Homes listed for sale aren’t staying that way for long — 19 days on average in February, which ended with just over 800 active listings in metro Richmond. (Jonathan Spiers photo)

With Richmond-area homes selling faster than they have in years and the number of homes listed for sale at any given time continuing to shrink, some in the local residential real estate industry are starting to wonder: is the region’s housing market heading toward some sort of breaking point?

Rick Jarvis thinks it is. The co-founder of local brokerage One South Realty Group pointed out that, at one point earlier this year, the number of preowned houses listed for sale in Central Virginia totaled about 600 — in a region, he emphasized, with 1.3 million people.

In two weeks’ time, he said, the number of houses sold in the region exceeded 600 — leading Jarvis to surmise: “We are literally heading to a point where the only inventory available is the inventory that was listed that day.”

Likening the scenario to a grocery delivery truck that hands out food in the parking lot instead of placing it on the store’s shelves, Jarvis said, “That’s what’s happening. There’s no inventory of houses for sale. It’s almost as if it doesn’t come out that day, there’s nothing to buy. It’s a pretty bad problem.”

What Jarvis and other observers describe as a problem, others see as a reflection of a desirable housing market driving buyer demand — albeit a market that’s gotten harder to enter for more would-be homeowners.

“It’s not that there’s no inventory. It’s how quickly it’s being absorbed,” said Laura Lafayette, CEO of the Richmond Association of Realtors and the Central Virginia Regional Multiple Listing Service.

And Lafayette has the stats to back that up. The number of homes that are selling has actually increased, with more than 3,800 more homes (condos and townhomes included) sold across the region last year than in 2019.

“There is inventory,” she said. “2020 was the best year in this century.”

It’s just that listings are selling faster and spending fewer days on the market — a rate driven perhaps by the pandemic and certainly by low mortgage interest rates — leading to competing offers and driving up purchase prices.

“The inventory is absorbed so quickly, that exacerbates this feeling of ‘There is no inventory,’” Lafayette said. “When people say there’s no inventory, I’m like, ‘Yeah, but we sold almost 4,000 more units.’”

Lafayette said closed sales last year totaled just over 25,500 across the CVRMLS footprint, which covers 16 jurisdictions in Central Virginia. In 2019, closed sales totaled about 21,700.

