Atlantic Union Bank made the biggest waves in 2024 with the completion of one acquisition and the announcement of another.

Mergers and acquisitions across all ends of the size spectrum were the hot topic in the local banking sector in 2024.

The year began with Virginia Credit Union, one of the region’s largest financial institutions, announcing its plans to merge with Roanoke-based Member One Federal Credit Union. The deal created the third-largest credit union in Virginia with nearly $7 billion in assets, 500,000 members, 37 branches and 1,100 employees.

Soon after, Atlantic Union Bank, the region’s biggest locally based bank, completed its $507 million acquisition of American National Bank in Danville.

Next to jump in on the action was Hampton Roads-based TowneBank, which struck a deal to acquire Midlothian-based Village Bank for $120 million. Once it closes, the deal will mean a $62 million windfall for Village’s main investor.

This fall, Strasburg, Virginia-based First Bank finalized its acquisition of Touchstone Bank, a $662 million institution headquartered in Prince George. The deal brought First Bank to $2.1 billion in total assets and includes Touchstone’s 12 branches, seven of which are in the southern reaches of the Richmond region.

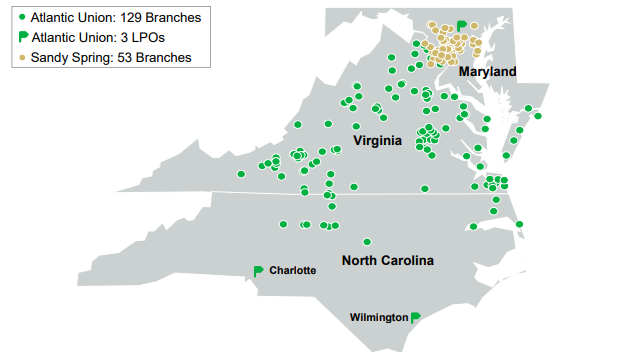

Then came the big one. Atlantic Union announced the deal of the year with its pending acquisition of Sandy Spring Bank in Northern Virginia. The combination will create a $39 billion banking behemoth and further cement AUB’s status as the largest regional bank headquartered in Virginia. The pending stock-for-stock deal, valued at $1.6 billion, would combine Sandy Spring’s $14 billion in assets with AUB’s $25 billion and give AUB its first major presence in Maryland and Washington, D.C., by taking on Sandy Spring’s 53 branches.

In between all the dealmaking was plenty of other local banking sector news.

VACU converted into a federal credit union, Blue Ridge Bank took on $150 million in new capital in a bid to stay alive, and a longtime local commercial loan officer from Primis Bank was sentenced to four years in federal prison for a years-long lending scheme.

There were branch moves galore throughout the year. Powhatan’s New Horizon Bank expanded out of its home county for the time with offices in the city of Richmond and Hampton Roads. North Carolina’s Southern Bank lined up its first branch in the local market, while national player Chase Bank continued its branch building activity in the area.

United Bank secured an East End site for what will be its first new branch in the market since acquiring Essex Bank. West Point-based C&F Bank swapped branches in Chesterfield. By way of Pennsylvania, Fulton Bank found a spot for a new West End branch. And Bank of America shuttered its downtown branch in the office tower that bears its name, while continuing branch expansion elsewhere in the region.

In case you missed it, here’s a rundown of the latest FDIC deposit market share report, showing how all the banks doing business in the Richmond region stack up.

Looking ahead to 2025, watch for Atlantic Union and TowneBank to close their respective Sandy Spring and Village Bank acquisitions in the new year. The question remains whether there’s room for more consolidation in the market and, if so, who are the likely targets?

Atlantic Union Bank made the biggest waves in 2024 with the completion of one acquisition and the announcement of another.

Mergers and acquisitions across all ends of the size spectrum were the hot topic in the local banking sector in 2024.

The year began with Virginia Credit Union, one of the region’s largest financial institutions, announcing its plans to merge with Roanoke-based Member One Federal Credit Union. The deal created the third-largest credit union in Virginia with nearly $7 billion in assets, 500,000 members, 37 branches and 1,100 employees.

Soon after, Atlantic Union Bank, the region’s biggest locally based bank, completed its $507 million acquisition of American National Bank in Danville.

Next to jump in on the action was Hampton Roads-based TowneBank, which struck a deal to acquire Midlothian-based Village Bank for $120 million. Once it closes, the deal will mean a $62 million windfall for Village’s main investor.

This fall, Strasburg, Virginia-based First Bank finalized its acquisition of Touchstone Bank, a $662 million institution headquartered in Prince George. The deal brought First Bank to $2.1 billion in total assets and includes Touchstone’s 12 branches, seven of which are in the southern reaches of the Richmond region.

Then came the big one. Atlantic Union announced the deal of the year with its pending acquisition of Sandy Spring Bank in Northern Virginia. The combination will create a $39 billion banking behemoth and further cement AUB’s status as the largest regional bank headquartered in Virginia. The pending stock-for-stock deal, valued at $1.6 billion, would combine Sandy Spring’s $14 billion in assets with AUB’s $25 billion and give AUB its first major presence in Maryland and Washington, D.C., by taking on Sandy Spring’s 53 branches.

In between all the dealmaking was plenty of other local banking sector news.

VACU converted into a federal credit union, Blue Ridge Bank took on $150 million in new capital in a bid to stay alive, and a longtime local commercial loan officer from Primis Bank was sentenced to four years in federal prison for a years-long lending scheme.

There were branch moves galore throughout the year. Powhatan’s New Horizon Bank expanded out of its home county for the time with offices in the city of Richmond and Hampton Roads. North Carolina’s Southern Bank lined up its first branch in the local market, while national player Chase Bank continued its branch building activity in the area.

United Bank secured an East End site for what will be its first new branch in the market since acquiring Essex Bank. West Point-based C&F Bank swapped branches in Chesterfield. By way of Pennsylvania, Fulton Bank found a spot for a new West End branch. And Bank of America shuttered its downtown branch in the office tower that bears its name, while continuing branch expansion elsewhere in the region.

In case you missed it, here’s a rundown of the latest FDIC deposit market share report, showing how all the banks doing business in the Richmond region stack up.

Looking ahead to 2025, watch for Atlantic Union and TowneBank to close their respective Sandy Spring and Village Bank acquisitions in the new year. The question remains whether there’s room for more consolidation in the market and, if so, who are the likely targets?

AUB should look at merging with Columbia SC’s Southern First Bank. That would give them a couple of branches in southern NC (Raleigh, Charlotte, Greensboro), a bunch across South Carolina, and give them entry into Atlanta.