Construction at HHHunt Homes’ Rutland Grove subdivision in 2020. HHHunt ranked No. 2 on the Home Building Association of Richmond’s annual list of its top 10 member builders. (BizSense file photos)

Business appears to remain strong among the area’s busiest homebuilders as the region’s housing market begins to show signs of a relative cooldown, though concerns about a possible lot shortage loom.

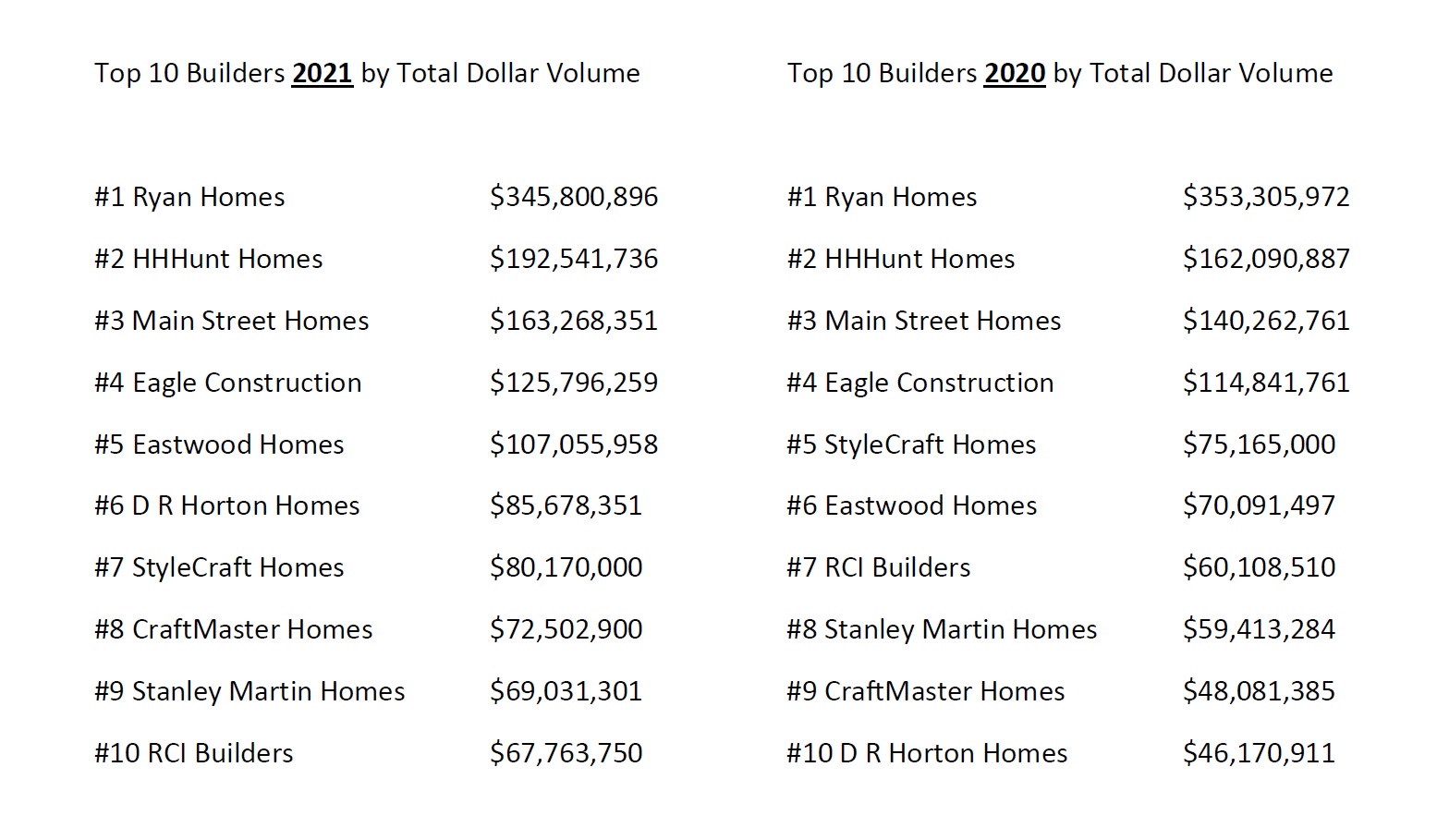

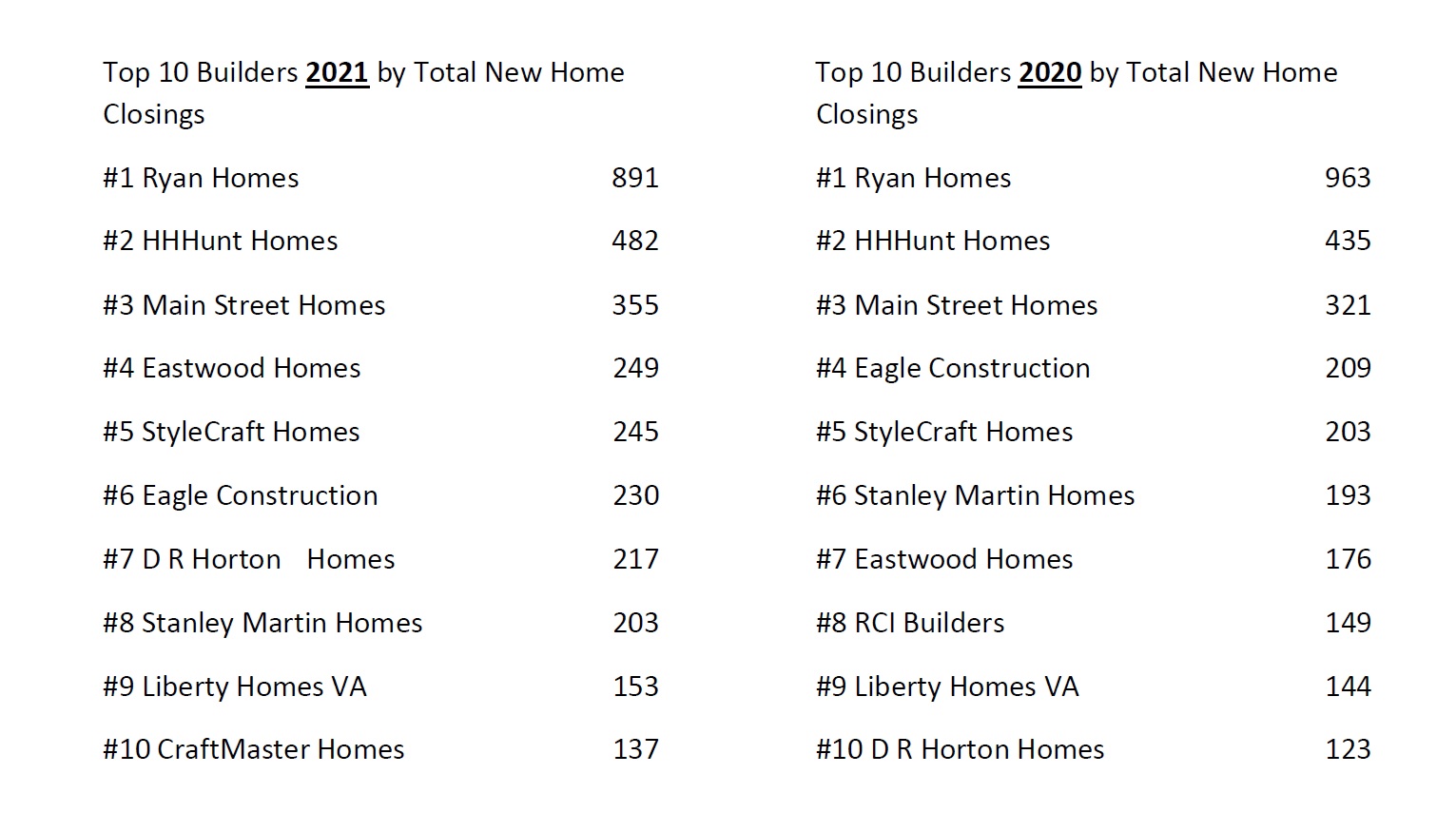

Earlier this year, the Home Building Association of Richmond announced its annual list of its top 10 member builders based on sales and unit volume. The rankings for 2021 saw the area’s top three builders retain their previous spots: Ryan Homes at No. 1, HHHunt Homes at No. 2 and Main Street Homes at No. 3.

