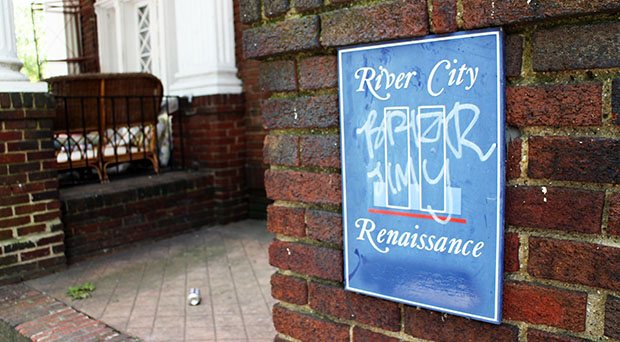

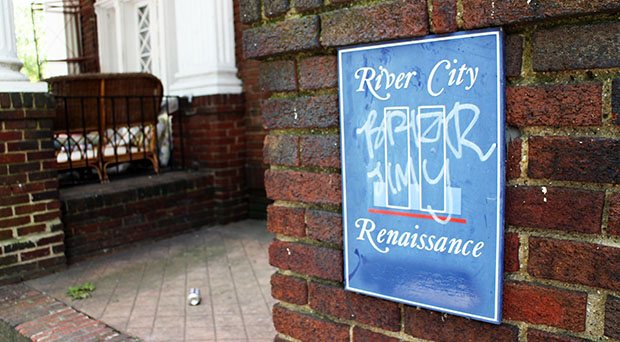

The properties held by developer Billy Jefferson through his two River City Renaissance firms are heading to auction. Photo by Evelyn Rupert.

An imprisoned Richmond developer’s trove of Fan apartment buildings is back up for auction.

Billy Jefferson’s River City Renaissance real estate portfolio, a collection of more than 400 apartments scattered between the Fan, Carytown and the Museum District, are being put up for sale in a conventional auction after avoiding foreclosure.

The sale, which was approved by federal bankruptcy court on Thursday, is scheduled for Dec. 18. Up for grabs will be 28 apartment buildings along Grace Street and Boulevard, as well as the 150-unit River City Court complex in the Museum District.

SVN/Motleys, the commercial real estate arm of Motleys Disposition Group, is handling the auction. The sale will be held at the East Franklin Street office of law firm Spotts Fain.

The portfolio has 439 apartment units total, Motley’s President Mark Motley said. The properties combined were most recently assessed at more than $31 million, according to city records.

“You really don’t see sales of this size,” Motley said. “You can have larger institutional buyers coming in to make offers, and because it’s being offered as individual properties as well, we are anticipating a substantial group of smaller investors to make offers on individual buildings or a cluster of buildings.”

While his properties head for auction, Jefferson is appealing a 20-year prison sentence related to a historic tax credit scheme and a subsequent plot to flee the country.

The River City Renaissance portfolio has been managed by court-ordered property receiver CompassRock Real Estate since March.

The property’s note holder attempted to foreclose on the River City Renaissance holdings in July, but the two entities through which Jefferson owns the portfolio retreated into Chapter 11 bankruptcy to block the foreclosure.

At that time, prosecutors and defense attorneys in Jefferson’s criminal case argued that the value in the River City properties was crucial to paying down the developer’s hefty restitution tab, and a foreclosure auction would likely draw a price below market value.

The two sides filed a joint motion asking a federal judge to release $165,000 of Jefferson’s money to hire Spotts Fain to steer the properties away from foreclosure.

Spotts Fain’s Robert Chappell, Neil McCullagh, Jennifer West and James Donaldson are handling the bankruptcy proceedings on River City Renaissance’s behalf.

Though the properties will still end up on the auction block, a foreclosure auction would have happened on the courthouse steps after a couple of weeks of minimal advertising. The order authorizing the current sale calls for a $50,000 advertising budget.

“This is not a small ad in the newspaper,” Motley said. “It’s a very extensive marketing campaign we believe will generate some interest in the properties.”

