Troubled loans are still a burden for local banks, but although nine out of the 17 banks headquartered in the Richmond region reported a loss in the second quarter, many were on the borderline of profitability, according to recently filed financial reports. And a few turned around their performance from this time last year.

Troubled loans are still a burden for local banks, but although nine out of the 17 banks headquartered in the Richmond region reported a loss in the second quarter, many were on the borderline of profitability, according to recently filed financial reports. And a few turned around their performance from this time last year.

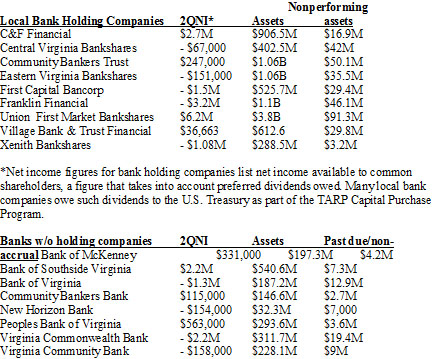

Union First Market Bankshares, the holding company of the biggest local bank in town, took in the most profit. Its $6.2 million second-quarter profit available to common shareholders, which is profit after accounting for dividends, was almost three times that of the nearest local competitor.

The largest loss of the quarter was at Franklin Financial Corp., the newly public holding company of Franklin Federal Savings Bank.

Franklin lost $3.2 million in the second quarter, although that was due to a hit to the books it took for giving $5.6 million of the proceeds of its April stock offering to its charitable foundation. It was otherwise profitable by $168,000.

Franklin lost $3.2 million in the second quarter, although that was due to a hit to the books it took for giving $5.6 million of the proceeds of its April stock offering to its charitable foundation. It was otherwise profitable by $168,000.

“I think everybody is still struggling a little bit,” said Rick Wheeler, CEO of Franklin Financial. “Many of the banks in our market were profitable but still recovering and still not returning to the earnings levels we’d like to achieve.”

Community Bankers Trust Corp., the Glen Allen-based holding company of Essex Bank, reported the largest turnaround of the quarter. Its $247,000 second-quarter profit was up from a loss of $19.8 million for the same period a year ago.

The holding companies of Central Virginia Bank and EVB also reported big turnarounds and were also profitable aside from preferred dividends owed for the TARP Capital Purchase Program.

CVB improved from a $1.2 million loss a year ago to a $67,000 loss in the second quarter of 2011. Its TARP payments, which it has deferred while it works its way through a written agreement, put it just barely in the red.

EVB had a slight loss of $151,000 after accounting for its TARP dividends, a major improvement from $6.3 million loss a year ago.

Borrowers are still feeling the pinch, though, and that’s weighing down local banks.

Those troubles are causing the banks to have to set aside millions in reserve for potential loan losses. And those reserves are what caused some banks to be in the red.

“I think there is still a lot of stress among borrowers,” Wheeler said. “I don’t think we’ve hit the bottom for everybody.”

The region’s newest bank, Powhatan-based New Horizon Bank, doesn’t yet have that problem.

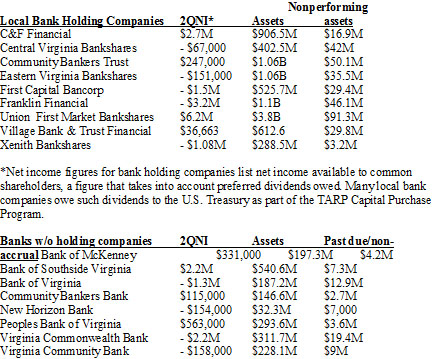

New Horizon, founded in late 2009, only had $7,000 in non-accrual loans. Its asset base grew to $32 million, almost double from a year ago. It lost $154,000 in the second quarter, much improved over last year, when it lost $536,000 in the second quarter. Such losses are typical of a startup bank during its first few years.

Petersburg-based Virginia Commonwealth Bank had one of the rougher quarters among its local peers, losing $2.2 million on top of a $400,000 loss in the first quarter. That compares with a $570,000 profit in the second quarter last year. It was beaten down by a $10 million increase in its past due and non-accrual loans compared with a year ago.