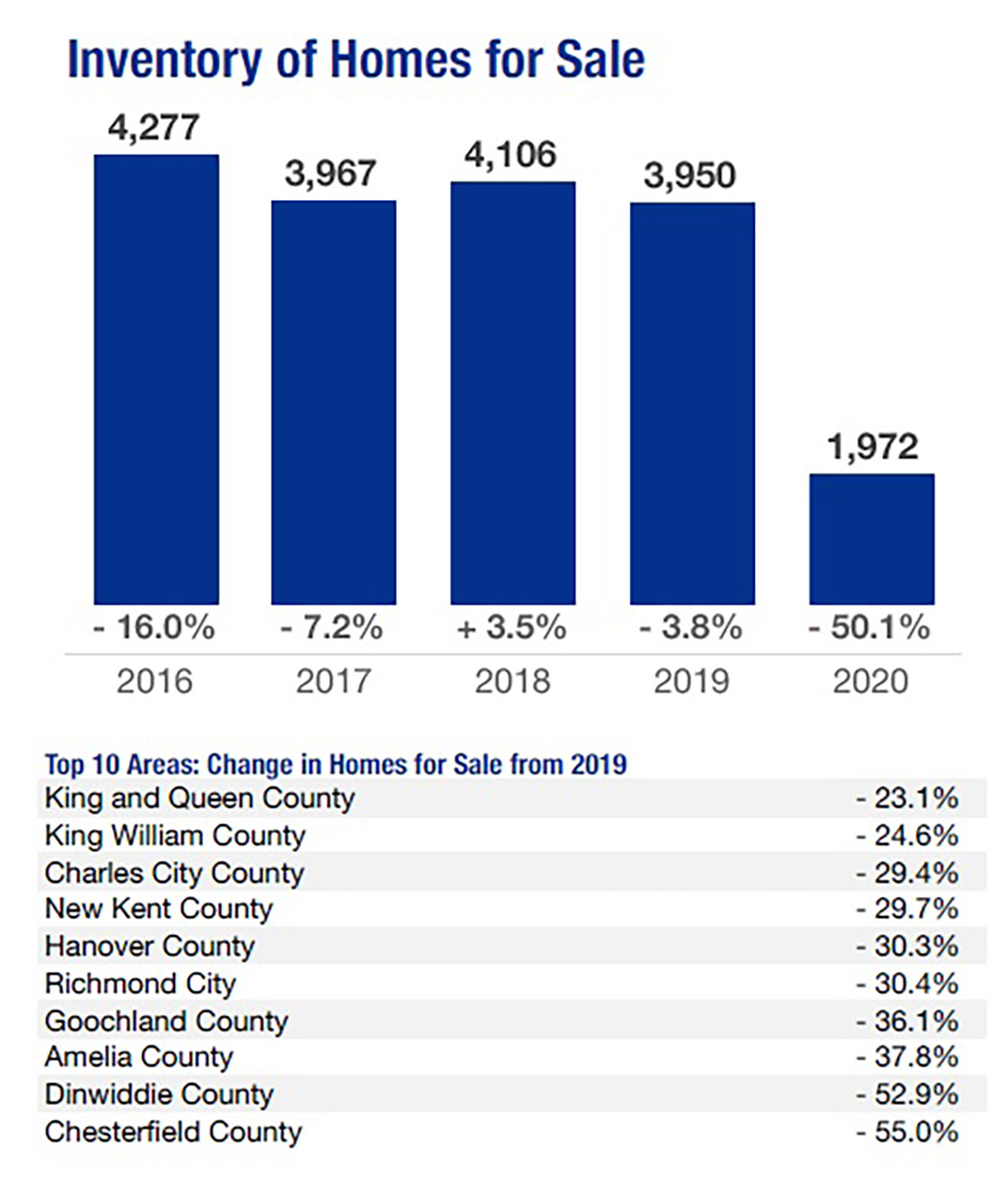

At the same time, the inventory of homes for sale dropped dramatically last year, from around 4,000 each of the previous four years to just under 2,000 in 2020, according to reports from CVRMLS.

“There’s definitely an inventory challenge, there’s no question about it,” Lafayette said. “I just think another way to look at it is it feels even tighter because the housing that is available is purchased so quickly.”

Quicker sales, higher purchases

That swiftness of sales is reflected in the latest monthly market numbers from CVRMLS.

The report for February, released about a week ago, shows that in metro Richmond (the city and Chesterfield, Hanover and Henrico counties), the average number of days that listings for single-family houses spent on the market before going under contract was 19. That’s compared to 43 in February 2020, just before the pandemic’s effects resulted in a spring slowdown and subsequent rebound.

The smaller number is in line with recent months’ findings, as 19 was likewise the average number of days that house listings spent on market in the fourth quarter of 2020, compared to 34 a year earlier and 36 the year before that. Last year’s third and second quarters averaged 25 and 26 days, respectively, while the pre-pandemic first quarter averaged 41 days on market.

