Henrico supervisors and staff hear from Laura Lafayette with Maggie Walker Community Land Trust during last week’s presentation on housing affordability challenges. (Jonathan Spiers photo)

When Henrico supervisors approved the massive and controversial Arcadia project in Varina, a provision was negotiated that at least 20 of the homes in the residential development would be built for lower-income households.

The housing proffer from developer East West Communities was the first such provision ever included in a zoning case in Henrico, officials said when Arcadia was approved early last year. It was accomplished through a collaboration with the Maggie Walker Community Land Trust, a regional nonprofit that buys and leases home lots to income-qualified buyers to keep the land “permanently affordable.”

While the 20 lots represent less than 3 percent of the nearly 800 homes to be built at Arcadia, administrators with the county and the nonprofit are pointing to the proffer, or something like it, as a potential approach to addressing housing affordability in Henrico and the region.

“Unless we do something, unless there is an inflection-point change to incentivize affordable housing in a different way, then the trends are going to be what they are,” County Manager John Vithoulkas told the board in a presentation last week.

“This is a time for an inflection point. There’s an opportunity here to do something different,” he said.

Describing housing affordability as “the most significant topic” facing Henrico, Virginia and the country right now, Vithoulkas added, “If you look at one topic that impacts so many things – from families, to passing on generational wealth, to economic development and new employees coming on and living in a locality – affordable housing is becoming more and more of an issue.”

As home prices in the region have continued to increase amid a competitive housing market and higher interest rates for mortgages, housing availability has also become a challenge as fewer homes are listed or remain on the market for buyers. Higher demand over supply has also increased rents, making it harder for renters to save toward a down payment and build wealth through homeownership.

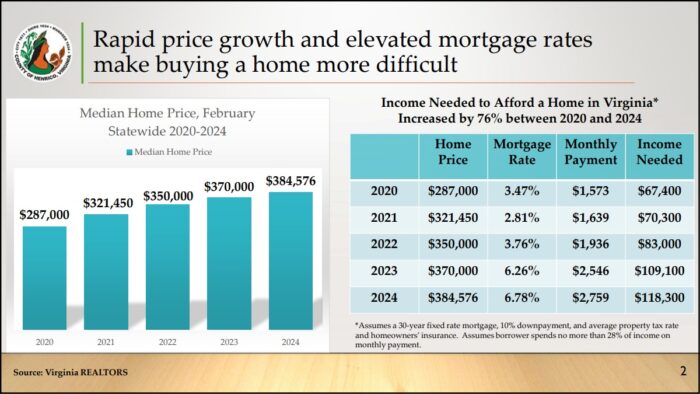

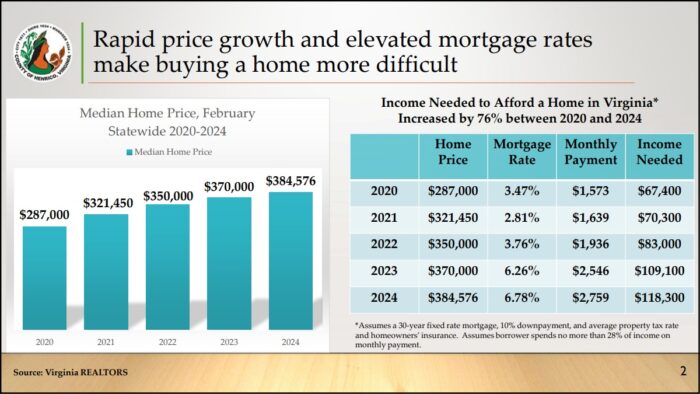

According to Virginia Realtors data, the median home price statewide rose from $287,000 in 2020 to over $384,000 in 2024, while mortgage rates in that time effectively doubled, from about 3.5 percent in 2020 to 6.8 percent this year. Monthly payments followed suit, and the income needed to afford a home in Virginia increased by 76 percent, from $67,400 four years ago to $118,300 today.

According to Virginia Realtors data, the median home price statewide rose from $287,000 in 2020 to over $384,000 in 2024, while mortgage rates in that time effectively doubled, from about 3.5 percent in 2020 to 6.8 percent this year. Monthly payments followed suit, and the income needed to afford a home in Virginia increased by 76 percent, from $67,400 four years ago to $118,300 today.

