A rendering of the 20-story version of the project that was planned to replace the Public Safety Building. (BizSense file)

It turns out that backing out of a downtown development deal cost VCU Health System more than a single $73 million payment. In fact, the overall cost to the health system appears to be ongoing.

The known cost for VCU Health to walk away from the project that relied on its lease appears to be closer to $80 million – and could end up being higher – because of its commitments to pay for a planned demolition of the site and for past and future payments of city real estate taxes that the unbuilt project was expected to produce.

As part of its arrangement to exit the project – a $325 million privately owned development that would have replaced the City of Richmond’s old Public Safety Building – VCU Health agreed to go through with demolishing the 69-year-old building, at an estimated cost of $5 million.

The health system further agreed, a Virginia Commonwealth University spokesperson confirmed, to continue paying the project’s guaranteed obligation payments. Those are annual payments to the city intended to cover the minimum real estate tax revenue that the project was anticipated to generate for the city over 25 years.

VCU Health, as master tenant of the project, was to have made the first two of those payments – $77,000 for tax year 2021, and $546,700 for 2022 – by the time the project was wound down earlier this year. An additional $1.3 million payment for the current tax year is due to the city in less than a month.

The three payments come to nearly $2 million – which, along with the $5 million demolition cost, and the previously reported $73 million payment, brings the total cost known so far to $80 million.

And that tab could continue to go up.

According to Grant Heston, chief marketing and communications officer for VCU, VCU Health agreed to continue the annual payments until the property, at 500 N. 10th St., is sold by the city. The payments are based on a schedule in the development agreement that the city signed with developer Capital City Partners in 2021.

The health system, Heston said in an email, “agreed to continue to make payments set forth in Exhibit G in the Development Agreement until the City conveys the site for future development to a new owner.”

That new owner could end up being VCU, the university, because it is now pursuing a new and more expensive project for the site: a $415 million development to house its planned VCU Dentistry Center.

When BizSense reported in February that the original project was effectively dead, after the city took back ownership of the property, VCU provided a statement that referred to the payments and the demolition, though not their dollar amounts. The statement did not disclose the $73 million exit payment.

The statement read: “The university is committed to working in partnership with the City to develop infrastructure that benefits students, patients, our communities and Virginia. Additionally, the university and health system will uphold our obligations as they relate to prior real estate tax commitments, as well as the demolition of the existing Public Safety Building structure.”

$73M payment was just the start

The $73 million payment that bought VCU Health out of its lease was made Feb. 1 to the project’s would-be landlord, an LLC tied to Oak Street Real Estate Capital, now a division of New York-based investment firm Blue Owl Capital. Oak Street was handling financing for the project for Capital City Partners, the local development team led by Susan Eastridge and Michael Hallmark.

The $73 million payment was required as part of a defeasance agreement that allowed the parties to walk away from the project free from litigation and to unwind what was owed on a $425 million project loan the landlord LLC had secured from UMB Bank. The payment was revealed last Friday in a statement to Richmond BizSense that accompanied a response to a Freedom of Information Act request to VCU Health.

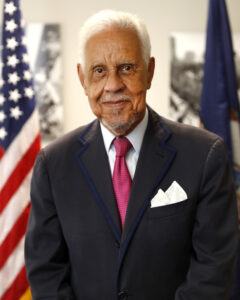

News of the payment prompted former Virginia Gov. Doug Wilder, a VCU professor and namesake of the university’s L. Douglas Wilder School of Government and Public Affairs, to hold a news conference Tuesday in which he called for the firing of VCU President Michael Rao, as well as a state investigation into how and why the payment was made. Rao is president of the university and of VCU Health.

In a radio appearance Wednesday on WRVA, Wilder reiterated his contention that the payment represents a cost to state taxpayers. VCU Health has maintained that the payment was made using the health system’s operating funds and did not involve university funds or state revenue.

“It’s hard to believe that anyone would say that no taxpayer dollars were involved,” Wilder said. “It’s absolutely crazy. And this wouldn’t have come out, we wouldn’t have known anything about this, but for a Freedom of Information request. The only way we know it now is someone had the temerity and the foresight to say, ‘Tell us what’s going on.’”