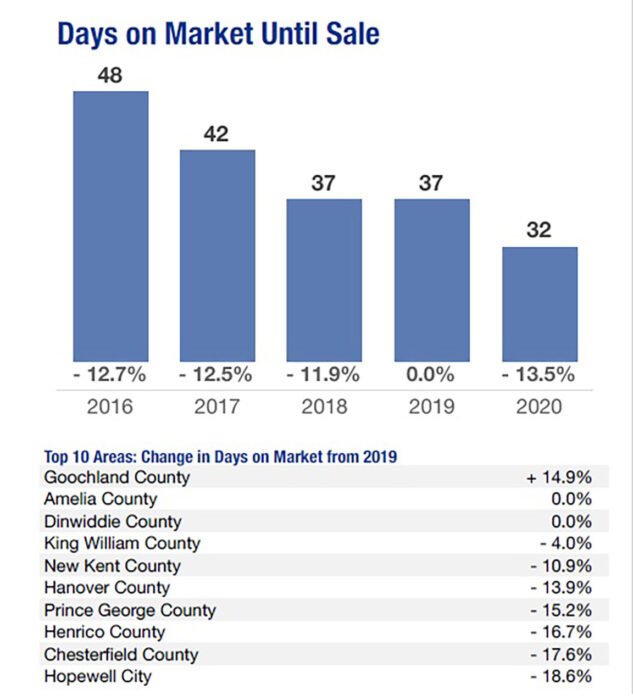

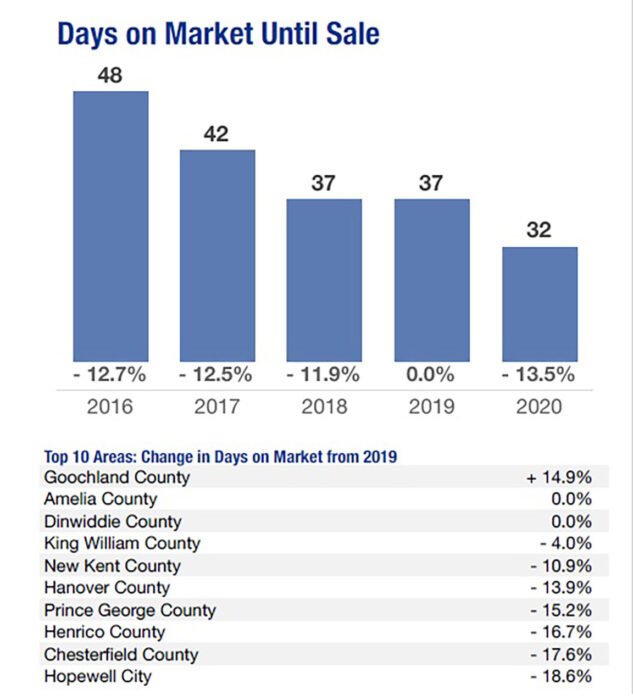

The number of days that listings remain on the market before they’re put under contract has been decreasing for years. (CVRMLS)

The average number of days on market for the full year was 32 in 2020, down from 37 the previous two years, 42 in 2017 and 48 in 2016, according to CVRMLS.

The quickening turnover rate has pushed sale prices up — to an average in February of more than $353,000, a 16 percent increase year-over-year. The median sale price for the month was $325,000, a nearly 24 percent jump over the same month in 2020. And sales on average were trending above list prices, with sales averaging about 2 percent over list price, compared to about 2 percent below in 2020.

The number of new listings in February totaled 1,074, while there were 1,094 pending and 887 closed sales. By the start of March, the inventory of homes for sale in metro Richmond totaled 828 — less than half what it was the same month in 2020, before the pandemic-fueled slowdown that prompted some sellers to take their listings off the market. The number amounts to just over half a month’s worth of supply of homes for sale — about 62 percent less supply from a year earlier.

‘People trying to enter the market simply can’t’

Jarvis said he saw the effects of such math with a recent One South listing near Parham and Three Chopt roads in Henrico — a brick rancher resale totaling 1,400 square feet.

“It was nice, well-maintained, probably a newer kitchen,” but nothing amazing, Jarvis said. “We put it out there for $300,000; we got 30 offers. That means one person got a house that day. The other 29 went back and started looking again.”

He added, “Think about the implications of that under-supply. These developers who keep building more and more apartments, they’ve got to build something else for sale, because we’re in a critical area for our region right now where we’re literally running out of houses.

“The implication as much as anything is: the people who are trying to enter the market simply can’t.”

With a competitive market vying for fewer homes, Jarvis said homebuyers requiring any type of financing are losing out to all-cash offers and buyers who can afford sizable down payments. The result is that lower-income and first-time homebuyers are unable to buy a home that they may have been able to just a few years ago.

“That’s a huge issue because, really, housing is no longer an asset that gets distributed across the population,” he said. “It’s being essentially limited to only those who have cash to purchase it, because debt buying just doesn’t work right now.”

Lafayette agreed that the market is tougher for first-time and financing-reliant buyers, but she said that’s typical for this time of year, before the traditionally busier spring market gets into full swing.

“There may be people who weren’t comfortable selling during COVID but now have gotten vaccinated, and maybe we’ll see a few more homes come on the market in ’21 that either didn’t go on the market in 2020 or went on the market very briefly last spring and were withdrawn by their owners.”

New construction has its challenges

Contributing to the situation is the current rate of new home construction, which local observers say has been slowed by pandemic- or storm-related delays in building materials, increasing costs of materials and labor, and costs and scarcity of developable land.

“New construction just can’t keep up the pace,” Lafayette said. “To take raw land and get it to a developable stage takes time. We then have the issue of labor supply, materials, and getting those materials, so all of that has really restricted the efficient flow of construction of new homes.”

Daniel Jones, board president of the Home Building Association of Richmond (HBAR) and president of development firm East West Communities, said the length of time required to get land purchased, zoned and to a developable stage, combined with the demand of the past year-plus, is putting a strain on the amount of buildable land available — and in turn the number of new homes coming online.

“Land’s just becoming harder and harder to find that’s actually quote-unquote ‘desirable’ and developable,” Jones said, “whether it be because of price point of land, access to public water and sewer, or some underlying issue.”

He added, “Any of the easy deals are long gone. We have a saying that’s been going around the development world for the past 12 months: Anything that you’re finding now has hair on it. There’s a reason it’s sitting there.”