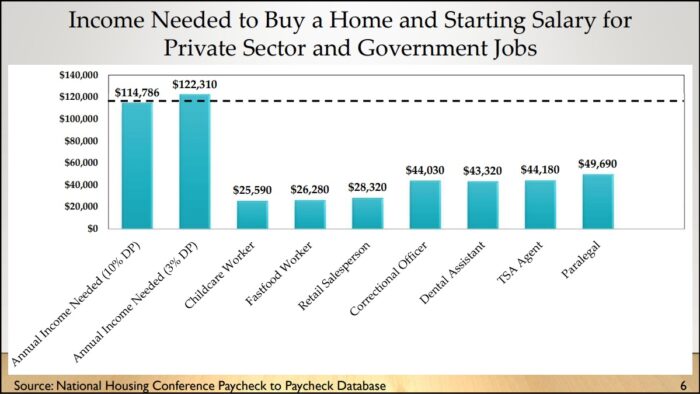

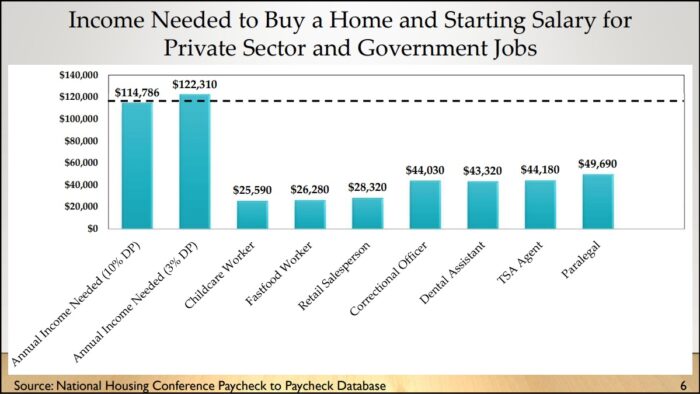

As of March, the median sale price for a single-family detached home in Henrico was $390,000, while the annual income needed to buy a home in the county remained at least double the starting salaries for many county employees. Despite recent pay hikes, a home purchase assistance program and other efforts to help bridge the gap, home ownership for many employees remains out of reach.

The data also shows that the number of county building permits for single-family homes has dropped by nearly half since 2003, from nearly 2,000 two decades ago to just over 1,000 last year. In that same time, Henrico’s cash reserves from annual revenues that exceeded budget projections have shot up, from about $125 million in 2003 to over $450 million in 2023.

The data also shows that the number of county building permits for single-family homes has dropped by nearly half since 2003, from nearly 2,000 two decades ago to just over 1,000 last year. In that same time, Henrico’s cash reserves from annual revenues that exceeded budget projections have shot up, from about $125 million in 2003 to over $450 million in 2023.

With that cash in hand, Vithoulkas said Henrico is in a position to begin to address the affordability issue through onetime investments like the Arcadia effort, in which the county contributed toward the land trust’s purchase of the 20 lots. But significantly more needs to be done across the county, he said.

“If you are talking about making some sort of impact on the market, you’re not going to be able to do it by doing five or 10 homes,” Vithoulkas told the board. “You have to have a meaningful number, which my math would be somewhere between 10 and 15 percent.

“Somehow impacting 10 to 15 percent of everything new coming out of the ground, and then, potentially, you begin to make a difference,” he said, putting that percentage at between 900 and 1,000 homes a year.

Exactly how the county would incentivize that number of homes annually remains to be seen. Following the presentation, supervisors directed Vithoulkas and his staff to come back with a proposal, which could involve different approaches for different areas of the county. Whatever the approach, Vithoulkas said it would not involve issuing debt or impact the county’s operating budget.

Exactly how the county would incentivize that number of homes annually remains to be seen. Following the presentation, supervisors directed Vithoulkas and his staff to come back with a proposal, which could involve different approaches for different areas of the county. Whatever the approach, Vithoulkas said it would not involve issuing debt or impact the county’s operating budget.

Laura Lafayette, CEO of the Richmond Association of Realtors and immediate past chair of MWCLT, told the board the approach to Arcadia worked well and could be applied to other developments in the county.

