Henrico County’s investment program would include Henrico Plaza, where a multiuse development with 580 homes is currently in the works. (BizSense file images)

After adjusting its enterprise zone boundaries last year, Henrico County is going beyond that program’s footprint to provide development incentives to more of the county’s older commercial corridors.

County supervisors last week approved the creation of the Henrico Investment Program, which provides incentives that are modeled after the enterprise zone program but are designated for areas outside of those enterprise zone boundaries.

The board also amended Henrico’s commercial rehabilitation tax credit program, making more buildings eligible to qualify for credits, including rehabbed buildings that are more than twice their original size.

The moves are aimed at encouraging revitalization of commercial and industrial properties in parts of the county that are economically struggling or have emerging development opportunities.

New areas included in the investment program include properties along Patterson Avenue from Starling Drive to the Goochland-Henrico line, and along West Broad Street from Hungary Spring Road to Pemberton Road.

Other areas include Staples Mill Road from Parham Road to Dumbarton Avenue, Williamsburg Road from Laburnum Avenue to Nine Mile Road, and Mechanicsville Turnpike from the Richmond-Henrico line to Henrico Plaza, where a multiuse development with 580 homes is currently in the works.

Those latter three areas are part of the enterprise zone and remain eligible for those incentives, though property owners will only be able to use one of the two programs so long as both options exist.

Established in 2003, Henrico’s enterprise zone works in conjunction with the overarching Virginia Enterprise Zone Program, which provides financial assistance to businesses that qualify for the county incentives. Businesses located within the zone are eligible for 14 county incentives, ranging from grants for building façade or landscaping improvements to partial tax exemption for property rehabs.

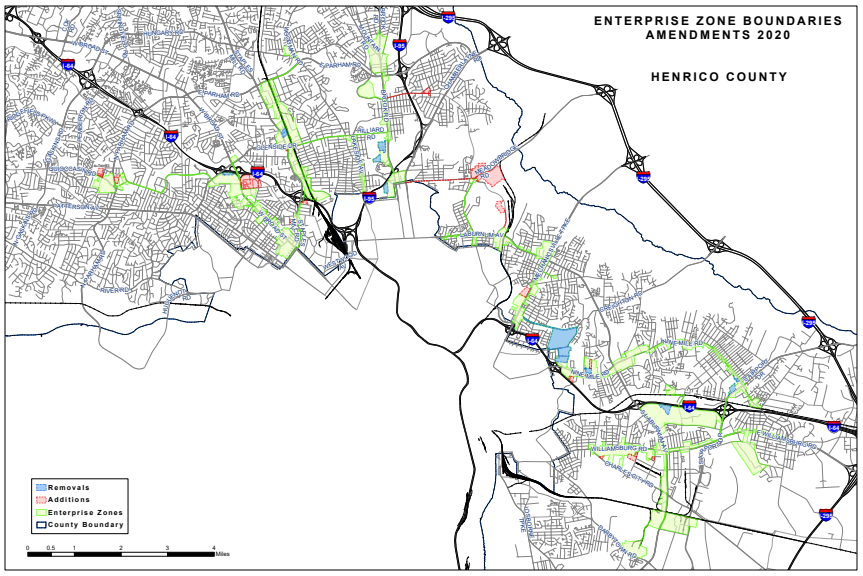

A state cap keeps Henrico’s enterprise zone to 3,840 acres, or six square miles, the boundaries of which the county adjusted last year. While the investment program area overlaps parts of the zone, it also extends to certain areas beyond it, providing incentives to more property owners for development or revitalization projects.

Set to begin in January, the investment program results from legislation adopted in the 2017 General Assembly session allowing counties to create their own economic revitalization zones.

Qualifications and incentives for the investment program are modeled after those under the enterprise zone, though the program also is expected to offer additional incentives, such as increasing the maximum for demolition grants to $100,000 based on building size.

Removal, refurbishment or replacement of building signs would be allowed under the program’s sign grant, and the program’s façade grant would be expanded to include building system improvements and roof repairs or improvements.

On top of such incentives, Henrico also provides a seven-year partial real estate tax exemption for rehabbed buildings that increase in assessed value by 40 percent or more. Last week’s amendments make buildings eligible for the exemption even if they are enlarged to more than twice their original size, where previously such projects were ineligible.

