Questions over the handling of nearly $3 million in leftover funds have revived the bankruptcy case of a long-since-collapsed Richmond financial giant.

A judge on Oct. 31 reopened the bankruptcy of LandAmerica Financial Group, the Henrico-based title insurance company that was abruptly toppled in November 2008.

While the case had been brought to what was considered a successful conclusion four years ago, $3 million had been set aside at the time to allow the company’s liquidation trustee, veteran LeClairRyan attorney Bruce Matson, to manage any extra expenses during the so-called wind-down process.

With two years left in the prescribed six-year wind-down period and $2.8 million still remaining in the account, court records show that it was discovered in August that the money had been removed from the account and split into personal accounts of Matson and his associate Robert Smith, and their wives.

The discrepancy was brought to light in August by Protiviti, which works as a financial advisor on bankruptcy cases, including those of LandAmerica and, more recently, LeClairRyan.

Smith, a former employee of Protiviti who now works with Matson at their patent analytics and litigation finance startup Randolph Square IP, led Protiviti’s work on the LandAmerica case.

In a letter to Judge Kevin Huennekens, Protiviti said it found in August that the LandAmerica trust account had a zero balance as of April of this year, after the funds were transferred earlier in the year to Matson Consulting and RS Consulting.

Protiviti said in the letter that it questioned Matson about the transfers on Aug. 21, and suggested that he look to potentially reopen the case to get the court’s input on “how the remaining funds should be held and disbursed.”

Five days later, Matson sent a letter to the judge, asking the court to weigh in on what to do with the money. His letter did not address Protiviti’s concerns over the funds having been transferred to personal accounts.

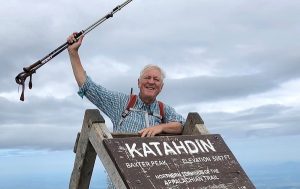

Smith stated in an accompanying letter that half of the money was moved into his account in early 2019 after Matson returned from an “extended sabbatical.” Matson completed a six-month through hike of the Appalachian Trail in 2018.

Smith stated in the letter that it was done to “decrease the concentration risk” of the funds and that he was awaiting further instruction from the court as to what to do with the money.

All parties involved ultimately met for a hearing on Oct. 16, during which, transcripts show, Matson told the judge “… all of the funds are accounted for.”

“They were put into other accounts, personal accounts, some accounts that were joint accounts with our wives,” Matson said, according to transcripts from the hearing. “In retrospect, that clearly was probably not the best idea.”

He explained to the judge that in late 2018, “I had a number of items going on personally and professionally,” while also alluding to “excessive charges” from the usual bank where his bankruptcy trustee accounts were held.

He said he was looking to “simplify the situation” and that he had already begun to “reconsolidate (the money) at the time that a question was raised about what happened to the funds.”

He told the judge there was $2.8 million on hand — far more than he expected there to be at this point in the wind-down process — and that there’s no substantial work left to be done.

That left him asking the court to help determine how best to disperse the leftover money, due to it being an unusual situation administratively, given that the case is closed and the wind-down documents did not clearly lay out how to dispose of unused funds.

Matson, while questioning his own decisions related to the transfers, did remind the judge of the success of the complex case, which recovered around 80 cents on the dollar on $600 million in claims.

“This was a really good case with a really good result. And I may have made a mistake,” he said.

Matson declined to comment for this story.

Ultimately, the case was resurrected, as it was necessary to reopen it to allow for the procedural process to play out. And, against Matson’s urging, the judge ordered he be replaced and a successor trustee be appointed, ruling that a “replacement fiduciary for the trust is in the best interest of creditors…”

Benjamin Ackerly Sr., a Richmond attorney who retired from Hunton Andrews Kurth, was chosen for the job, which calls for tracking the transfers and distributing the remaining funds. He’ll be paid $600 an hour for his services, money that would come out of the remaining funds.

Also on hand at the Oct. 16 hearing was Robert Van Arsdale, assistant U.S. trustee at the Office of the U.S. Trustee in Richmond; Mike Wilson, who represents Prudential Investment Management, which is among the largest of LandAmerica’s creditors; and Lynn Tavenner, the trustee overseeing the LeClairRyan bankruptcy.

Van Arsdale told the judge his office was concerned about the splitting of the money between Matson and Smith and the fact that it went into accounts shared with their wives, “… which under anybody’s idea of fiduciary responsibilities, just didn’t make sense to us … .”

Tavenner said there are some funds due to LeClairRyan for flat fees it was owed from the work of Matson and the firm’s lawyers who helped him on the case over time.

In the end, all involved agreed on what to do with the remaining funds. From the $2.8 million, $70,000 would be paid to the LeClairRyan bankruptcy estate. Then, anything left after Ackerly’s work is done would go to creditors. Anything left after that, if it’s less than $100,000, would go to be paid as a charitable distribution to CARE (Credit Abuse Resistance Education), whose chairman is Lynn Tavenner.

Questions over the handling of nearly $3 million in leftover funds have revived the bankruptcy case of a long-since-collapsed Richmond financial giant.

A judge on Oct. 31 reopened the bankruptcy of LandAmerica Financial Group, the Henrico-based title insurance company that was abruptly toppled in November 2008.