“I think it’s such a wonderful model, because the private sector developer took lots that were $80,000 and took them to $40,000, and the county made a sizable contribution. With those two commitments, we went out and raised $500,000 in two weeks from private philanthropy, because they saw the beauty of public, private and nonprofit partnership,” Lafayette said.

The land trust, she added, “could never be in Arcadia without that formula. Our 20 families – maybe we’ll get some more – will be in an unbelievable community. We’re really proud of the work we do across this region, but that’s a game-changer, and I think it’s a model that could be replicated again and again.”

Using a “pay-it-forward” approach to help qualified owners build equity, MWCLT leases the land to an income-qualified homebuyer for little to no lease payments, and the buyer then only has to purchase the house.

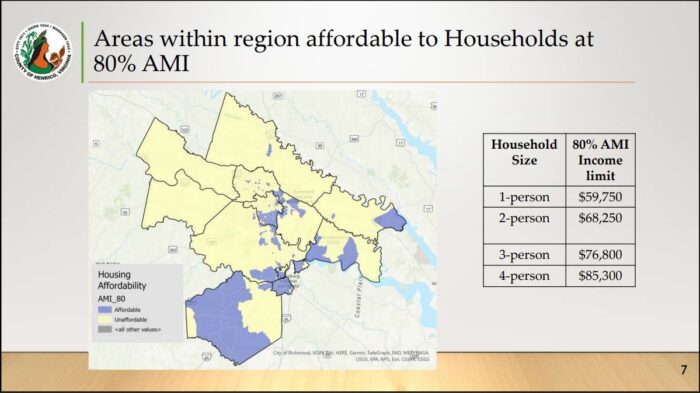

In exchange for the reduced price, the buyer agrees to keep only half the proceeds when it is later sold, while the remaining equity stays with the house to keep it affordable for the next qualified buyer. Income-qualified buyers are those who make 50 to 115 percent of the Richmond area median income, currently $109,400.

Formed nearly a decade ago, MWCLT has built and sold 83 homes in that time, with 24 built and 19 sold last year. Homeowners’ average income last year was $52,000, less than half the regional AMI, according to the nonprofit. It now has over 150 homes in the pipeline.

At least 20 of the nearly 800 homes approved for the Arcadia development at Route 5 and Pocahontas Parkway are to be built for lower-income households. (BizSense file)

Since Arcadia’s approval, county planners have been encouraging similar housing proffers in conversations with developers seeking rezonings. Just recently, the department has started including a blurb in planners’ staff reports emphasizing the issue and noting that other zoning requests “have provided for lots within the proposed development to be sold at cost” to a nonprofit or government entity “with the goal of constructing affordable housing.”

“The applicant is encouraged to consider a similar commitment as part of this request,” the blurb concludes. Henrico Planning Director Joe Emerson said the language carried over from Arcadia and was recently added to reports, but is not a formal policy.

“We had not verbalized it in a report, but with the shortage of affordable housing, we wanted to make the development community aware of the (MWCLT) opportunity,” Emerson said in an email to BizSense. “We just ask that developers consider the possibility.”

Whether it’s a policy or per-project approach, Lafayette told the supervisors they have an opportunity to set an example for the rest of the region to follow.

“The bottom line is we’ve all got to be in this game, because housing’s a different dynamic,” Lafayette said. “When you have the hole that we’ve dug, we are talking millions upon millions to address the situation.

“No, we are never going to solve it completely. But we can continue to be transactional, or we can be bold and be transformational,” she said. “That’s the opportunity I believe that’s before Henrico, and I believe that we need the moral leadership and courage of a jurisdiction to take this bold step.”

Board Chairman Tyrone Nelson, who represents the Varina District where Arcadia was approved, reiterated a desire for a proposal with an impact.

“We’ve got to do something that maybe local government hasn’t really stumbled into,” Nelson said, noting local and national efforts to address the issue, such as the City of Richmond’s Affordable Housing Trust Fund and housing crisis declaration last year.

“We’ve got to find a way to start to get into this place where we are making housing affordable,” Nelson said. “I’m not talking about the million-dollar home; I’m talking about the first-time homeowner who may be a police officer or a teacher or working at the 911 center, or TSA agent or paralegal: people who have a hard time qualifying to get into a house.”

Referring to other challenges where he said Henrico has been proactive, Nelson added, “I think it’s time for us to figure out a way to do something transformational, that can impact our community.”

