As creditors work to force it into bankruptcy, the former operator of a local ethanol plant has also left the government hanging in an economic development deal gone sour.

Vireol Bio Energy LLC, which until last month operated the 55-acre ethanol production plant at 701 S. Sixth Ave. in Hopewell, is facing liquidation at the hands of a group of companies that it owes a combined $2 million.

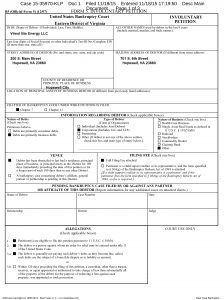

The creditors, which include a division of Dominion Resources, last week filed an involuntary bankruptcy petition for Vireol that asks the court to determine whether the company can be forced into Chapter 7 and to locate and liquidate any remaining assets.

Meanwhile, the state government, in light of Vireol’s short-lived venture in Hopewell, is looking into the potential to recoup $250,000 it gave the company last year as part of an incentive package.

The incentives, the bulk of which came through a grant from the Governor’s Agriculture and Forestry Industries Development Fund, were meant to award the company for what was touted as a $26 million investment in the Hopewell plant that would create 70 jobs.

The fund operates on the assumption that the recipient company will be around at least long enough to achieve its stated goals. But less than two years after taking over the plant, Vireol had ceased operations at the facility. One of its affiliate companies sold the property last month for $18 million.

State Secretary of Agriculture and Forestry Todd Haymore confirmed that $250,000 from the AFID program was disbursed to the city of Hopewell, which then paid the money to Vireol as required.

In light of Vireol bowing out of Hopewell, Haymore said there are claw-back provisions included in such agreements that could allow the government to attempt to recover the money from the company. He said his office is looking into whether it is able to take such action in this case.

The city of Hopewell also has its eye on Vireol and its affiliates. City Treasurer Terri Batton said Future Fuels LLP, which owned the ethanol facility until the sale last month, owes Hopewell $806,000 in delinquent real estate, machinery and tools taxes. That’s not including penalties and interest or the current taxes the company would owe for the second half of 2015.

Future Fuels appears to be tied to Vireol, according to several lawsuits filed by the company’s creditors.

Also included in one of those lawsuits is an allegation that Vireol was trying to delay its dissolution until the first quarter of 2016 in order to receive an additional government grant of $250,000.

That allegation is likely alluding to $250,000 that Hopewell agreed to pay Vireol as matching funds to the state grant.

Hopewell confirmed through its city attorney Stefan Calos of Sands Anderson that those funds had not yet been dispersed to Vireol and it has no intention of doing so given the company’s exit from the facility.

While the Vireol situation illustrates the fallout that can occur when the recipient of economic develoment incentives doesn’t hold up its end of a deal, Haymore said it is rare, at least within the AFID program, for these deals to go awry.

Thirty grants have been award through AFID in its three years of existence, he said. Until now, only one of those recipients has folded before achieving the goals it promised and a subsequent bankruptcy of that company helped the state recover the funds, Haymore said.

As creditors work to force it into bankruptcy, the former operator of a local ethanol plant has also left the government hanging in an economic development deal gone sour.

Vireol Bio Energy LLC, which until last month operated the 55-acre ethanol production plant at 701 S. Sixth Ave. in Hopewell, is facing liquidation at the hands of a group of companies that it owes a combined $2 million.

The creditors, which include a division of Dominion Resources, last week filed an involuntary bankruptcy petition for Vireol that asks the court to determine whether the company can be forced into Chapter 7 and to locate and liquidate any remaining assets.

Meanwhile, the state government, in light of Vireol’s short-lived venture in Hopewell, is looking into the potential to recoup $250,000 it gave the company last year as part of an incentive package.

The incentives, the bulk of which came through a grant from the Governor’s Agriculture and Forestry Industries Development Fund, were meant to award the company for what was touted as a $26 million investment in the Hopewell plant that would create 70 jobs.

The fund operates on the assumption that the recipient company will be around at least long enough to achieve its stated goals. But less than two years after taking over the plant, Vireol had ceased operations at the facility. One of its affiliate companies sold the property last month for $18 million.

State Secretary of Agriculture and Forestry Todd Haymore confirmed that $250,000 from the AFID program was disbursed to the city of Hopewell, which then paid the money to Vireol as required.

In light of Vireol bowing out of Hopewell, Haymore said there are claw-back provisions included in such agreements that could allow the government to attempt to recover the money from the company. He said his office is looking into whether it is able to take such action in this case.

The city of Hopewell also has its eye on Vireol and its affiliates. City Treasurer Terri Batton said Future Fuels LLP, which owned the ethanol facility until the sale last month, owes Hopewell $806,000 in delinquent real estate, machinery and tools taxes. That’s not including penalties and interest or the current taxes the company would owe for the second half of 2015.

Future Fuels appears to be tied to Vireol, according to several lawsuits filed by the company’s creditors.

Also included in one of those lawsuits is an allegation that Vireol was trying to delay its dissolution until the first quarter of 2016 in order to receive an additional government grant of $250,000.

That allegation is likely alluding to $250,000 that Hopewell agreed to pay Vireol as matching funds to the state grant.

Hopewell confirmed through its city attorney Stefan Calos of Sands Anderson that those funds had not yet been dispersed to Vireol and it has no intention of doing so given the company’s exit from the facility.

While the Vireol situation illustrates the fallout that can occur when the recipient of economic develoment incentives doesn’t hold up its end of a deal, Haymore said it is rare, at least within the AFID program, for these deals to go awry.

Thirty grants have been award through AFID in its three years of existence, he said. Until now, only one of those recipients has folded before achieving the goals it promised and a subsequent bankruptcy of that company helped the state recover the funds, Haymore said.