A massive clog in the pipes of the American mortgage system is bubbling up in Richmond courts.

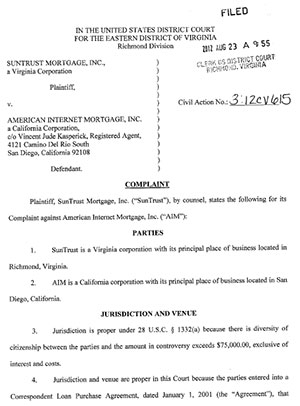

SunTrust Mortgage, headquartered in Manchester, has filed dozens of lawsuits over the past 18 months in a quest to recoup millions of dollars from small companies that sold loans to SunTrust that went bad.

Beaten down by demands from the likes of Fannie Mae and Freddie Mac to repurchase the soured loans, SunTrust is dishing out lumps to those next in line: the mortgage brokers and small mortgage bankers that initiated the loans.

The lawsuits, filed in Richmond Federal Court and Henrico County Circuit Court, are going after the mortgage brokers that popped up left and right during the real estate boom with names such as Majestic Home Loan, A-Plus Mortgage, Integrity Financial Services and Best Results Mortgage. Some smaller community banks have also been sued.

“What we’re seeing is a microcosm of what was going on in the mortgage industry,” said Kevin Funk, an attorney with Richmond law firm DurretteCrump who has defended more than a dozen mortgage company defendants in these cases. “You start with easy money. You loosen your standards. Now we’re seeing the fallout.”

SunTrust Mortgage has filed more than 100 suits in Eastern District Federal Court in Richmond. At least 50 have been filed in Henrico County Circuit Court since mid-2011.

The lawsuits take on companies from across the country, with noticeable hotspots such as Southern Florida and California, and they seek paybacks ranging from $7,000 to more than $1 million.

In the Henrico cases alone, SunTrust Mortgage is looking to recoup almost $12 million. The majority of the suits relate to loans made between 2006 and 2008, when just about anyone could get a mortgage.

How it all started

The mechanism of the mortgage market that has resulted in these suits goes like this: Mortgage brokers that are too small to fund loans themselves bring in borrowers, get them “qualified” and send them off to big lenders such as SunTrust to get funded.

“Many of these were small, basically mom-and-pop mortgage companies with very limited resources,” said George Doumar, an attorney in Northern Virginia who has defended three mortgage companies in cases against SunTrust. “They process forms according to Fannie and Freddie standards.”

Other cases involve small community banks and mortgage banks – often called correspondent lenders – that have enough to initially fund the loans but quickly sell them up the line to middleman banks such as SunTrust.

SunTrust and its peers then package those loans and sell them to Fannie Mae and Freddie Mac, and sometimes even larger banks, where they are securitized and sold to investors.

The crux of SunTrust’s lawsuits is that at each step of the buy-a-loan-and-pass-it-on process are warranties and indemnification contracts.

Entities such as Fannie Mae made good on its contracts with SunTrust and other big banks by demanding the repurchase of hundreds of millions of dollars in bad loans after borrowers stopped paying and the properties ended up in foreclosure. SunTrust, too, had warranties against the small mortgage companies.

As Funk explains it, the agreements in a nutshell say, “You are going to sell me this loan. If I suffer a loss, you’re going to pay me the loss.”

How the cases play out

SunTrust has plenty of motivation to fight for at least some of the money.

According to its latest financial report, SunTrust received $384 million in repurchase demands in the fourth quarter of 2012, an improvement over $636 million in same quarter of 2011.

SunTrust has recognized $1.6 billion in losses related to repurchases since the process began, according to its financial filings. SunTrust spokesperson Mike McCoy said the company does not comment on litigation.

SunTrust isn’t alone in being on the hook to Fannie and Freddie. And the government-sponsored entities aren’t yet done with their demands.

Bank of America earlier this month struck an $11.7 billion agreement with Fannie to satisfy buyback demands, according to a Bloomberg report. Fannie is about three-quarters of the way through its demand attempts, the report states. JP Morgan Chase & Co., Wells Fargo, Citigroup and others remain on the hook.

The amount the banks seeks to win back in the lawsuits is typically the balance owed to Fannie or Freddie after they’ve sold the collateral real estate at foreclosure.

Doumar, who has represented brokers in Minnesota, Florida and Massachusetts, argues that SunTrust’s suits are heavily one-sided.

