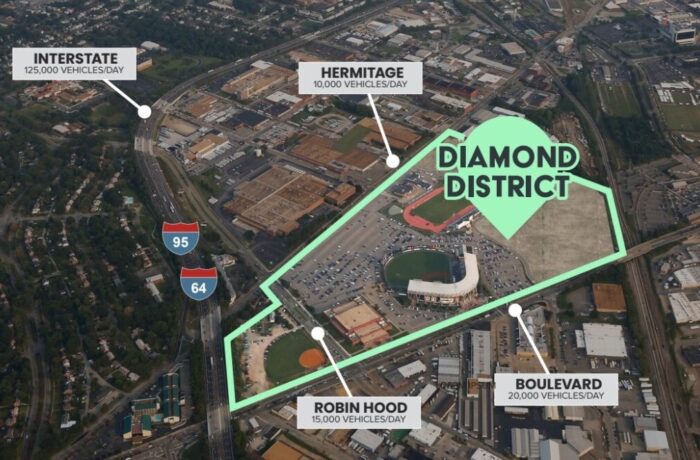

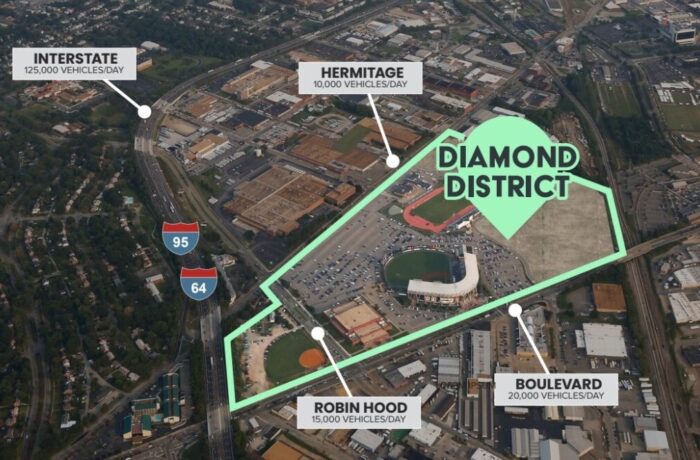

The Diamond District site consists of 67 acres bordered by Arthur Ashe Boulevard, Hermitage Road, the interstate and the railroad tracks. (BizSense file images)

Facing a costlier debt market and the loss of an anticipated source of state funding, the City of Richmond and its Diamond District developer are looking to make a significant change in their approach to financing the $2.4 billion ballpark-anchored development.

In a proposal that will be presented to City Council today, administrators are recommending that the city issue its own revenue bonds to fund the stadium and infrastructure for the development’s first phase, rather than having bonds issued through a community development authority (CDA) as had been planned up to this point.

Doing so would lock in a lower interest rate that’s expected to save the city $215 million in debt costs over the 30-year length of the loans.

It also would allow the bonds to be issued sooner, in time for the city to secure a projected $24 million in state funding that’s expected to be lost with the pending July 1 expiration of a state sales tax incentive program that had been worked into the project’s budget.

The city would assume more risk with the approach. It would be responsible for repaying the general obligation bond debt should the developer default or the project not succeed in paying for itself over time through incremental financing of tax revenues generated by the development.

Lincoln Saunders, Richmond’s chief administrative officer, said the city is weighing that risk against its confidence in the project – and in the Richmond Flying Squirrels – to make the new ballpark and larger development a success.

“We are recommending this because we think it is fiscally sound and, in the end, lower risk for the city,” Saunders said in an interview with BizSense.

“Given the fact that we have a (baseball) team with a proven track record of success and attendance, and we have a development team that we have confidence can build the private development that is planned for phase one, we think that risk, that likelihood, is incredibly low, because we believe that the economics of this project are so strong.”

Saunders said the approach would not impact the city’s debt capacity and would free up nearly $24 million of debt capacity that had been programmed for the infrastructure improvements. He described the approach as similar to how the city financed the Stone Brewing production facility, in which the debt has been offset by the company’s lease payments.