Reston-based Ryan remained on top despite a dip compared to 2020, with sales dropping from $353 million to $345 million and new home closings down from 963 to 891, according to HBAR’s numbers (determined from data supplied by builders and research firm Integra Realty Resources–Richmond).

HHHunt and Main Street saw their numbers go up, with HHHunt reporting $192 million in sales last year and 482 new homes sold, compared to $162 million and 435 homes in 2020. Main Street saw $163 million in sales and 355 units sold last year, up from $140 million and 321 the previous year.

HHHunt and Main Street saw their numbers go up, with HHHunt reporting $192 million in sales last year and 482 new homes sold, compared to $162 million and 435 homes in 2020. Main Street saw $163 million in sales and 355 units sold last year, up from $140 million and 321 the previous year.

Eagle Construction of VA retained its fourth-place spot on the sales volume list with $125 million last year, though it dropped two spots in new homes sold, coming in at sixth place with 230. Notably, Eagle had ranked higher in 2020 with fewer homes sold – 209 – but was surpassed last year by Eastwood Homes and StyleCraft Homes with 249 and 245, respectively.

Eastwood ranked fifth in sales volume with $107 million, while StyleCraft ranked seventh with $80 million.

The biggest jump year-to-year on both of HBAR’s top-10 lists was made by D.R. Horton, which ranked sixth in sales volume in 2021 with $85 million and seventh in homes sold with 217. The previous year, the Texas-based builder ranked 10th on both lists, with $46 million and 123 homes sold.

Rounding out last year’s top 10 sales list were No. 8 CraftMaster Homes ($72 million), No. 9 Stanley Martin Homes ($69 million) and No. 10 RCI Builders ($67 million). On the home closings list, Stanley Martin placed eighth with 203, Liberty Homes VA came in ninth with 153, and CraftMaster came in 10th with 137.

Rounding out last year’s top 10 sales list were No. 8 CraftMaster Homes ($72 million), No. 9 Stanley Martin Homes ($69 million) and No. 10 RCI Builders ($67 million). On the home closings list, Stanley Martin placed eighth with 203, Liberty Homes VA came in ninth with 153, and CraftMaster came in 10th with 137.

A tally of all of the builders on each list showed that sales volume among the top 10 totaled $1.3 billion in 2021 and new home closings totaled 3,162. Both figures are up from previous years: $1.1 billion and 2,916 homes in 2020; $995 million and 2,684 in 2019; and $930 million and 2,381 in 2018.

While the numbers appear to show increasing productivity and sales among area builders, they don’t reflect the full picture of market activity across the region, HBAR CEO Danna Markland noted.

“The rankings do not necessarily paint an accurate picture of demand or performance because many of these builders/developers closed out sections that limited their supply in the latter part of 2020 and into 2021,” Markland said in an email.

She said many builders put holds on or capped home sales in certain communities to balance out their production levels. She added that some builders are now opting to build solely on spec to better manage those levels and price fluctuations.

“That is a far departure from summer/fall 2020 when spec inventory was unheard of,” Markland said.

Beyond the top 10 builder lists, Markland noted one of the biggest year-to-year jumps in the market was made by Virginia Beach-based Boyd Homes, which climbed 17 spots from 2020 to 2021 in rankings compiled by Integra Realty Resources–Richmond.

While not cracking the top 10 in HBAR’s analysis, which covers a wider footprint and includes a few more localities than IRR–Richmond’s, Markland noted that Boyd reached IRR’s No. 10 spot with $38 million in sales and 112 homes sold, up from $7 million and 24 homes in 2020.

“I expect that is a response to the market — higher demand for townhomes,” Markland said, noting Boyd’s emphasis on that product type.

Markland also pointed to a recent report from Chesterfield County that showed notably more multifamily and attached residential units approved last year than single-family detached homes. According to the report from the county’s planning department, zoning approved by the county accounted for 5,588 multifamily units, 1,777 townhomes and 1,514 single-family homes.

