Al Lingerfelt is taking his shopping spree on the road.

After buying up almost 1.5 million square feet of office space in the Richmond suburban office market, the developer announced Monday that he had closed on almost 500,000 square feet in Nashville, Tenn.

And his firm, the Lingerfelt Companies, is going to keep looking beyond Richmond.

“We’d be happy to increase our presence here, but realistically there is only so much we’ll be able to get our hands on,” Lingerfelt said. “We’re aggressively looking throughout the Mid-Atlantic.”

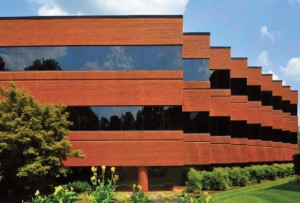

The 113,000-square-foot Lakeview Ridge III office building in Nashville, part of Lingerfelt’s five-building purchase. (Images courtesy of Lingerfelt Companies)

The $41 million Tennessee deal was for five buildings near the Nashville airport previously owned by Highwoods Properties.

Brian Witthoefft, a principal with the Lingerfelt Companies, said the deal was in keeping with the company’s strategy of buying up suburban offices in second-tier markets.

“It’s a particularly great time to buy for private equity and private investors,” Witthoefft said. “It dovetails with what’s going on in the industry, with some firms selling legacy assets and redeploying in first-tier markets.”

The Nashville deal, financed by institutional investors and other debt, adds 485,000 square feet to the Lingerfelt Companies’ portfolio, which now includes 2.6 million square feet of office space.

The vast majority of those holdings were purchased beginning in May 2011, when the company announced a $100 million deal on 14 office buildings in Innsbrook.

A few months later, Lingerfelt paid $9.3 million for a building on Glen Forest Drive.

And in April, the company announced the acquisition of three buildings at the Boulders office park, adding another 300,000 square feet.

Highwoods Properties said in a news release that the properties it sold to Lingerfelt were about 22 years old and were in a market the company saw as weak.

“The disposition of these older, Class B properties further improves the quality of our overall portfolio,” Highwoods CEO Ed Fritsch said in the release. “The sale also marks our exit from Nashville’s airport submarket which has consistently been one of the market’s weakest.”

Highwoods said the buildings were performing well below its other Nashville properties.

The buildings that Lingerfelt bought are expected to generate $3.5 million this year in operating income, according to Highwoods.

Witthoefft said the Lingerfelt Companies disagrees that the properties are Class B.

“It’s ultimately subjective,” he said. “We see them as Class A, maybe B-plus.”

Mark Douglas, a broker with Cushman & Wakefield | Thalhimer who specializes in office property, said that Lingerfelt’s strategy of buying up offices from companies ditching the market is a smart one.

“He’s got money, and he’s taking advantage of the market,” Douglas said.

Al Lingerfelt is taking his shopping spree on the road.

After buying up almost 1.5 million square feet of office space in the Richmond suburban office market, the developer announced Monday that he had closed on almost 500,000 square feet in Nashville, Tenn.

And his firm, the Lingerfelt Companies, is going to keep looking beyond Richmond.

“We’d be happy to increase our presence here, but realistically there is only so much we’ll be able to get our hands on,” Lingerfelt said. “We’re aggressively looking throughout the Mid-Atlantic.”

The 113,000-square-foot Lakeview Ridge III office building in Nashville, part of Lingerfelt’s five-building purchase. (Images courtesy of Lingerfelt Companies)

The $41 million Tennessee deal was for five buildings near the Nashville airport previously owned by Highwoods Properties.

Brian Witthoefft, a principal with the Lingerfelt Companies, said the deal was in keeping with the company’s strategy of buying up suburban offices in second-tier markets.

“It’s a particularly great time to buy for private equity and private investors,” Witthoefft said. “It dovetails with what’s going on in the industry, with some firms selling legacy assets and redeploying in first-tier markets.”

The Nashville deal, financed by institutional investors and other debt, adds 485,000 square feet to the Lingerfelt Companies’ portfolio, which now includes 2.6 million square feet of office space.

The vast majority of those holdings were purchased beginning in May 2011, when the company announced a $100 million deal on 14 office buildings in Innsbrook.

A few months later, Lingerfelt paid $9.3 million for a building on Glen Forest Drive.

And in April, the company announced the acquisition of three buildings at the Boulders office park, adding another 300,000 square feet.

Highwoods Properties said in a news release that the properties it sold to Lingerfelt were about 22 years old and were in a market the company saw as weak.

“The disposition of these older, Class B properties further improves the quality of our overall portfolio,” Highwoods CEO Ed Fritsch said in the release. “The sale also marks our exit from Nashville’s airport submarket which has consistently been one of the market’s weakest.”

Highwoods said the buildings were performing well below its other Nashville properties.

The buildings that Lingerfelt bought are expected to generate $3.5 million this year in operating income, according to Highwoods.

Witthoefft said the Lingerfelt Companies disagrees that the properties are Class B.

“It’s ultimately subjective,” he said. “We see them as Class A, maybe B-plus.”

Mark Douglas, a broker with Cushman & Wakefield | Thalhimer who specializes in office property, said that Lingerfelt’s strategy of buying up offices from companies ditching the market is a smart one.

“He’s got money, and he’s taking advantage of the market,” Douglas said.