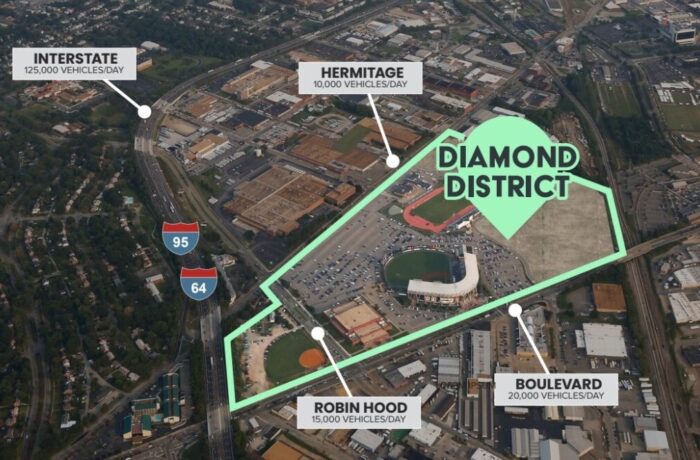

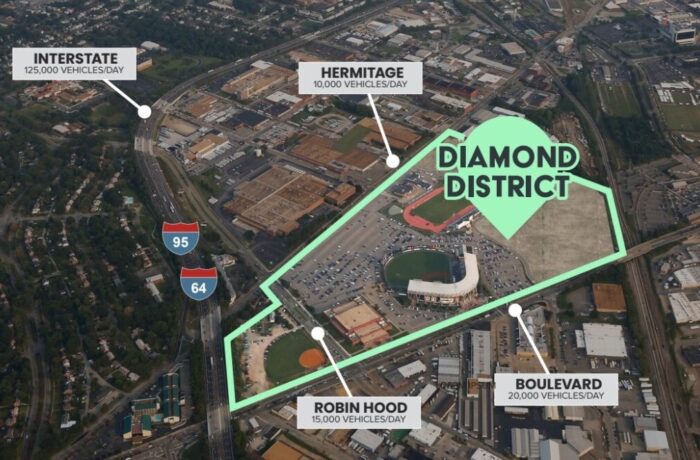

The Diamond District site consists of 67 acres bordered by Arthur Ashe Boulevard, Hermitage Road, Interstate 95 and the railroad tracks. (BizSense file)

A first step toward establishing a community development authority to help finance parts of the Diamond District project has been taken by Richmond’s Economic Development Authority.

The EDA’s Board of Directors on Thursday authorized the filing of a petition to Richmond City Council to create a Diamond District CDA, which would issue nonrecourse bonds as part of the funding for the project’s anchor baseball stadium and infrastructure improvements needed for future phases of the development.

The petition is to be filed once the city conveys its 60-acre portion of the 67-acre Diamond District site to the EDA, which would subsequently sell the 60 acres to developer RVA Diamond Partners. The remaining 7 acres that make up VCU’s Sports Backers Stadium would be purchased in a separate transaction with the university.

The 67-acre site includes The Diamond baseball stadium and nearby Sports Backers Stadium. (BizSense file)

City Council approved the transfer of the 60 acres in May, when it also approved a development agreement with RVA Diamond Partners for the mixed-use project that includes a new 9,000-seat stadium to replace The Diamond.

As of Thursday’s EDA meeting, however, the six city-owned parcels that make up the 60 acres had yet to be transferred.

At that meeting, Leonard Sledge, the city’s economic development director, told the board that the transfers are “in process.” Asked afterward why the parcels haven’t transferred yet, Sledge said his department has “prioritized other tasks related to this project and others,” adding that the transfers “will occur in the timeline needed” to establish the CDA.

John O’Neill, an attorney with Hunton Andrews Kurth who’s advising the EDA, told the board that a CDA petition has to be made to City Council by the property owner, hence the need to wait for the property to transfer from city ownership. He said the approval would allow the board chairman to sign the petition once the EDA owns the property, which he said would be “sometime soon.”

Creation of the CDA, including appointment of its members, would then be up to City Council, Sledge told the board.

“This alone does not create a CDA,” he said. “City Council still has the ability to say yes or no. But this petition process is a critical step for them to reach whatever decision they are going to make around this. This is not a surprise to anyone.”

The land sale for the project’s first phase requires a seven-vote super-majority approval from council.

Asked by board member Neil Milliser if the EDA has “any reason to believe that there might be a change of heart on this,” Sledge said no.

“From my perspective, this is perfunctory,” Sledge said.

CDAs are a method that local governments can use to help fund a project using tax revenue generated by that project over time. They have been used locally on large-scale developments such as Short Pump Town Center in Henrico, and are being used for Henrico’s arena-anchored GreenCity project.

Such revenue – from real estate, admissions and BPOL taxes, as well as portions of meals tax and state sales tax – would be restricted to those produced within the 67-acre Diamond District site.

Financing plan includes TIF district

The $2.4 billion project’s financing plan is based on an expanded tax increment financing (TIF) district that includes privately owned properties beyond the 67-acre site, the bulk of them adjacent to or across streets from the site.

