A proposed bill in the General Assembly that would allow a portion of state tax revenues to go toward the proposed Navy Hill project would significantly reduce the amount of downtown real estate needed to pay off bonds for a new arena, according to the developer.

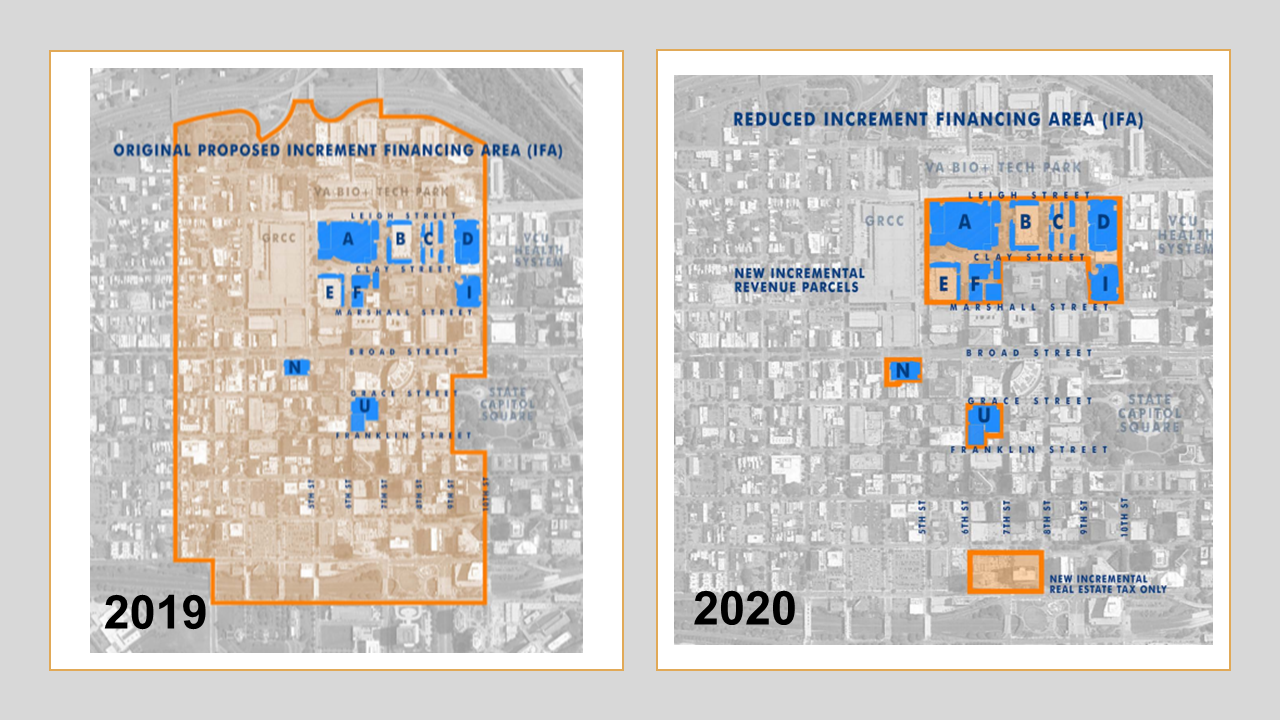

An analysis by NH District Corp. and city administrators projects that the controversial proposed tax increment financing area to support Navy Hill could be shrunk from an approximate 80-block area to the equivalent of 11 blocks, as a result of the legislation that would provide just over 2 percent of state sales and use tax revenues generated by the project to help the city pay off the $300 million in bonds that would fund the arena.

The percentage would produce $55.7 million in state tax revenues to help pay off the arena bonds over 30 years, according to the developer. With those funds added, NHDC says the 11 blocks – consisting of only the project properties, Dominion Energy’s new downtown tower and the utility’s planned second tower – would generate enough incremental real estate tax revenue from new development and increased assessments to cover the rest of the bonds. It would in turn rely less on city taxes to pay off the bonds.

The analysis from NHDC – a group that includes Dominion CEO Tom Farrell – was presented to members of Richmond City Council at a committee meeting Thursday, just hours before the last in a series of public hearings on the project that council has been holding over the past two weeks. A final public hearing would come before a vote, which council is aiming to make by the end of February.

The financing area – also referred to as a TIF, or tax-increment financing district – was previously proposed for an 80-block area bordered to the west and east by First and 10th streets, and to the north and south by Interstate 64-95 and the Downtown Expressway.

The new district would consist of the core project area – eight of the 10 blocks between Leigh and Marshall streets and between Fifth and 10th streets – along with two separated blocks south of Broad Street planned for two additional buildings, the new Dominion tower at 600 Canal Place, and the second tower next door – which Dominion has filed plans for but has yet to say if it will indeed build.