According to research firm Integra Realty Resources–Richmond, the number of vacant lots sold in Central Virginia rose 33 percent in the fourth quarter of 2020, with 1,432 lots sold — about 350 more than the same timeframe in 2019.

Permitting activity followed suit, jumping 39 percent with 1,430 permits issued in the fourth quarter compared to 1,032 the year before. The number of new homes sold increased 8 percent, with 1,279 sold compared to 1,180 the last three months of 2019.

Jones said demand has been so strong that builders are forsaking their typical output of speculative construction, which he said would typically make up about a fourth of a builder’s activity on top of homes that are presold ahead of construction.

“You don’t see any specs anymore in Richmond, just because the builders are having so much success with presales and they’re focusing on those,” Jones said. “That’s a nuance that we haven’t seen in quite some time.”

HBAR CEO Danna Markland said those pressures and increased demand could result in builders running out of lots to build on this year.

“If this pace continues, you may even see builders capping their contracts,” Markland said, “just because they want to be able to handle the volume.”

While times are challenging for the industry, Markland said, “This is the best market we have ever seen. That’s what I hear from all of our builders consistently. You’re seeing the highest confidence levels among builders on record, but that is tempered by this potential of a cooling effect from those material delays and from the limitations of lot inventory.”

‘Where’s all the demand coming from?’

Lafayette, while acknowledging a lack of first-time home inventory and the increase in average home prices, said the situation also reveals a high demand for homes in the Richmond area in particular.

“The other part of the story here is this tremendous demand,” she said. “While there’s definitely some households that can’t enter the market, the other question is: where’s all the demand coming from?”

One source could be spillover from larger metros, where similarly rising prices and decreasing inventory — as well as pandemic-era remote-workability — may be encouraging homebuyers to broaden the scope of their search.

Lisa Sturtevant, chief economist with the Virginia Realtors Association, said she’s observed some such migration over the past year, though not as much as she had expected months into the pandemic.

“I think we have some movement around the edges of people moving from bigger metros — primarily from Northern Virginia — to places like Charlottesville, Harrisonburg, and maybe the Richmond metro. But I’m not as convinced as I was last fall that this is a huge trend,” Sturtevant said in an email.

“Some people will continue to full-time telecommute, but the survey data I’m seeing suggests that people will be going back to the office at least a couple of times a week,” she said. “So, if you work in D.C., it’s possible to move to the Richmond area if you’re only going up I-95 once or twice a week. But I’m not sure we have a handle on how many people that is.”

Sturtevant said a recent survey of the state group’s members showed that nearly half of the buyers in 70 transactions in metro Richmond were locals moving within the same area. Just over a third were moving from elsewhere in Virginia, while 16 percent were relocating from out-of-state.

The group’s stats also show that, in the second half of 2020, home sales increased more strongly in rural and suburban counties than in more-urban counties and cities compared to the last half of 2019. But, Sturtevant said, “Cities did pretty well, too.”

Affordability remains a concern

While such demand means good times for the local housing industry, both in real estate selling and new home construction, Lafayette said there is a flip side to that, as well: the lack of housing stock for lower-income buyers.

“We just don’t have an adequate supply of affordable rental and first-time homeownership opportunities,” said Lafayette, whose work with the nonprofit Maggie Walker Community Land Trust aims to increase homeownership for lower-income buyers.

“To know that people are struggling with stable shelter is the flip side of this, and what really breaks your heart,” she said. “We live in a country of abundance; we shouldn’t be having this scarcity issue.”

Lafayette said the challenge continues to be how to get more lower-income-level units, both for-sale homes and rentals, constructed and on the market. But it’s going to take more than market changes or an uptick in construction, she said, noting needs for more zoning in more parts of the region to allow for more housing types and price points.

“I think that’s going to continue to be a conversation: how do we free up more land for different types of ownership, whether it’s townhomes, a condo, a duplex, a quad, that allows for ownership and some equity to be built but isn’t tied to that traditional single-family detached model,” she said.

“We can’t just build our way out of this deficit, and we’ve known that for a really long time,” she said. “It would take an enormous amount of time to build our way out.”

Homes listed for sale aren’t staying that way for long — 19 days on average in February, which ended with just over 800 active listings in metro Richmond. (Jonathan Spiers photo)

With Richmond-area homes selling faster than they have in years and the number of homes listed for sale at any given time continuing to shrink, some in the local residential real estate industry are starting to wonder: is the region’s housing market heading toward some sort of breaking point?

