Richmond’s biggest bank is about to get a lot bigger.

Downtown-based Atlantic Union Bank announced on Monday its plans to acquire Maryland-based Sandy Spring Bank, a transaction that will create a $39 billion banking behemoth and further cement AUB’s status as the largest regional bank headquartered in Virginia.

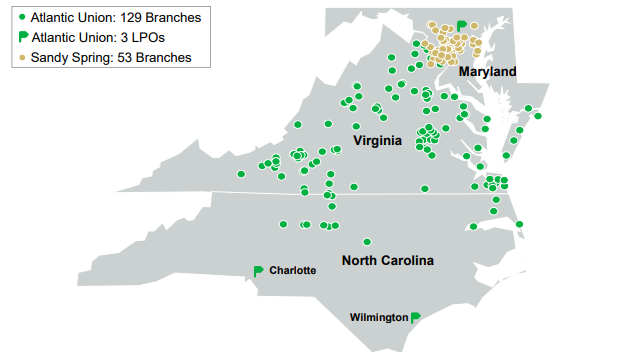

The stock-for-stock deal, valued at $1.6 billion, would combine Sandy Spring’s $14 billion in assets with AUB’s $25 billion. AUB also would gain its first major presence in Maryland and Washington, D.C., and an expanded presence in Northern Virginia, by taking on Sandy Spring’s 53 branches.

Those will add to AUB’s 129 branches spanning most of Virginia and parts of North Carolina. It will be a franchise that AUB CEO John Asbury said would second to none in this part of the country.

“What has never been done before and can never be done again is to take the number one bank in Maryland and combine that with the number one bank in Virginia and what you end up with is the number one regional bank in the lower Mid-Atlantic,” Asbury said in an interview with BizSense.

It marks AUB’s largest ever acquisition and follows the deal it closed earlier this year to absorb American National Bank, a $3 billion institution in Danville.

Where that deal gave AUB an expanded presence in the western part of Virginia, the Maryland-D.C.-Northern Virginia market was a missing piece in what Asbury said is a desired footprint for the bank. Bringing Sandy Spring into the fold will complete AUB’s goal of covering the ‘Golden Crescent,’ the name of the stretch from the Greater Washington D.C. area, down through Richmond and into Hampton Roads.

Asbury, who will lead the combined organizations, said he’s been looking at Sandy Spring as an acquisition target for several years because it’s the only complimentary bank that has a footprint that could complete that picture for AUB.

“It is really the one and only opportunity to actually execute that strategy,” Asbury said.

Along with the branch network, Sandy Spring brings with it nearly $12 billion in deposits and $11 billion in loans. It also has wealth management subsidiaries Rembert Pendleton Jackson and West Financial Services that will nearly double AUB’s wealth management business by $6.5 billion in assets under management.

The combined bank will have $32 billion in deposits, $30 billion in loans and a $13 billion wealth management arm.

Atlantic Union will be the surviving brand once the deal closes, marking an end to the Sandy Spring name that dates to the bank’s founding in 1868 by a group of Quakers in Maryland. The bank is headquartered today in Olney, Maryland. The combined banks will be headquartered from AUB’s base in the James Center in downtown Richmond.

As part of the deal, each share of Sandy Spring stock will be exchanged for 0.9 shares of AUB stock, pegging the value at approximately $34.93 per Sandy Spring share. Sandy Spring stock closed Monday at $31.78. AUB’s stock closed at $36.21.

Expected to close in the third quarter of 2025, the combination has been approved by the board of directors of each company. Shareholders of both banks and regulators must still sign off on the deal.

A condition of the deal includes AUB raising approximately $350 million in capital through a public offering of 9.85 million shares at $35.50 apiece. The proceeds of that raise will help bolster its capital base to offset $2 billion worth of Sandy Spring loans that will be sold off as part of the transaction.

Asbury said those loans consist entirely of debt on commercial real estate that have “ultra-low” fixed interest rates that were originated before the recent rise in rates. While the loans are still performing, an acquisition requires they be “marked to market,” and their low, fixed rates in the face of today’s higher rates would cause a capital hit to AUB.

“We had to shrink the bank in order buy it,” Asbury said of Sandy Spring.

AUB is represented in the transaction by financial advisor Morgan Stanley and legal advisor Davis Polk & Wardwell. Sandy Spring’s financial advisor Keefe, Bruyette & Woods and its legal counsel is Kilpatrick Townsend & Stockton.

The Sandy Spring deal will be AUB’s fifth acquisition in the last decade. In addition to American National, its other previous deals included taking on Northern Virginia’s Access National Bank, Christiansburg-based StellarOne Bank and Richmond-based Xenith Bank.