Henrico supervisors and staff hear from Laura Lafayette with Maggie Walker Community Land Trust during last week’s presentation on housing affordability challenges. (Jonathan Spiers photo)

When Henrico supervisors approved the massive and controversial Arcadia project in Varina, a provision was negotiated that at least 20 of the homes in the residential development would be built for lower-income households.

The housing proffer from developer East West Communities was the first such provision ever included in a zoning case in Henrico, officials said when Arcadia was approved early last year. It was accomplished through a collaboration with the Maggie Walker Community Land Trust, a regional nonprofit that buys and leases home lots to income-qualified buyers to keep the land “permanently affordable.”

While the 20 lots represent less than 3 percent of the nearly 800 homes to be built at Arcadia, administrators with the county and the nonprofit are pointing to the proffer, or something like it, as a potential approach to addressing housing affordability in Henrico and the region.

“Unless we do something, unless there is an inflection-point change to incentivize affordable housing in a different way, then the trends are going to be what they are,” County Manager John Vithoulkas told the board in a presentation last week.

“This is a time for an inflection point. There’s an opportunity here to do something different,” he said.

Describing housing affordability as “the most significant topic” facing Henrico, Virginia and the country right now, Vithoulkas added, “If you look at one topic that impacts so many things – from families, to passing on generational wealth, to economic development and new employees coming on and living in a locality – affordable housing is becoming more and more of an issue.”

As home prices in the region have continued to increase amid a competitive housing market and higher interest rates for mortgages, housing availability has also become a challenge as fewer homes are listed or remain on the market for buyers. Higher demand over supply has also increased rents, making it harder for renters to save toward a down payment and build wealth through homeownership.

According to Virginia Realtors data, the median home price statewide rose from $287,000 in 2020 to over $384,000 in 2024, while mortgage rates in that time effectively doubled, from about 3.5 percent in 2020 to 6.8 percent this year. Monthly payments followed suit, and the income needed to afford a home in Virginia increased by 76 percent, from $67,400 four years ago to $118,300 today.

According to Virginia Realtors data, the median home price statewide rose from $287,000 in 2020 to over $384,000 in 2024, while mortgage rates in that time effectively doubled, from about 3.5 percent in 2020 to 6.8 percent this year. Monthly payments followed suit, and the income needed to afford a home in Virginia increased by 76 percent, from $67,400 four years ago to $118,300 today.

As of March, the median sale price for a single-family detached home in Henrico was $390,000, while the annual income needed to buy a home in the county remained at least double the starting salaries for many county employees. Despite recent pay hikes, a home purchase assistance program and other efforts to help bridge the gap, home ownership for many employees remains out of reach.

The data also shows that the number of county building permits for single-family homes has dropped by nearly half since 2003, from nearly 2,000 two decades ago to just over 1,000 last year. In that same time, Henrico’s cash reserves from annual revenues that exceeded budget projections have shot up, from about $125 million in 2003 to over $450 million in 2023.

The data also shows that the number of county building permits for single-family homes has dropped by nearly half since 2003, from nearly 2,000 two decades ago to just over 1,000 last year. In that same time, Henrico’s cash reserves from annual revenues that exceeded budget projections have shot up, from about $125 million in 2003 to over $450 million in 2023.

With that cash in hand, Vithoulkas said Henrico is in a position to begin to address the affordability issue through onetime investments like the Arcadia effort, in which the county contributed toward the land trust’s purchase of the 20 lots. But significantly more needs to be done across the county, he said.

“If you are talking about making some sort of impact on the market, you’re not going to be able to do it by doing five or 10 homes,” Vithoulkas told the board. “You have to have a meaningful number, which my math would be somewhere between 10 and 15 percent.

“Somehow impacting 10 to 15 percent of everything new coming out of the ground, and then, potentially, you begin to make a difference,” he said, putting that percentage at between 900 and 1,000 homes a year.

