With its first acquisition in four years, Richmond’s biggest bank is buying its way into new territory.

Atlantic Union Bank on Tuesday announced a pending deal to purchase American National Bank & Trust Co., a $3 billion, 114-year-old institution based in Danville.

It’s American National’s footprint and two dozen branches in Southwest and Southside Virginia, and sought-after markets in North Carolina, that helped drive the all-stock transaction, which is valued at $416.8 million and is targeted for a first quarter 2024 closing.

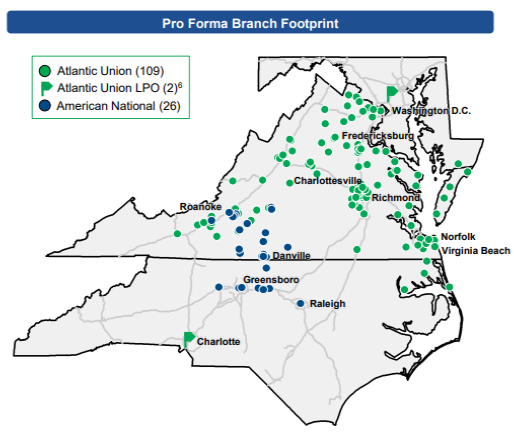

Atlantic Union CEO John Asbury said a look at a branch map of both banks illustrates the geographical logic of the transaction.

“It’s hand in glove. It should be plainly evident why we’re interested in these guys,” Asbury said in an interview Tuesday afternoon.

While Atlantic Union has more than 100 branches around most of Virginia, it lacks a concentration in three key parts of the state where American National has a foothold.

“Lynchburg, Danville and Martinsville are the three largest cities (in Virginia) where we don’t have a presence,” Asbury said.

“The added bonus is their physical presence in the Piedmont Triad,” he said, referring to the area of North Carolina made up of Greensboro, Winston-Salem and High Point. American National also has a presence in Raleigh.

As regional competitors such as TowneBank have expanded more into those major North Carolina markets, AUB has yet to make a major push into the Tar Heel State, other than a few branches in eastern North Carolina and a loan office in Charlotte.

“This will change our narrative a bit because it will give us a long-term expansion opportunity in North Carolina,” Asbury said.

The only branch overlap between the two sides is in Roanoke, Blacksburg/Christiansburg and Lynchburg. While such overlap is typically eliminated in bank mergers of this type, the company said it’s too soon to say whether any branches in those areas will be consolidated.

Asbury said AUB also likes the fundamentals of how American National has operated.

“American National Bank has been around 114 years and is generally considered a rock-solid institution,” he said. “They’re kind of a like classic Americana small town bank. They make loans and they take deposits.”

Driving the deal for American National is a need to help the 114-year-old bank keep up with the times in a more immediate way.

“Even with our incredible performance, our incredible reputation, we felt as though we were losing relevance not to just our shareholder but our customers in the way this industry is changing rapidly,” said Jeff Haley, American National’s chairman, president and CEO, during an investor conference call on Tuesday.

“My concern was that we needed to do something and there were really no other better options than partnering with what I believe is taking two of the best banks in Virginia with over 200 years of experience… both high performing companies, putting them together to solidify Virginia but to also set the springboard for continued expansion in North Carolina.

Asbury concurred.

“By coming together, we’re an accelerant to them,” he said of American National.

With the American National name set to be retired in favor of the Atlantic Union brand and the combined banks’ headquarters to be in Richmond, Haley said it’s bittersweet to end American National’s run, which began in 1909 in Danville.

“This is in some ways a sad day but it’s because of 114 years of being based in Danville. But that is more personal. This is an incredible transaction,” he said. “I’m a little bit today like a proud father letting my child go to college. I’m a little sad but I’m so excited about the opportunities for everyone involved in this transaction.”

Should it close next year as expected, the deal would mark AUB’s fourth acquisition since 2014. That year it acquired Christiansburg-based StellarOne Bank. Then came the acquisition of Richmond-based Xenith Bank in 2018, and Northern Virginia’s Access National Bank a year later.

Asbury said the pandemic had a cooling effect on M&A momentum, but that the bank used the last few years to get a proper grip on those previous three deals.

“The frontend was beginning to outrun the backend, so it gave us a digestion period to slow down and get everything right,” Asbury said.

AUB will have $23.7 billion in total assets when it officially absorbs American National. That’s up from $4 billion in 2014 when it began its stretch of acquisitions and up from $8 billion when Asbury took over as CEO in 2016.

When he arrived at what was then known as Union Bank & Trust, Asbury talked of a strategy to create “the new Crestar,” a reference to a long-since consolidated Virginia banking giant from the late ’90s that had upwards of $24 billion in assets.

Seven years into his tenure and with that size range in sight, Asbury said he’s pleased with how the plan has progressed.

“We said we would do our best to bring back to Virginia a great regional bank that would be an alternative to these giants,” he said, referring to competitors such as Bank of America, Truist and the like. “We’re built to go head-to-head every day with these larger competitors.”

AUB is advised in the American National deal by investment banking firm Piper Sandler & Co. and law firm Covington & Burling. Keefe, Bruyette & Woods and Williams Mullen are advising American National.

As part of the deal, each share of American National stock will be converted into 1.35 shares of Atlantic Union stock, valuing the deal at $39.23 per share.

Atlantic Union parent company Atlantic Union Bankshares trades on the NYSE under the symbol AUB. American National Bankshares currently trades on Nasdaq as AMNB.

The deal comes on the heels of cost-cutting measures recently implemented by AUB. The multi-pronged plan was aimed at slashing $17 million in costs annually as the bank looks to keep expenses in check in the face of rising interest rates and tightening margins.