Ballpark timeline unchanged

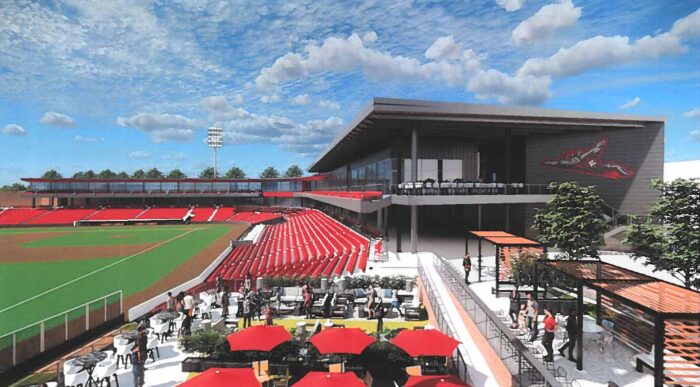

The new ballpark would rise just south of The Diamond, between Sports Backers Stadium and the railroad crossing along Arthur Ashe Boulevard.

Saunders said the new financing approach would not affect the schedule for construction of the ballpark, which is slated to break ground in June and be completed in time for the 2026 baseball season. The ballpark is expected to take more than 18 months to build.

The proposal follows the recommendation of the city’s financial advisor, Davenport & Co., which advocated the change in a memo to the city late last month.

Davenport advises the approach in light of interest rates for CDA bonds being at least double the 4 percent rate that the city could secure by issuing its own general obligation bond off its AA+/Aa1 credit rating, the second-highest possible for a municipality.

The lower rate is expected to save the city $215 million in debt costs over the 30-year term of the bonds for the first phase, resulting in over $418 million of incremental surplus revenue that, according to Davenport’s assessment, more than doubles the return to the city on its investment compared to the CDA approach.

Also driving the recommendation is the pending expiration of the state sales tax incentive program that the city has expected would generate $24 million for the project. The program was removed from the General Assembly’s budget for the coming fiscal year as opponents sought to block funding for a controversial arena-anchored project in Alexandria that was championed by Gov. Glenn Youngkin.

With the incentive program slated to end July 1, and with the revenue bond approach able to be turned around faster than the steps needed for a CDA, Saunders said Richmond can secure that $24 million by issuing its own bond for the stadium, a process he said can be completed in June.

Ordinances are to be introduced today reflecting the change, as well as amendments to the definitive agreements between the city and its development team, whose makeup also is changing.

City Council would need to sign off on the changes.

Development team updates roster

RVA Diamond Partners, the team that’s been led by D.C.-based Republic Properties, Chicago-based Loop Capital and local firm Thalhimer Realty Partners, is changing to a new entity – Diamond District Partners – led by TRP and Loop, without Republic.

Reasons for the change are not entirely clear. Attempts to reach Republic to verify its status on the project have been unsuccessful.

The development team change, which Saunders is acknowledging in his update to council, follows another shakeup to the team in recent months. Design and development of the stadium specifically has been handed over to the Flying Squirrels via an arrangement with Machete Group, a venue advisory and development management firm that’s been consulting the ballclub on the project.

Machete, which made its own pitch for the Diamond District but lost out to RVA Diamond Partners, has brought on architecture firm Odell to finish designing the ballpark, replacing previous stadium designer DLR Group. Machete’s involvement also effectively replaces previous stadium consultant JMI Sports.

The change frees up TRP and Loop to focus solely on the larger 67-acre mixed-use development, the first phase of which would help pay for the $110 million stadium through tax increment financing (TIF), in which tax revenue generated from the new development is put toward paying off the bond debt.

Despite the changes to the development team’s roster, Saunders said the city remains confident in TRP and Loop to pull off the Diamond District, describing Machete’s involvement as effectively balancing out the other team changes.

“Machete Group has now stepped in to manage the stadium, so we do still have at least three major players we’re partnering with to bring this project to success,” Saunders said.

“With the separation of the responsibilities, I think that does put less direct pressure on the development team,” he said. “What we’re now asking the development team to do is do what we know they do well, which is build great multifamily, retail, commercial space.”

