The Richmond Christian Center filed Friday for Chapter 11. (Photo by Burl Rolett)

A Southside church filed yet another last-minute bankruptcy Friday to derail its lender’s second attempt at foreclosure in two months.

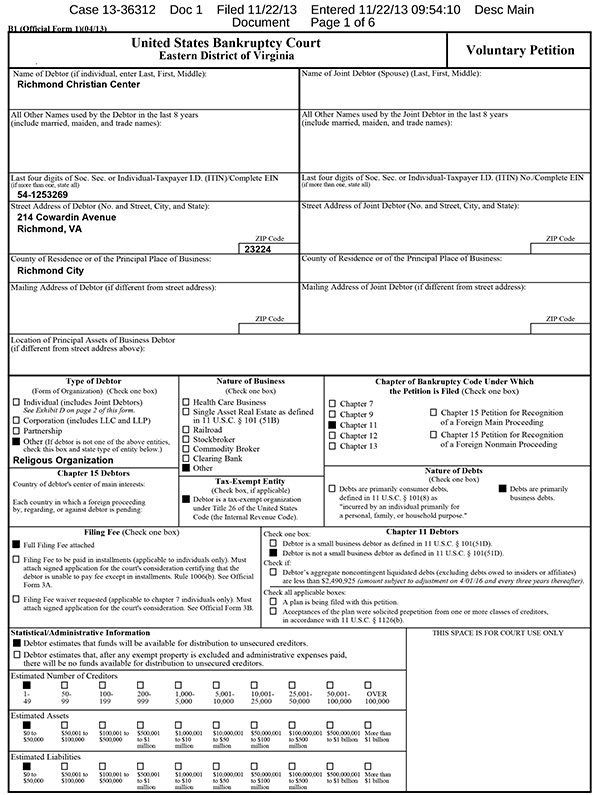

The Richmond Christian Center filed for Chapter 11 bankruptcy protection minutes before its 77,000-square-foot church at 214 Cowardin Ave. was scheduled to go to auction on the steps of the Richmond courthouse. The filing is an attempt to stave off foreclosure as the Christian Center works to sell the building.

“We just want it sold in a market sale,” said Kevin Funk, a DurretteCrump attorney representing the church in its bankruptcy case. “We think there’s equity in the property. We can make payments that are consistent with the debt load at this point, and we are confident that a bankruptcy court will give the opportunity to make those payments.”

Cushman & Wakefield | Thalhimer is marketing the church’s city-block-size property, as well as a roughly one-acre parcel across 19th Street and two surface parking lots on the other side of Wall Street. The asking price for the package is $5 million, according to a listing on the brokerage’s website.The filing marks the church’s second trip into the shelter of Chapter 11 since September. The RCC used the same strategy to push back a foreclosure auction scheduled for the 25th of that month. In October, a judge dismissed the case, citing a failure by the church to file proper documents.

Foundation Capital Resources, a Mississippi-based lender and REIT that specializes in financing for churches, has been seeking to foreclose on the property after RCC defaulted on a $4.4 million loan issued in September 2005.

Funk estimated that the loan has a remaining balance between $1.5 million and $1.9 million. The one-acre plot the church sits atop is assessed at $1.96 million, according to city records.

On Nov. 12, Foundation Capital Resources filed a lawsuit against RCC in Richmond Circuit Court, claiming it is in default on its loan. The lender is seeking a judgment of almost $1.6 million.

The RCC operated out of the building throughout the first foreclosure attempt but was locked out Nov. 7, according to Ron Page, an attorney who represented the Christian Center at the time. Phone messages left for the Christian Center were not returned by press time Friday, and the Cowardin Street building was locked.

Paul Campsen, a Norfolk-based attorney with Kaufman & Canoles, is representing the lender in the foreclosure process. He did not return a phone message seeking comment. Campsen and Dennis Lewandowski are representing the lender in the circuit court case as well.

David Lannetti and Christopher Stuart Colby of Norfolk law firm Vandeventer Black have served as substitute trustees for the lender throughout the foreclosure process.

Thalhimer brokers Isaac DeRegibus and John Myers are handling the listing. DeRegibus said he could not comment on the push to sell the property.

RCC’s latest bankruptcy filing lists its liabilities and assets between $0 and $50,000, although Funk said those numbers are not indicative of total assets or liabilities and include only a $30,000 unsecured debt owed by the church to law firm Harrell & Chambliss. Foundation’s debt, secured by the church property, was not included in the $50,000 figure.

Funk said the RCC plans to continue its ministry should the building sell or be foreclosed upon, although he was unaware of any firm plans for the congregation.

Pastor Stephen Parson could not be reached for comment.

The Richmond Christian Center filed Friday for Chapter 11. (Photo by Burl Rolett)

A Southside church filed yet another last-minute bankruptcy Friday to derail its lender’s second attempt at foreclosure in two months.

The Richmond Christian Center filed for Chapter 11 bankruptcy protection minutes before its 77,000-square-foot church at 214 Cowardin Ave. was scheduled to go to auction on the steps of the Richmond courthouse. The filing is an attempt to stave off foreclosure as the Christian Center works to sell the building.

“We just want it sold in a market sale,” said Kevin Funk, a DurretteCrump attorney representing the church in its bankruptcy case. “We think there’s equity in the property. We can make payments that are consistent with the debt load at this point, and we are confident that a bankruptcy court will give the opportunity to make those payments.”

Cushman & Wakefield | Thalhimer is marketing the church’s city-block-size property, as well as a roughly one-acre parcel across 19th Street and two surface parking lots on the other side of Wall Street. The asking price for the package is $5 million, according to a listing on the brokerage’s website.The filing marks the church’s second trip into the shelter of Chapter 11 since September. The RCC used the same strategy to push back a foreclosure auction scheduled for the 25th of that month. In October, a judge dismissed the case, citing a failure by the church to file proper documents.

Foundation Capital Resources, a Mississippi-based lender and REIT that specializes in financing for churches, has been seeking to foreclose on the property after RCC defaulted on a $4.4 million loan issued in September 2005.

Funk estimated that the loan has a remaining balance between $1.5 million and $1.9 million. The one-acre plot the church sits atop is assessed at $1.96 million, according to city records.

On Nov. 12, Foundation Capital Resources filed a lawsuit against RCC in Richmond Circuit Court, claiming it is in default on its loan. The lender is seeking a judgment of almost $1.6 million.

The RCC operated out of the building throughout the first foreclosure attempt but was locked out Nov. 7, according to Ron Page, an attorney who represented the Christian Center at the time. Phone messages left for the Christian Center were not returned by press time Friday, and the Cowardin Street building was locked.

Paul Campsen, a Norfolk-based attorney with Kaufman & Canoles, is representing the lender in the foreclosure process. He did not return a phone message seeking comment. Campsen and Dennis Lewandowski are representing the lender in the circuit court case as well.

David Lannetti and Christopher Stuart Colby of Norfolk law firm Vandeventer Black have served as substitute trustees for the lender throughout the foreclosure process.

Thalhimer brokers Isaac DeRegibus and John Myers are handling the listing. DeRegibus said he could not comment on the push to sell the property.

RCC’s latest bankruptcy filing lists its liabilities and assets between $0 and $50,000, although Funk said those numbers are not indicative of total assets or liabilities and include only a $30,000 unsecured debt owed by the church to law firm Harrell & Chambliss. Foundation’s debt, secured by the church property, was not included in the $50,000 figure.

Funk said the RCC plans to continue its ministry should the building sell or be foreclosed upon, although he was unaware of any firm plans for the congregation.

Pastor Stephen Parson could not be reached for comment.