Looking at homebuilding activity so far in 2022, Markland said a sample of 19 HBAR member builders showed a 28 percent decrease in net sales in March compared to the same month last year. She said the average sale price increased 17 percent to $519,717, compared to March 2021.

“The average number of communities those builders are building in decreased 11 percent in that same time period, which is evidence of the lot crisis,” Markland said, referring to an apparent shortage of buildable home sites in the region due to housing demand outpacing residential development.

A variety of homes are taking shape at Stanley Martin Homes’ ReTreat at One development. (BizSense file)

Homebuying likewise cooled

While HBAR’s member sample showed a decrease in net sales, the region’s homebuying market appears to be similarly cooling, according to the latest market report from the Central Virginia Regional Multiple Listing Service.

CVRMLS reported fewer sales overall in the first quarter this year compared to the first three months of 2021, with 3,380 total sales in the metro area representing a decrease of 9 percent, or 343 fewer sales. Despite the drop, total sales for the quarter remained above the region’s seven-year average.

The median sale price for the quarter was $333,439 regionwide, up 13 percent from last year. According to the report, the median price in Hanover County exceeded $400,000 for the first time, rising 20 percent to $410,000.

Homes sold faster on average compared to last year, with days-on-market averaging 20 compared to 23 last year. Inventory was less, with 1,536 active listings at the end of the quarter — an 11 percent drop from last year’s abnormal numbers.

In a statement that accompanied the report, Dare Tulloch, president of CVRMLS and the Richmond Association of Realtors, said the market has slowed compared to last year but remains strong across the region.

Tulloch said sale price levels exceeded the asking price in all but one of the 16 local markets in Central Virginia in the first quarter.

Construction at HHHunt Homes’ Rutland Grove subdivision in 2020. HHHunt ranked No. 2 on the Home Building Association of Richmond’s annual list of its top 10 member builders. (BizSense file photos)

Business appears to remain strong among the area’s busiest homebuilders as the region’s housing market begins to show signs of a relative cooldown, though concerns about a possible lot shortage loom.