Small brokers that initiate a loan but don’t actually fund it might get a fee of 1 percent or less on each transaction, he said.

“They may have made a $1,000 on a transaction but then get sued for $500,000,” Doumar said.

Some of the suits do end up in settlement, but the odds that SunTrust will be awarded the sought-after amount are slim. Many of the cases quietly go to default judgment, with the defendants unable to defend themselves or even to respond to the suits.

“The simple answer is a lot are out of business,” Funk said of the defendants. “There are nowhere near as many mortgage brokers now as there were in ’05 or ’06. A lot of these people, even if they file an answer to the suit, may not be out of the business but they are teetering on the edge.”

When the defendant is still around and able to pay something, which typically occurs when going after a correspondent lender, negotiations begin.

“We try to find some common ground and hash out a solution,” Funk said. “They’ve been realistic in their expectations,” he said of SunTrust.

Any settlements are all confidential.

That’s typically the end of the line as most of the owners of the defendant mortgage companies have no personal liabilities in their dealings with banks such as SunTrust, so the corporate lawyers can’t go after them.

Nor do the mortgage brokers have much of a chance to go after the borrowers further down the line. The borrowers in most cases were in trouble to begin with. And properties that served as collateral are typically long gone through foreclosure.

The bright side for Richmond lawyers

All these cases are being litigated locally because SunTrust Mortgage’s headquarters is at 1001 Semmes Ave., and Richmond courts were chosen as the proper jurisdiction for all such suits.

That’s good news at least for several local attorneys that have landed plenty of work in the dozens of cases.

In addition to Funk and Doumar, SunTrust is represented in many of the cases by Bob Perrow, an attorney with Williams Mullen. Perrow said he had not been authorized by SunTrust to comment on the cases.

Scott Bruggeman, an attorney with the Richmond office of Wolfe & Wyman, is working many of the cases in federal court for SunTrust. He referred all comments to SunTrust’s corporate spokesman.

Michael Montgomery, an attorney with Sinnott, Nuckols & Logan in Midlothian, helped defend a broker out of Georgia in a federal case filed by SunTrust Mortgage.

Richmond law firm Spotts Fain has also landed work in the cases.

A massive clog in the pipes of the American mortgage system is bubbling up in Richmond courts.

SunTrust Mortgage, headquartered in Manchester, has filed dozens of lawsuits over the past 18 months in a quest to recoup millions of dollars from small companies that sold loans to SunTrust that went bad.

Beaten down by demands from the likes of Fannie Mae and Freddie Mac to repurchase the soured loans, SunTrust is dishing out lumps to those next in line: the mortgage brokers and small mortgage bankers that initiated the loans.

The lawsuits, filed in Richmond Federal Court and Henrico County Circuit Court, are going after the mortgage brokers that popped up left and right during the real estate boom with names such as Majestic Home Loan, A-Plus Mortgage, Integrity Financial Services and Best Results Mortgage. Some smaller community banks have also been sued.

“What we’re seeing is a microcosm of what was going on in the mortgage industry,” said Kevin Funk, an attorney with Richmond law firm DurretteCrump who has defended more than a dozen mortgage company defendants in these cases. “You start with easy money. You loosen your standards. Now we’re seeing the fallout.”

SunTrust Mortgage has filed more than 100 suits in Eastern District Federal Court in Richmond. At least 50 have been filed in Henrico County Circuit Court since mid-2011.

The lawsuits take on companies from across the country, with noticeable hotspots such as Southern Florida and California, and they seek paybacks ranging from $7,000 to more than $1 million.

In the Henrico cases alone, SunTrust Mortgage is looking to recoup almost $12 million. The majority of the suits relate to loans made between 2006 and 2008, when just about anyone could get a mortgage.

How it all started

The mechanism of the mortgage market that has resulted in these suits goes like this: Mortgage brokers that are too small to fund loans themselves bring in borrowers, get them “qualified” and send them off to big lenders such as SunTrust to get funded.

“Many of these were small, basically mom-and-pop mortgage companies with very limited resources,” said George Doumar, an attorney in Northern Virginia who has defended three mortgage companies in cases against SunTrust. “They process forms according to Fannie and Freddie standards.”

Other cases involve small community banks and mortgage banks – often called correspondent lenders – that have enough to initially fund the loans but quickly sell them up the line to middleman banks such as SunTrust.

SunTrust and its peers then package those loans and sell them to Fannie Mae and Freddie Mac, and sometimes even larger banks, where they are securitized and sold to investors.

