The bankrupt former head of a Richmond investment firm is facing federal criminal charges more than a year after admitting he lied to several banks about his wealth to keep borrowing money.

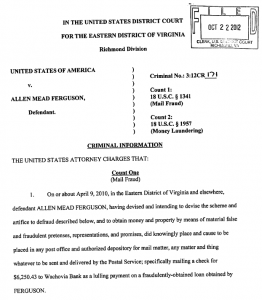

Allen Mead Ferguson was charged Oct. 22 by the U.S. Attorney’s Office with mail fraud and money laundering. The allegations stem from millions of dollars in bank loans Ferguson secured by claiming as collateral assets that did not exist.

“The purpose of the scheme was for Ferguson to obtain funds from various federally insured financial institutions in order to personally enrich himself,” the U.S. Attorney’s Office said in the case filing.

Ferguson used to be chairman and chief executive of Craigie Inc., formerly one of Richmond’s oldest investment banking firms.

Ferguson was charged via the criminal information process, which does not require an arrest or a grand jury indictment.

He is scheduled to appear Nov. 14 in federal court for bond and plea agreement hearings. Ferguson faces a maximum of 20 years on each criminal count, according to the U.S. Attorney’s Office. If convicted of mail fraud, he would also be ordered to forfeit $5.65 million, money the charges claim was obtained as a result of the alleged crime. He would also have to turn over funds or property tied to the money laundering charge, the filing states.

The criminal allegations come more than 18 months after Ferguson and his wife, Mary Rutherfoord Mercer Ferguson, filed for Chapter 11 bankruptcy protection. They later filed for Chapter 7 liquidation.At the time of their initial filing, the couple, who were active in the local philanthropy scene, had income of about $2,200 from Social Security and expenses of $22,000 a month. The couple listed more than $6 million in debt, including over-leveraged real estate such as their former home on Three Chopt Road. They had also borrowed more than $800,000 from friends, including several prominent Richmonders, the bankruptcy filings showed. The Fergusons were donors to the Society of the Cincinnati, St. Christopher’s School, the Valentine Richmond History Center, Colonial Dames and Riverside School.

Mary Ferguson is not named in the federal criminal charges.

It was during the couple’s personal bankruptcy hearings that Allen Ferguson admitted under oath that he lied about a supposed $3 million in investment accounts. Union First Market Bank, EVB and Wachovia/Wells Fargo each eventually filed suit, claiming that Ferguson falsely represented those assets in order to deceive the banks and obtain more loans.

Transfers of money tied to those fraudulently obtained loans are what led to the current criminal charges.

As it pertains to the mail fraud allegation, when Wachovia began to question Ferguson in 2009 after loaning him $655,000 based on the supposed assets, he mailed a check to pay interest as a “lulling payment” to keep the bank at bay, according to the charges.

“Ferguson knowingly mailed this check to assure Wachovia that he still owned the assets described in his personal financial statements when, in fact, he did not,” the charges state.

The money laundering charge stems from a check written to Union Bank and Trust, a predecessor of Union First Market. Ferguson wrote a $60,000 check to Union using money that the complaint alleges was fraudulently obtained and was from the account tied to the mail fraud charge.

Union at one point loaned the Fergusons more than $800,000. EVB was owed $1.54 million at the time of the couple’s bankruptcy but is not mentioned in the criminal case.

In addition to Allen Ferguson’s work at the Craigie bond-trading firm, the couple’s wealth was derived from a longtime local rug business and real estate once owned by Mary Ferguson’s father, George Mercer.

Shortly after the Fergusons’ personal bankruptcy filing, Mercer Rug Cleansing and Victory Rug Cleaning were put into bankruptcy in an attempt to prevent the couple’s creditors from snatching them as collateral.

The business assets were eventually liquidated and sold at auction.

The couple’s home and valuable personal assets, including artwork, furniture and membership interests in the Country Club of Virginia, were also sold to recoup funds for creditors.

Their personal bankruptcy case continues in federal court.

The U.S. Attorney’s Office declined to comment on the case against Allen Ferguson. Assistant U.S. Attorney Jessica Brumberg is working the case.

Judge Robert E. Payne, who was to oversee the case, recused himself last week. No reason was given for the recusal in court records.

Ferguson’s bond hearing this month will determine whether he’ll remain free as the case progresses or should be taken into custody.

Although a plea hearing has been set, the details of any pending plea agreement have not been revealed in court records.

Richard Cullen and Brandon Santos, attorneys with McGuireWoods, are representing Ferguson.