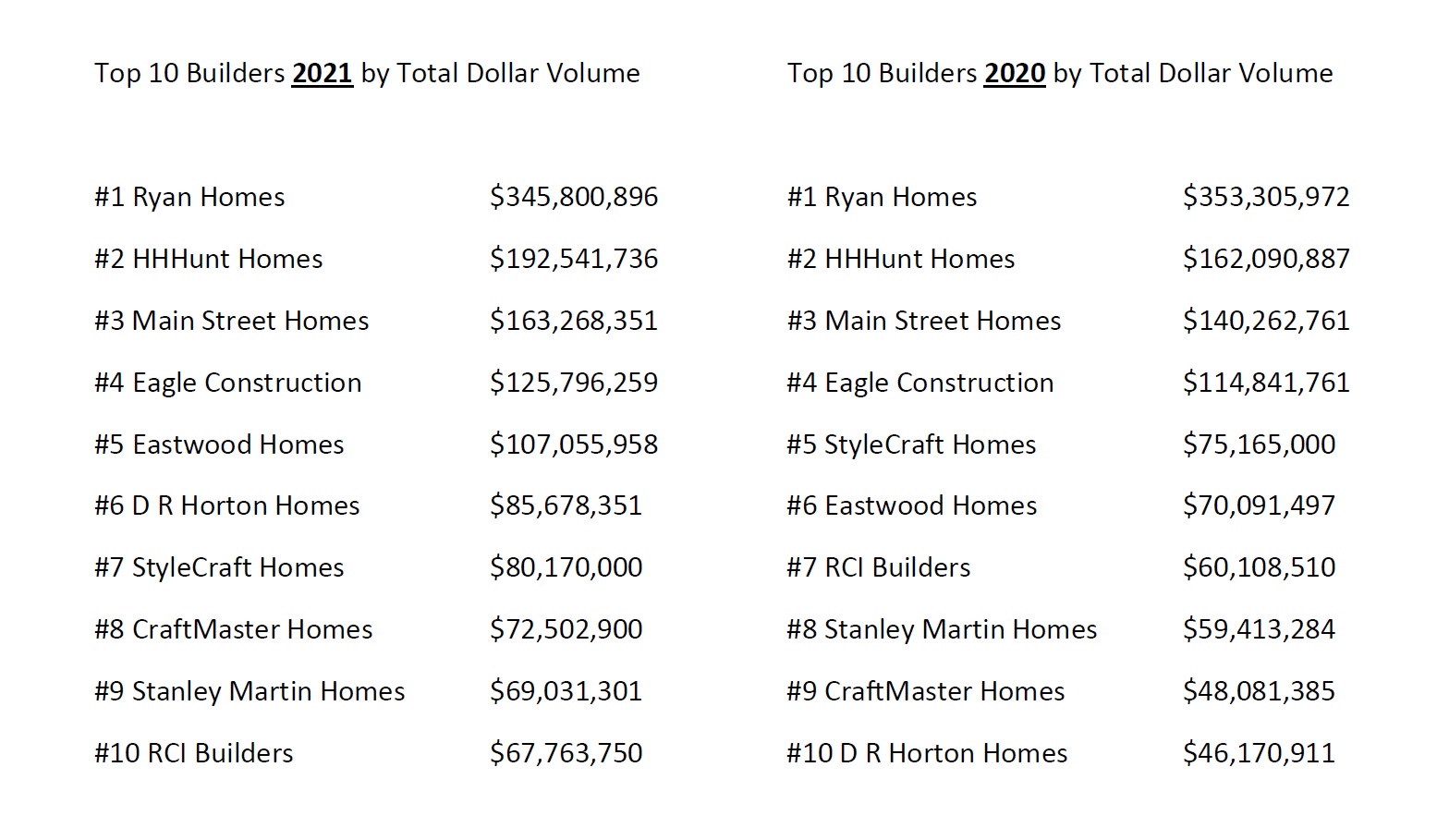

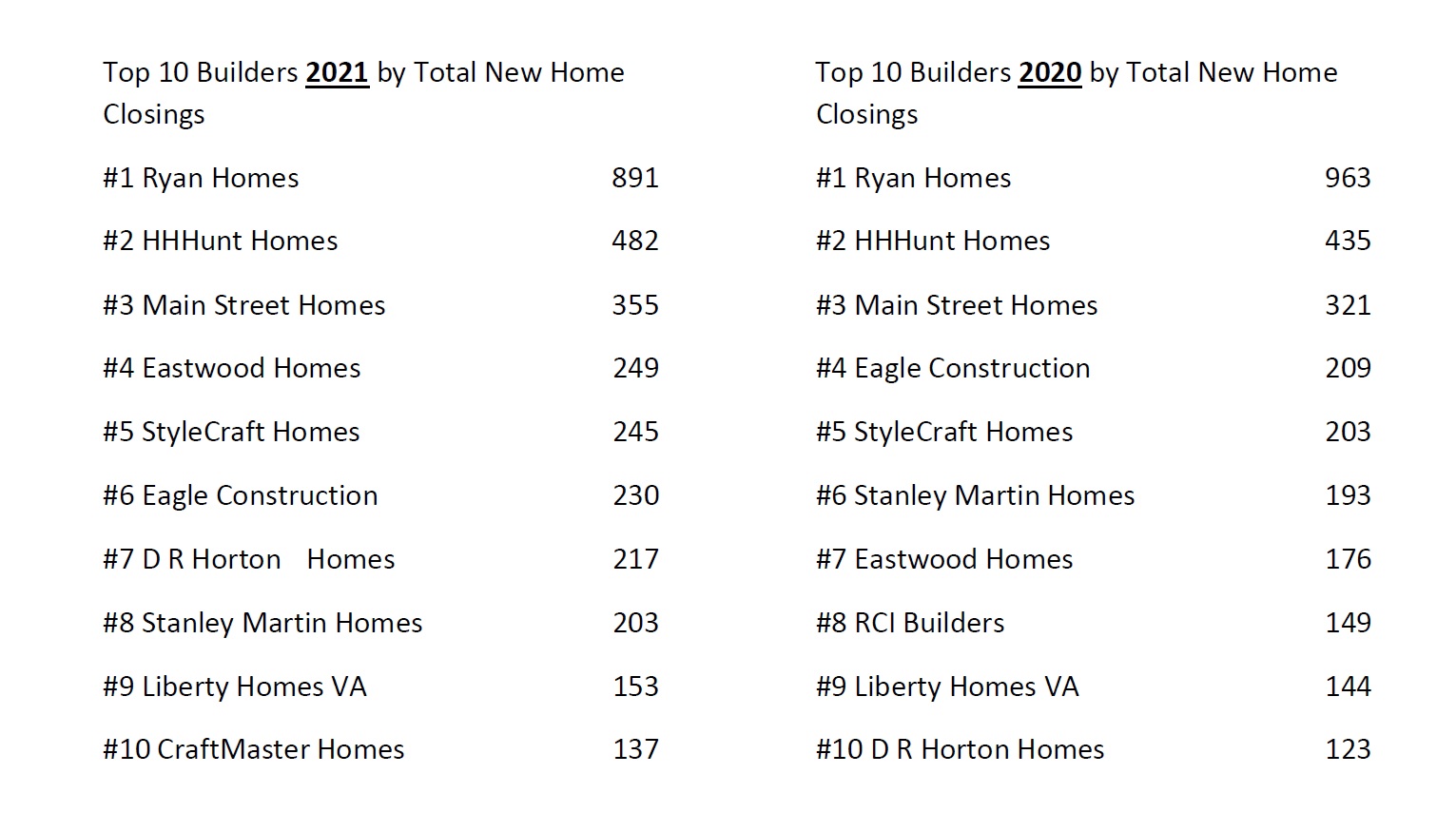

Earlier this year, the Home Building Association of Richmond announced its annual list of its top 10 member builders based on sales and unit volume. The rankings for 2021 saw the area’s top three builders retain their previous spots: Ryan Homes at No. 1, HHHunt Homes at No. 2 and Main Street Homes at No. 3.

Reston-based Ryan remained on top despite a dip compared to 2020, with sales dropping from $353 million to $345 million and new home closings down from 963 to 891, according to HBAR’s numbers (determined from data supplied by builders and research firm Integra Realty Resources–Richmond).

HHHunt and Main Street saw their numbers go up, with HHHunt reporting $192 million in sales last year and 482 new homes sold, compared to $162 million and 435 homes in 2020. Main Street saw $163 million in sales and 355 units sold last year, up from $140 million and 321 the previous year.

HHHunt and Main Street saw their numbers go up, with HHHunt reporting $192 million in sales last year and 482 new homes sold, compared to $162 million and 435 homes in 2020. Main Street saw $163 million in sales and 355 units sold last year, up from $140 million and 321 the previous year.