The cuts included layoffs of 4 percent of its staff, affecting 74 jobs. It’s also shaving costs by reducing its amount of leased corporate office space, including vacating nearly two entire floors in Three James Center, which houses its corporate headquarters in downtown Richmond. It will continue to occupy one floor and maintain its home base in the building.

With its first acquisition in four years, Richmond’s biggest bank is buying its way into new territory.

Atlantic Union Bank on Tuesday announced a pending deal to purchase American National Bank & Trust Co., a $3 billion, 114-year-old institution based in Danville.

It’s American National’s footprint and two dozen branches in Southwest and Southside Virginia, and sought-after markets in North Carolina, that helped drive the all-stock transaction, which is valued at $416.8 million and is targeted for a first quarter 2024 closing.

Atlantic Union CEO John Asbury said a look at a branch map of both banks illustrates the geographical logic of the transaction.

“It’s hand in glove. It should be plainly evident why we’re interested in these guys,” Asbury said in an interview Tuesday afternoon.

While Atlantic Union has more than 100 branches around most of Virginia, it lacks a concentration in three key parts of the state where American National has a foothold.

“Lynchburg, Danville and Martinsville are the three largest cities (in Virginia) where we don’t have a presence,” Asbury said.

“The added bonus is their physical presence in the Piedmont Triad,” he said, referring to the area of North Carolina made up of Greensboro, Winston-Salem and High Point. American National also has a presence in Raleigh.

As regional competitors such as TowneBank have expanded more into those major North Carolina markets, AUB has yet to make a major push into the Tar Heel State, other than a few branches in eastern North Carolina and a loan office in Charlotte.

“This will change our narrative a bit because it will give us a long-term expansion opportunity in North Carolina,” Asbury said.

The only branch overlap between the two sides is in Roanoke, Blacksburg/Christiansburg and Lynchburg. While such overlap is typically eliminated in bank mergers of this type, the company said it’s too soon to say whether any branches in those areas will be consolidated.

Asbury said AUB also likes the fundamentals of how American National has operated.

“American National Bank has been around 114 years and is generally considered a rock-solid institution,” he said. “They’re kind of a like classic Americana small town bank. They make loans and they take deposits.”

Driving the deal for American National is a need to help the 114-year-old bank keep up with the times in a more immediate way.

“Even with our incredible performance, our incredible reputation, we felt as though we were losing relevance not to just our shareholder but our customers in the way this industry is changing rapidly,” said Jeff Haley, American National’s chairman, president and CEO, during an investor conference call on Tuesday.

“My concern was that we needed to do something and there were really no other better options than partnering with what I believe is taking two of the best banks in Virginia with over 200 years of experience… both high performing companies, putting them together to solidify Virginia but to also set the springboard for continued expansion in North Carolina.

Asbury concurred.

“By coming together, we’re an accelerant to them,” he said of American National.

With the American National name set to be retired in favor of the Atlantic Union brand and the combined banks’ headquarters to be in Richmond, Haley said it’s bittersweet to end American National’s run, which began in 1909 in Danville.

“This is in some ways a sad day but it’s because of 114 years of being based in Danville. But that is more personal. This is an incredible transaction,” he said. “I’m a little bit today like a proud father letting my child go to college. I’m a little sad but I’m so excited about the opportunities for everyone involved in this transaction.”

Should it close next year as expected, the deal would mark AUB’s fourth acquisition since 2014. That year it acquired Christiansburg-based StellarOne Bank. Then came the acquisition of Richmond-based Xenith Bank in 2018, and Northern Virginia’s Access National Bank a year later.

Asbury said the pandemic had a cooling effect on M&A momentum, but that the bank used the last few years to get a proper grip on those previous three deals.

“The frontend was beginning to outrun the backend, so it gave us a digestion period to slow down and get everything right,” Asbury said.

AUB will have $23.7 billion in total assets when it officially absorbs American National. That’s up from $4 billion in 2014 when it began its stretch of acquisitions and up from $8 billion when Asbury took over as CEO in 2016.

When he arrived at what was then known as Union Bank & Trust, Asbury talked of a strategy to create “the new Crestar,” a reference to a long-since consolidated Virginia banking giant from the late ’90s that had upwards of $24 billion in assets.

Seven years into his tenure and with that size range in sight, Asbury said he’s pleased with how the plan has progressed.

“We said we would do our best to bring back to Virginia a great regional bank that would be an alternative to these giants,” he said, referring to competitors such as Bank of America, Truist and the like. “We’re built to go head-to-head every day with these larger competitors.”

AUB is advised in the American National deal by investment banking firm Piper Sandler & Co. and law firm Covington & Burling. Keefe, Bruyette & Woods and Williams Mullen are advising American National.

As part of the deal, each share of American National stock will be converted into 1.35 shares of Atlantic Union stock, valuing the deal at $39.23 per share.

Atlantic Union parent company Atlantic Union Bankshares trades on the NYSE under the symbol AUB. American National Bankshares currently trades on Nasdaq as AMNB.

The deal comes on the heels of cost-cutting measures recently implemented by AUB. The multi-pronged plan was aimed at slashing $17 million in costs annually as the bank looks to keep expenses in check in the face of rising interest rates and tightening margins.

The cuts included layoffs of 4 percent of its staff, affecting 74 jobs. It’s also shaving costs by reducing its amount of leased corporate office space, including vacating nearly two entire floors in Three James Center, which houses its corporate headquarters in downtown Richmond. It will continue to occupy one floor and maintain its home base in the building.