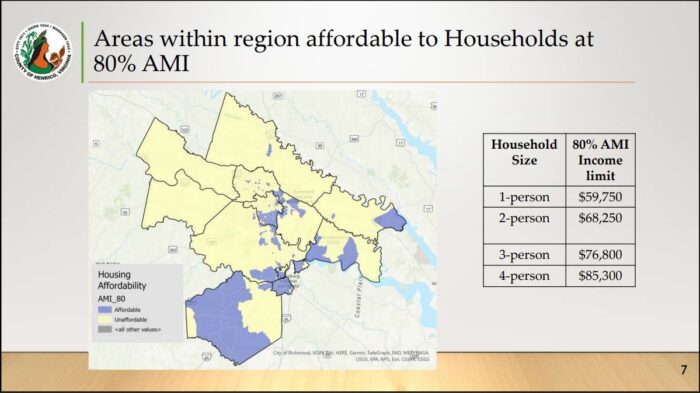

Exactly how the county would incentivize that number of homes annually remains to be seen. Following the presentation, supervisors directed Vithoulkas and his staff to come back with a proposal, which could involve different approaches for different areas of the county. Whatever the approach, Vithoulkas said it would not involve issuing debt or impact the county’s operating budget.

Exactly how the county would incentivize that number of homes annually remains to be seen. Following the presentation, supervisors directed Vithoulkas and his staff to come back with a proposal, which could involve different approaches for different areas of the county. Whatever the approach, Vithoulkas said it would not involve issuing debt or impact the county’s operating budget.

Laura Lafayette, CEO of the Richmond Association of Realtors and immediate past chair of MWCLT, told the board the approach to Arcadia worked well and could be applied to other developments in the county.

“I think it’s such a wonderful model, because the private sector developer took lots that were $80,000 and took them to $40,000, and the county made a sizable contribution. With those two commitments, we went out and raised $500,000 in two weeks from private philanthropy, because they saw the beauty of public, private and nonprofit partnership,” Lafayette said.

The land trust, she added, “could never be in Arcadia without that formula. Our 20 families – maybe we’ll get some more – will be in an unbelievable community. We’re really proud of the work we do across this region, but that’s a game-changer, and I think it’s a model that could be replicated again and again.”

Using a “pay-it-forward” approach to help qualified owners build equity, MWCLT leases the land to an income-qualified homebuyer for little to no lease payments, and the buyer then only has to purchase the house.

In exchange for the reduced price, the buyer agrees to keep only half the proceeds when it is later sold, while the remaining equity stays with the house to keep it affordable for the next qualified buyer. Income-qualified buyers are those who make 50 to 115 percent of the Richmond area median income, currently $109,400.

Formed nearly a decade ago, MWCLT has built and sold 83 homes in that time, with 24 built and 19 sold last year. Homeowners’ average income last year was $52,000, less than half the regional AMI, according to the nonprofit. It now has over 150 homes in the pipeline.

At least 20 of the nearly 800 homes approved for the Arcadia development at Route 5 and Pocahontas Parkway are to be built for lower-income households. (BizSense file)

Since Arcadia’s approval, county planners have been encouraging similar housing proffers in conversations with developers seeking rezonings. Just recently, the department has started including a blurb in planners’ staff reports emphasizing the issue and noting that other zoning requests “have provided for lots within the proposed development to be sold at cost” to a nonprofit or government entity “with the goal of constructing affordable housing.”

“The applicant is encouraged to consider a similar commitment as part of this request,” the blurb concludes. Henrico Planning Director Joe Emerson said the language carried over from Arcadia and was recently added to reports, but is not a formal policy.

“We had not verbalized it in a report, but with the shortage of affordable housing, we wanted to make the development community aware of the (MWCLT) opportunity,” Emerson said in an email to BizSense. “We just ask that developers consider the possibility.”

Whether it’s a policy or per-project approach, Lafayette told the supervisors they have an opportunity to set an example for the rest of the region to follow.

“The bottom line is we’ve all got to be in this game, because housing’s a different dynamic,” Lafayette said. “When you have the hole that we’ve dug, we are talking millions upon millions to address the situation.

“No, we are never going to solve it completely. But we can continue to be transactional, or we can be bold and be transformational,” she said. “That’s the opportunity I believe that’s before Henrico, and I believe that we need the moral leadership and courage of a jurisdiction to take this bold step.”

Board Chairman Tyrone Nelson, who represents the Varina District where Arcadia was approved, reiterated a desire for a proposal with an impact.

“We’ve got to do something that maybe local government hasn’t really stumbled into,” Nelson said, noting local and national efforts to address the issue, such as the City of Richmond’s Affordable Housing Trust Fund and housing crisis declaration last year.