Eagle Construction of VA retained its fourth-place spot on the sales volume list with $125 million last year, though it dropped two spots in new homes sold, coming in at sixth place with 230. Notably, Eagle had ranked higher in 2020 with fewer homes sold – 209 – but was surpassed last year by Eastwood Homes and StyleCraft Homes with 249 and 245, respectively.

Eastwood ranked fifth in sales volume with $107 million, while StyleCraft ranked seventh with $80 million.

The biggest jump year-to-year on both of HBAR’s top-10 lists was made by D.R. Horton, which ranked sixth in sales volume in 2021 with $85 million and seventh in homes sold with 217. The previous year, the Texas-based builder ranked 10th on both lists, with $46 million and 123 homes sold.

Rounding out last year’s top 10 sales list were No. 8 CraftMaster Homes ($72 million), No. 9 Stanley Martin Homes ($69 million) and No. 10 RCI Builders ($67 million). On the home closings list, Stanley Martin placed eighth with 203, Liberty Homes VA came in ninth with 153, and CraftMaster came in 10th with 137.

Rounding out last year’s top 10 sales list were No. 8 CraftMaster Homes ($72 million), No. 9 Stanley Martin Homes ($69 million) and No. 10 RCI Builders ($67 million). On the home closings list, Stanley Martin placed eighth with 203, Liberty Homes VA came in ninth with 153, and CraftMaster came in 10th with 137.