Rick Jarvis thinks it is. The co-founder of local brokerage One South Realty Group pointed out that, at one point earlier this year, the number of preowned houses listed for sale in Central Virginia totaled about 600 — in a region, he emphasized, with 1.3 million people.

In two weeks’ time, he said, the number of houses sold in the region exceeded 600 — leading Jarvis to surmise: “We are literally heading to a point where the only inventory available is the inventory that was listed that day.”

Likening the scenario to a grocery delivery truck that hands out food in the parking lot instead of placing it on the store’s shelves, Jarvis said, “That’s what’s happening. There’s no inventory of houses for sale. It’s almost as if it doesn’t come out that day, there’s nothing to buy. It’s a pretty bad problem.”

What Jarvis and other observers describe as a problem, others see as a reflection of a desirable housing market driving buyer demand — albeit a market that’s gotten harder to enter for more would-be homeowners.

“It’s not that there’s no inventory. It’s how quickly it’s being absorbed,” said Laura Lafayette, CEO of the Richmond Association of Realtors and the Central Virginia Regional Multiple Listing Service.

And Lafayette has the stats to back that up. The number of homes that are selling has actually increased, with more than 3,800 more homes (condos and townhomes included) sold across the region last year than in 2019.

“There is inventory,” she said. “2020 was the best year in this century.”

It’s just that listings are selling faster and spending fewer days on the market — a rate driven perhaps by the pandemic and certainly by low mortgage interest rates — leading to competing offers and driving up purchase prices.

“The inventory is absorbed so quickly, that exacerbates this feeling of ‘There is no inventory,’” Lafayette said. “When people say there’s no inventory, I’m like, ‘Yeah, but we sold almost 4,000 more units.’”

Lafayette said closed sales last year totaled just over 25,500 across the CVRMLS footprint, which covers 16 jurisdictions in Central Virginia. In 2019, closed sales totaled about 21,700.

At the same time, the inventory of homes for sale dropped dramatically last year, from around 4,000 each of the previous four years to just under 2,000 in 2020, according to reports from CVRMLS.

“There’s definitely an inventory challenge, there’s no question about it,” Lafayette said. “I just think another way to look at it is it feels even tighter because the housing that is available is purchased so quickly.”

Quicker sales, higher purchases

That swiftness of sales is reflected in the latest monthly market numbers from CVRMLS.

The report for February, released about a week ago, shows that in metro Richmond (the city and Chesterfield, Hanover and Henrico counties), the average number of days that listings for single-family houses spent on the market before going under contract was 19. That’s compared to 43 in February 2020, just before the pandemic’s effects resulted in a spring slowdown and subsequent rebound.

The smaller number is in line with recent months’ findings, as 19 was likewise the average number of days that house listings spent on market in the fourth quarter of 2020, compared to 34 a year earlier and 36 the year before that. Last year’s third and second quarters averaged 25 and 26 days, respectively, while the pre-pandemic first quarter averaged 41 days on market.

The number of days that listings remain on the market before they’re put under contract has been decreasing for years. (CVRMLS)

The average number of days on market for the full year was 32 in 2020, down from 37 the previous two years, 42 in 2017 and 48 in 2016, according to CVRMLS.

The quickening turnover rate has pushed sale prices up — to an average in February of more than $353,000, a 16 percent increase year-over-year. The median sale price for the month was $325,000, a nearly 24 percent jump over the same month in 2020. And sales on average were trending above list prices, with sales averaging about 2 percent over list price, compared to about 2 percent below in 2020.

The number of new listings in February totaled 1,074, while there were 1,094 pending and 887 closed sales. By the start of March, the inventory of homes for sale in metro Richmond totaled 828 — less than half what it was the same month in 2020, before the pandemic-fueled slowdown that prompted some sellers to take their listings off the market. The number amounts to just over half a month’s worth of supply of homes for sale — about 62 percent less supply from a year earlier.

‘People trying to enter the market simply can’t’

Jarvis said he saw the effects of such math with a recent One South listing near Parham and Three Chopt roads in Henrico — a brick rancher resale totaling 1,400 square feet.

“It was nice, well-maintained, probably a newer kitchen,” but nothing amazing, Jarvis said. “We put it out there for $300,000; we got 30 offers. That means one person got a house that day. The other 29 went back and started looking again.”

He added, “Think about the implications of that under-supply. These developers who keep building more and more apartments, they’ve got to build something else for sale, because we’re in a critical area for our region right now where we’re literally running out of houses.

“The implication as much as anything is: the people who are trying to enter the market simply can’t.”

