The views expressed in Guest Opinions represent only those of the author and are in no way endorsed by Richmond BizSense or any BizSense staff member.

Q: I’m turning 45 this year and the reality is hitting me that I am about halfway through my working career. I have $275,000 saved in a 401(k) plan and another $125,000 in a traditional IRA. Going forward, I plan to save the maximum amount in my 401(k) every year. Am I on track to retire at age 65?

Q: I’m turning 45 this year and the reality is hitting me that I am about halfway through my working career. I have $275,000 saved in a 401(k) plan and another $125,000 in a traditional IRA. Going forward, I plan to save the maximum amount in my 401(k) every year. Am I on track to retire at age 65?

Sincerely,

Cresting the Hill

Dear Cresting,

By midlife, everyone should schedule an annual physical with their doctor and routinely assess the state of their financial health. With regular retirement checkups, you can make small course corrections now rather than waiting until a small problem has ballooned beyond your control. I would need additional background information to address your specific situation in detail, but I can share some helpful rules of thumb.

It’s best to measure your progress in after-tax dollars. When the time comes for you to pull money out of your 401(k) and traditional IRA, you will have to pay taxes on this money. By subtracting 30 percent from your current retirement plan total, you are left with $280,000.

Your progress toward retirement is entirely based on the standard of living to which you’ve become accustomed. So if your friends call you “Gucci” now, you probably need to accelerate your retirement savings plans. You can quickly measure your standard of living by starting with your income and subtracting savings and taxes. If you make $85,000, save $10,000, and pay taxes of $10,000, your standard of living is roughly $65,000.

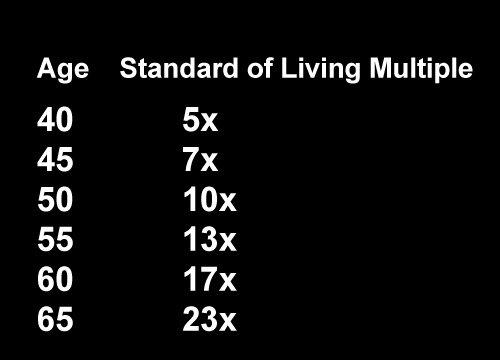

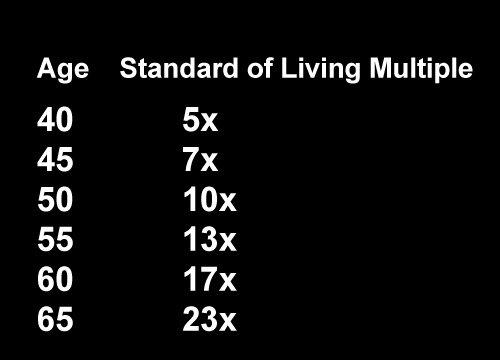

By age 45, you should have seven times your standard of living. So if your standard of living is $65,000, your after-tax retirement savings should be just over $455,000. If you expect to receive an inflation adjusted pension benefit of $20,000 a year, subtract this amount from your current standard of living. So at $45,000 ($65,000 minus $20,000), your target retirement savings at age 45 should be $315,000 in after-tax dollars.

You can retire in comfort when you have saved 23 times your income needs. At this point you can begin to live off 4.36 percent of your savings, which is the percentage that can be safely withdrawn from a cost-efficient and diversified retirement portfolio without fear of outliving your savings. If you want to know “your number,” multiply your desired lifestyle by 23.

You can retire in comfort when you have saved 23 times your income needs. At this point you can begin to live off 4.36 percent of your savings, which is the percentage that can be safely withdrawn from a cost-efficient and diversified retirement portfolio without fear of outliving your savings. If you want to know “your number,” multiply your desired lifestyle by 23.

Saving 15 percent of your income is a good benchmark simply to stay on track toward meeting your retirement goals. Getting serious about those goals means you must begin to think of yourself as a super saver. If you see that you need to catch up, you will want to target a 20 percent or 25 percent savings rate.