Motleys is also bringing in Louis Fisher III, a Florida-based agent with Sperry Van Ness’ national multifamily sales force, to work the sale. Fisher will focus on selling larger, national real estate firms on the River City portfolio.

Interested parties can begin the qualification process by visiting a website expected to go live this weekend. From there they will be asked to sign a confidentiality agreement to gain access to documentation on the properties.

The auctioneers will offer scheduled tours of Jefferson’s buildings between Nov.10 and Nov. 25, and all interested bidders must submit an opening bid and a 5 percent deposit by Dec. 10.

Up to two-thirds of the top bidders on each property or group of properties will be invited to participate in the live auction on Dec. 18.

And interested parties may not be difficult to find, at least locally.

Duke Dodson, president of locally based Dodson Property Management, said the Jefferson buildings are prime real estate, tenants are usually easy to find, and Fan multifamily properties are rather liquid investments.

Portfolios as large as Jefferson’s also rarely come on the market, he said, especially in the Fan. Dodson said a building or two will go for sale here and there, and they’ve usually sold very quickly and at a premium for the seller.

“Any kind of Fan multifamily – four, six, eight, 10, 12 units – in the last two years, that’s been a really hot segment,” Dodson said. “You’ll have multiple showings the first day and multiple offers on the first day.”

A bankruptcy court will have to rule on precisely which parties take priority when the proceeds from the sale are paid out. But U.S. Bank holds about $36 million worth of secured mortgages that would have to be paid down before the buildings’ owners would see any money.

Jefferson’s share would be made available to pay down his more than $9 million restitution requirement.

River City Renaissance and River City Renaissance III also have at least one other investor who could claim a share of the sale’s proceeds. William C. Boinest owns 20 percent of an entity called Jefferson Investment Group that owns 93.5 percent of the River City Renaissance firms, according to filings in Chesterfield County Circuit Court.

The River City Renaissance portfolio will become the second major piece of Jefferson’s real estate empire to change hands in recent months. A note holder on the former Tobacco Factory Lofts in Manchester took that building back through foreclosure in October.

The Parachute Factory apartment building at 307 Stockton St. still remains in Jefferson’s ownership. Lenders have indicated an intention to foreclose on that building. That property, like the Tobacco Factory, is underwater on an eight-figure mortgage, and the sale would likely not bring in any cash for restitution.

The properties held by developer Billy Jefferson through his two River City Renaissance firms are heading to auction. Photo by Evelyn Rupert.

An imprisoned Richmond developer’s trove of Fan apartment buildings is back up for auction.

Billy Jefferson’s River City Renaissance real estate portfolio, a collection of more than 400 apartments scattered between the Fan, Carytown and the Museum District, are being put up for sale in a conventional auction after avoiding foreclosure.

The sale, which was approved by federal bankruptcy court on Thursday, is scheduled for Dec. 18. Up for grabs will be 28 apartment buildings along Grace Street and Boulevard, as well as the 150-unit River City Court complex in the Museum District.

SVN/Motleys, the commercial real estate arm of Motleys Disposition Group, is handling the auction. The sale will be held at the East Franklin Street office of law firm Spotts Fain.

The portfolio has 439 apartment units total, Motley’s President Mark Motley said. The properties combined were most recently assessed at more than $31 million, according to city records.

“You really don’t see sales of this size,” Motley said. “You can have larger institutional buyers coming in to make offers, and because it’s being offered as individual properties as well, we are anticipating a substantial group of smaller investors to make offers on individual buildings or a cluster of buildings.”

While his properties head for auction, Jefferson is appealing a 20-year prison sentence related to a historic tax credit scheme and a subsequent plot to flee the country.

The River City Renaissance portfolio has been managed by court-ordered property receiver CompassRock Real Estate since March.

The property’s note holder attempted to foreclose on the River City Renaissance holdings in July, but the two entities through which Jefferson owns the portfolio retreated into Chapter 11 bankruptcy to block the foreclosure.