The health system has said it decided to exit the project in light of challenges arising over the course of the pandemic and the financial obligations that came with the project.

In a statement attributed to its interim CEO Marlon Levy, VCU Health said last week: “The original project plans were developed before the pandemic. While they were well intentioned, by late 2021 construction and other challenges made it simply impossible to build the original project.

“Moving forward today would cause dire long-term financial repercussions. With that in mind, VCU Health was forced to make a difficult, but also prudent, decision to exit the original project,” the statement said, adding that the one-time payment was needed to end its obligations on the site. “Making this one-time payment means avoiding far greater financial obligations and problems in the future.”

According to the lease agreement signed with the landlord, VCU Health was on the hook to pay more than a half billion dollars in rent over the 25-year lease. The agreement called for rents to increase annually, from roughly $12.8 million the first year to nearly $32 million the final year, with the overall lease totaling more than $617 million.

Real estate tax payments increase annually

The guaranteed obligation payments were included in the original project’s development agreement to ensure that the city received real estate tax revenue from the site, regardless of how promptly, or successfully, the property was developed.

Because the project had been expected to take nearly four years to complete, the payments in the development agreement schedule jump significantly the first three years, reflecting the expected progress of development, then level off at about $2 million for the fourth and fifth tax years. The annual payments would increase more gradually thereafter, reaching just under $3 million for the final tax year, 2045.

If paid out completely, the 25 payments would total nearly $56 million paid to the city.

According to the agreement, the payments are due on or before June 5 of each respective tax year. That puts this year’s payment of nearly $1.3 million as being due in less than a month.

Last year, the payment for 2022 – $546,700 – was not made in full before the June 5 deadline, prompting the city to issue VCU Health a notice of failure to remit payment, according to documents BizSense obtained through FOIA requests to the city.

The same day, June 30, the city sent a second default notice to Capital City Partners for failing to submit permits for demolition and other site work on time, and for failure to remit the missed guaranteed obligation payment.

The city had previously issued a a default notice to Capital City Partners and the landlord stating that they had failed to perform work in accordance with the development agreement and milestone schedule, among other alleged shortcomings. That notice followed CCP’s filing of a scaled-down development plan for the project, a portion of which was reduced from 20 stories in height to 12.

In a response the following day, VCU Health put the blame for the missed payment on CCP, which it said had access to the project budget escrow to make the payments for VCU Health and had the authority to do so where the health system did not, based on how the process was set up in the financing and payment draws.

VCU Health asked CCP to complete the payment. It wasn’t clear from the documents if the payment was made.

Requests to the city and VCU Health to confirm whether the first two payments were completed, and whether this year’s payment has been made, were not answered this week.

It isn’t clear whether the city is still holding VCU Health to making this year’s or future years’ payments on the unbuilt project. An email sent to Leonard Sledge, the city’s economic development director, and to Lincoln Saunders, chief administrative officer, asking whether the city has given any consideration to ending the payments in light of the health system’s stated financial challenges was not returned Thursday.

The city ultimately took the property back from the landlord LLC in February after determining that the original project had not progressed according to the development agreement.

Demolition to start this year

The Public Safety Building site at Leigh and 10th streets, a block away from City Hall. (BizSense file photo)

As part of the project wind-down process in February, VCU Health also signed a license agreement with the city for access to the now city-owned site to demolish the Public Safety Building.

Demolition would complete what CCP started with asbestos abatement and other site preparations that had gotten underway before the initial default notice was sent to the developer. Site conditions and other factors were among the reasons VCU Health has said it decided to back out of the project, which it said could not be completed without incurring “a material increase” in its cost and schedule.

The agreement contains a scope of work that includes remediation of contaminated and hazardous materials including asbestos abatement, demolition and removal of the building, and placement of protective fencing. Emails between attorneys who prepared the agreement name DPR Construction as VCU Health’s contractor for the work.

A construction schedule that also was shared indicates the work was supposed to get underway in March, with fencing to be installed and abatement started this month. Demolition was scheduled to start in August and last 75 days, with all work to be completed by the end of this year.

