Health Diagnostic Laboratory is officially up for grabs.

A federal bankruptcy judge on Tuesday approved the downtown-based medical lab’s request to pursue a sale of its business and assets in an auction process that should wrap up by the end of September.

HDL will now begin soliciting bids from interested parties. Douglas Sbertoli, HDL’s general counsel, said the company has received interest from a “mix of financial and strategic investors” but did not elaborate on the details of the potential buyers.

At least one of HDL’s competitors, Texas-based True Health Diagnostics, has shown interest in buying the company.

All bidders will have to submit offers by Sept. 10. Judge Kevin Huennekens will have the final ruling in approving a sale at a hearing on Sept. 16, court documents indicate.

The sale process is a result of HDL’s Chapter 11 bankruptcy filing in early June. It sought bankruptcy protection after defaulting on a line of credit with its largest lender, BB&T, and the bank consequently cut it off from its funds. HDL filed the motion for permission to pursue a sale a few weeks later.

Jason Harbour, a Hunton & Williams attorney representing HDL, told Huennekens at Tuesday’s hearing that the sale is an important step that is in the best interest of the debtors and creditors.

HDL has more than 200 creditors, according to its initial bankruptcy filings. They include the federal government, which is owed $49.5 million from the settlement of a federal investigation. Former CEO and co-founder Tonya Mallory, the Washington Redskins and several law firms are also on the list of creditors, owed millions of dollars combined.

The sale is being conducted under Section 363 of the federal bankruptcy code, which means the buyer can purchase the company’s assets without its liabilities. Bidders have the option to both purchase HDL and all its assets or to invest in the company’s Chapter 11 workout plan in exchange for some debt or equity in the company.

Further dismantling of the company has already begun.

Harbour told the judge that HDL will likely file a motion later this week for approval of a sale of other assets “on an expedited time frame.” Sbertoli said those assets include HDL’s smaller facility in De Soto, Kansas.

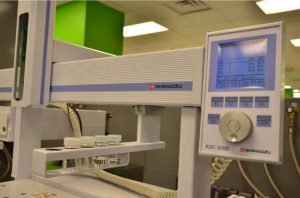

And the company has already sold what it described as excess laboratory equipment in an auction that ended in late June. Sbertoli said the company is not sharing the amount that the auction generated but said it was more than $1 million. The equipment sale freed up space in HDL’s downtown headquarters to potentially make way for a new tenant and the chance to generate extra rental income.

At the same hearing Tuesday, Huennekens also approved HDL’s request to conduct a so-called 2004 examination of UnitedHealthcare Insurance Co. HDL is attempting to learn more about what it suspects may be millions of dollars in claims reimbursements that UnitedHealthcare has delayed paying.

United objected to the examination motion, arguing that it sought medical records for over 66,000 of HDL’s claims, of which HDL provided 10 percent. Of those records, only a fraction was legitimate, the insurer argues. Many were duplicate claims or even claims that did not follow physician’s orders.

“There are serious problems here,” Eric Goldstein, an attorney representing United, said Tuesday of the claims in question.

Hunton & Williams attorney Toby Long argued that the examination will simply make clear whether or not HDL is owed funds.

“We believe the claims are valid and are trying to figure out the claims process,” Long said.

It’s one of many disagreements HDL has had with large insurance companies over the past year. Cigna filed an $84 million suit in November of last year, to which HDL filed a $66 million countersuit. Aetna also sued HDL earlier this year. Those cases have since been put on hold during HDL’s bankruptcy process.

Health Diagnostic Laboratory is officially up for grabs.

A federal bankruptcy judge on Tuesday approved the downtown-based medical lab’s request to pursue a sale of its business and assets in an auction process that should wrap up by the end of September.

HDL will now begin soliciting bids from interested parties. Douglas Sbertoli, HDL’s general counsel, said the company has received interest from a “mix of financial and strategic investors” but did not elaborate on the details of the potential buyers.

At least one of HDL’s competitors, Texas-based True Health Diagnostics, has shown interest in buying the company.

All bidders will have to submit offers by Sept. 10. Judge Kevin Huennekens will have the final ruling in approving a sale at a hearing on Sept. 16, court documents indicate.

The sale process is a result of HDL’s Chapter 11 bankruptcy filing in early June. It sought bankruptcy protection after defaulting on a line of credit with its largest lender, BB&T, and the bank consequently cut it off from its funds. HDL filed the motion for permission to pursue a sale a few weeks later.

Jason Harbour, a Hunton & Williams attorney representing HDL, told Huennekens at Tuesday’s hearing that the sale is an important step that is in the best interest of the debtors and creditors.

HDL has more than 200 creditors, according to its initial bankruptcy filings. They include the federal government, which is owed $49.5 million from the settlement of a federal investigation. Former CEO and co-founder Tonya Mallory, the Washington Redskins and several law firms are also on the list of creditors, owed millions of dollars combined.

The sale is being conducted under Section 363 of the federal bankruptcy code, which means the buyer can purchase the company’s assets without its liabilities. Bidders have the option to both purchase HDL and all its assets or to invest in the company’s Chapter 11 workout plan in exchange for some debt or equity in the company.

Further dismantling of the company has already begun.

Harbour told the judge that HDL will likely file a motion later this week for approval of a sale of other assets “on an expedited time frame.” Sbertoli said those assets include HDL’s smaller facility in De Soto, Kansas.

And the company has already sold what it described as excess laboratory equipment in an auction that ended in late June. Sbertoli said the company is not sharing the amount that the auction generated but said it was more than $1 million. The equipment sale freed up space in HDL’s downtown headquarters to potentially make way for a new tenant and the chance to generate extra rental income.

At the same hearing Tuesday, Huennekens also approved HDL’s request to conduct a so-called 2004 examination of UnitedHealthcare Insurance Co. HDL is attempting to learn more about what it suspects may be millions of dollars in claims reimbursements that UnitedHealthcare has delayed paying.

United objected to the examination motion, arguing that it sought medical records for over 66,000 of HDL’s claims, of which HDL provided 10 percent. Of those records, only a fraction was legitimate, the insurer argues. Many were duplicate claims or even claims that did not follow physician’s orders.

“There are serious problems here,” Eric Goldstein, an attorney representing United, said Tuesday of the claims in question.

Hunton & Williams attorney Toby Long argued that the examination will simply make clear whether or not HDL is owed funds.

“We believe the claims are valid and are trying to figure out the claims process,” Long said.

It’s one of many disagreements HDL has had with large insurance companies over the past year. Cigna filed an $84 million suit in November of last year, to which HDL filed a $66 million countersuit. Aetna also sued HDL earlier this year. Those cases have since been put on hold during HDL’s bankruptcy process.