At that time, prosecutors and defense attorneys in Jefferson’s criminal case argued that the value in the River City properties was crucial to paying down the developer’s hefty restitution tab, and a foreclosure auction would likely draw a price below market value.

The two sides filed a joint motion asking a federal judge to release $165,000 of Jefferson’s money to hire Spotts Fain to steer the properties away from foreclosure.

Spotts Fain’s Robert Chappell, Neil McCullagh, Jennifer West and James Donaldson are handling the bankruptcy proceedings on River City Renaissance’s behalf.

Though the properties will still end up on the auction block, a foreclosure auction would have happened on the courthouse steps after a couple of weeks of minimal advertising. The order authorizing the current sale calls for a $50,000 advertising budget.

“This is not a small ad in the newspaper,” Motley said. “It’s a very extensive marketing campaign we believe will generate some interest in the properties.”

Motleys is also bringing in Louis Fisher III, a Florida-based agent with Sperry Van Ness’ national multifamily sales force, to work the sale. Fisher will focus on selling larger, national real estate firms on the River City portfolio.

Interested parties can begin the qualification process by visiting a website expected to go live this weekend. From there they will be asked to sign a confidentiality agreement to gain access to documentation on the properties.

The auctioneers will offer scheduled tours of Jefferson’s buildings between Nov.10 and Nov. 25, and all interested bidders must submit an opening bid and a 5 percent deposit by Dec. 10.

Up to two-thirds of the top bidders on each property or group of properties will be invited to participate in the live auction on Dec. 18.

And interested parties may not be difficult to find, at least locally.

Duke Dodson, president of locally based Dodson Property Management, said the Jefferson buildings are prime real estate, tenants are usually easy to find, and Fan multifamily properties are rather liquid investments.

Portfolios as large as Jefferson’s also rarely come on the market, he said, especially in the Fan. Dodson said a building or two will go for sale here and there, and they’ve usually sold very quickly and at a premium for the seller.

“Any kind of Fan multifamily – four, six, eight, 10, 12 units – in the last two years, that’s been a really hot segment,” Dodson said. “You’ll have multiple showings the first day and multiple offers on the first day.”

A bankruptcy court will have to rule on precisely which parties take priority when the proceeds from the sale are paid out. But U.S. Bank holds about $36 million worth of secured mortgages that would have to be paid down before the buildings’ owners would see any money.

Jefferson’s share would be made available to pay down his more than $9 million restitution requirement.

River City Renaissance and River City Renaissance III also have at least one other investor who could claim a share of the sale’s proceeds. William C. Boinest owns 20 percent of an entity called Jefferson Investment Group that owns 93.5 percent of the River City Renaissance firms, according to filings in Chesterfield County Circuit Court.

The River City Renaissance portfolio will become the second major piece of Jefferson’s real estate empire to change hands in recent months. A note holder on the former Tobacco Factory Lofts in Manchester took that building back through foreclosure in October.

The Parachute Factory apartment building at 307 Stockton St. still remains in Jefferson’s ownership. Lenders have indicated an intention to foreclose on that building. That property, like the Tobacco Factory, is underwater on an eight-figure mortgage, and the sale would likely not bring in any cash for restitution.

This is a very exciting development in the disposition of these properties. I expect it to draw a lot of inquiries and many offers. As a resident of the neighborhood, I look forward to seeing a buyer who will upgrade the properties and return them to the splendor that is representative of the community. The Museum District deserves better than they way these fine buildings have been managed. We like to say, “there are no bad buildings, but there is bad ownership”.

The group of buildings near broad on boulevard are the sole reason that intersection is still a dirty mess. Helped by the cookie factory rehab, that intersection still takes away from, and is not representative of, the surrounding neighborhoods of Scott’s addition, museum district, and the fan. These are under kept slum-lord buildings that attract bad tenants that do not care about their surroundings. Litter, graffiti, vagrancy, and petty crime fester at this intersection. This intersection remains seedy, polar opposite of the surrounding neighborhoods, all because of this group of buildings. What is really bad is it is a primary… Read more »