New project to be partially taxable

For VCU’s Dentistry Center project, which would replace the School of Dentistry’s Lyons Dental Building and Dental Building 1 on the nearby MCV Campus, it isn’t clear whether the university would buy the Public Safety Building property from the city or what it would potentially pay for it.

It also isn’t clear how soon such a transaction could be completed, potentially keeping VCU Health on the hook for future tax year payments.

University ownership would take the 3-acre property off the city’s tax rolls, because VCU is exempt from paying city real estate taxes. With VCU Health leasing the previously planned project, the property would have remained taxable under private ownership.

In an interview this week, Matt Conrad, vice president of external and government relations for VCU and VCU Health, said the goal for the dentistry project is for the university to own the property and incorporate uses such as retail that would make at least part of the new building taxable to the city. He said the project also would benefit the city by including a reconnection of Clay Street through the site, a cost to be borne by VCU.

“As sort of a high-level deal point for use of the parcel by the university for the School of Dentistry, we’ve agreed to reconnect Clay Street through the southern portion of the parcel, and have also committed to tax revenue-generating uses such as retail on the portion of the parcel immediately facing the reconstructed Clay Street, so that should be an additional source of tax revenue for the city,” Conrad said.

The rest of the property that would house the Dentistry Center would be university-owned, as required by state law, Conrad said.

“It’s a requirement of state law that a state entity own that portion in order to receive state funding for construction,” he said.

“We’re hoping that, in the end, the university will be the beneficial user of the Clay Street parcel, and we are working with the governor and the legislature to secure authorization for a new School of Dentistry on that site,” Conrad said. “VCU Health System, through the School of Dentistry, is the largest provider of Medicaid dental care to patients in the state, so we are very excited about the new use on the Clay Street parcel.”

The university – a separate entity from VCU Health, but with some shared leadership in Rao and other dual administrators and board members – has said the 314,000-square-foot facility is envisioned as “a grand gateway” for its downtown medical center.

BizSense reporter Jack Jacobs contributed to this report.

A rendering of the 20-story version of the project that was planned to replace the Public Safety Building. (BizSense file)

It turns out that backing out of a downtown development deal cost VCU Health System more than a single $73 million payment. In fact, the overall cost to the health system appears to be ongoing.

The known cost for VCU Health to walk away from the project that relied on its lease appears to be closer to $80 million – and could end up being higher – because of its commitments to pay for a planned demolition of the site and for past and future payments of city real estate taxes that the unbuilt project was expected to produce.

As part of its arrangement to exit the project – a $325 million privately owned development that would have replaced the City of Richmond’s old Public Safety Building – VCU Health agreed to go through with demolishing the 69-year-old building, at an estimated cost of $5 million.

The health system further agreed, a Virginia Commonwealth University spokesperson confirmed, to continue paying the project’s guaranteed obligation payments. Those are annual payments to the city intended to cover the minimum real estate tax revenue that the project was anticipated to generate for the city over 25 years.

VCU Health, as master tenant of the project, was to have made the first two of those payments – $77,000 for tax year 2021, and $546,700 for 2022 – by the time the project was wound down earlier this year. An additional $1.3 million payment for the current tax year is due to the city in less than a month.

The three payments come to nearly $2 million – which, along with the $5 million demolition cost, and the previously reported $73 million payment, brings the total cost known so far to $80 million.

And that tab could continue to go up.

According to Grant Heston, chief marketing and communications officer for VCU, VCU Health agreed to continue the annual payments until the property, at 500 N. 10th St., is sold by the city. The payments are based on a schedule in the development agreement that the city signed with developer Capital City Partners in 2021.

The health system, Heston said in an email, “agreed to continue to make payments set forth in Exhibit G in the Development Agreement until the City conveys the site for future development to a new owner.”

That new owner could end up being VCU, the university, because it is now pursuing a new and more expensive project for the site: a $415 million development to house its planned VCU Dentistry Center.

