Activation Capital, which operates the VA Bio+Tech Park in downtown Richmond near the Coliseum, has new leadership in place as the organization continues planning for a new building on the campus. (BizSense file)

Weeks after its CEO resigned, Activation Capital has selected a new temporary chief with ties to the governor and a construction background to lead the organization as it seeks to roll forward a long-planned development project in Richmond.

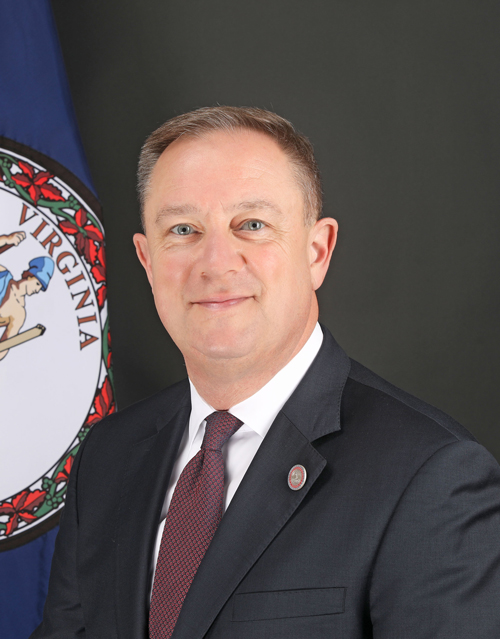

Robert Ward will serve as interim CEO of Activation Capital, an independent state authority that supports companies and entrepreneurs in the life sciences sector. Ward is chief transformation officer in Gov. Glenn Youngkin’s administration and previously served as an adviser to the governor.

Ward also was formerly president and CEO of Skanska USA Commercial Development, the American arm of the Swedish construction company.

That experience made him a good pick to lead Activation Capital, given that the organization is in the midst of finalizing a major capital project, Secretary of Commerce and Trade Caren Merrick said after an Activation Capital board of directors meeting on Thursday, where the directors voted to approve Ward’s appointment.

“He has a great depth of real estate expertise in construction projects, particularly in the life sciences,” said Merrick, who is the vice chairwoman of the authority’s board. “I agreed this would be a good interim step because of the critical nature of this project.”

Ward takes over from Chandra Briggman, who abruptly left the organization in the midst of its push to build a new lab facility to expand the 34-acre Virginia BioTechnology Research Park campus in downtown Richmond, which is operated by Activation Capital.

Activation Capital is weighing two potential options for the development at the corner of Jackson and North Seventh streets. The facility is dubbed the Innovation Center and has been years in the making.

One option is a 107,000-square-foot, four-story building. That version would have about 33,000 square feet of lab space with 24 lab bays. The upper two floors would be devoted to a yet-unsigned anchor tenant, the presence of which is deemed critical to the financial viability of the project.

But finding that anchor tenant has been a challenge and has held up the project. Kipton Currier, Activation Capital’s vice president of operations, told the board during its meeting that VCU Massey Cancer Center has been identified as a potential anchor user, and that a term sheet for such an agreement was sent to VCU in May.

But whether Massey Cancer would join the project was unclear. VCU President Michael Rao, who is the chairman of Activation Capital’s board of directors, declined to comment on the proposal at the meeting. He directed comment to a university spokesman, who later in the day stated in an email there was no update to share.

Currier said the project could instead proceed with a different anchor tenant, and the main consideration is that the tenant be a company involved in the life sciences field, which includes pharmaceuticals, medical devices and biotechnology.

“We’re not done with it,” Currier said of the hunt for the appropriate tenant to serve as the foundation for the project. “There’s still an opportunity to find an anchor tenant and proceed with the original concept.”

Also under consideration is a considerably smaller two-story, 25,000-square-foot facility, which would feature about 7,000 square feet of lab space and 16 lab bays.

Both versions of the project would feature a cafe and K-12 outreach lab on the first floor, and an incubator space for life sciences companies on the second level.

