic and aluminum manufacturer headquartered in the Boulders office park in Chesterfield, moved the most since the election. Its stock closed Monday at $24.05, up 33 percent since Nov. 8.

CarMax share prices rose 28.1 percent, from $48.68 on Nov. 8 to $62.36 at the end of trading on Monday.

It was followed closely by Kinsale Capital, a local insurer already on a steady upward ride since going public this summer that has enjoyed an extra push since Trump’s victory. Its share price closed Monday at $31.54, up 31 percent since Election Day.

Not far behind is CarMax, thanks to a 28.1 percent bump in its share price – from $48.68 per share on Nov. 8 to $62.36 at the end of trading on Monday.

The only stragglers are Henrico-based insurer Genworth Financial and Goochland-based food distribution giant Performance Food Group, whose share prices have declined since Nov. 8, by 3.96 and 3.62 percent, respectively.

Share prices of Genworth, which has struggled with nine-figure losses in its long-term care insurance division and is being acquired by a Chinese conglomerate, had tanked in the days leading up to the election and hasn’t caught onto the “Trump Train.” It closed at $3.88 per share on Monday.

Performance Food Group, which returned to the stock market about a year ago after going private, fell nearly 18 percent between Nov. 8 and Dec. 1, bottoming out at $20.45. Since then, its stock price has jumped back up 17 percent, to close at $23.95 on Monday.

Two of Richmond’s biggest companies in terms of revenue, Altria and Dominion, have registered modest growth in their share prices during this stretch, after each experienced a downward spike for a few days after the election but have since ticked up steadily with the rest of the market.