Stadium to break ground in June

Under the new financing plan, Richmond would issue the bonds for the stadium in June, in time to remain eligible for the state sales tax incentive and to allow for groundbreaking on the project that month.

Bonds for the phase-one infrastructure improvements would be issued in July, with site work for those improvements, valued at nearly $40 million, getting underway that month.

The 22 acres that make up the first phase would be sold in August to Diamond District Partners, which would make the purchase using funds that TRP and Loop recently raised from Richmond investors.

The developers have agreed to pay $16 million for the land and purchase $20 million in bonds. The land sale requires that a number of closing conditions are met, including the Flying Squirrels ballclub signing a lease for the new stadium.

Construction on the 10,000-seat stadium would start this fall, and development of the rest of the first phase would start next spring, with plans for more than 1,100 residential units, 58,000 square feet of retail, a 180-room hotel and an 11-acre public park.

Saunders stressed that the overall development remains unchanged, with the project still requiring minority business participation and a mix of housing styles and price and rental ranges. While the financing would change, the sources of revenue to pay for the project would remain the same, he said.

It also would free up adjacent taxable properties that had been planned to be included in the CDA’s TIF district to support the Diamond District. With a CDA no longer needed, the expanded TIF area beyond the 67 acres that make up the project would continue to generate taxes for general city services.

“It actually is returning not only in the lower debt payment but because we don’t have to dedicate the expanded TIF, we’re preserving more of the city’s organic growth for the general fund and for city priorities,” Saunders said.

“In a better market, when the interest-rate spread between public and private is not as wide as it is today, I think our preference would still be to go the CDA approach and no moral obligation of the city. But when the interest-rate spread has now reached 4 to 5 percent, the benefit of reducing the risk of project failure is outweighed by the cost of borrowing at that extremely high rate,” he said.

While the new financing approach puts the debt payment obligation squarely on the city, Saunders said it remains confident that the project will succeed in paying for itself.

“We believe strongly in the success of this project. As long as the ballpark opens and the private development gets built, the risk to the taxpayers is nonexistent because the revenues will be there to more than cover the bonds,” Saunders said.

“We believe in the Squirrels. We believe that they have a track record of delivering a great product in baseball, and fans are still going to come and want to be part of the ‘Funn,’” he said. “And we believe in not just the developer but the greater Scott’s Addition area.”

Note: This story has been revised with updated debt cost savings and state sales tax projections from Davenport & Co.

The Diamond District site consists of 67 acres bordered by Arthur Ashe Boulevard, Hermitage Road, the interstate and the railroad tracks. (BizSense file images)

Facing a costlier debt market and the loss of an anticipated source of state funding, the City of Richmond and its Diamond District developer are looking to make a significant change in their approach to financing the $2.4 billion ballpark-anchored development.

In a proposal that will be presented to City Council today, administrators are recommending that the city issue its own revenue bonds to fund the stadium and infrastructure for the development’s first phase, rather than having bonds issued through a community development authority (CDA) as had been planned up to this point.

Doing so would lock in a lower interest rate that’s expected to save the city $215 million in debt costs over the 30-year length of the loans.

It also would allow the bonds to be issued sooner, in time for the city to secure a projected $24 million in state funding that’s expected to be lost with the pending July 1 expiration of a state sales tax incentive program that had been worked into the project’s budget.

The city would assume more risk with the approach. It would be responsible for repaying the general obligation bond debt should the developer default or the project not succeed in paying for itself over time through incremental financing of tax revenues generated by the development.

Lincoln Saunders, Richmond’s chief administrative officer, said the city is weighing that risk against its confidence in the project – and in the Richmond Flying Squirrels – to make the new ballpark and larger development a success.

“We are recommending this because we think it is fiscally sound and, in the end, lower risk for the city,” Saunders said in an interview with BizSense.

“Given the fact that we have a (baseball) team with a proven track record of success and attendance, and we have a development team that we have confidence can build the private development that is planned for phase one, we think that risk, that likelihood, is incredibly low, because we believe that the economics of this project are so strong.”

Saunders said the approach would not impact the city’s debt capacity and would free up nearly $24 million of debt capacity that had been programmed for the infrastructure improvements. He described the approach as similar to how the city financed the Stone Brewing production facility, in which the debt has been offset by the company’s lease payments.