With a competitive market vying for fewer homes, Jarvis said homebuyers requiring any type of financing are losing out to all-cash offers and buyers who can afford sizable down payments. The result is that lower-income and first-time homebuyers are unable to buy a home that they may have been able to just a few years ago.

“That’s a huge issue because, really, housing is no longer an asset that gets distributed across the population,” he said. “It’s being essentially limited to only those who have cash to purchase it, because debt buying just doesn’t work right now.”

Lafayette agreed that the market is tougher for first-time and financing-reliant buyers, but she said that’s typical for this time of year, before the traditionally busier spring market gets into full swing.

“There may be people who weren’t comfortable selling during COVID but now have gotten vaccinated, and maybe we’ll see a few more homes come on the market in ’21 that either didn’t go on the market in 2020 or went on the market very briefly last spring and were withdrawn by their owners.”

New construction has its challenges

Contributing to the situation is the current rate of new home construction, which local observers say has been slowed by pandemic- or storm-related delays in building materials, increasing costs of materials and labor, and costs and scarcity of developable land.

“New construction just can’t keep up the pace,” Lafayette said. “To take raw land and get it to a developable stage takes time. We then have the issue of labor supply, materials, and getting those materials, so all of that has really restricted the efficient flow of construction of new homes.”

Daniel Jones, board president of the Home Building Association of Richmond (HBAR) and president of development firm East West Communities, said the length of time required to get land purchased, zoned and to a developable stage, combined with the demand of the past year-plus, is putting a strain on the amount of buildable land available — and in turn the number of new homes coming online.

“Land’s just becoming harder and harder to find that’s actually quote-unquote ‘desirable’ and developable,” Jones said, “whether it be because of price point of land, access to public water and sewer, or some underlying issue.”

He added, “Any of the easy deals are long gone. We have a saying that’s been going around the development world for the past 12 months: Anything that you’re finding now has hair on it. There’s a reason it’s sitting there.”

According to research firm Integra Realty Resources–Richmond, the number of vacant lots sold in Central Virginia rose 33 percent in the fourth quarter of 2020, with 1,432 lots sold — about 350 more than the same timeframe in 2019.

Permitting activity followed suit, jumping 39 percent with 1,430 permits issued in the fourth quarter compared to 1,032 the year before. The number of new homes sold increased 8 percent, with 1,279 sold compared to 1,180 the last three months of 2019.

Jones said demand has been so strong that builders are forsaking their typical output of speculative construction, which he said would typically make up about a fourth of a builder’s activity on top of homes that are presold ahead of construction.

“You don’t see any specs anymore in Richmond, just because the builders are having so much success with presales and they’re focusing on those,” Jones said. “That’s a nuance that we haven’t seen in quite some time.”

HBAR CEO Danna Markland said those pressures and increased demand could result in builders running out of lots to build on this year.

“If this pace continues, you may even see builders capping their contracts,” Markland said, “just because they want to be able to handle the volume.”

While times are challenging for the industry, Markland said, “This is the best market we have ever seen. That’s what I hear from all of our builders consistently. You’re seeing the highest confidence levels among builders on record, but that is tempered by this potential of a cooling effect from those material delays and from the limitations of lot inventory.”

‘Where’s all the demand coming from?’

Lafayette, while acknowledging a lack of first-time home inventory and the increase in average home prices, said the situation also reveals a high demand for homes in the Richmond area in particular.

“The other part of the story here is this tremendous demand,” she said. “While there’s definitely some households that can’t enter the market, the other question is: where’s all the demand coming from?”

One source could be spillover from larger metros, where similarly rising prices and decreasing inventory — as well as pandemic-era remote-workability — may be encouraging homebuyers to broaden the scope of their search.

Lisa Sturtevant, chief economist with the Virginia Realtors Association, said she’s observed some such migration over the past year, though not as much as she had expected months into the pandemic.

“I think we have some movement around the edges of people moving from bigger metros — primarily from Northern Virginia — to places like Charlottesville, Harrisonburg, and maybe the Richmond metro. But I’m not as convinced as I was last fall that this is a huge trend,” Sturtevant said in an email.

“Some people will continue to full-time telecommute, but the survey data I’m seeing suggests that people will be going back to the office at least a couple of times a week,” she said. “So, if you work in D.C., it’s possible to move to the Richmond area if you’re only going up I-95 once or twice a week. But I’m not sure we have a handle on how many people that is.”

