The Wahoo war chest still reigns supreme in Virginia.

The University of Virginia endowment fund grew to $5.16 billion during fiscal 2013, up 7.9 percent from a market value of $4.78 billion in 2012, according to a study released this month by the National Association of College and University Business Officers.

That makes it by far the largest college or university endowment in the state and the 19th largest in the nation based on market value, the NACUBO report found.

Among top local schools, the University of Richmond’s endowment surpassed the $2 billion mark during 2013, reaching $2.02 billion for the year, up from $1.86 billion, according to the report. That’s an increase in value of 8.3 percent. UR’s fund was ranked 34th out of 849 schools covered by the report.

Virginia Commonwealth University saw its endowment skyrocket last year, but the figure comes with an asterisk.The market value of VCU’s endowment grew by almost 203 percent during fiscal 2013, compared with the previous year.

It was valued at about $1.32 billion at the close of fiscal 2013, making it the 61st largest on the NACUBO’s list. In 2012, the university reported an endowment of about $438 million.

A notation on the figure, however, explains the increase was due to a “re-designation of certain long-term investments held by related VCU entities as ‘quasi-endowments.’”

VCU executive director of university relations Pam Lepley said the school’s combined endowment includes funds managed by VCU and related entities, such as the VCU Health System, the Medical College of Virginia Foundation, the VCU School of Business Foundation and the VCU School of Engineering Foundation.

The $877.9 million increase in the endowment’s value last fiscal year occurred because governing boards within VCU deemed some health system and engineering foundation long-term investments to be “quasi-endowments,” following a yearlong analysis of financial structures and cash needs, Lepley said in an email.

An endowment fund’s market value growth takes into account investment gains or losses, withdrawals during the year for a school’s operations, capital expenses and financial aid, management fees, and contributions from donors.

In discussing the performance of their endowments, area universities prefer to put the emphasis on the rate of return of their investments, rather than total market value.

UVA spokesman McGregor McCance noted the university’s return of 13.4 percent on its investments in fiscal 2013. The university’s endowment is managed by the University of Virginia Investment Management Company.

“We’re pleased with the FY2013 return, but we firmly believe that it’s more important to focus on the long-term investment horizon,” McCance said in an email. “UVIMCO manages the endowment investments on an indefinite horizon, meaning decisions are made with an eye toward many, many years ahead.”

McCance said UVA’s annualized return for the 20-year period ending June 30 was 11.8 percent.

The University of Richmond’ reports a 12.6 percent rate of return on investments during the same period, spokeswoman Linda Evans said.

UR’s endowment is managed by Spider Management Company. Evans said the company does not discuss endowment specifics.

VCU’s investment return for the year was 10.89 percent compared with 0.59% for fiscal year 2012.

According to NACUBO, the U.S. colleges and universities surveyed had an average return of 11.7 percent, net of fees, for fiscal 2013 — a big jump from 2012’s average loss of 0.3 percent. The average change in market value was 10 percent, the study said. That figure also included a handful of Canadian universities.

NACUBO said that, on average, 8.8 percent of funds needed for each school’s operating budget come from their endowment. Many institutions also use the money to provide financial aid and to fund other student and faculty programs.

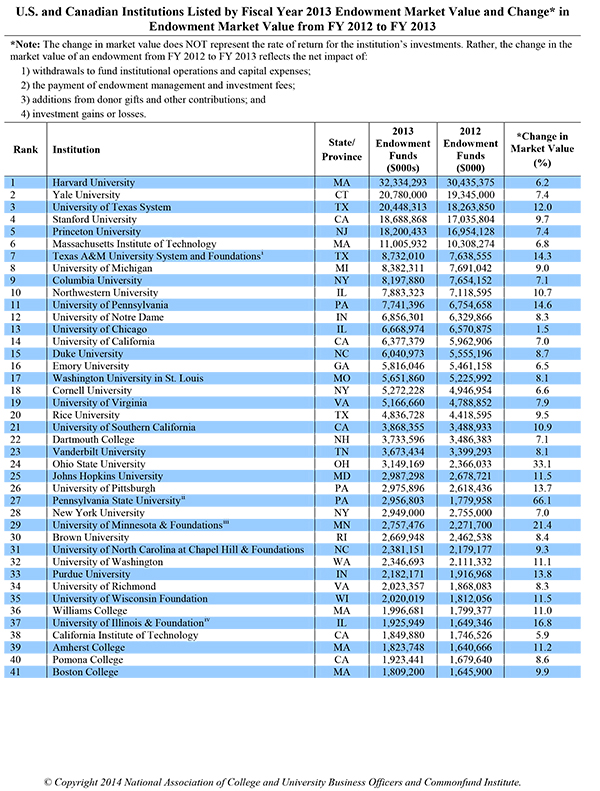

Harvard University’s $32.33 billion endowment led NACUBO’s list. Yale, the University of Texas, Stanford and Princeton rounded out the five largest endowments.

Here’s how some other Virginia schools fared:

• Washington and Lee University: 6.6 percent increase in market value, from $1.261 billion in fiscal 2012 to $1.345 billion in fiscal 2013.

• College of William and Mary and Foundations: 8.3 percent increase in market value, from $644.2 million to $697.7 million.

• Virginia Tech Foundation: 11 percent increase in market value, from $594.7 million to $660.3 million.

• Medical College of Virginia Foundation: 15.6 percent increase in market value, from $298.2 million to $334.6 million.