While the case had been brought to what was considered a successful conclusion four years ago, $3 million had been set aside at the time to allow the company’s liquidation trustee, veteran LeClairRyan attorney Bruce Matson, to manage any extra expenses during the so-called wind-down process.

With two years left in the prescribed six-year wind-down period and $2.8 million still remaining in the account, court records show that it was discovered in August that the money had been removed from the account and split into personal accounts of Matson and his associate Robert Smith, and their wives.

The discrepancy was brought to light in August by Protiviti, which works as a financial advisor on bankruptcy cases, including those of LandAmerica and, more recently, LeClairRyan.

Smith, a former employee of Protiviti who now works with Matson at their patent analytics and litigation finance startup Randolph Square IP, led Protiviti’s work on the LandAmerica case.

In a letter to Judge Kevin Huennekens, Protiviti said it found in August that the LandAmerica trust account had a zero balance as of April of this year, after the funds were transferred earlier in the year to Matson Consulting and RS Consulting.

Protiviti said in the letter that it questioned Matson about the transfers on Aug. 21, and suggested that he look to potentially reopen the case to get the court’s input on “how the remaining funds should be held and disbursed.”

Five days later, Matson sent a letter to the judge, asking the court to weigh in on what to do with the money. His letter did not address Protiviti’s concerns over the funds having been transferred to personal accounts.

Smith stated in an accompanying letter that half of the money was moved into his account in early 2019 after Matson returned from an “extended sabbatical.” Matson completed a six-month through hike of the Appalachian Trail in 2018.

Smith stated in the letter that it was done to “decrease the concentration risk” of the funds and that he was awaiting further instruction from the court as to what to do with the money.

All parties involved ultimately met for a hearing on Oct. 16, during which, transcripts show, Matson told the judge “… all of the funds are accounted for.”

“They were put into other accounts, personal accounts, some accounts that were joint accounts with our wives,” Matson said, according to transcripts from the hearing. “In retrospect, that clearly was probably not the best idea.”

He explained to the judge that in late 2018, “I had a number of items going on personally and professionally,” while also alluding to “excessive charges” from the usual bank where his bankruptcy trustee accounts were held.

He said he was looking to “simplify the situation” and that he had already begun to “reconsolidate (the money) at the time that a question was raised about what happened to the funds.”

He told the judge there was $2.8 million on hand — far more than he expected there to be at this point in the wind-down process — and that there’s no substantial work left to be done.

That left him asking the court to help determine how best to disperse the leftover money, due to it being an unusual situation administratively, given that the case is closed and the wind-down documents did not clearly lay out how to dispose of unused funds.

Matson, while questioning his own decisions related to the transfers, did remind the judge of the success of the complex case, which recovered around 80 cents on the dollar on $600 million in claims.

“This was a really good case with a really good result. And I may have made a mistake,” he said.

Matson declined to comment for this story.

Ultimately, the case was resurrected, as it was necessary to reopen it to allow for the procedural process to play out. And, against Matson’s urging, the judge ordered he be replaced and a successor trustee be appointed, ruling that a “replacement fiduciary for the trust is in the best interest of creditors…”

Benjamin Ackerly Sr., a Richmond attorney who retired from Hunton Andrews Kurth, was chosen for the job, which calls for tracking the transfers and distributing the remaining funds. He’ll be paid $600 an hour for his services, money that would come out of the remaining funds.

Also on hand at the Oct. 16 hearing was Robert Van Arsdale, assistant U.S. trustee at the Office of the U.S. Trustee in Richmond; Mike Wilson, who represents Prudential Investment Management, which is among the largest of LandAmerica’s creditors; and Lynn Tavenner, the trustee overseeing the LeClairRyan bankruptcy.

Van Arsdale told the judge his office was concerned about the splitting of the money between Matson and Smith and the fact that it went into accounts shared with their wives, “… which under anybody’s idea of fiduciary responsibilities, just didn’t make sense to us … .”

Tavenner said there are some funds due to LeClairRyan for flat fees it was owed from the work of Matson and the firm’s lawyers who helped him on the case over time.

In the end, all involved agreed on what to do with the remaining funds. From the $2.8 million, $70,000 would be paid to the LeClairRyan bankruptcy estate. Then, anything left after Ackerly’s work is done would go to creditors. Anything left after that, if it’s less than $100,000, would go to be paid as a charitable distribution to CARE (Credit Abuse Resistance Education), whose chairman is Lynn Tavenner.

HUH.

Is it normal for money to be spread out among people like this and no charges brought?

And the rest of the money going to a charity that one of the people involved in this, does not seem normal to me either.

Any lawyers want to chime in?

I felt like I was reading “Who’s on First?” with no fault directed at the author.

What do you think happened to the entire company? The executives pilfered the company and put the money in their pockets. It’s pretty much par for the course and in line with the hijinks that we’re going on before the demise of Land America. No one went to jail and happened to anyone because they were all connected.

Has there been any development on this?

I just check their website and Randolph Square IP still shows Rob Smith as their COO but Bruce Matson has been removed. So I guess nothing ever came of this? It’s really sad how nothing has been done given the fact that Randolph Square IP is registered with the SEC and manages/invests people’s money. One investor sued them for breach of contract, which probably could have been avoided if the legal system wasn’t so corrupt.