The changes, aimed to allow more flexibility in design, also allow non-residential buildings larger than 20,000 square feet to qualify for the exemption, if the expanded portion is 125 percent or less of the building’s original size. Rehabbed non-residential buildings up to 20,000 square feet can qualify regardless of original size.

Seventy-one projects have received the exemption since it was created in 2004, according to the county.

The investment program also sets the stage for incentives to continue after the county’s enterprise zone expires. The zone is currently scheduled to sunset at the end of 2022, but could be extended another five years.

Henrico County’s investment program would include Henrico Plaza, where a multiuse development with 580 homes is currently in the works. (BizSense file images)

After adjusting its enterprise zone boundaries last year, Henrico County is going beyond that program’s footprint to provide development incentives to more of the county’s older commercial corridors.

County supervisors last week approved the creation of the Henrico Investment Program, which provides incentives that are modeled after the enterprise zone program but are designated for areas outside of those enterprise zone boundaries.

The board also amended Henrico’s commercial rehabilitation tax credit program, making more buildings eligible to qualify for credits, including rehabbed buildings that are more than twice their original size.

The moves are aimed at encouraging revitalization of commercial and industrial properties in parts of the county that are economically struggling or have emerging development opportunities.

New areas included in the investment program include properties along Patterson Avenue from Starling Drive to the Goochland-Henrico line, and along West Broad Street from Hungary Spring Road to Pemberton Road.

Other areas include Staples Mill Road from Parham Road to Dumbarton Avenue, Williamsburg Road from Laburnum Avenue to Nine Mile Road, and Mechanicsville Turnpike from the Richmond-Henrico line to Henrico Plaza, where a multiuse development with 580 homes is currently in the works.

Those latter three areas are part of the enterprise zone and remain eligible for those incentives, though property owners will only be able to use one of the two programs so long as both options exist.

Established in 2003, Henrico’s enterprise zone works in conjunction with the overarching Virginia Enterprise Zone Program, which provides financial assistance to businesses that qualify for the county incentives. Businesses located within the zone are eligible for 14 county incentives, ranging from grants for building façade or landscaping improvements to partial tax exemption for property rehabs.

A state cap keeps Henrico’s enterprise zone to 3,840 acres, or six square miles, the boundaries of which the county adjusted last year. While the investment program area overlaps parts of the zone, it also extends to certain areas beyond it, providing incentives to more property owners for development or revitalization projects.

Set to begin in January, the investment program results from legislation adopted in the 2017 General Assembly session allowing counties to create their own economic revitalization zones.

Qualifications and incentives for the investment program are modeled after those under the enterprise zone, though the program also is expected to offer additional incentives, such as increasing the maximum for demolition grants to $100,000 based on building size.

Removal, refurbishment or replacement of building signs would be allowed under the program’s sign grant, and the program’s façade grant would be expanded to include building system improvements and roof repairs or improvements.

On top of such incentives, Henrico also provides a seven-year partial real estate tax exemption for rehabbed buildings that increase in assessed value by 40 percent or more. Last week’s amendments make buildings eligible for the exemption even if they are enlarged to more than twice their original size, where previously such projects were ineligible.

The changes, aimed to allow more flexibility in design, also allow non-residential buildings larger than 20,000 square feet to qualify for the exemption, if the expanded portion is 125 percent or less of the building’s original size. Rehabbed non-residential buildings up to 20,000 square feet can qualify regardless of original size.

Seventy-one projects have received the exemption since it was created in 2004, according to the county.

The investment program also sets the stage for incentives to continue after the county’s enterprise zone expires. The zone is currently scheduled to sunset at the end of 2022, but could be extended another five years.

I wish they’d consider expanding that enterprise zone to include the Dabney Industrial Park to coincide with the City TOD rezoning being debated along the West Broad Corridor. It would prompt a faster redevelopment of acreage in the Dabney area, relieving it of automobile oriented usage. There are a lot of storm water and sewerage costs to come before that area becomes the next Scott Addition.

Enterprise Zone benefits don’t typically help with residential properties, which are all the big things going on in Scotts Addition. If they want residential like that they should not extend the enterprise zone, but give other incentives to encourage what they want.

Yet they expanded it down Willow Lawn Drive where there’s a proposal for 500 apartments and just west of the Home Deport on West Broad where there’s a proposal for 250 apartments. And previously the County included the Libbie Mill area where about 2000 residential units are being developed.There must be some reason for those areas to be covered by the designation.