Monday’s news marks the second pending local bank merger announced in recent weeks. Midlothian-based Village Bank announced last month its deal to be acquired by Hampton Roads-based TowneBank.

And earlier this month, Prince George-based Touchstone Bank completed its deal to be acquired by First Bank out of Strasburg, Virginia.

Richmond’s biggest bank is about to get a lot bigger.

Downtown-based Atlantic Union Bank announced on Monday its plans to acquire Maryland-based Sandy Spring Bank, a transaction that will create a $39 billion banking behemoth and further cement AUB’s status as the largest regional bank headquartered in Virginia.

The stock-for-stock deal, valued at $1.6 billion, would combine Sandy Spring’s $14 billion in assets with AUB’s $25 billion. AUB also would gain its first major presence in Maryland and Washington, D.C., and an expanded presence in Northern Virginia, by taking on Sandy Spring’s 53 branches.

Those will add to AUB’s 129 branches spanning most of Virginia and parts of North Carolina. It will be a franchise that AUB CEO John Asbury said would second to none in this part of the country.

“What has never been done before and can never be done again is to take the number one bank in Maryland and combine that with the number one bank in Virginia and what you end up with is the number one regional bank in the lower Mid-Atlantic,” Asbury said in an interview with BizSense.

It marks AUB’s largest ever acquisition and follows the deal it closed earlier this year to absorb American National Bank, a $3 billion institution in Danville.

Where that deal gave AUB an expanded presence in the western part of Virginia, the Maryland-D.C.-Northern Virginia market was a missing piece in what Asbury said is a desired footprint for the bank. Bringing Sandy Spring into the fold will complete AUB’s goal of covering the ‘Golden Crescent,’ the name of the stretch from the Greater Washington D.C. area, down through Richmond and into Hampton Roads.

Asbury, who will lead the combined organizations, said he’s been looking at Sandy Spring as an acquisition target for several years because it’s the only complimentary bank that has a footprint that could complete that picture for AUB.

“It is really the one and only opportunity to actually execute that strategy,” Asbury said.

Along with the branch network, Sandy Spring brings with it nearly $12 billion in deposits and $11 billion in loans. It also has wealth management subsidiaries Rembert Pendleton Jackson and West Financial Services that will nearly double AUB’s wealth management business by $6.5 billion in assets under management.

The combined bank will have $32 billion in deposits, $30 billion in loans and a $13 billion wealth management arm.

Atlantic Union will be the surviving brand once the deal closes, marking an end to the Sandy Spring name that dates to the bank’s founding in 1868 by a group of Quakers in Maryland. The bank is headquartered today in Olney, Maryland. The combined banks will be headquartered from AUB’s base in the James Center in downtown Richmond.

As part of the deal, each share of Sandy Spring stock will be exchanged for 0.9 shares of AUB stock, pegging the value at approximately $34.93 per Sandy Spring share. Sandy Spring stock closed Monday at $31.78. AUB’s stock closed at $36.21.

Expected to close in the third quarter of 2025, the combination has been approved by the board of directors of each company. Shareholders of both banks and regulators must still sign off on the deal.

A condition of the deal includes AUB raising approximately $350 million in capital through a public offering of 9.85 million shares at $35.50 apiece. The proceeds of that raise will help bolster its capital base to offset $2 billion worth of Sandy Spring loans that will be sold off as part of the transaction.

Asbury said those loans consist entirely of debt on commercial real estate that have “ultra-low” fixed interest rates that were originated before the recent rise in rates. While the loans are still performing, an acquisition requires they be “marked to market,” and their low, fixed rates in the face of today’s higher rates would cause a capital hit to AUB.

“We had to shrink the bank in order buy it,” Asbury said of Sandy Spring.

AUB is represented in the transaction by financial advisor Morgan Stanley and legal advisor Davis Polk & Wardwell. Sandy Spring’s financial advisor Keefe, Bruyette & Woods and its legal counsel is Kilpatrick Townsend & Stockton.

The Sandy Spring deal will be AUB’s fifth acquisition in the last decade. In addition to American National, its other previous deals included taking on Northern Virginia’s Access National Bank, Christiansburg-based StellarOne Bank and Richmond-based Xenith Bank.

Monday’s news marks the second pending local bank merger announced in recent weeks. Midlothian-based Village Bank announced last month its deal to be acquired by Hampton Roads-based TowneBank.

And earlier this month, Prince George-based Touchstone Bank completed its deal to be acquired by First Bank out of Strasburg, Virginia.