Cullen said Thursday in an email to Richmond BizSense that he and his client have no comment except to say, “Mr. Ferguson has been cooperating with all involved in the legal process and will continue to do so.”

A message left for Ferguson at his home was not returned by press time.

The bankrupt former head of a Richmond investment firm is facing federal criminal charges more than a year after admitting he lied to several banks about his wealth to keep borrowing money.

Allen Mead Ferguson was charged Oct. 22 by the U.S. Attorney’s Office with mail fraud and money laundering. The allegations stem from millions of dollars in bank loans Ferguson secured by claiming as collateral assets that did not exist.

“The purpose of the scheme was for Ferguson to obtain funds from various federally insured financial institutions in order to personally enrich himself,” the U.S. Attorney’s Office said in the case filing.

Ferguson used to be chairman and chief executive of Craigie Inc., formerly one of Richmond’s oldest investment banking firms.

Ferguson was charged via the criminal information process, which does not require an arrest or a grand jury indictment.

He is scheduled to appear Nov. 14 in federal court for bond and plea agreement hearings. Ferguson faces a maximum of 20 years on each criminal count, according to the U.S. Attorney’s Office. If convicted of mail fraud, he would also be ordered to forfeit $5.65 million, money the charges claim was obtained as a result of the alleged crime. He would also have to turn over funds or property tied to the money laundering charge, the filing states.

The criminal allegations come more than 18 months after Ferguson and his wife, Mary Rutherfoord Mercer Ferguson, filed for Chapter 11 bankruptcy protection. They later filed for Chapter 7 liquidation.At the time of their initial filing, the couple, who were active in the local philanthropy scene, had income of about $2,200 from Social Security and expenses of $22,000 a month. The couple listed more than $6 million in debt, including over-leveraged real estate such as their former home on Three Chopt Road. They had also borrowed more than $800,000 from friends, including several prominent Richmonders, the bankruptcy filings showed. The Fergusons were donors to the Society of the Cincinnati, St. Christopher’s School, the Valentine Richmond History Center, Colonial Dames and Riverside School.

Mary Ferguson is not named in the federal criminal charges.

It was during the couple’s personal bankruptcy hearings that Allen Ferguson admitted under oath that he lied about a supposed $3 million in investment accounts. Union First Market Bank, EVB and Wachovia/Wells Fargo each eventually filed suit, claiming that Ferguson falsely represented those assets in order to deceive the banks and obtain more loans.

Transfers of money tied to those fraudulently obtained loans are what led to the current criminal charges.

As it pertains to the mail fraud allegation, when Wachovia began to question Ferguson in 2009 after loaning him $655,000 based on the supposed assets, he mailed a check to pay interest as a “lulling payment” to keep the bank at bay, according to the charges.

“Ferguson knowingly mailed this check to assure Wachovia that he still owned the assets described in his personal financial statements when, in fact, he did not,” the charges state.

The money laundering charge stems from a check written to Union Bank and Trust, a predecessor of Union First Market. Ferguson wrote a $60,000 check to Union using money that the complaint alleges was fraudulently obtained and was from the account tied to the mail fraud charge.

Union at one point loaned the Fergusons more than $800,000. EVB was owed $1.54 million at the time of the couple’s bankruptcy but is not mentioned in the criminal case.

In addition to Allen Ferguson’s work at the Craigie bond-trading firm, the couple’s wealth was derived from a longtime local rug business and real estate once owned by Mary Ferguson’s father, George Mercer.

Shortly after the Fergusons’ personal bankruptcy filing, Mercer Rug Cleansing and Victory Rug Cleaning were put into bankruptcy in an attempt to prevent the couple’s creditors from snatching them as collateral.

The business assets were eventually liquidated and sold at auction.

The couple’s home and valuable personal assets, including artwork, furniture and membership interests in the Country Club of Virginia, were also sold to recoup funds for creditors.

Their personal bankruptcy case continues in federal court.

The U.S. Attorney’s Office declined to comment on the case against Allen Ferguson. Assistant U.S. Attorney Jessica Brumberg is working the case.

Judge Robert E. Payne, who was to oversee the case, recused himself last week. No reason was given for the recusal in court records.

Ferguson’s bond hearing this month will determine whether he’ll remain free as the case progresses or should be taken into custody.

Although a plea hearing has been set, the details of any pending plea agreement have not been revealed in court records.

Richard Cullen and Brandon Santos, attorneys with McGuireWoods, are representing Ferguson.

Cullen said Thursday in an email to Richmond BizSense that he and his client have no comment except to say, “Mr. Ferguson has been cooperating with all involved in the legal process and will continue to do so.”

A message left for Ferguson at his home was not returned by press time.