Financial checkups are key to a healthy and secure retirement. Your lifestyle and savings decisions will have the ultimate impact on your retirement goals. Find your inner super saver today.

The views expressed in Guest Opinions represent only those of the author and are in no way endorsed by Richmond BizSense or any BizSense staff member.

Q: I’m turning 45 this year and the reality is hitting me that I am about halfway through my working career. I have $275,000 saved in a 401(k) plan and another $125,000 in a traditional IRA. Going forward, I plan to save the maximum amount in my 401(k) every year. Am I on track to retire at age 65?

Q: I’m turning 45 this year and the reality is hitting me that I am about halfway through my working career. I have $275,000 saved in a 401(k) plan and another $125,000 in a traditional IRA. Going forward, I plan to save the maximum amount in my 401(k) every year. Am I on track to retire at age 65?

Sincerely,

Cresting the Hill

Dear Cresting,

By midlife, everyone should schedule an annual physical with their doctor and routinely assess the state of their financial health. With regular retirement checkups, you can make small course corrections now rather than waiting until a small problem has ballooned beyond your control. I would need additional background information to address your specific situation in detail, but I can share some helpful rules of thumb.

It’s best to measure your progress in after-tax dollars. When the time comes for you to pull money out of your 401(k) and traditional IRA, you will have to pay taxes on this money. By subtracting 30 percent from your current retirement plan total, you are left with $280,000.

Your progress toward retirement is entirely based on the standard of living to which you’ve become accustomed. So if your friends call you “Gucci” now, you probably need to accelerate your retirement savings plans. You can quickly measure your standard of living by starting with your income and subtracting savings and taxes. If you make $85,000, save $10,000, and pay taxes of $10,000, your standard of living is roughly $65,000.

By age 45, you should have seven times your standard of living. So if your standard of living is $65,000, your after-tax retirement savings should be just over $455,000. If you expect to receive an inflation adjusted pension benefit of $20,000 a year, subtract this amount from your current standard of living. So at $45,000 ($65,000 minus $20,000), your target retirement savings at age 45 should be $315,000 in after-tax dollars.

You can retire in comfort when you have saved 23 times your income needs. At this point you can begin to live off 4.36 percent of your savings, which is the percentage that can be safely withdrawn from a cost-efficient and diversified retirement portfolio without fear of outliving your savings. If you want to know “your number,” multiply your desired lifestyle by 23.

You can retire in comfort when you have saved 23 times your income needs. At this point you can begin to live off 4.36 percent of your savings, which is the percentage that can be safely withdrawn from a cost-efficient and diversified retirement portfolio without fear of outliving your savings. If you want to know “your number,” multiply your desired lifestyle by 23.

Saving 15 percent of your income is a good benchmark simply to stay on track toward meeting your retirement goals. Getting serious about those goals means you must begin to think of yourself as a super saver. If you see that you need to catch up, you will want to target a 20 percent or 25 percent savings rate.

Financial checkups are key to a healthy and secure retirement. Your lifestyle and savings decisions will have the ultimate impact on your retirement goals. Find your inner super saver today.

Great information. The chart on how much we should have saved by each age was helpful.

Most people are no where near this level of savings. Certainly, some people have not been as careful or responsible as they should have been, but some others simply have to save as much despite best efforts.

I think the idea of retirement will soon be considered a luxury. The government simply cannot afford the current Medicare and Social Security levels and they will go bust. The Baby Boomers will continue to use their overwhelming numbers to vote down any possible reforms.

Generation X and younger should prepare for some extreme times ahead.

anonymous, good points. I specifically left Social Security out of this analysis because of the uncertainty regarding future benefits. The Social Security system is scheduled to begin deficit spending in 2017. Most likely, they will fix the short fall by pushing the Normal Retirement Age out to age 70 for the younger generations and by limiting benefits for the higher earners. Valued in net present value dollars, Social Security typically represents about half a million dollars which can be the largest asset in a retirement portfolio. If you wanted to add Social Security back into the formula, you could apply… Read more »