Activation Capital’s new wet labs and office building is planned to be built on a parking lot the organization owns in downtown Richmond. (Jack Jacobs)

Currier said that Activation Capital has been successful in meeting milestones required as conditions of grant funding the organization has received to finance the facility, and that since the smaller project isn’t reliant on a major tenant it’s an option to ensure the organization stays on track.

Activation Capital has $31 million on hand to build and equip the facility. The funding is a combination of federal, state, local and authority money.

“It still delivers what we’re trying to deliver with the first project,” Currier said of the smaller proposal. “The redesign concept adds optionality for us. It de-risks the project and our ability to move something forward to ensure that we meet our grant goals.”

Both projects would rise on what’s currently a downtown surface parking lot owned by Activation Capital. The organization envisions breaking ground in the spring of 2025.

The Activation Capital board has not yet set a date to vote on which option to move forward with, according to an Activation Capital spokeswoman.

Cost estimates for the two development options haven’t been finalized, the spokeswoman said.

In 2019, Activation Capital was planning a 100,000-square-foot, six-story building for the project and had broadly stuck with that same development vision as recently as late 2022. That version of the project was pegged at between $45 million and $50 million.

The project would bring new wet lab and office space to Activation Capital’s campus, which is known as VA Bio+Tech Park. More than 70 companies in research and development and life sciences operate on the campus, which consists of multiple buildings that total 1.2 million square feet.

Currier said the new building would help Activation Capital accommodate demand for lab space. She said Activation Capital turns away an average of eight companies a year because of the lack of space at Bio+Tech Park.

Next month, Activation Capital will kick off its first session of the new Frontier BioHealth program to provide training and mentorship to startups. Currier said the program will introduce out-of-town companies to Richmond, and Activation Capital wants space to allow them the option to relocate here.

The appointment of Ward as interim president and CEO was approved unanimously by the board in the voice vote Thursday. Ward was present when the vote took place and then joined the meeting as a participant.

Briggman was the organization’s CEO from May 2020 until she stepped down in mid-June. The Activation Capital board expects to start a search for a permanent CEO soon.

In a prepared statement, Ward said he was appreciative of Briggman’s efforts during her four-year tenure and looked to build on the work of Activation Capital, which includes a role in the ongoing initiative to develop a pharmaceutical manufacturing hub in the Richmond-Petersburg region.

“I want to thank outgoing CEO Chandra Briggman for her leadership and I look forward to furthering Activation Capital’s mission and priorities as interim CEO,” Ward said. “As the search continues for a CEO, I am committed to growing and fostering Activation Capital’s venture, ecosystem and pharmaceutical cluster development.”

Activation Capital, which operates the VA Bio+Tech Park in downtown Richmond near the Coliseum, has new leadership in place as the organization continues planning for a new building on the campus. (BizSense file)

Weeks after its CEO resigned, Activation Capital has selected a new temporary chief with ties to the governor and a construction background to lead the organization as it seeks to roll forward a long-planned development project in Richmond.

Robert Ward will serve as interim CEO of Activation Capital, an independent state authority that supports companies and entrepreneurs in the life sciences sector. Ward is chief transformation officer in Gov. Glenn Youngkin’s administration and previously served as an adviser to the governor.

Ward also was formerly president and CEO of Skanska USA Commercial Development, the American arm of the Swedish construction company.

That experience made him a good pick to lead Activation Capital, given that the organization is in the midst of finalizing a major capital project, Secretary of Commerce and Trade Caren Merrick said after an Activation Capital board of directors meeting on Thursday, where the directors voted to approve Ward’s appointment.

“He has a great depth of real estate expertise in construction projects, particularly in the life sciences,” said Merrick, who is the vice chairwoman of the authority’s board. “I agreed this would be a good interim step because of the critical nature of this project.”

Ward takes over from Chandra Briggman, who abruptly left the organization in the midst of its push to build a new lab facility to expand the 34-acre Virginia BioTechnology Research Park campus in downtown Richmond, which is operated by Activation Capital.

Activation Capital is weighing two potential options for the development at the corner of Jackson and North Seventh streets. The facility is dubbed the Innovation Center and has been years in the making.