When BizSense reported in February that the original project was effectively dead, after the city took back ownership of the property, VCU provided a statement that referred to the payments and the demolition, though not their dollar amounts. The statement did not disclose the $73 million exit payment.

The statement read: “The university is committed to working in partnership with the City to develop infrastructure that benefits students, patients, our communities and Virginia. Additionally, the university and health system will uphold our obligations as they relate to prior real estate tax commitments, as well as the demolition of the existing Public Safety Building structure.”

$73M payment was just the start

The $73 million payment that bought VCU Health out of its lease was made Feb. 1 to the project’s would-be landlord, an LLC tied to Oak Street Real Estate Capital, now a division of New York-based investment firm Blue Owl Capital. Oak Street was handling financing for the project for Capital City Partners, the local development team led by Susan Eastridge and Michael Hallmark.

The $73 million payment was required as part of a defeasance agreement that allowed the parties to walk away from the project free from litigation and to unwind what was owed on a $425 million project loan the landlord LLC had secured from UMB Bank. The payment was revealed last Friday in a statement to Richmond BizSense that accompanied a response to a Freedom of Information Act request to VCU Health.

News of the payment prompted former Virginia Gov. Doug Wilder, a VCU professor and namesake of the university’s L. Douglas Wilder School of Government and Public Affairs, to hold a news conference Tuesday in which he called for the firing of VCU President Michael Rao, as well as a state investigation into how and why the payment was made. Rao is president of the university and of VCU Health.

In a radio appearance Wednesday on WRVA, Wilder reiterated his contention that the payment represents a cost to state taxpayers. VCU Health has maintained that the payment was made using the health system’s operating funds and did not involve university funds or state revenue.

“It’s hard to believe that anyone would say that no taxpayer dollars were involved,” Wilder said. “It’s absolutely crazy. And this wouldn’t have come out, we wouldn’t have known anything about this, but for a Freedom of Information request. The only way we know it now is someone had the temerity and the foresight to say, ‘Tell us what’s going on.’”

The health system has said it decided to exit the project in light of challenges arising over the course of the pandemic and the financial obligations that came with the project.

In a statement attributed to its interim CEO Marlon Levy, VCU Health said last week: “The original project plans were developed before the pandemic. While they were well intentioned, by late 2021 construction and other challenges made it simply impossible to build the original project.

“Moving forward today would cause dire long-term financial repercussions. With that in mind, VCU Health was forced to make a difficult, but also prudent, decision to exit the original project,” the statement said, adding that the one-time payment was needed to end its obligations on the site. “Making this one-time payment means avoiding far greater financial obligations and problems in the future.”

According to the lease agreement signed with the landlord, VCU Health was on the hook to pay more than a half billion dollars in rent over the 25-year lease. The agreement called for rents to increase annually, from roughly $12.8 million the first year to nearly $32 million the final year, with the overall lease totaling more than $617 million.

Real estate tax payments increase annually

The guaranteed obligation payments were included in the original project’s development agreement to ensure that the city received real estate tax revenue from the site, regardless of how promptly, or successfully, the property was developed.

Because the project had been expected to take nearly four years to complete, the payments in the development agreement schedule jump significantly the first three years, reflecting the expected progress of development, then level off at about $2 million for the fourth and fifth tax years. The annual payments would increase more gradually thereafter, reaching just under $3 million for the final tax year, 2045.

If paid out completely, the 25 payments would total nearly $56 million paid to the city.

According to the agreement, the payments are due on or before June 5 of each respective tax year. That puts this year’s payment of nearly $1.3 million as being due in less than a month.

Last year, the payment for 2022 – $546,700 – was not made in full before the June 5 deadline, prompting the city to issue VCU Health a notice of failure to remit payment, according to documents BizSense obtained through FOIA requests to the city.

The same day, June 30, the city sent a second default notice to Capital City Partners for failing to submit permits for demolition and other site work on time, and for failure to remit the missed guaranteed obligation payment.

The city had previously issued a a default notice to Capital City Partners and the landlord stating that they had failed to perform work in accordance with the development agreement and milestone schedule, among other alleged shortcomings. That notice followed CCP’s filing of a scaled-down development plan for the project, a portion of which was reduced from 20 stories in height to 12.