A tally of all of the builders on each list showed that sales volume among the top 10 totaled $1.3 billion in 2021 and new home closings totaled 3,162. Both figures are up from previous years: $1.1 billion and 2,916 homes in 2020; $995 million and 2,684 in 2019; and $930 million and 2,381 in 2018.

While the numbers appear to show increasing productivity and sales among area builders, they don’t reflect the full picture of market activity across the region, HBAR CEO Danna Markland noted.

“The rankings do not necessarily paint an accurate picture of demand or performance because many of these builders/developers closed out sections that limited their supply in the latter part of 2020 and into 2021,” Markland said in an email.

She said many builders put holds on or capped home sales in certain communities to balance out their production levels. She added that some builders are now opting to build solely on spec to better manage those levels and price fluctuations.

“That is a far departure from summer/fall 2020 when spec inventory was unheard of,” Markland said.

Beyond the top 10 builder lists, Markland noted one of the biggest year-to-year jumps in the market was made by Virginia Beach-based Boyd Homes, which climbed 17 spots from 2020 to 2021 in rankings compiled by Integra Realty Resources–Richmond.

While not cracking the top 10 in HBAR’s analysis, which covers a wider footprint and includes a few more localities than IRR–Richmond’s, Markland noted that Boyd reached IRR’s No. 10 spot with $38 million in sales and 112 homes sold, up from $7 million and 24 homes in 2020.

“I expect that is a response to the market — higher demand for townhomes,” Markland said, noting Boyd’s emphasis on that product type.

Markland also pointed to a recent report from Chesterfield County that showed notably more multifamily and attached residential units approved last year than single-family detached homes. According to the report from the county’s planning department, zoning approved by the county accounted for 5,588 multifamily units, 1,777 townhomes and 1,514 single-family homes.

Looking at homebuilding activity so far in 2022, Markland said a sample of 19 HBAR member builders showed a 28 percent decrease in net sales in March compared to the same month last year. She said the average sale price increased 17 percent to $519,717, compared to March 2021.

“The average number of communities those builders are building in decreased 11 percent in that same time period, which is evidence of the lot crisis,” Markland said, referring to an apparent shortage of buildable home sites in the region due to housing demand outpacing residential development.

A variety of homes are taking shape at Stanley Martin Homes’ ReTreat at One development. (BizSense file)

Homebuying likewise cooled

While HBAR’s member sample showed a decrease in net sales, the region’s homebuying market appears to be similarly cooling, according to the latest market report from the Central Virginia Regional Multiple Listing Service.

CVRMLS reported fewer sales overall in the first quarter this year compared to the first three months of 2021, with 3,380 total sales in the metro area representing a decrease of 9 percent, or 343 fewer sales. Despite the drop, total sales for the quarter remained above the region’s seven-year average.

The median sale price for the quarter was $333,439 regionwide, up 13 percent from last year. According to the report, the median price in Hanover County exceeded $400,000 for the first time, rising 20 percent to $410,000.

Homes sold faster on average compared to last year, with days-on-market averaging 20 compared to 23 last year. Inventory was less, with 1,536 active listings at the end of the quarter — an 11 percent drop from last year’s abnormal numbers.

In a statement that accompanied the report, Dare Tulloch, president of CVRMLS and the Richmond Association of Realtors, said the market has slowed compared to last year but remains strong across the region.

Tulloch said sale price levels exceeded the asking price in all but one of the 16 local markets in Central Virginia in the first quarter.

Six of the top ten in dollar volume and unit sales are home grown companies, whose corporate HQ is here in the Richmond area. Ryan Homes has been here so long it seems to be a local though in fact it is the #3 volume builder nationwide. Increasingly Richmond has become attractive to similar size nationals like DR Horton and Lennar and they’ll put the squeeze on the local players as they did in Northern Virginia. The money to be made is in developing lots and selling to Wall Street. I’m hearing about several “coming soon” build-to-rent deals in the… Read more »

Several notable items to consider:

The swift uptick in mortgage rates will alter the number of units for everybody, and it could be ugly for many builders depending on how much dirt they are sitting on, the big guys and the little guys.

Not one mention of “affordable housing” – what a shame