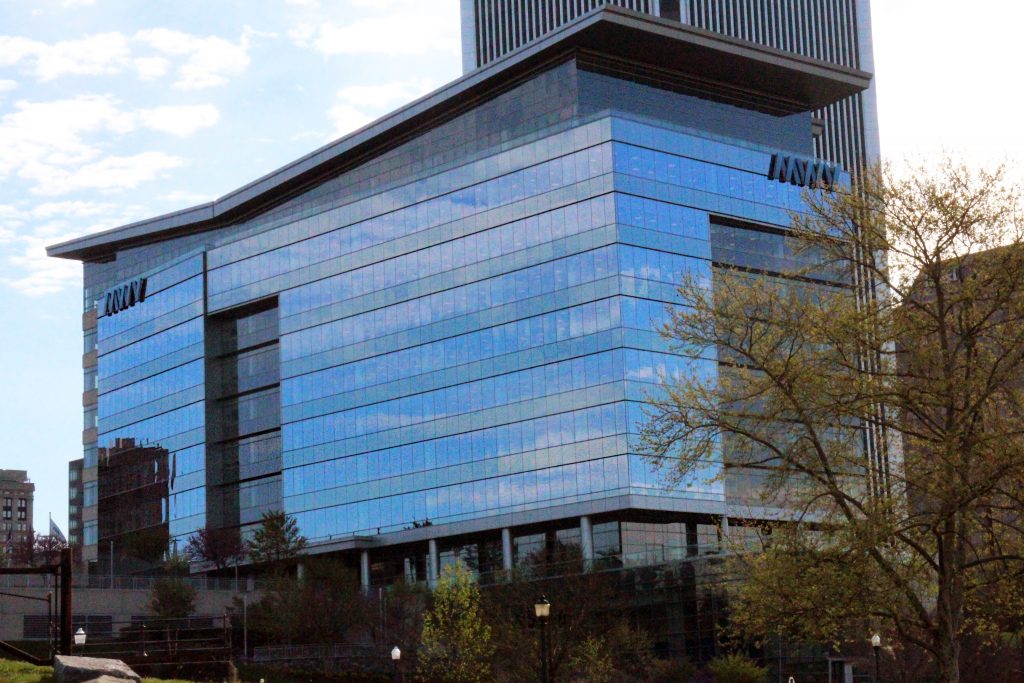

The MeadWestvaco building will continue to be the company’s headquarters after its merger with Rock-Tenn. Photo by Jonathan Spiers.

With overwhelming support from their respective shareholders, packaging giants MeadWestvaco and Rock-Tenn Co. are expected to finalize their merger as WestRock Company later today.

Five months after the merger was first announced, the final approvals needed to make WestRock a reality are set to be signed sometime today, clearing the way for the combined company to begin trading on the New York Stock Exchange, under the ticker symbol WRK.

The signatures follow the approval last week of more than 95 percent of the companies’ voting shareholders, representing at least 80 percent of their respective total shares. That approval was the last step needed in the process, said Tucker McNeil, a spokesman for Richmond-based MWV.

“That’s a better approval rating than most,” McNeil said Tuesday. “We’re excited to be joining Rock-Tenn and forming WestRock, and we’ll have a lot more to say starting tomorrow.”

McNeil said a formal announcement would be issued later today.

The new company will be headquartered in MWV’s downtown tower at 501 S. Fifth St. McNeil said a program is in the works to replace the company’s signage on that building and its 300 facilities worldwide.

Once trading begins under the WRK symbol, either later today or at opening bell on Thursday, MWV and Rock-Tenn’s RKT will be delisted from the Big Board effective July 2.

The merger between MWV – one of Richmond’s six Fortune 500 companies – and Georgia-based Rock-Tenn was announced in January. The marriage is expected to create a packaging colossus with a combined $15.7 billion in annual revenue.

The companies expect to save $300 million over the first three years by eliminating overlapping costs. Pension costs were also a driver of the deal, as Rock-Tenn’s pension fund was underfunded by about $1.1 billion. MWV’s U.S. pension fund was overfunded by about $1.3 billion.

The merger is not the first in the history of MWV, which was formed in 2002 by the merger of Mead Corp. and Westvaco. The company relocated its headquarters to Richmond in 2006, ultimately setting up shop in its riverside tower in 2010.

With the creation of WestRock, MWV CEO John Luke Jr. will take on a new role as a non-executive chairman, marking the first time in the history of MWV’s various iterations that a member of the Luke family is not a top executive. According to a Bloomberg report, a Luke has run the company for six generations.

The combined company will consist of 42,000 employees in locations in North America, South America, Europe and Asia. That’s nearly quadruples the workforce of MWV, which produced about $5.6 billion in revenue last year.

In addition to making packaging for various consumer goods, MWV also has a specialty chemicals operation used by industrial firms.