In a response the following day, VCU Health put the blame for the missed payment on CCP, which it said had access to the project budget escrow to make the payments for VCU Health and had the authority to do so where the health system did not, based on how the process was set up in the financing and payment draws.

VCU Health asked CCP to complete the payment. It wasn’t clear from the documents if the payment was made.

Requests to the city and VCU Health to confirm whether the first two payments were completed, and whether this year’s payment has been made, were not answered this week.

It isn’t clear whether the city is still holding VCU Health to making this year’s or future years’ payments on the unbuilt project. An email sent to Leonard Sledge, the city’s economic development director, and to Lincoln Saunders, chief administrative officer, asking whether the city has given any consideration to ending the payments in light of the health system’s stated financial challenges was not returned Thursday.

The city ultimately took the property back from the landlord LLC in February after determining that the original project had not progressed according to the development agreement.

Demolition to start this year

The Public Safety Building site at Leigh and 10th streets, a block away from City Hall. (BizSense file photo)

As part of the project wind-down process in February, VCU Health also signed a license agreement with the city for access to the now city-owned site to demolish the Public Safety Building.

Demolition would complete what CCP started with asbestos abatement and other site preparations that had gotten underway before the initial default notice was sent to the developer. Site conditions and other factors were among the reasons VCU Health has said it decided to back out of the project, which it said could not be completed without incurring “a material increase” in its cost and schedule.

The agreement contains a scope of work that includes remediation of contaminated and hazardous materials including asbestos abatement, demolition and removal of the building, and placement of protective fencing. Emails between attorneys who prepared the agreement name DPR Construction as VCU Health’s contractor for the work.

A construction schedule that also was shared indicates the work was supposed to get underway in March, with fencing to be installed and abatement started this month. Demolition was scheduled to start in August and last 75 days, with all work to be completed by the end of this year.

New project to be partially taxable

For VCU’s Dentistry Center project, which would replace the School of Dentistry’s Lyons Dental Building and Dental Building 1 on the nearby MCV Campus, it isn’t clear whether the university would buy the Public Safety Building property from the city or what it would potentially pay for it.

It also isn’t clear how soon such a transaction could be completed, potentially keeping VCU Health on the hook for future tax year payments.

University ownership would take the 3-acre property off the city’s tax rolls, because VCU is exempt from paying city real estate taxes. With VCU Health leasing the previously planned project, the property would have remained taxable under private ownership.

In an interview this week, Matt Conrad, vice president of external and government relations for VCU and VCU Health, said the goal for the dentistry project is for the university to own the property and incorporate uses such as retail that would make at least part of the new building taxable to the city. He said the project also would benefit the city by including a reconnection of Clay Street through the site, a cost to be borne by VCU.

“As sort of a high-level deal point for use of the parcel by the university for the School of Dentistry, we’ve agreed to reconnect Clay Street through the southern portion of the parcel, and have also committed to tax revenue-generating uses such as retail on the portion of the parcel immediately facing the reconstructed Clay Street, so that should be an additional source of tax revenue for the city,” Conrad said.

The rest of the property that would house the Dentistry Center would be university-owned, as required by state law, Conrad said.

“It’s a requirement of state law that a state entity own that portion in order to receive state funding for construction,” he said.

“We’re hoping that, in the end, the university will be the beneficial user of the Clay Street parcel, and we are working with the governor and the legislature to secure authorization for a new School of Dentistry on that site,” Conrad said. “VCU Health System, through the School of Dentistry, is the largest provider of Medicaid dental care to patients in the state, so we are very excited about the new use on the Clay Street parcel.”

The university – a separate entity from VCU Health, but with some shared leadership in Rao and other dual administrators and board members – has said the 314,000-square-foot facility is envisioned as “a grand gateway” for its downtown medical center.

BizSense reporter Jack Jacobs contributed to this report.

Kudos to Jonathan and BizSense for continuing to break this story. It’s hard to fathom how the University ever considered this a good deal. Or why they agreed to a contract with so little flexibility and such unfavorable terms.

