The cryptocurrency craze has helped birth a startup in Richmond.

Coin Savage, a cryptocurrency financial services and analysis firm in Shockoe Bottom, is preparing its full launch.

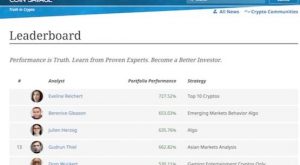

After starting last fall as a crypto news and analysis website, this month the startup will unveil its main feature, a leaderboard that shows how different cryptocurrency analysts’ investments perform.

With nearly 2,000 crypto currencies now in existence with a combined $250 billion market cap, said the industry is underserved regarding expert analysis, co-founder Andrew Elliott said.

“There are very few other places to get good solid analysis,” Elliott said. “Mainstream analysts haven’t gotten involved yet.”

Elliott describes himself as a traditional finance guy who sees cryptocurrencies as a pragmatic investment. After serving in the Marines and studying at UVA and Georgetown University, Elliott worked in finance, including as an investment advisor at local firm Davenport & Co.

He said that like many mainstream folks in the financial industry, he was dubious about cryptocurrency at first.

“I was thinking, ‘This is kind of like a bubble.’ But once I started doing the homework, my whole opinion whirled,” he said.

He said he realized he was hooked on crypto when he found himself lying awake in bed, checking crypto coin prices in the middle of the night last summer.

“I’d really gone down the rabbit hole,” Elliott said, laughing. “There were lots of long nights where my girlfriend thought I was nuts.”

After getting deep into it, he began discussing how to get involved in the crypto boom with friend Will Trible, a JMU alum with a background in web design.

Last fall, they launched Coin Savage’s website, where they and about 20 other crypto analysts from around the country cover and analyze the cryptocurrency market.

With its new leaderboard feature that tracks its contributors’ positions and how successful they are, Elliott said it’s akin to stock market research firm Morningstar.

“There’s a trust gap in crypto. Our big aspiration is solving trust, and the way to do that is to track analysts’ performance,” Elliott said. “We’re adding the leaderboard feature to allow (analysts) to really differentiate themselves and establish credibility.”

Coin Savage earns revenue through sponsored content from other crypto-adjacent companies, but Elliott said the plan is monetize through subscription-like access to certain types of crypto data.

Elliott said he and Trible have invested about $40,000 into Coin Savage, which is based out of the 1717 Innovation Center in Shockoe Bottom.

Personally, Elliott said he thinks many of the nearly 2,000 different cryptocurrencies aren’t worth investing in. He’s invested in about a dozen and said the most prominent currencies include Bitcoin, Ethereum, XRP and Bitcoin Cash.

Elliott said he now sees investing in cryptocurrencies as venture capital with a bonus.

“It’s like venture capital with liquidity,” Elliott said. “You can buy into an early-stage tech company, but you can’t get your money out until they go public or get bought out. With crypto, you can take out your money right away.”

The cryptocurrency craze has helped birth a startup in Richmond.

Coin Savage, a cryptocurrency financial services and analysis firm in Shockoe Bottom, is preparing its full launch.

After starting last fall as a crypto news and analysis website, this month the startup will unveil its main feature, a leaderboard that shows how different cryptocurrency analysts’ investments perform.

With nearly 2,000 crypto currencies now in existence with a combined $250 billion market cap, said the industry is underserved regarding expert analysis, co-founder Andrew Elliott said.

“There are very few other places to get good solid analysis,” Elliott said. “Mainstream analysts haven’t gotten involved yet.”

Elliott describes himself as a traditional finance guy who sees cryptocurrencies as a pragmatic investment. After serving in the Marines and studying at UVA and Georgetown University, Elliott worked in finance, including as an investment advisor at local firm Davenport & Co.

He said that like many mainstream folks in the financial industry, he was dubious about cryptocurrency at first.

“I was thinking, ‘This is kind of like a bubble.’ But once I started doing the homework, my whole opinion whirled,” he said.

He said he realized he was hooked on crypto when he found himself lying awake in bed, checking crypto coin prices in the middle of the night last summer.

“I’d really gone down the rabbit hole,” Elliott said, laughing. “There were lots of long nights where my girlfriend thought I was nuts.”

After getting deep into it, he began discussing how to get involved in the crypto boom with friend Will Trible, a JMU alum with a background in web design.

Last fall, they launched Coin Savage’s website, where they and about 20 other crypto analysts from around the country cover and analyze the cryptocurrency market.

With its new leaderboard feature that tracks its contributors’ positions and how successful they are, Elliott said it’s akin to stock market research firm Morningstar.

“There’s a trust gap in crypto. Our big aspiration is solving trust, and the way to do that is to track analysts’ performance,” Elliott said. “We’re adding the leaderboard feature to allow (analysts) to really differentiate themselves and establish credibility.”

Coin Savage earns revenue through sponsored content from other crypto-adjacent companies, but Elliott said the plan is monetize through subscription-like access to certain types of crypto data.

Elliott said he and Trible have invested about $40,000 into Coin Savage, which is based out of the 1717 Innovation Center in Shockoe Bottom.

Personally, Elliott said he thinks many of the nearly 2,000 different cryptocurrencies aren’t worth investing in. He’s invested in about a dozen and said the most prominent currencies include Bitcoin, Ethereum, XRP and Bitcoin Cash.

Elliott said he now sees investing in cryptocurrencies as venture capital with a bonus.

“It’s like venture capital with liquidity,” Elliott said. “You can buy into an early-stage tech company, but you can’t get your money out until they go public or get bought out. With crypto, you can take out your money right away.”