The 22 CEOs of the Richmond region’s top publicly traded companies. Altria CEO William Gifford is pictured in the second row, third from left.

Things are looking up for many of the CEOs at some of the Richmond region’s biggest companies.

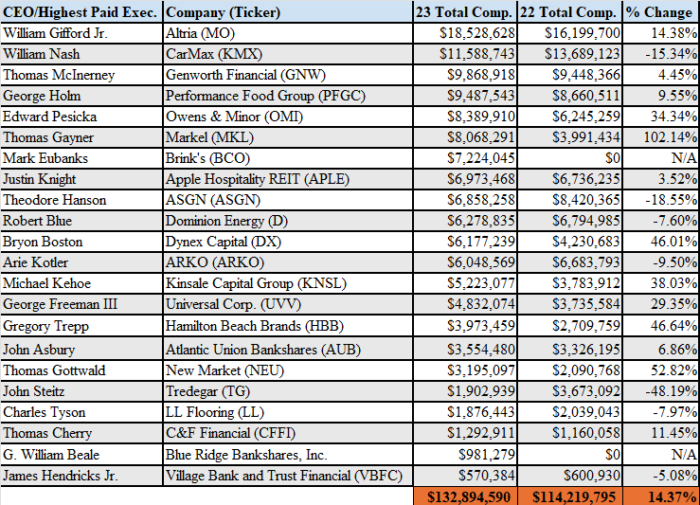

A majority of the top bosses of the area’s 22 largest publicly traded companies experienced pay increases in 2023, according to a BizSense analysis of their recently filed proxy statements.

The overall group saw an average percentage increase of 14% in their total pay packages from 2022 to 2023. The average value of their total compensation last year was $5.45 million last year, down from an average $5.69 million in 2022.

Altria CEO William Gifford Jr. clinched the top of the leaderboard for 2023 for the second year in a row, with a total pay package of more than $18 million, about $2 million more than his 2022 compensation. His 2023 earnings are more than triple the average total compensation package of his peers on the list.

There is no 2022 compensation data for Brink’s CEO Mark Eubanks and Blue Ridge Bankshares CEO Billy Beale. They each began their tenures with the firms in 2023.

Markel CEO Thomas Gayner saw the biggest pay boost percent-wise, increasing by 102% from 2022 to 2023. Gayner’s pay package totaled $8 million last year, largely due to a twofold increase in so-called non-equity incentive payments, which how public proxies label cash payouts.

Another notable compensation increase belongs to NewMarket CEO Thomas Gottwald, who saw a 52.8% increase in his earnings, from $2.09 million in 2022 and $3.2 million in 2023. Much of that was attributable to Gottwald’s pension value changing by over $900,000.

Other CEOs with significant earnings increases include: Owens & Minor’s Edward Pesicka (34.34%); Dynex Capital’s Byron Boston (46.01%); Kinsale Capital Group’s Michael Kehoe (38.03%); and Universal Corp.’s George Freeman III (29.35%).

Public company CEO pay packages typically include a base salary, stock awards, bonuses and non-equity incentive payments. The calculations disclosed in annual proxy statements also include perks such as contributions to executive’s retirement plans, corporate health programs, tax planning services and, in some instances, things like an allowance for a company car, country club dues and personal use of the company private jet.

CarMax CEO William Nash earned the second highest compensation package last year at $11.59 million, but faced a 15% decrease from 2022 after his salary, stock awards and non-equity incentive payments dropped. His total pay in 2022 was $13.69 million.

Tredegar CEO John Steitz faced the sharpest drop for the year at 48.19%, from $3.67 million to $1.9 million. That was due in part to a decline in stock awards from $2 million to $576,750.

The decrease in Steitz’s compensation coincided with a steep drop in net income for Tredegar, which fell from $29 million in 2022 to a net loss of $105.9 million in 2023. The Gottwald family, the company’s largest shareholders, earlier this year expressed discontent with Tredegar’s poor financial performance after stock went down 29% over the last year.