Tax revenue from those properties would be used to help pay bonds for the new $90 million stadium, as well as public infrastructure improvements around the site along Arthur Ashe Boulevard and Hermitage and Robin Hood roads.

A map of the expanded TIF district shows privately owned properties in blue and publicly owned properties in orange.

Officials have said the expanded TIF district is aimed at improving areas around the Diamond District to make it more accessible and connected with surrounding neighborhoods. The properties added to the district would not be charged additional taxes or fees.

Adding the nearby parcels to the TIF district would allow the CDA to issue tax-exempt bonds and secure lower interest rates, and fund the additional infrastructure connections to adjacent neighborhoods. Proceeds from the property sale to RVA Diamond Partners would be used to reduce the stadium bond debt.

The development agreement calls for RVA Diamond Partners to pay $16 million for the first-phase property that includes the stadium site, consisting of 22 acres at 2728 Hermitage Road and 2907 N. Arthur Ashe Blvd.

The city would finance infrastructure upgrades for the first phase with $23 million in general obligation bonds. RVA Diamond Partners would remain responsible for infrastructure improvements in subsequent phases by providing a special assessment backstop on the stadium and infrastructure bonds. Minimum investment in the first phase has been projected at over $627 million.

RVA Diamond Partners – led by D.C.-based Republic Properties Corp., locally based Thalhimer Realty Partners and Chicago-based investment bank Loop Capital – is aiming to complete the new stadium by spring 2026, a year later than a deadline that Major League Baseball set for both major and minor league venues to meet new facility standards.

The 38-year-old Diamond, which does not meet those standards, has been home to the Richmond Flying Squirrels minor-league ball club since 2010.

The larger Diamond District development, to include a mix of office, residential, retail and hotel uses and infrastructure improvements, is projected for completion in 15 years.

The Diamond District site consists of 67 acres bordered by Arthur Ashe Boulevard, Hermitage Road, Interstate 95 and the railroad tracks. (BizSense file)

A first step toward establishing a community development authority to help finance parts of the Diamond District project has been taken by Richmond’s Economic Development Authority.

The EDA’s Board of Directors on Thursday authorized the filing of a petition to Richmond City Council to create a Diamond District CDA, which would issue nonrecourse bonds as part of the funding for the project’s anchor baseball stadium and infrastructure improvements needed for future phases of the development.

The petition is to be filed once the city conveys its 60-acre portion of the 67-acre Diamond District site to the EDA, which would subsequently sell the 60 acres to developer RVA Diamond Partners. The remaining 7 acres that make up VCU’s Sports Backers Stadium would be purchased in a separate transaction with the university.

The 67-acre site includes The Diamond baseball stadium and nearby Sports Backers Stadium. (BizSense file)

City Council approved the transfer of the 60 acres in May, when it also approved a development agreement with RVA Diamond Partners for the mixed-use project that includes a new 9,000-seat stadium to replace The Diamond.

As of Thursday’s EDA meeting, however, the six city-owned parcels that make up the 60 acres had yet to be transferred.

At that meeting, Leonard Sledge, the city’s economic development director, told the board that the transfers are “in process.” Asked afterward why the parcels haven’t transferred yet, Sledge said his department has “prioritized other tasks related to this project and others,” adding that the transfers “will occur in the timeline needed” to establish the CDA.

John O’Neill, an attorney with Hunton Andrews Kurth who’s advising the EDA, told the board that a CDA petition has to be made to City Council by the property owner, hence the need to wait for the property to transfer from city ownership. He said the approval would allow the board chairman to sign the petition once the EDA owns the property, which he said would be “sometime soon.”

Creation of the CDA, including appointment of its members, would then be up to City Council, Sledge told the board.

“This alone does not create a CDA,” he said. “City Council still has the ability to say yes or no. But this petition process is a critical step for them to reach whatever decision they are going to make around this. This is not a surprise to anyone.”

The land sale for the project’s first phase requires a seven-vote super-majority approval from council.

Asked by board member Neil Milliser if the EDA has “any reason to believe that there might be a change of heart on this,” Sledge said no.

“From my perspective, this is perfunctory,” Sledge said.

CDAs are a method that local governments can use to help fund a project using tax revenue generated by that project over time. They have been used locally on large-scale developments such as Short Pump Town Center in Henrico, and are being used for Henrico’s arena-anchored GreenCity project.

Such revenue – from real estate, admissions and BPOL taxes, as well as portions of meals tax and state sales tax – would be restricted to those produced within the 67-acre Diamond District site.

Financing plan includes TIF district

The $2.4 billion project’s financing plan is based on an expanded tax increment financing (TIF) district that includes privately owned properties beyond the 67-acre site, the bulk of them adjacent to or across streets from the site.

Tax revenue from those properties would be used to help pay bonds for the new $90 million stadium, as well as public infrastructure improvements around the site along Arthur Ashe Boulevard and Hermitage and Robin Hood roads.

A map of the expanded TIF district shows privately owned properties in blue and publicly owned properties in orange.