The TIF area as a result would shrink from 235 acres to about 26 and would free up 869 parcels, incremental real estate tax revenue from which would instead go directly into the city’s coffers. NHDC projects that the total real estate tax revenue growth from those parcels would exceed $172 million over the life of the arena bonds, producing $5 million in the project’s first five years and $15 million in the following five years that would instead go toward city services such as schools and streets.

The portion of citywide taxable real estate revenues that would go toward the arena bonds would reduce from 6.5 percent to 0.8 percent.

Jennifer Mullen, a Roth Jackson attorney representing NHDC, said the new financing structure would maintain the desired debt service coverage ratio of 1.5 percent, meaning the city would produce $1.50 in TIF funds for every $1 in debt service. She said the debt also would remain non-recourse revenue bonds and the city would have no moral obligation to cover any shortfalls in debt service payment.

Of the state sales and use tax revenues projected to be generated by the Navy Hill properties over 30 years, $93.3 million would go to the state, while the $55.7 million would go to paying off the arena bonds.

The changes would result from House Bill 1345, which Del. Jeff Bourne of Richmond introduced last week. The bill is similar to legislation adopted last year to support the Dome mixed-use redevelopment project in Virginia Beach. Earlier this week, at an announcement that CoStar Group would fill one of Navy Hill’s office buildings, Richmond Mayor Levar Stoney said preliminary analysis of the bill’s impact showed the TIF district could be reduced in size by at least half.

Stoney also said progress had been made to locate enough income-based housing units within the project area to meet the city’s required percentage threshold for new multifamily residential development.

An aerial rendering of the proposed new arena and the surrounding buildings. (Courtesy navyhillrva.com)

As currently proposed, Navy Hill would consist of a 17,500-seat arena, a 541-room Hyatt Regency hotel, 2,000 market-rate apartments, an initial 280 income-based housing units with potential for more, renovated Blues Armory building, GRTC transfer center, and additional retail, office and city-use buildings.

The project would be kickstarted with $900 million in private investment that is projected to total $1.3 billion upon completion of the project. The development agreement put forth by the mayor and now under review by City Council requires NHDC to show the $900 million has been secured before the city can pursue a bond sale to finance the arena, projected to cost $235 million and planned to be the largest in Virginia.

The Navy Hill properties – to include the arena, a new hotel, new office and retail buildings, hundreds of market-rate and income-based residential units, and other improvements – would contribute incremental revenues from additional city taxes beyond the real estate tax, excluding the city’s meals tax. The Dominion tower properties would contribute only incremental revenues from real estate tax.

A proposed bill in the General Assembly that would allow a portion of state tax revenues to go toward the proposed Navy Hill project would significantly reduce the amount of downtown real estate needed to pay off bonds for a new arena, according to the developer.

An analysis by NH District Corp. and city administrators projects that the controversial proposed tax increment financing area to support Navy Hill could be shrunk from an approximate 80-block area to the equivalent of 11 blocks, as a result of the legislation that would provide just over 2 percent of state sales and use tax revenues generated by the project to help the city pay off the $300 million in bonds that would fund the arena.

The percentage would produce $55.7 million in state tax revenues to help pay off the arena bonds over 30 years, according to the developer. With those funds added, NHDC says the 11 blocks – consisting of only the project properties, Dominion Energy’s new downtown tower and the utility’s planned second tower – would generate enough incremental real estate tax revenue from new development and increased assessments to cover the rest of the bonds. It would in turn rely less on city taxes to pay off the bonds.

The analysis from NHDC – a group that includes Dominion CEO Tom Farrell – was presented to members of Richmond City Council at a committee meeting Thursday, just hours before the last in a series of public hearings on the project that council has been holding over the past two weeks. A final public hearing would come before a vote, which council is aiming to make by the end of February.

The financing area – also referred to as a TIF, or tax-increment financing district – was previously proposed for an 80-block area bordered to the west and east by First and 10th streets, and to the north and south by Interstate 64-95 and the Downtown Expressway.

The new district would consist of the core project area – eight of the 10 blocks between Leigh and Marshall streets and between Fifth and 10th streets – along with two separated blocks south of Broad Street planned for two additional buildings, the new Dominion tower at 600 Canal Place, and the second tower next door – which Dominion has filed plans for but has yet to say if it will indeed build.

The TIF area as a result would shrink from 235 acres to about 26 and would free up 869 parcels, incremental real estate tax revenue from which would instead go directly into the city’s coffers. NHDC projects that the total real estate tax revenue growth from those parcels would exceed $172 million over the life of the arena bonds, producing $5 million in the project’s first five years and $15 million in the following five years that would instead go toward city services such as schools and streets.