• Hampton University: 9.3 percent increase in market value, from $232.5 million to $254.1 million.

• Old Dominion University: 7.3 percent increase in market value, from $168 million to $180.4 million.

• Hampden Sydney College: 4.1 percent increase in market value, from $128.9 million to $134.2 million.

• Randolph-Macon College: 4.5 percent increase in market value, from $120.8 million to $126.3 million.

• James Madison University Foundation: 12.4 percent increase in market value, from $59.5 million to $66.9 million.

• George Mason University Foundation: 7.4 percent increase in market value, from $55.1 million to $59.2 million.

• Virginia State University: 13.9 percent increase in market value, from $24 million to $27.3 million.

• J. Sargent Reynolds Community College Foundation: 21.1 percent increase in market value, from $5.2 million to $6.3 million.

The Wahoo war chest still reigns supreme in Virginia.

The University of Virginia endowment fund grew to $5.16 billion during fiscal 2013, up 7.9 percent from a market value of $4.78 billion in 2012, according to a study released this month by the National Association of College and University Business Officers.

That makes it by far the largest college or university endowment in the state and the 19th largest in the nation based on market value, the NACUBO report found.

Among top local schools, the University of Richmond’s endowment surpassed the $2 billion mark during 2013, reaching $2.02 billion for the year, up from $1.86 billion, according to the report. That’s an increase in value of 8.3 percent. UR’s fund was ranked 34th out of 849 schools covered by the report.

Virginia Commonwealth University saw its endowment skyrocket last year, but the figure comes with an asterisk.The market value of VCU’s endowment grew by almost 203 percent during fiscal 2013, compared with the previous year.

It was valued at about $1.32 billion at the close of fiscal 2013, making it the 61st largest on the NACUBO’s list. In 2012, the university reported an endowment of about $438 million.

A notation on the figure, however, explains the increase was due to a “re-designation of certain long-term investments held by related VCU entities as ‘quasi-endowments.’”

VCU executive director of university relations Pam Lepley said the school’s combined endowment includes funds managed by VCU and related entities, such as the VCU Health System, the Medical College of Virginia Foundation, the VCU School of Business Foundation and the VCU School of Engineering Foundation.

The $877.9 million increase in the endowment’s value last fiscal year occurred because governing boards within VCU deemed some health system and engineering foundation long-term investments to be “quasi-endowments,” following a yearlong analysis of financial structures and cash needs, Lepley said in an email.

An endowment fund’s market value growth takes into account investment gains or losses, withdrawals during the year for a school’s operations, capital expenses and financial aid, management fees, and contributions from donors.

In discussing the performance of their endowments, area universities prefer to put the emphasis on the rate of return of their investments, rather than total market value.

UVA spokesman McGregor McCance noted the university’s return of 13.4 percent on its investments in fiscal 2013. The university’s endowment is managed by the University of Virginia Investment Management Company.

“We’re pleased with the FY2013 return, but we firmly believe that it’s more important to focus on the long-term investment horizon,” McCance said in an email. “UVIMCO manages the endowment investments on an indefinite horizon, meaning decisions are made with an eye toward many, many years ahead.”

McCance said UVA’s annualized return for the 20-year period ending June 30 was 11.8 percent.

The University of Richmond’ reports a 12.6 percent rate of return on investments during the same period, spokeswoman Linda Evans said.

UR’s endowment is managed by Spider Management Company. Evans said the company does not discuss endowment specifics.

VCU’s investment return for the year was 10.89 percent compared with 0.59% for fiscal year 2012.

According to NACUBO, the U.S. colleges and universities surveyed had an average return of 11.7 percent, net of fees, for fiscal 2013 — a big jump from 2012’s average loss of 0.3 percent. The average change in market value was 10 percent, the study said. That figure also included a handful of Canadian universities.

NACUBO said that, on average, 8.8 percent of funds needed for each school’s operating budget come from their endowment. Many institutions also use the money to provide financial aid and to fund other student and faculty programs.

Harvard University’s $32.33 billion endowment led NACUBO’s list. Yale, the University of Texas, Stanford and Princeton rounded out the five largest endowments.

Here’s how some other Virginia schools fared:

• Washington and Lee University: 6.6 percent increase in market value, from $1.261 billion in fiscal 2012 to $1.345 billion in fiscal 2013.

• College of William and Mary and Foundations: 8.3 percent increase in market value, from $644.2 million to $697.7 million.

• Virginia Tech Foundation: 11 percent increase in market value, from $594.7 million to $660.3 million.

• Medical College of Virginia Foundation: 15.6 percent increase in market value, from $298.2 million to $334.6 million.

• Hampton University: 9.3 percent increase in market value, from $232.5 million to $254.1 million.

• Old Dominion University: 7.3 percent increase in market value, from $168 million to $180.4 million.

• Hampden Sydney College: 4.1 percent increase in market value, from $128.9 million to $134.2 million.

• Randolph-Macon College: 4.5 percent increase in market value, from $120.8 million to $126.3 million.

• James Madison University Foundation: 12.4 percent increase in market value, from $59.5 million to $66.9 million.

• George Mason University Foundation: 7.4 percent increase in market value, from $55.1 million to $59.2 million.

• Virginia State University: 13.9 percent increase in market value, from $24 million to $27.3 million.

• J. Sargent Reynolds Community College Foundation: 21.1 percent increase in market value, from $5.2 million to $6.3 million.