GPB Scientific, a medical research firm based at the BioTechnology Research Park at 800 E. Leigh St., recently announced it had secured $18 million in funding. (BizSense file)

With a new pool of cash in hand, a local medical research firm is moving toward commercialization of its cell and gene therapy devices.

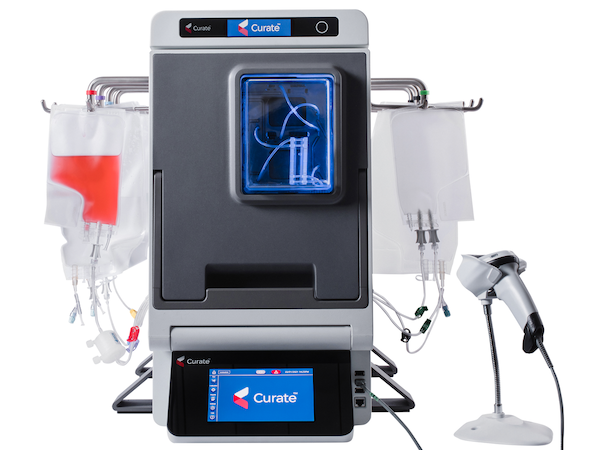

GPB Scientific announced last month it had closed on an $18 million funding round. The money will help the company roll out its Curate cell processing system, which separates and extracts cells from blood samples to create therapies for cancer and other diseases.

Funding came by way of Amgen Ventures and Vensana Capital (firms that have contributed toward previous raises), a new undisclosed investor, as well as angel investors.

Mike Grisham, GPB’s president and CEO, said the company expects to have the devices put to use with bio-pharmaceutical companies in earnest in 2022.

“We’re focused on the cell and gene therapy markets and we’re working with major biopharma companies to help them scale up their manufacturing of cell therapies while dramatically lowering the cost of production,” Grisham said, adding that Curate is designed to be a more efficient and cost-effective way to extract cells than existing methods.

GPB was founded in 2002, though work on the Curate system began in 2016. It is still a pre-revenue company.

Prior to 2016, GPB and its spin-off companies developed several devices and research methods for the microfluidics field, and the company’s first area of focus was prenatal diagnosis of chromosomal abnormalities.

The recently raised $18 million comes as the second and final tranche of a $33.5 million round. The round was initially $25.5 million, but was increased to make way for additional funding.

Grisham said the $18 million pot is expected to last the company through the first half of 2023.

Before the latest round, GPB had raised $12.5 million from investors and another $4 million in grants.

The Curate system by Richmond-based GPB Scientific is designed to make the separation and extraction of cells from blood samples more efficient and cost-effective than existing methods. (Courtesy of GPB Scientific)

GPB’s methods prioritize separation and extraction of T-cells from blood samples to be modified to better recognize and attack cancer. The company says other technologies that separate and extract cells use stronger physical force and chemicals to do the work, and Curate is designed to use gentler methods intended to create higher cell yields.

A contracted manufacturer builds the Curate system, and GPB adds the finishing touches and does quality-control checks before shipping units to customers.

With the Curate system, the company seeks to decrease the cost of cell therapies from the current range of $500,000 to $800,000 down to as much as half the cost.

GPB has its headquarters at BioTechnology Research Park, which is at 800 E. Leigh St. The company also has a presence in San Diego, where it recently moved into a new 11,000-square-foot manufacturing facility. It has 20 full-time employees.

Grisham said that pandemic-related supply chain disruptions did little to slow beta testing and interest in the company’s devices.

“COVID impacted the supply chain, and the volume of beta placements was limited by supply chain logistics. But fortunately, we had enough supply to get all the key data,” Grisham said. “There’s a huge demand for what we’re doing. It slowed us down from a Mach 2 to a Mach 1.”

GPB Scientific, a medical research firm based at the BioTechnology Research Park at 800 E. Leigh St., recently announced it had secured $18 million in funding. (BizSense file)

With a new pool of cash in hand, a local medical research firm is moving toward commercialization of its cell and gene therapy devices.

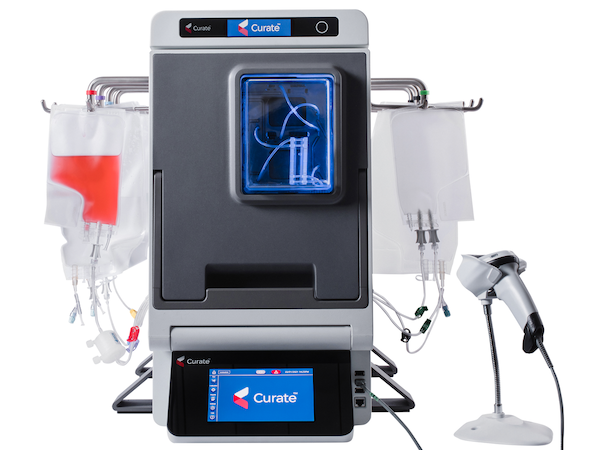

GPB Scientific announced last month it had closed on an $18 million funding round. The money will help the company roll out its Curate cell processing system, which separates and extracts cells from blood samples to create therapies for cancer and other diseases.

Funding came by way of Amgen Ventures and Vensana Capital (firms that have contributed toward previous raises), a new undisclosed investor, as well as angel investors.

Mike Grisham, GPB’s president and CEO, said the company expects to have the devices put to use with bio-pharmaceutical companies in earnest in 2022.

“We’re focused on the cell and gene therapy markets and we’re working with major biopharma companies to help them scale up their manufacturing of cell therapies while dramatically lowering the cost of production,” Grisham said, adding that Curate is designed to be a more efficient and cost-effective way to extract cells than existing methods.

GPB was founded in 2002, though work on the Curate system began in 2016. It is still a pre-revenue company.

Prior to 2016, GPB and its spin-off companies developed several devices and research methods for the microfluidics field, and the company’s first area of focus was prenatal diagnosis of chromosomal abnormalities.

The recently raised $18 million comes as the second and final tranche of a $33.5 million round. The round was initially $25.5 million, but was increased to make way for additional funding.

Grisham said the $18 million pot is expected to last the company through the first half of 2023.

Before the latest round, GPB had raised $12.5 million from investors and another $4 million in grants.

The Curate system by Richmond-based GPB Scientific is designed to make the separation and extraction of cells from blood samples more efficient and cost-effective than existing methods. (Courtesy of GPB Scientific)

GPB’s methods prioritize separation and extraction of T-cells from blood samples to be modified to better recognize and attack cancer. The company says other technologies that separate and extract cells use stronger physical force and chemicals to do the work, and Curate is designed to use gentler methods intended to create higher cell yields.

A contracted manufacturer builds the Curate system, and GPB adds the finishing touches and does quality-control checks before shipping units to customers.

With the Curate system, the company seeks to decrease the cost of cell therapies from the current range of $500,000 to $800,000 down to as much as half the cost.

GPB has its headquarters at BioTechnology Research Park, which is at 800 E. Leigh St. The company also has a presence in San Diego, where it recently moved into a new 11,000-square-foot manufacturing facility. It has 20 full-time employees.

Grisham said that pandemic-related supply chain disruptions did little to slow beta testing and interest in the company’s devices.

“COVID impacted the supply chain, and the volume of beta placements was limited by supply chain logistics. But fortunately, we had enough supply to get all the key data,” Grisham said. “There’s a huge demand for what we’re doing. It slowed us down from a Mach 2 to a Mach 1.”