Sturtevant said a recent survey of the state group’s members showed that nearly half of the buyers in 70 transactions in metro Richmond were locals moving within the same area. Just over a third were moving from elsewhere in Virginia, while 16 percent were relocating from out-of-state.

The group’s stats also show that, in the second half of 2020, home sales increased more strongly in rural and suburban counties than in more-urban counties and cities compared to the last half of 2019. But, Sturtevant said, “Cities did pretty well, too.”

Affordability remains a concern

While such demand means good times for the local housing industry, both in real estate selling and new home construction, Lafayette said there is a flip side to that, as well: the lack of housing stock for lower-income buyers.

“We just don’t have an adequate supply of affordable rental and first-time homeownership opportunities,” said Lafayette, whose work with the nonprofit Maggie Walker Community Land Trust aims to increase homeownership for lower-income buyers.

“To know that people are struggling with stable shelter is the flip side of this, and what really breaks your heart,” she said. “We live in a country of abundance; we shouldn’t be having this scarcity issue.”

Lafayette said the challenge continues to be how to get more lower-income-level units, both for-sale homes and rentals, constructed and on the market. But it’s going to take more than market changes or an uptick in construction, she said, noting needs for more zoning in more parts of the region to allow for more housing types and price points.

“I think that’s going to continue to be a conversation: how do we free up more land for different types of ownership, whether it’s townhomes, a condo, a duplex, a quad, that allows for ownership and some equity to be built but isn’t tied to that traditional single-family detached model,” she said.

“We can’t just build our way out of this deficit, and we’ve known that for a really long time,” she said. “It would take an enormous amount of time to build our way out.”

1 – There truly is an inventory issue

2 – There is an even bigger affordable housing inventory issue

The new apartments along Board Street were the Old Fish and Game Office was at I was dis pointed when they only built them to be 3 to 4 stories they needed to be at least 8 to 10 stories to take some pressure off this run away rental market.

Don’t forget material costs. Lumber is up 188% in the last year (since pandemic began). New 2000 sqft homes are almost all wood material construction with about $50,000 in wood based products in 2019 now costing over $125,000 in 2021.

Richmond housing market is on fire no doubt about it.

What I don’t understand is most jobs in Richmond barely are between $14.00 to $11.00 a hour and even then a lot of them are part time. I also find it distribing with how picky they are for these crappy jobs I really don’t understand how there are no jobs out their that pay more then $20,000 a year and yet they are building hundreds of $400,000 to $800,000 with home owner’s fees of $200 a month. I also don’t think people are moving out of the city in that the City of Richmond is going into hyper drive with… Read more »

To me the job market being able to sustain these home prices maters most of all. Such as if I saw lots of $60,000 dollar jobs everywhere I would be understanding of the home prices but I have not and I’m wondering were all this money comes from? I’m working on a news paper story called if you can suddenly do your job on line then your job is toast. Such as these remote workers who can do everything on line will soon find their jobs outsourced over seas in a year or two with the pandemic letting companies know… Read more »

that’s not true about the jobs though? You can google this… Look at how fast things are selling. If no one had the money to buy them, they wouldn’t be selling. They are selling, so you are clearly wrong about the money out there…

It’s been very difficult to find affordable housing or “starter homes” for decades now. Developers are no longer incentivized to build small 1400 sq ft ranchers like in the 70s because they need to cover the massive regulatory and tax burden placed on them by federal, state, and county bureaucracies – and that requires bigger, more expensive homes (very often on a tiny lot). Inflationary monetary policy, taxes, and regulatory compliance costs have contributed significantly to this, and lower income folks suffer as a result. It should be profitable to build affordable homes, but currently it is not. It’s easy… Read more »

It kind if funny that “Big government bad” talking points are not brought up in the article, but are brought up by a poster with a pseudonym. Actually, we need more regulation to allow lower income people to own property.

the rush to the higher priced properties is caused by the growing wealth inequality in America.

People are priced out of owning property, and are stuck on the rental treadmill,paying for years and never getting any return on the investment.

“Ackkkshualllllyyy” Come on man that was all just assertions. Let me guess: if you increase regulation of the housing market, but low income people still don’t own homes, then the solution will be even more regulation, right? People are “priced out” because the Biggest Bank (i.e. the Federal Reserve) engages in inflationary monetary policy. Renting is not an investment. It is an expense. Expenses do not build equity, but they also can be walked away from much more easily than investments can. When you don’t renew your lease, you can leave your apartment no questions asked. It’s not so easy… Read more »

so by these lights, San Francisco and NYC, the most highly regulated housing areas in the country should also be the cheapest? Yet they aren’t… I wonder why that is.