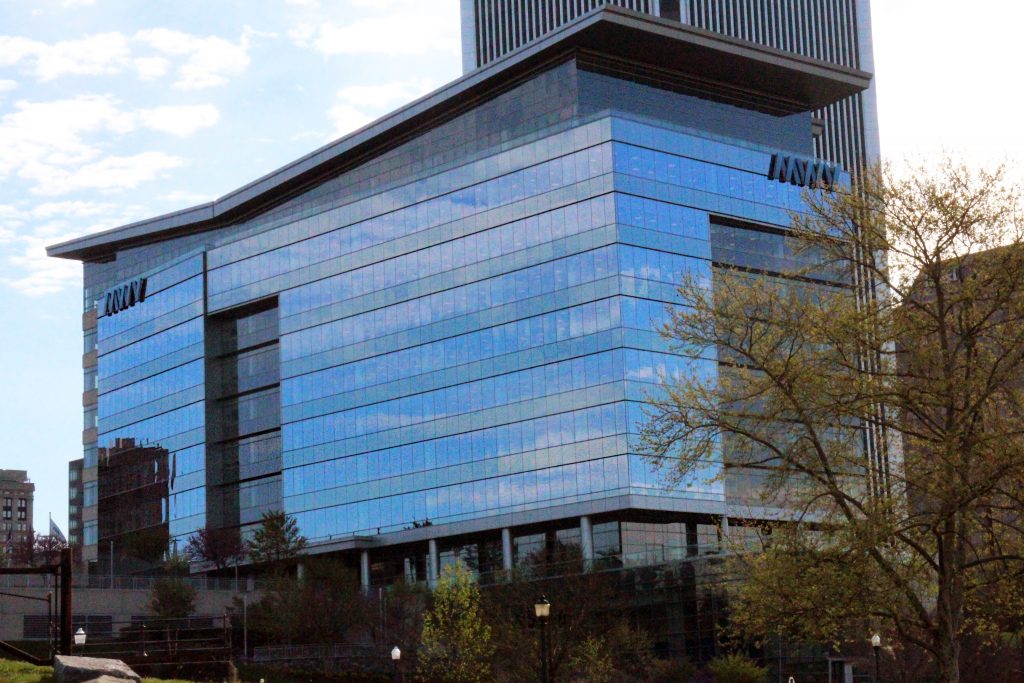

The MeadWestvaco building will continue to be the company’s headquarters after its merger with Rock-Tenn. Photo by Jonathan Spiers.

With overwhelming support from their respective shareholders, packaging giants MeadWestvaco and Rock-Tenn Co. are expected to finalize their merger as WestRock Company later today.

Five months after the merger was first announced, the final approvals needed to make WestRock a reality are set to be signed sometime today, clearing the way for the combined company to begin trading on the New York Stock Exchange, under the ticker symbol WRK.

The signatures follow the approval last week of more than 95 percent of the companies’ voting shareholders, representing at least 80 percent of their respective total shares. That approval was the last step needed in the process, said Tucker McNeil, a spokesman for Richmond-based MWV.

“That’s a better approval rating than most,” McNeil said Tuesday. “We’re excited to be joining Rock-Tenn and forming WestRock, and we’ll have a lot more to say starting tomorrow.”

McNeil said a formal announcement would be issued later today.

The new company will be headquartered in MWV’s downtown tower at 501 S. Fifth St. McNeil said a program is in the works to replace the company’s signage on that building and its 300 facilities worldwide.

Once trading begins under the WRK symbol, either later today or at opening bell on Thursday, MWV and Rock-Tenn’s RKT will be delisted from the Big Board effective July 2.

The merger between MWV – one of Richmond’s six Fortune 500 companies – and Georgia-based Rock-Tenn was announced in January. The marriage is expected to create a packaging colossus with a combined $15.7 billion in annual revenue.

The companies expect to save $300 million over the first three years by eliminating overlapping costs. Pension costs were also a driver of the deal, as Rock-Tenn’s pension fund was underfunded by about $1.1 billion. MWV’s U.S. pension fund was overfunded by about $1.3 billion.

The merger is not the first in the history of MWV, which was formed in 2002 by the merger of Mead Corp. and Westvaco. The company relocated its headquarters to Richmond in 2006, ultimately setting up shop in its riverside tower in 2010.

With the creation of WestRock, MWV CEO John Luke Jr. will take on a new role as a non-executive chairman, marking the first time in the history of MWV’s various iterations that a member of the Luke family is not a top executive. According to a Bloomberg report, a Luke has run the company for six generations.

The combined company will consist of 42,000 employees in locations in North America, South America, Europe and Asia. That’s nearly quadruples the workforce of MWV, which produced about $5.6 billion in revenue last year.

In addition to making packaging for various consumer goods, MWV also has a specialty chemicals operation used by industrial firms.