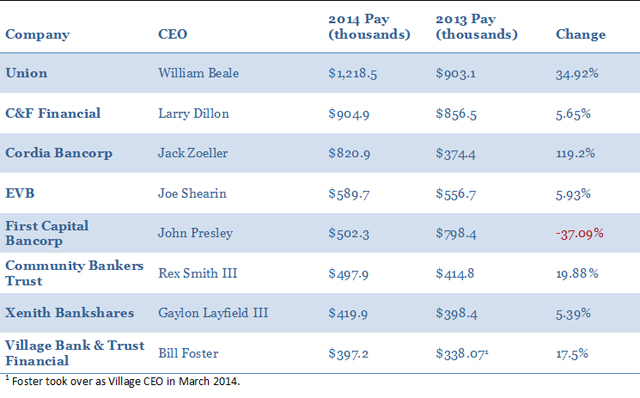

The CEO of Richmond’s biggest bank also boasts the biggest paycheck among his local peers.

Union Bankshares’ Billy Beale came out on top last year as the highest paid bank executive among publicly-traded community banks headquartered in the Richmond market.

A $200,000 jump in Beale’s 2014 salary – from about $477,000 to $679,000 – helped propel his total compensation above the million-dollar mark, bringing his overall pay package for the year to more than $1.2 million. That was an increase of about 35 percent increase over Beale’s previous year earnings.

The next-highest earner was C&F Financial CEO Larry Dillion, whose compensation totaled $904,000 – a 5 percent increase from 2013.

Richmond BizSense analyzed the proxy statements of the eight locally based, publicly traded banks that file with the SEC. A list of top pay packages for other publicly traded companies in Richmond was presented yesterday.

Total compensation, as disclosed by the companies in their recently released proxy statements, includes base salary, stock and option awards, change in the value of their pensions, deferred compensation, nonequity incentive awards and other perks.

All but one of the CEOs of the eight local banks saw their compensation increase in 2014. The group saw an average increase of 21.4 percent.

In addition to salary, Beale’s compensation included stock awards of nearly $340,000, non-equity incentive plan compensation of $120,000 and other compensation valued at nearly $80,000.

Beale’s rise in pay in 2014 coincides with Union’s acquisition of StellarOne Bank, a deal that created a $7 billion institution with more than 130 branches statewide.

Beale’s jump in compensation was the second-highest increase seen in 2014. Jack Zoeller, CEO of Bank of Virginia parent company Cordia Bancorp, saw the biggest rise and ended the year with more than double the compensation he received in 2013. Zoeller’s total pay package exceeded $820,000 for 2014, up 119 percent from $374,489 the previous year. That bump was fueled by a $75,000 bonus and $277,000 in stock awards.

First Capital Bancorp CEO John Presley saw the largest decrease in total compensation in 2014 with a 37 percent decline. Presley’s pay package decreased from $798,000 in 2013 to $502,000 in 2014, the main difference being a $317,000 bonus he received in 2013 but not last year.

Rounding out the top five behind Beale, Dillon and Zoeller were Eastern Virginia Bankshares CEO Joe Shearin, whose earnings rose nearly 6 percent to more than $589,000 in 2014, and First Capital’s Presley.

Rex Smith III, CEO of Essex Bank parent company Community Bankers Trust, received $497,000 – an increase of more than $82,000, or about 20 percent. And Xenith Bankshares’ Gaylon Layfield III received just under $420,000, an increase from 2013 of $21,000, or about 5 percent.

Lowest on the list was Village Bank & Trust Financial CEO Bill Foster, who was named the bank’s top executive upon the retirement of Thomas Winfree in February 2014. Foster’s total compensation of $397,000 was 3 percent higher than Winfree’s $384,000 in 2013.

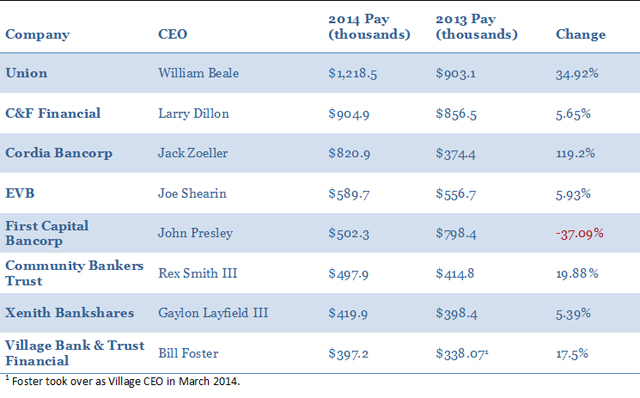

The CEO of Richmond’s biggest bank also boasts the biggest paycheck among his local peers.

Union Bankshares’ Billy Beale came out on top last year as the highest paid bank executive among publicly-traded community banks headquartered in the Richmond market.

A $200,000 jump in Beale’s 2014 salary – from about $477,000 to $679,000 – helped propel his total compensation above the million-dollar mark, bringing his overall pay package for the year to more than $1.2 million. That was an increase of about 35 percent increase over Beale’s previous year earnings.

The next-highest earner was C&F Financial CEO Larry Dillion, whose compensation totaled $904,000 – a 5 percent increase from 2013.

Richmond BizSense analyzed the proxy statements of the eight locally based, publicly traded banks that file with the SEC. A list of top pay packages for other publicly traded companies in Richmond was presented yesterday.

Total compensation, as disclosed by the companies in their recently released proxy statements, includes base salary, stock and option awards, change in the value of their pensions, deferred compensation, nonequity incentive awards and other perks.

All but one of the CEOs of the eight local banks saw their compensation increase in 2014. The group saw an average increase of 21.4 percent.

In addition to salary, Beale’s compensation included stock awards of nearly $340,000, non-equity incentive plan compensation of $120,000 and other compensation valued at nearly $80,000.

Beale’s rise in pay in 2014 coincides with Union’s acquisition of StellarOne Bank, a deal that created a $7 billion institution with more than 130 branches statewide.

Beale’s jump in compensation was the second-highest increase seen in 2014. Jack Zoeller, CEO of Bank of Virginia parent company Cordia Bancorp, saw the biggest rise and ended the year with more than double the compensation he received in 2013. Zoeller’s total pay package exceeded $820,000 for 2014, up 119 percent from $374,489 the previous year. That bump was fueled by a $75,000 bonus and $277,000 in stock awards.

First Capital Bancorp CEO John Presley saw the largest decrease in total compensation in 2014 with a 37 percent decline. Presley’s pay package decreased from $798,000 in 2013 to $502,000 in 2014, the main difference being a $317,000 bonus he received in 2013 but not last year.

Rounding out the top five behind Beale, Dillon and Zoeller were Eastern Virginia Bankshares CEO Joe Shearin, whose earnings rose nearly 6 percent to more than $589,000 in 2014, and First Capital’s Presley.

Rex Smith III, CEO of Essex Bank parent company Community Bankers Trust, received $497,000 – an increase of more than $82,000, or about 20 percent. And Xenith Bankshares’ Gaylon Layfield III received just under $420,000, an increase from 2013 of $21,000, or about 5 percent.

Lowest on the list was Village Bank & Trust Financial CEO Bill Foster, who was named the bank’s top executive upon the retirement of Thomas Winfree in February 2014. Foster’s total compensation of $397,000 was 3 percent higher than Winfree’s $384,000 in 2013.