I just built a house in the city, it’s something I do. Literally a third of the cost was regulatory and governmental. Do you think I’m going to eat that? If so you are really confused. I passed that cost right on…

If you make things expensive to build, why are you so surprised when they are expensive?

” Literally a third of the cost was regulatory and governmental. “

I actually prefer houses that don’t go up like a box or matches or fall down in the breeze, thanks to those pesky building standards.

This is often stated, but really only goes to show the complete ignorance of the person making the comment I’m afraid. I’d call it a straw man argument, but it’s really not sophisticated enough to be one. I’m not talking about building standards. I never mentioned building standards in fact, with which I have no problem, but I’ll address them in any case. First – How many houses have you heard of falling down in the Fan/Museum District/ West End, all of which were built before building standards? Not exact an endemic problem. Second – Modern building codes are mostly… Read more »

Charles, is that survey for the goverment or a mortgage insurance company? I’m not aware of any local law that requires a survey for a land transaction. Just a deed. And if it is for an older house on a lot, you’d pay a few hundred, not thousand. Having said that, some of the government requirements (state and local) related to NEW developments do indeed border on the ridiculous.

city of Richmond Remodel permits. Not purchase

Regulations like having to buy nutrient runoff credits have nothing to do with how “safe” your house is.

John, I am glad to see someone hit the ball; you got it right. A twist on what you state that is, developers are “incentivized” to build “expensive” homes to cover significant increases in resource costs due to the reasons you state and some others.

Charles Wilson

This was a very thoughtful, thorough, soundly researched and educational piece of writing. Thanks for your work and the perspectives you captured in your delivery. Even further proof of the need for skilled labor to keep up with the demand as best as possible.

It’s funny how realtors blame builders, government regulations, neighborhood associations, you name it, but never do they talk about the fees and commissions they charge. They always act like they’re blameless saints.

Great job with this piece. Funny to see CapCenter’s 1% fee ads on the same page. 3% to each side is ridiculous, especially for larger transactions.

When it comes to the extreme demand for housing, the conversation can not be complete without mentioning the historically low interest rates we are seeing and how that affects the purchasing power for the average homebuyer. When those in real estate talk about prices, we think in terms of sale price. But those who are shopping for homes think in terms of their monthly mortgage payment and what they can afford to fit their budget. The price of the home is secondary. Consider the following scenarios. Assume this household puts down 20% to purchase a home, which is pretty standard.… Read more »

I agree that interest rates are incentivizing this feeding frenzy. I do think it’s important to note that the manipulation of interest rates does not increase purchasing power – quite the opposite. It is an easy money policy that results in more dollars chasing fewer goods. It reduces our purchasing power. If our dollars bought us more house today than they did 3 years ago, I would agree that our purchasing power went up. Being able to get a bigger loan for a house that costs more dollars than it did 3 years ago is certainly the intent of this… Read more »

This will only last until the pandemic abates (i.e. interest rates increase and the pattern of working from home evens out).

Save your fortunes, realtors. There will be a hangover.

Yes, but you could have said the housing market was overheated 3 years ago and been right then also. The question is, how long can the housing market stay irrational? When the Fed is treading new ground every day, the answer is nobody knows.

I think working from home is going to be a permanent change, and commercial property owners are the ones who need to beware.

Ms. Layette seems to overlook the obvious conclusion created by the confluence of all market indicators, ignores the other market indicators to inventory by unit count, misunderstands those indicators, or perhaps it is the semantics of what Mr. Jarvis says that trips her up. Mr. Jarvis and the data support a significant imbalance of supply/demand, with demand outstripping supply. If I recall correctly, the National Association of Realtors’ senior economist typically cites a 3-month supply as a key signal to a balanced housing market. The problem should worsen given the time to add new units to the SFR housing stock;… Read more »

I always love to see Rick’s data! He is data driven and knows this market inside and out! Thank you for a great article!

Jim

The market for home purchases is driven primarily by 1 factor, interest rates × amount financed equating to MONTHLY PAYMENT for the purchaser. House values are drive high by demand vs supply. The artificially low rates that exist now, in a period of rising prices (gas, lumber, higher rent, utilities and taxes etc.) lend a sence of urgency to those first time buyers who want to own rather than rent. The demand begins with them, who seldom if ever, pay cash. They ‘prime the pump’. The homes the purchase are seldom New, rather pre-owned or ‘Existing’. In 27 years of… Read more »

And check the data but in 2021 we have record number of pure “cash sales” also. The market is so hot, buyers remove the financial contingency entirely.