The portion of citywide taxable real estate revenues that would go toward the arena bonds would reduce from 6.5 percent to 0.8 percent.

Jennifer Mullen, a Roth Jackson attorney representing NHDC, said the new financing structure would maintain the desired debt service coverage ratio of 1.5 percent, meaning the city would produce $1.50 in TIF funds for every $1 in debt service. She said the debt also would remain non-recourse revenue bonds and the city would have no moral obligation to cover any shortfalls in debt service payment.

Of the state sales and use tax revenues projected to be generated by the Navy Hill properties over 30 years, $93.3 million would go to the state, while the $55.7 million would go to paying off the arena bonds.

The changes would result from House Bill 1345, which Del. Jeff Bourne of Richmond introduced last week. The bill is similar to legislation adopted last year to support the Dome mixed-use redevelopment project in Virginia Beach. Earlier this week, at an announcement that CoStar Group would fill one of Navy Hill’s office buildings, Richmond Mayor Levar Stoney said preliminary analysis of the bill’s impact showed the TIF district could be reduced in size by at least half.

Stoney also said progress had been made to locate enough income-based housing units within the project area to meet the city’s required percentage threshold for new multifamily residential development.

An aerial rendering of the proposed new arena and the surrounding buildings. (Courtesy navyhillrva.com)

As currently proposed, Navy Hill would consist of a 17,500-seat arena, a 541-room Hyatt Regency hotel, 2,000 market-rate apartments, an initial 280 income-based housing units with potential for more, renovated Blues Armory building, GRTC transfer center, and additional retail, office and city-use buildings.

The project would be kickstarted with $900 million in private investment that is projected to total $1.3 billion upon completion of the project. The development agreement put forth by the mayor and now under review by City Council requires NHDC to show the $900 million has been secured before the city can pursue a bond sale to finance the arena, projected to cost $235 million and planned to be the largest in Virginia.

The Navy Hill properties – to include the arena, a new hotel, new office and retail buildings, hundreds of market-rate and income-based residential units, and other improvements – would contribute incremental revenues from additional city taxes beyond the real estate tax, excluding the city’s meals tax. The Dominion tower properties would contribute only incremental revenues from real estate tax.

Cute. Adjusted TIF still includes Dominion’s Tower and yet to be rebuilt (awaiting to secure TIF) 2nd Tower.

Nothing to suspect here, no cronyism, keep it moving…

Ashley,

It is clear the new Dominion tower is included to make the TIF work financially.

Can you explain specifically what is suspect about it?

James:

I’ll take that one. What is inherently suspect is the creation of special regulatory and tax schemes for a favored class of politically connected investors. These deals always seem to wind up like the Affordable Care Act, i.e., we will have to pass it in order to know what is in it. How many pages long is the complete package of legislation?

If there are problems in the city’s basic tax and regulatory infrastructure, then the problem should be solved on a macro level rather than creating special tax breaks for favored classes of politically connected investors.

Honestly, If they’re putting up almost a billion dollars of private money to kick start this project, I don’t see why anyone is having reservations the properties in the TIF.

If this project is such a great idea, why does it need any taxpayer money to make money? Certainly, the public should fund essential infrastructure such as demolition of abandoned buildings, fire and police stations etc. But nothing else. There is a difference between free enterprise (in which private entities put their own capital at risk in exchange for returns proportional to the risk of the investment) and private enterprise, which, in its modern iteration means that private entities fund their own capital investment with public funds and the public takes the downside risk. This is a familiar model: savings… Read more »

Because of the public non profit parts . The arena in particular. The public funding is for the arena and infrastructure.

There would be no reason for TIF funding if this was just private enterprise. But it isn’t, read the package.

What’s keeping say VCU and Dom (insert any other large company) from just making the arena a private venture? Could it be they don’t think the numbers are there to justify the risk, but it’s a better pill to swallow if the taxpayer takes the risk?

They’re literally footing almost a billion dollars worth of private investment into this. Did you miss that part?

Is it actually “private’ investment” if it is a public utility that charges rates that guarantee this “profit” that is being offered as investment?

Oh, I see. You’ve falsely equated Dominion with NHDC. Which would be like equating Tesla with SpaceX.

Actually, I was just asking a question, not spreading a conclusion. I really wanted to know who the “they” was. And since you seem willing to help, is Dominion part of the group? Thanks in advance for your input.

Shouldn’t the Council have waited to see what this bill does before requesting the entire Navy Hill proposal be withdrawn?

Bill is being pulled by Bourne. Not only has city support never materialize but not a lot of positive support from Committee that has done nothing since it filing.