Ballpark timeline unchanged

The new ballpark would rise just south of The Diamond, between Sports Backers Stadium and the railroad crossing along Arthur Ashe Boulevard.

Saunders said the new financing approach would not affect the schedule for construction of the ballpark, which is slated to break ground in June and be completed in time for the 2026 baseball season. The ballpark is expected to take more than 18 months to build.

The proposal follows the recommendation of the city’s financial advisor, Davenport & Co., which advocated the change in a memo to the city late last month.

Davenport advises the approach in light of interest rates for CDA bonds being at least double the 4 percent rate that the city could secure by issuing its own general obligation bond off its AA+/Aa1 credit rating, the second-highest possible for a municipality.

The lower rate is expected to save the city $215 million in debt costs over the 30-year term of the bonds for the first phase, resulting in over $418 million of incremental surplus revenue that, according to Davenport’s assessment, more than doubles the return to the city on its investment compared to the CDA approach.

Also driving the recommendation is the pending expiration of the state sales tax incentive program that the city has expected would generate $24 million for the project. The program was removed from the General Assembly’s budget for the coming fiscal year as opponents sought to block funding for a controversial arena-anchored project in Alexandria that was championed by Gov. Glenn Youngkin.

With the incentive program slated to end July 1, and with the revenue bond approach able to be turned around faster than the steps needed for a CDA, Saunders said Richmond can secure that $24 million by issuing its own bond for the stadium, a process he said can be completed in June.

Ordinances are to be introduced today reflecting the change, as well as amendments to the definitive agreements between the city and its development team, whose makeup also is changing.

City Council would need to sign off on the changes.

Development team updates roster

RVA Diamond Partners, the team that’s been led by D.C.-based Republic Properties, Chicago-based Loop Capital and local firm Thalhimer Realty Partners, is changing to a new entity – Diamond District Partners – led by TRP and Loop, without Republic.

Reasons for the change are not entirely clear. Attempts to reach Republic to verify its status on the project have been unsuccessful.

The development team change, which Saunders is acknowledging in his update to council, follows another shakeup to the team in recent months. Design and development of the stadium specifically has been handed over to the Flying Squirrels via an arrangement with Machete Group, a venue advisory and development management firm that’s been consulting the ballclub on the project.

Machete, which made its own pitch for the Diamond District but lost out to RVA Diamond Partners, has brought on architecture firm Odell to finish designing the ballpark, replacing previous stadium designer DLR Group. Machete’s involvement also effectively replaces previous stadium consultant JMI Sports.

The change frees up TRP and Loop to focus solely on the larger 67-acre mixed-use development, the first phase of which would help pay for the $110 million stadium through tax increment financing (TIF), in which tax revenue generated from the new development is put toward paying off the bond debt.

Despite the changes to the development team’s roster, Saunders said the city remains confident in TRP and Loop to pull off the Diamond District, describing Machete’s involvement as effectively balancing out the other team changes.

“Machete Group has now stepped in to manage the stadium, so we do still have at least three major players we’re partnering with to bring this project to success,” Saunders said.

“With the separation of the responsibilities, I think that does put less direct pressure on the development team,” he said. “What we’re now asking the development team to do is do what we know they do well, which is build great multifamily, retail, commercial space.”

Stadium to break ground in June

Under the new financing plan, Richmond would issue the bonds for the stadium in June, in time to remain eligible for the state sales tax incentive and to allow for groundbreaking on the project that month.

Bonds for the phase-one infrastructure improvements would be issued in July, with site work for those improvements, valued at nearly $40 million, getting underway that month.

The 22 acres that make up the first phase would be sold in August to Diamond District Partners, which would make the purchase using funds that TRP and Loop recently raised from Richmond investors.

The developers have agreed to pay $16 million for the land and purchase $20 million in bonds. The land sale requires that a number of closing conditions are met, including the Flying Squirrels ballclub signing a lease for the new stadium.

Construction on the 10,000-seat stadium would start this fall, and development of the rest of the first phase would start next spring, with plans for more than 1,100 residential units, 58,000 square feet of retail, a 180-room hotel and an 11-acre public park.