Others who experienced compensation decreases in 2023 include: ASGN’s Theodore Hanson (-18.55%); Dominion Energy’s Robert Blue (-7.60%); ARKO’s Arie Kotler (-9.50%); LL Flooring’s Charles Tyson (-7.97%); and Village Bank and Trust’s James Hendricks Jr. (-5.08%).

Hanson made just under $7 million last year, $1 million less than in 2022 after his non-equity incentive payments dropped 83.4% from 2022 to 2023.

Blue’s 7.60% decrease led him to fall five places in the ranking after his compensation dropped from $6.79 million in 2022 to $6.28 million in 2023. He was the sixth highest compensated CEO on last year’s list, but sank to eleventh this year.

In total, the 22 CEOs on the list received a combined $132.89 million in 2023, higher than both the 2022 and 2021 totals, which were $119.54 million and $121.8 million respectively.

Editor’s note: Not included in the calculations for this story is locally based and publicly traded Medalist Diversified REIT. The company’s CEO is not a salaried employee.

The 22 CEOs of the Richmond region’s top publicly traded companies. Altria CEO William Gifford is pictured in the second row, third from left.

Things are looking up for many of the CEOs at some of the Richmond region’s biggest companies.

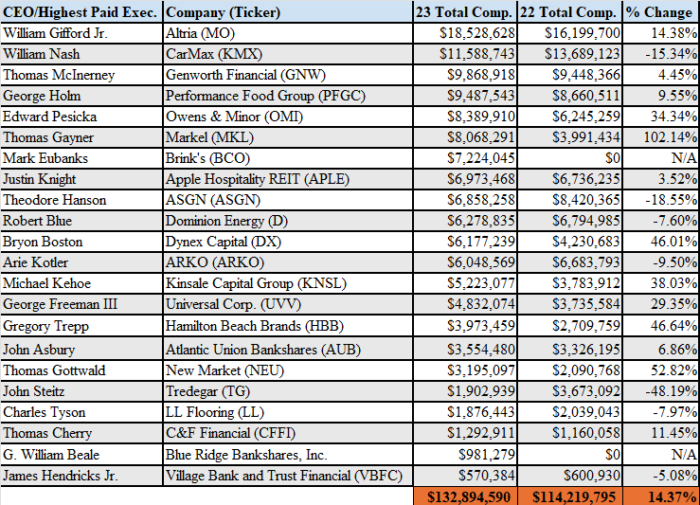

A majority of the top bosses of the area’s 22 largest publicly traded companies experienced pay increases in 2023, according to a BizSense analysis of their recently filed proxy statements.

The overall group saw an average percentage increase of 14% in their total pay packages from 2022 to 2023. The average value of their total compensation last year was $5.45 million last year, down from an average $5.69 million in 2022.

Altria CEO William Gifford Jr. clinched the top of the leaderboard for 2023 for the second year in a row, with a total pay package of more than $18 million, about $2 million more than his 2022 compensation. His 2023 earnings are more than triple the average total compensation package of his peers on the list.

There is no 2022 compensation data for Brink’s CEO Mark Eubanks and Blue Ridge Bankshares CEO Billy Beale. They each began their tenures with the firms in 2023.

Markel CEO Thomas Gayner saw the biggest pay boost percent-wise, increasing by 102% from 2022 to 2023. Gayner’s pay package totaled $8 million last year, largely due to a twofold increase in so-called non-equity incentive payments, which how public proxies label cash payouts.

Another notable compensation increase belongs to NewMarket CEO Thomas Gottwald, who saw a 52.8% increase in his earnings, from $2.09 million in 2022 and $3.2 million in 2023. Much of that was attributable to Gottwald’s pension value changing by over $900,000.

Other CEOs with significant earnings increases include: Owens & Minor’s Edward Pesicka (34.34%); Dynex Capital’s Byron Boston (46.01%); Kinsale Capital Group’s Michael Kehoe (38.03%); and Universal Corp.’s George Freeman III (29.35%).