Wheeler said there will likely be some consolidation involving smaller banks over the next few years, and possibly beginning this year.

“There’s fatigue out there,” Wheeler said. “With the regulatory climate, there needs to be a heck of a lot more consolidation in the industry for efficiencies. There definitely are a lot of banks that are too small to survive.”

Michael Schwartz is a BizSense reporter and covers banking. Please send news tips to [email protected].

Troubled loans are still a burden for local banks, but although nine out of the 17 banks headquartered in the Richmond region reported a loss in the second quarter, many were on the borderline of profitability, according to recently filed financial reports. And a few turned around their performance from this time last year.

Troubled loans are still a burden for local banks, but although nine out of the 17 banks headquartered in the Richmond region reported a loss in the second quarter, many were on the borderline of profitability, according to recently filed financial reports. And a few turned around their performance from this time last year.

Union First Market Bankshares, the holding company of the biggest local bank in town, took in the most profit. Its $6.2 million second-quarter profit available to common shareholders, which is profit after accounting for dividends, was almost three times that of the nearest local competitor.

The largest loss of the quarter was at Franklin Financial Corp., the newly public holding company of Franklin Federal Savings Bank.

Franklin lost $3.2 million in the second quarter, although that was due to a hit to the books it took for giving $5.6 million of the proceeds of its April stock offering to its charitable foundation. It was otherwise profitable by $168,000.

Franklin lost $3.2 million in the second quarter, although that was due to a hit to the books it took for giving $5.6 million of the proceeds of its April stock offering to its charitable foundation. It was otherwise profitable by $168,000.

“I think everybody is still struggling a little bit,” said Rick Wheeler, CEO of Franklin Financial. “Many of the banks in our market were profitable but still recovering and still not returning to the earnings levels we’d like to achieve.”

Community Bankers Trust Corp., the Glen Allen-based holding company of Essex Bank, reported the largest turnaround of the quarter. Its $247,000 second-quarter profit was up from a loss of $19.8 million for the same period a year ago.

The holding companies of Central Virginia Bank and EVB also reported big turnarounds and were also profitable aside from preferred dividends owed for the TARP Capital Purchase Program.

CVB improved from a $1.2 million loss a year ago to a $67,000 loss in the second quarter of 2011. Its TARP payments, which it has deferred while it works its way through a written agreement, put it just barely in the red.

EVB had a slight loss of $151,000 after accounting for its TARP dividends, a major improvement from $6.3 million loss a year ago.

Borrowers are still feeling the pinch, though, and that’s weighing down local banks.

Those troubles are causing the banks to have to set aside millions in reserve for potential loan losses. And those reserves are what caused some banks to be in the red.

“I think there is still a lot of stress among borrowers,” Wheeler said. “I don’t think we’ve hit the bottom for everybody.”

The region’s newest bank, Powhatan-based New Horizon Bank, doesn’t yet have that problem.

New Horizon, founded in late 2009, only had $7,000 in non-accrual loans. Its asset base grew to $32 million, almost double from a year ago. It lost $154,000 in the second quarter, much improved over last year, when it lost $536,000 in the second quarter. Such losses are typical of a startup bank during its first few years.

Petersburg-based Virginia Commonwealth Bank had one of the rougher quarters among its local peers, losing $2.2 million on top of a $400,000 loss in the first quarter. That compares with a $570,000 profit in the second quarter last year. It was beaten down by a $10 million increase in its past due and non-accrual loans compared with a year ago.

Wheeler said there will likely be some consolidation involving smaller banks over the next few years, and possibly beginning this year.

“There’s fatigue out there,” Wheeler said. “With the regulatory climate, there needs to be a heck of a lot more consolidation in the industry for efficiencies. There definitely are a lot of banks that are too small to survive.”

Michael Schwartz is a BizSense reporter and covers banking. Please send news tips to [email protected].