Saunders stressed that the overall development remains unchanged, with the project still requiring minority business participation and a mix of housing styles and price and rental ranges. While the financing would change, the sources of revenue to pay for the project would remain the same, he said.

It also would free up adjacent taxable properties that had been planned to be included in the CDA’s TIF district to support the Diamond District. With a CDA no longer needed, the expanded TIF area beyond the 67 acres that make up the project would continue to generate taxes for general city services.

“It actually is returning not only in the lower debt payment but because we don’t have to dedicate the expanded TIF, we’re preserving more of the city’s organic growth for the general fund and for city priorities,” Saunders said.

“In a better market, when the interest-rate spread between public and private is not as wide as it is today, I think our preference would still be to go the CDA approach and no moral obligation of the city. But when the interest-rate spread has now reached 4 to 5 percent, the benefit of reducing the risk of project failure is outweighed by the cost of borrowing at that extremely high rate,” he said.

While the new financing approach puts the debt payment obligation squarely on the city, Saunders said it remains confident that the project will succeed in paying for itself.

“We believe strongly in the success of this project. As long as the ballpark opens and the private development gets built, the risk to the taxpayers is nonexistent because the revenues will be there to more than cover the bonds,” Saunders said.

“We believe in the Squirrels. We believe that they have a track record of delivering a great product in baseball, and fans are still going to come and want to be part of the ‘Funn,’” he said. “And we believe in not just the developer but the greater Scott’s Addition area.”

Note: This story has been revised with updated debt cost savings and state sales tax projections from Davenport & Co.

This sounds more promising than the previous finance structure, particularly in freeing up taxes on land developments outside the district. Still, the City taxpayers are on the hook if the privately funded apartments and commercial fail to be built. There are two tenants for the ballpark, an advantage this project has over the planned Henrico arena. The gameday attendance record is strong but the ticket price for a seat will be much, much higher in the new park than before and that will impact attendance. We’d better cross our fingers in the City. The Henrico residents should cross their fingers… Read more »

It does??? Cause this PUTS all the risk on the taxpayers, it would lower the borrowing ability of the City which is already at its limits, and as you said it depends of private development being built. It is NOT the stadium or the Squirrels that will be providing the majority of the new funds to pay off the bonds. It is the ancillary development. Development that still has not formal/framed timeline. Will the deal then have a clause that the city can foreclose on any and all of the properties in the district to sell them off to pay… Read more »

The lease payments from the Squirrels will be $2-3M per year, about 5x what they pay now. The article says that it will free up the City’s borrowing capacity by freeing up taxable properties from the TIF. That’s good.

It frees up the taxes from the TIF but the amount of annual taxes from the properties in the TIF that will freed up have ZERO effect to the multimillion dollar bond that will be borrowed to build the stadium. Think of it like a credit card, yes we will have more income to make future payments but we are MAXING out the card and then making the payments. And those future buildings tax payments and additions to the bond capacity DOES NOT occur until those properties show up on the tax rolls. We are borrowing the money first and… Read more »

And by the way does this mean without the CDA that the City will be spending $25M in city dollars to but the SportsBackers stadium? Or is it OUT of the project now. PS bond payments will be over $12M in payments most likely for term of the loan. Wow $2-$3M in rent, a couple of hundred thousand each in direct district sales and ticket revenue taxes. I promise you more than 1/2 of the payment will come from the general fund for properties outside of the “district” for the first 3-5 years. That means every taxpayer in Richmond will… Read more »

Thank you for pointing out a small part of what should be The Obvious to all.

The city could have made much more up front by selling the land to the best buyer.

Next, after valuable, profitable RE was built on it, the city would make recurrent money every year there after.

And that money would have flowed through years ago.

As you know, money now is worth more than money tomorrow.

Too simple for these guys though.

When you are digging your self in a hole the only smart move is to stop.

I have been saying they have been doing this all wrong from the start.

Diamond District going to end up like the Coliseum?

This does seem more promising and financially prudent. The CDA approach seemed to slow down an already painfully slow process. Hopefully they can get this done in time.