The crux of SunTrust’s lawsuits is that at each step of the buy-a-loan-and-pass-it-on process are warranties and indemnification contracts.

Entities such as Fannie Mae made good on its contracts with SunTrust and other big banks by demanding the repurchase of hundreds of millions of dollars in bad loans after borrowers stopped paying and the properties ended up in foreclosure. SunTrust, too, had warranties against the small mortgage companies.

As Funk explains it, the agreements in a nutshell say, “You are going to sell me this loan. If I suffer a loss, you’re going to pay me the loss.”

How the cases play out

SunTrust has plenty of motivation to fight for at least some of the money.

According to its latest financial report, SunTrust received $384 million in repurchase demands in the fourth quarter of 2012, an improvement over $636 million in same quarter of 2011.

SunTrust has recognized $1.6 billion in losses related to repurchases since the process began, according to its financial filings. SunTrust spokesperson Mike McCoy said the company does not comment on litigation.

SunTrust isn’t alone in being on the hook to Fannie and Freddie. And the government-sponsored entities aren’t yet done with their demands.

Bank of America earlier this month struck an $11.7 billion agreement with Fannie to satisfy buyback demands, according to a Bloomberg report. Fannie is about three-quarters of the way through its demand attempts, the report states. JP Morgan Chase & Co., Wells Fargo, Citigroup and others remain on the hook.

The amount the banks seeks to win back in the lawsuits is typically the balance owed to Fannie or Freddie after they’ve sold the collateral real estate at foreclosure.

Doumar, who has represented brokers in Minnesota, Florida and Massachusetts, argues that SunTrust’s suits are heavily one-sided.

Small brokers that initiate a loan but don’t actually fund it might get a fee of 1 percent or less on each transaction, he said.

“They may have made a $1,000 on a transaction but then get sued for $500,000,” Doumar said.

Some of the suits do end up in settlement, but the odds that SunTrust will be awarded the sought-after amount are slim. Many of the cases quietly go to default judgment, with the defendants unable to defend themselves or even to respond to the suits.

“The simple answer is a lot are out of business,” Funk said of the defendants. “There are nowhere near as many mortgage brokers now as there were in ’05 or ’06. A lot of these people, even if they file an answer to the suit, may not be out of the business but they are teetering on the edge.”

When the defendant is still around and able to pay something, which typically occurs when going after a correspondent lender, negotiations begin.

“We try to find some common ground and hash out a solution,” Funk said. “They’ve been realistic in their expectations,” he said of SunTrust.

Any settlements are all confidential.

That’s typically the end of the line as most of the owners of the defendant mortgage companies have no personal liabilities in their dealings with banks such as SunTrust, so the corporate lawyers can’t go after them.

Nor do the mortgage brokers have much of a chance to go after the borrowers further down the line. The borrowers in most cases were in trouble to begin with. And properties that served as collateral are typically long gone through foreclosure.

The bright side for Richmond lawyers

All these cases are being litigated locally because SunTrust Mortgage’s headquarters is at 1001 Semmes Ave., and Richmond courts were chosen as the proper jurisdiction for all such suits.

That’s good news at least for several local attorneys that have landed plenty of work in the dozens of cases.

In addition to Funk and Doumar, SunTrust is represented in many of the cases by Bob Perrow, an attorney with Williams Mullen. Perrow said he had not been authorized by SunTrust to comment on the cases.

Scott Bruggeman, an attorney with the Richmond office of Wolfe & Wyman, is working many of the cases in federal court for SunTrust. He referred all comments to SunTrust’s corporate spokesman.

Michael Montgomery, an attorney with Sinnott, Nuckols & Logan in Midlothian, helped defend a broker out of Georgia in a federal case filed by SunTrust Mortgage.

Richmond law firm Spotts Fain has also landed work in the cases.

When bank-owned mortgage companies with the help of Wall Street firms solicited Mortgage Brokers and Correspondents in the early 2,000’s for their loan originations, they had insatiable appetites for any mortgage where the borrower’s could fog a mirror. The loose(or nearly non-existent) underwriting guidelines were not established by Mortgage Brokers or Correspondents….they were written by the banks themselves and driven by what Wall Street promised to market via mortgage-backed securities. When it all came crashing down, banks like Suntrust suddenly needed a scapegoat to take the blame for what will go down as one of the biggest bank scams in… Read more »