BisSense/Jonathan: Thank you so much for your efforts on this story. I will always support VCU for everything they’ve done to help revitalize the urban core, but my support isn’t without criticism (ex. Tearing down old buildings unnecessarily, creating a police force that’s way too big/powerful, etc). This story goes deeper and deeper and it highlights so much abuse and mismanagement.

As a former capital markets executive specializing in commercial real estate, my experience with defeasance is that it is an obligation of the building owner/landlord to make whole. Further, most construction loans do not have defeasance language. Its not clear in any of the articles which party caused the deal to unravel. If construction costs and the pandemic caused the developer to pull back, then VCU should have been released from their lease obligation i.e. the developer could not deliver the project. Regardless of the facts, whoever negotiated the deal for VCU got outmaneuvered and cut a bad deal.

So much for Virginia knowing how to

make a good deal and not getting totally

outsmarted. $80M plus of taxpayer $ gone

down the drain! I suggest Henrico county

take a real good look at anything they agree

To do with CCP. CCP appears to have escaped

with little or no financial damage. Wonder why?

I wish someone would confirm or deny if Henrico is doing business with CCP. One poster said yes, and then another said no in earlier articles. It would be nice to know if this is the same entity that will be doing the Green City project. It would also be nice to name the principals within all the LLC’s, Inc’s, and other financial firms who may have benefitted from VCU Health’s Real Estate division’s incompetence. Someone at VCU/VCU Health needs to lose their job over the millions of dollars paid out to date for bad negotiation or bad contracts, or… Read more »

Eastridge and Hallmark are definitely doing Green City. The only conceivable scenario on how they were able to walk away unscathed is VCU Health as Master Tenant walked on the deal. That said, there a number of City Notices for default and failure to perform.

Agree with the prior comments. This is an example of excellent journalism at a time when excellent journalism is sorely lacking.

Keep shining the light for us, Jonathan.

Astute reporting. However, as mentioned below, the giant hole in all reporting is which party caused this deal to unravel? It’s inconceivable to me that CCP as developer, was unable to execute development but then avoided all financial responsibility on the defeasance.

However, if VCU as a result of Covid decided to terminate their lease-it does make sense that CCP walks away without obligations. If VCU made that business decision, their responsibility for that payment is perfectly understandable

OMG – I am shaking my head because I have no words.

But the Diamond District will be totally fine, don’t worry at all.

It’s good that people are (rightfully) upset about this waste of money. But this happens every year on a much larger scale with the federal government throwing away exponentially more money. This is a drop in the bucket in comparison. We need more indignation with all their ridiculous expenditures.

Can anyone comment on whether they think Matt Conrad needs to be replaced? It seems he has failed to manage the monies and projects. He seems to know a lot about the projects – is he the one responsible for this $73mil fiasco? Matt states in the article, “It’s a requirement of state law that a state entity own that portion in order to receive state funding for construction,”. Did the law change, or did someone not get the memo on the CCP building the Dentistry School was going to RENT??? Is Matt saying this is why VCU Health had… Read more »

The writer needs to make sure no money was paid to Capital City Partners, the local development team led by Susan Eastridge and Michael Hallmark. Not only is this the same group that is doing Green City in Henrico but the articles continue to make reference to the fact the City had to send default notices to Eastridge and Hallmark and that ultimately the City took back the building for failure to perform. So which occurred 1st – VCU Health Walked or Eastridge and Hallmark failed to perform? If the latter it’s impossible to see how VCU would owe a… Read more »

No one will ever be held accountable or be prosecuted, is VCU going to press charges against itself? – this happens because conflicts of interest aren’t disclosed during negotiations, either to opposing sides or the public, which is unethical. The people responsible should recuse themselves but don’t.

This whole thing smells worse than Richmond sewers during a summer drought. I think more FOIA requests are in order. Spiers does such an amazing job in a city that sorely lacks honest local reporting. BizSense is way more reliable than RTD.

Should be relatively easy to find out who at MCV/VCU signed off on this deal. Should Henrico be uneasy with these players?