Officials have said the expanded TIF district is aimed at improving areas around the Diamond District to make it more accessible and connected with surrounding neighborhoods. The properties added to the district would not be charged additional taxes or fees.

Adding the nearby parcels to the TIF district would allow the CDA to issue tax-exempt bonds and secure lower interest rates, and fund the additional infrastructure connections to adjacent neighborhoods. Proceeds from the property sale to RVA Diamond Partners would be used to reduce the stadium bond debt.

The development agreement calls for RVA Diamond Partners to pay $16 million for the first-phase property that includes the stadium site, consisting of 22 acres at 2728 Hermitage Road and 2907 N. Arthur Ashe Blvd.

The city would finance infrastructure upgrades for the first phase with $23 million in general obligation bonds. RVA Diamond Partners would remain responsible for infrastructure improvements in subsequent phases by providing a special assessment backstop on the stadium and infrastructure bonds. Minimum investment in the first phase has been projected at over $627 million.

RVA Diamond Partners – led by D.C.-based Republic Properties Corp., locally based Thalhimer Realty Partners and Chicago-based investment bank Loop Capital – is aiming to complete the new stadium by spring 2026, a year later than a deadline that Major League Baseball set for both major and minor league venues to meet new facility standards.

The 38-year-old Diamond, which does not meet those standards, has been home to the Richmond Flying Squirrels minor-league ball club since 2010.

The larger Diamond District development, to include a mix of office, residential, retail and hotel uses and infrastructure improvements, is projected for completion in 15 years.

Wow, is it me or is this taking a long time to get moving? I would have expected shovels to be in the ground by now for at least the stadium to meet the MLB deadline. Seems like the Diamond District, VCU Athletic Village and Green City are moving at a snail’s pace.

The city just cant afford the egg on their face if they don’t follow through with the Diamond District. They will still move slow and make it as hard and complicated as possible for the developers – not because they want to, but just because they can’t help themselves.

The Athletic Village will happen too, because VCU is basically playing with monopoly money.

Green City just might be Henrico’s first big blunder though. I may be in the minority opinion, but I think they’ve bitten off more than they can chew.

I might be miles off base, but at the rate this is going, I don’t see the ballpark being anywhere close for an April 2025 opening day. Heck, at the rate this is going, I could see City Center downtown — including removal of the Coliseum — actually coming together before the ballpark is built and is open for business.

So much time has passed and the apparent lack of urgency on this is just startling.

Looking online it appears the average minor league stadium timeline is about 30 months from ground breaking. We are right at 30 months now from opening day in 2026 and publicly there have been no detailed plans released, much less contracts bid or awarded to start construction. There are still many supply chain issues for big ticket items that are running 24 months plus from order date. I don’t see anyway the ballpark opens prior to 2027 at this point which is sad but unfortunately not unexpected.

The City Council approved the transfer of the 60 acres in May. Why is there a 4-month lag time for the EDA to move forward since the CDA is essential for project to proceed? Slow motion seems to be the wat the City works. Far different than Green City in Henrico County. It will be interesting to see what the interest rate on the Bonds will be, since delay usually indicates a higher rate in today’s environment.

Brian because they do NOT know what to do despite the history of screwing up every other major development project. The sale of property will pay down the bonds; ha ha ha the sale proceeds will probably be used for the cost overruns. $90M will probably balloon to $110M by the time they get started. And non-recourse bonds will never sell for a project in the City. The market of investors will NOT take the risk considering the City has never had one successful CDA that did not require the City to step in and clean up/pay it off. The… Read more »

Michael – agreed regarding your estimate on the length of time it will take the city to actually get the CDA set up and bonds sold. If that, in fact comes to pass, that’s already half a year of down time while critical administrative functions are put into place before any necessary site prep work can begin, much less the first shovel of dirt be turned to start actual construction. And if you mean by a certain senior staffer fleeing you mean Ms. Pechin: that though had crossed my mind. She’s done all she can do to lead the horse… Read more »

PS I did forget to add that we will have change of administration in the middle of all this too come next January.

Zero chance this Diamond District goes off without a hitch. Either it will stall at 25-50% completion, have huge cost over runs the city will somehow be on the hook for, or the city will be extorted into publicly funding structured parking garages. All the while the TIF for the baseball stadium capital expenses will ensure that the development contributes very little to the general fund and becomes a burden on the tax roll. What good is growth if it burdens the tax roll instead of buoying it? Disappointed that our council and mayor are constantly chasing mega projects. Better… Read more »

It appears the city/EDA is providing a sweetheart deal selling the two parcels assessed at $18.7 million, for a mere $16 million. Most commercial properties in Richmond sell 25-50 percent above assessed value.

I wonder if MLB is going to even grant an exemption to Richmond. It would be very tough, if not impossible, to build a new stadium ready by opening day 2025 if construction started now. I’d guess that there will either need to be improvements to the Diamond for the 2025 season (which would be a waste of money), the City of Richmond will pay a hefty penalty to MLB for non-compliance, or the Squirrels are going to be playing home games in another ballpark in 2025 until the new stadium is ready.