“We’ve got to find a way to start to get into this place where we are making housing affordable,” Nelson said. “I’m not talking about the million-dollar home; I’m talking about the first-time homeowner who may be a police officer or a teacher or working at the 911 center, or TSA agent or paralegal: people who have a hard time qualifying to get into a house.”

Referring to other challenges where he said Henrico has been proactive, Nelson added, “I think it’s time for us to figure out a way to do something transformational, that can impact our community.”

That’s a great way to it in for-sale housing. The jurisdiction trades higher density for lower housing cost. It’s been working that way all over the country for decades. For rental housing, the incentive that can be offered by the jurisdiction is a sliding scale real estate tax rate by providing the landlord a rebate based upon the household income of the lessee, passing through that savings in a reduction of monthly rent. The renter has to prove eligibility and the landlord has to submit that record for the rebate.

Remember that we are a Dillon Rule state and localities are only allowed to do what the state permits them to do. This may not be a tax structure the state allows.

I am aware of “like” actions elsewhere in VA, so it is probably doable without extraordinary effort.

All great points!

Looking good Henrico!

While I salute any effort to move the needle on affordable workforce housing, this is a grain of sand in an a nationwide crisis. Government will never solve this problem, only exasperate it. Case in point, the Biden Administration is trying to push through a nationwide energy efficiency code for all government backed mortgage property that will raise the cost of homes 15k. They also raised Canadian lumber tariffs 50% over previous amount. Trillion dollar deficit spending every 100 days is fueling inflation while growth plummets. Lastly energy policy has been decimated. 100% of housing un affordability can be traced… Read more »

Rick, you raise good points about the high cost of inputs. Many of those price increases are caused by government actions whose leaders are supported by lower-income people.

There is zero reason for energy efficiency to cost more if it is addressed in the planning stage. In NYC, nearly all affordable housing these days is built to Passive House standards. Developers all over the country are recognizing the business case for building in resiliency and sustainability. In much of the country, builders do not build starter homes because the profit incentive is to build bigger. Starter homes are built in build-to-rent communities because the cash flow from rents is more profitable than the gain from the sale. Only government can solve that problem, and it’s done with tax… Read more »

I’m pro energy efficiency. But it costs me lots of money, even when addressed in the planning stage. Why? It runs up against other city of richmond requirements.

And spray foam costs much more than fiberglass. And energy saving HVAC costs much more (economically inefficient).

The government has caused the problem by making it impossible to make a profit building starter housing. Making it profitable again will solve the problem

I have seen reports from experienced builders who reckon on $5k extra to build to the higher performance standards. We buy cars and we expect accurate mpg figures when we buy them. We buy houses – our biggest investment – and we hope they perform. Given the increasing energy costs, it has been sensible and obvious for decades that better performing houses give lower through life costs to the occupants. $5k up front for decades of lower costs. Buildings should perform better.

Do the math, and you’ll probably find the extra $5k (which I’m not conceding) will end up about $12/month for the duration of the mortgage. That’s to save the homeowner half of their monthly energy bill. This is not magical thinking, and it doesn’t require a belief system — it’s just science and math.

it’s very very unlikely to be half their bill. More like that 12/month will save them 50 a month in practice.

it’s more than 5k, depending on which standards. Through in some of the new england window standards and 50k is easy to hit. Roof to r49 is pretty doable, that one isn’t bad. 2×6 walls and insulation will blow through 5k.

Raising house prices by $50k in this market isn’t going to be a hot seller, even if it does make life cycle financial sense.

All in all, this is a great idea, and I look forward to seeing what the additional proposals have to offer. The one issue I find here is that the homebuyer does not get to keep the full proceeds from the sale of the home. While I understand this is needed to keep the home affordable for future tenants, this does not help build generational wealth.

It helps, but simply not as much as normal. They would still build wealth on the structure, but not the land. Better than nothing and a stepping stone to building equity towards the purchase of another home.

True.

Ironic how counties restrict the supply of housing by denying zoning cases and passing restrictive land use laws that have taken away the potential for thousands of new homes each year then pat themselves on the back by creating 20 low income homes. Even if builders only built expensive homes it would still free up cheaper existing homes for first time home buyers, but they’ll never admit that they are the root causse of the problem.

