8300 Staples Trace Road in the Staples Mill Trace subdivision was one of several properties saved from foreclosure by the Chapter 11 filing.

With a portfolio of residential properties slipping away to foreclosure, a local homebuilder receded into bankruptcy Friday.

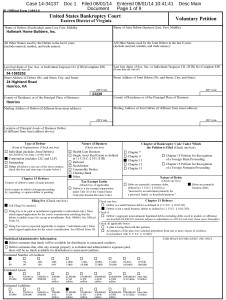

Hallmark Home Builders Inc. filed for Chapter 11 bankruptcy protection on Aug. 1.

The day before, the company lost 13 residential lots and two finished homes at auction but filed for bankruptcy just in time to save another seven lots and 10 homes from additional foreclosure auctions that had been scheduled for Friday afternoon.

The foreclosures were spurred by the builder defaulting on a loan from Union First Market Bank. The loan was backed by 32 residential properties in Henrico, Hanover, King William, New Kent and Louisa counties.

A slate of five courthouse auctions was scheduled for Hallmark’s properties Thursday and Friday of last week. The July 31 sales happened as planned, and Hallmark Home Builders lost its properties in King William and New Kent County.

Those holdings included lots in the Central Crossing subdivision in King William County and the Brickshire subdivision and New Kent. Jonathan Hauser, a Troutman Sanders attorney handling the foreclosures, said those lots were sold at auction to third-party bidders.

Another of the company’s undeveloped lots in Louisa County’s Castle Park subdivision went to auction at 10 a.m. Friday morning.

But Hallmark’s Chapter 11 filing, entered at 10:41 a.m. Friday morning, beat out foreclosure auctions scheduled for 11:30 in Hanover County and 1 p.m. in Henrico County.

The move has, at least temporarily, kept Hallmark from losing the remaining 17 lots.

Seven of the lots have homes on them. The homes are in the Staples Mill Trace, Hunton Station, Mountain Laurel Townhouses and Lee’s Crossing subdivisions in Henrico. The Hanover County properties slated for foreclosure included three lots, each with finished homes, at Elwin Place, The Hollows and Glen Harbor subdivisions.

Hallmark’s initial foreclosure filing values its assets between $0 and $50,000 with liabilities in the $1 million to $10 million range. Union is its largest creditor listed in the initial filing. Others listed with debt claims against the company are Hanover County, Henrico County, King William County, law firm Williams Mullen, several property owners associations and other businesses. It also lists disputed debts to several companies.

Hallmark lists Thomas Towers Jr. as its president and owner. Towers could not be reached at Hallmark’s offices for comment. The company in its filing lists an address of 24 Highland Road in Henrico. Its website lists an office address at 7714-C Whitepine Road in Chesterfield.

Hallmark is being represented in its bankruptcy by Sands Anderson attorney John Smith, who did not return a call seeking comment Friday afternoon.

8300 Staples Trace Road in the Staples Mill Trace subdivision was one of several properties saved from foreclosure by the Chapter 11 filing.

With a portfolio of residential properties slipping away to foreclosure, a local homebuilder receded into bankruptcy Friday.

Hallmark Home Builders Inc. filed for Chapter 11 bankruptcy protection on Aug. 1.

The day before, the company lost 13 residential lots and two finished homes at auction but filed for bankruptcy just in time to save another seven lots and 10 homes from additional foreclosure auctions that had been scheduled for Friday afternoon.

The foreclosures were spurred by the builder defaulting on a loan from Union First Market Bank. The loan was backed by 32 residential properties in Henrico, Hanover, King William, New Kent and Louisa counties.

A slate of five courthouse auctions was scheduled for Hallmark’s properties Thursday and Friday of last week. The July 31 sales happened as planned, and Hallmark Home Builders lost its properties in King William and New Kent County.

Those holdings included lots in the Central Crossing subdivision in King William County and the Brickshire subdivision and New Kent. Jonathan Hauser, a Troutman Sanders attorney handling the foreclosures, said those lots were sold at auction to third-party bidders.

Another of the company’s undeveloped lots in Louisa County’s Castle Park subdivision went to auction at 10 a.m. Friday morning.

But Hallmark’s Chapter 11 filing, entered at 10:41 a.m. Friday morning, beat out foreclosure auctions scheduled for 11:30 in Hanover County and 1 p.m. in Henrico County.

The move has, at least temporarily, kept Hallmark from losing the remaining 17 lots.

Seven of the lots have homes on them. The homes are in the Staples Mill Trace, Hunton Station, Mountain Laurel Townhouses and Lee’s Crossing subdivisions in Henrico. The Hanover County properties slated for foreclosure included three lots, each with finished homes, at Elwin Place, The Hollows and Glen Harbor subdivisions.

Hallmark’s initial foreclosure filing values its assets between $0 and $50,000 with liabilities in the $1 million to $10 million range. Union is its largest creditor listed in the initial filing. Others listed with debt claims against the company are Hanover County, Henrico County, King William County, law firm Williams Mullen, several property owners associations and other businesses. It also lists disputed debts to several companies.

Hallmark lists Thomas Towers Jr. as its president and owner. Towers could not be reached at Hallmark’s offices for comment. The company in its filing lists an address of 24 Highland Road in Henrico. Its website lists an office address at 7714-C Whitepine Road in Chesterfield.

Hallmark is being represented in its bankruptcy by Sands Anderson attorney John Smith, who did not return a call seeking comment Friday afternoon.

Hate to see businesses fail but this one wasn’t doing much good anyway. The last thing we need around here are more crappy plastic tract houses.