Public company CEO pay packages typically include a base salary, stock awards, bonuses and non-equity incentive payments. The calculations disclosed in annual proxy statements also include perks such as contributions to executive’s retirement plans, corporate health programs, tax planning services and, in some instances, things like an allowance for a company car, country club dues and personal use of the company private jet.

CarMax CEO William Nash earned the second highest compensation package last year at $11.59 million, but faced a 15% decrease from 2022 after his salary, stock awards and non-equity incentive payments dropped. His total pay in 2022 was $13.69 million.

Tredegar CEO John Steitz faced the sharpest drop for the year at 48.19%, from $3.67 million to $1.9 million. That was due in part to a decline in stock awards from $2 million to $576,750.

The decrease in Steitz’s compensation coincided with a steep drop in net income for Tredegar, which fell from $29 million in 2022 to a net loss of $105.9 million in 2023. The Gottwald family, the company’s largest shareholders, earlier this year expressed discontent with Tredegar’s poor financial performance after stock went down 29% over the last year.

Others who experienced compensation decreases in 2023 include: ASGN’s Theodore Hanson (-18.55%); Dominion Energy’s Robert Blue (-7.60%); ARKO’s Arie Kotler (-9.50%); LL Flooring’s Charles Tyson (-7.97%); and Village Bank and Trust’s James Hendricks Jr. (-5.08%).

Hanson made just under $7 million last year, $1 million less than in 2022 after his non-equity incentive payments dropped 83.4% from 2022 to 2023.

Blue’s 7.60% decrease led him to fall five places in the ranking after his compensation dropped from $6.79 million in 2022 to $6.28 million in 2023. He was the sixth highest compensated CEO on last year’s list, but sank to eleventh this year.

In total, the 22 CEOs on the list received a combined $132.89 million in 2023, higher than both the 2022 and 2021 totals, which were $119.54 million and $121.8 million respectively.

Editor’s note: Not included in the calculations for this story is locally based and publicly traded Medalist Diversified REIT. The company’s CEO is not a salaried employee.

Wow! So much for all these CEOs touting DEI!

Not sure why you’re getting downvoted. The very first thing that caught my attention was the extreme lack of diversity.

I would be interested in seeing where RVA’s 2024 Power Women would appear on this list of CEO compensation.

In all fairness I don’t care what you look like or what you’re into. Only thing I care about is can you do the job and be competent enough to do it. If your not smart enough or lack the drive and motivation to do a job then your nothing but dead weight to me. Gen z you need to step it up. Everyone maybe except Gen z has done jobs they hate but when they wine and cry because there body is hurting or your well being is suffering it’s not up to your work to babysit you. Too… Read more »

You’re missing the point. The reality is it takes a certain skill set to serve as a CEO, and that skill set is frequently honed starting at a very young age through mentorship and opportunities. If POC are not placed under the wings of those in leadership positions then this is precisely the result. Are these CEOs the most qualified? Likely. Is it because they were mentored from a very young age? Also likely. It’s no secret that POC have historically not been afforded the same opportunities earlier in life as white people, and that becomes very apparent in images… Read more »

You mean die? That’s what dei is it’s where everything goes to die. This country doing a great job of killing off everything faster than a rocket ship going to the space station.

Amen, brother!

DEI and ESG are more the preoccupations of the HR and PR departments. These guys have successful enterprises to run. Woke activism does not improve shareholder value.

This is where they should start leveling the playing field. Workers only got a 4% raise on their measly salary. These CEOs do not need all the money. They should distribute it more equally with the workers and stock holders.

You should join the board of these companies so you can have some input in how their leaders are compensated

They earn every penny.

Very smart individuals.Lots of responsibilities.

Not One Woman listed, not unless Arie is a woman.

The Commonwealth of Virginia needs to look beyond the white shirt, black tie and black suit for CEO’s!!

Good luck to that ever happening.