It’s complicated. Much of the land use laws are beyond common sense regarding residential — people in these comments act as if private enterprises like homebuilders shouldn’t care about profit, which would drive them out of business, well munis, and these counties ALSO care about money too, and what they care about is tax revenue in and county spending out —- and the main reason why the country doesn’t let affordable small houses on small lots to be built is that they require the homebuilder to do all sorts of things and pay for all sorts of things that make… Read more »

I found one of the points in this article to be of interest – the difference in focus on supply and demand. Obviously the social democratic aspects will upset some, but an interesting success story:

https://www.theguardian.com/society/2024/apr/30/california-housing-vienna-lessons

Why don’t you move to California if you think it’s such a success.

I’m sorry if you feel treatened by someone looking at ideas from elsewhere.

I think it probably has to do with WHERE the ideas are coming from and who. California has recently not proven good at ANY policy solutions, and housing affordability certainly is one of them — developers with land are beset with all sorts of impediments, including huge govt GRAFT the scale of which we are not used to here, along with tons more regulations. Ironically, developers who own miles of expensive California land are TERRIBLE investments — the amount of palms they have to grease and pet govt requirements they have to include in their budget make it barely worth… Read more »

Ah! Now I see this is about Austria, one of my favorite countries, not California, which DOES have good weather…. Well. Lots to say about places like Austria — let’s just say that, for now at least, places like Austria have a lot of SOCIAL trust and are a bit more like one tribe than, say, the USA. Human nature is a hard problem to solve, and even Scandinavian counties like Norway still have human nature problems, and even families and clans sometimes can’t get along — but when people don’t even agree about culture in a country, and the… Read more »

Here’s a fascinating article on how Vienna, Austria manages to be known as a bastion of affordable housing.

Could Vienna’s approach to affordable housing work in California? | Housing | The Guardian

How bout we legalize starter homes, duplexes and ADUs?

I did not know starter homes were illegal

Technically, they aren’t.

But trying to build them without permits is, and one could theoretically get the permits, and then eventually go bankrupt when you try to build starter homes to the standards, pay all the infrastructure fees, etc, for so little or no profit per unit due to not only the expense of requirements, but the labor, etc….

People on these pages like to talk about how expensive it is to buy a home, but it is more instructive to learn how expensive it is to BUILD a home, and then have enough curiosity to learn WHY it is so expensive. Here is site that represents how eye-opening the general info out there is, it explains why even tiny, cheap-o new builds built on cheap infill (meaning there already once was a house there) lots in some of Petersburg’s most crummy neighborhoods can sell for 170$ a sq. ft ——- because it generally costs 190$ a square foot… Read more »

I don’t know why this got downvoted. It’s true

The answer is in your question.

A lot of people downvote the truth. It is why I post here, to get more truth out to people who are unburdened by facts.

really? They are functionally illegal. I’m actually stunned someone doesn’t know that these days considering how often it’s discussed. Take a look at a case study, one of the small starter houses in the near west end or Maymont area, and then run it through zoning and the code and see what happens. Functionally illegal to build now unless someone wants to guarantee. that they will work their butt off to take a loss. One can build them yes. I’ve done so. But not at starter home pricing. 30-50k of soft costs to city alone, and 6 months to get… Read more »

Thank you for contributing to the Truth side of the discussion. One of the more “Progressive” things I state on these boards is that the Federal Govt needs to get involved — not to bully localities in some ways, that always has unintended negative consequences, but to INCENTIVIZE the best homebuilders to build starter homes small, dense and fast enough to get product out there like they did after WWII — anyone interested in how fast they were able to put up single family homes in the late 40s and 50s can watch tons of videos about it — it… Read more »

people need to ponder that inclusionary zoning is effectively a tax on housing. And taxing something makes in more expensive.

The real solution is to make it profitable to build cheap housing, by removing the zoning hurdles that make it impossible.

As I pointed out in another response, zoning is only one of the challenges. I know this well. I have a friend who lived in a rather exclusive little downtown in NJ which was commutable to Philly where his wife worked. He got himself elected to be a New Jersey version of the guy who decides what is what about “Do we need a new Library and how is it going to be done, etc…” and he decided that what was needed was for the city to build Affordable Housing, in this case apts. There was a lot of opposition,… Read more »