One option is a 107,000-square-foot, four-story building. That version would have about 33,000 square feet of lab space with 24 lab bays. The upper two floors would be devoted to a yet-unsigned anchor tenant, the presence of which is deemed critical to the financial viability of the project.

But finding that anchor tenant has been a challenge and has held up the project. Kipton Currier, Activation Capital’s vice president of operations, told the board during its meeting that VCU Massey Cancer Center has been identified as a potential anchor user, and that a term sheet for such an agreement was sent to VCU in May.

But whether Massey Cancer would join the project was unclear. VCU President Michael Rao, who is the chairman of Activation Capital’s board of directors, declined to comment on the proposal at the meeting. He directed comment to a university spokesman, who later in the day stated in an email there was no update to share.

Currier said the project could instead proceed with a different anchor tenant, and the main consideration is that the tenant be a company involved in the life sciences field, which includes pharmaceuticals, medical devices and biotechnology.

“We’re not done with it,” Currier said of the hunt for the appropriate tenant to serve as the foundation for the project. “There’s still an opportunity to find an anchor tenant and proceed with the original concept.”

Also under consideration is a considerably smaller two-story, 25,000-square-foot facility, which would feature about 7,000 square feet of lab space and 16 lab bays.

Both versions of the project would feature a cafe and K-12 outreach lab on the first floor, and an incubator space for life sciences companies on the second level.

Activation Capital’s new wet labs and office building is planned to be built on a parking lot the organization owns in downtown Richmond. (Jack Jacobs)

Currier said that Activation Capital has been successful in meeting milestones required as conditions of grant funding the organization has received to finance the facility, and that since the smaller project isn’t reliant on a major tenant it’s an option to ensure the organization stays on track.

Activation Capital has $31 million on hand to build and equip the facility. The funding is a combination of federal, state, local and authority money.

“It still delivers what we’re trying to deliver with the first project,” Currier said of the smaller proposal. “The redesign concept adds optionality for us. It de-risks the project and our ability to move something forward to ensure that we meet our grant goals.”

Both projects would rise on what’s currently a downtown surface parking lot owned by Activation Capital. The organization envisions breaking ground in the spring of 2025.

The Activation Capital board has not yet set a date to vote on which option to move forward with, according to an Activation Capital spokeswoman.

Cost estimates for the two development options haven’t been finalized, the spokeswoman said.

In 2019, Activation Capital was planning a 100,000-square-foot, six-story building for the project and had broadly stuck with that same development vision as recently as late 2022. That version of the project was pegged at between $45 million and $50 million.

The project would bring new wet lab and office space to Activation Capital’s campus, which is known as VA Bio+Tech Park. More than 70 companies in research and development and life sciences operate on the campus, which consists of multiple buildings that total 1.2 million square feet.

Currier said the new building would help Activation Capital accommodate demand for lab space. She said Activation Capital turns away an average of eight companies a year because of the lack of space at Bio+Tech Park.

Next month, Activation Capital will kick off its first session of the new Frontier BioHealth program to provide training and mentorship to startups. Currier said the program will introduce out-of-town companies to Richmond, and Activation Capital wants space to allow them the option to relocate here.

The appointment of Ward as interim president and CEO was approved unanimously by the board in the voice vote Thursday. Ward was present when the vote took place and then joined the meeting as a participant.

Briggman was the organization’s CEO from May 2020 until she stepped down in mid-June. The Activation Capital board expects to start a search for a permanent CEO soon.

In a prepared statement, Ward said he was appreciative of Briggman’s efforts during her four-year tenure and looked to build on the work of Activation Capital, which includes a role in the ongoing initiative to develop a pharmaceutical manufacturing hub in the Richmond-Petersburg region.

“I want to thank outgoing CEO Chandra Briggman for her leadership and I look forward to furthering Activation Capital’s mission and priorities as interim CEO,” Ward said. “As the search continues for a CEO, I am committed to growing and fostering Activation Capital’s venture, ecosystem and pharmaceutical cluster development.”

What is the plan for the Consolidated labs state building when it moves to Hanover? Talking two buildings and about 150k in space (or more) being vacant in a couple of years!