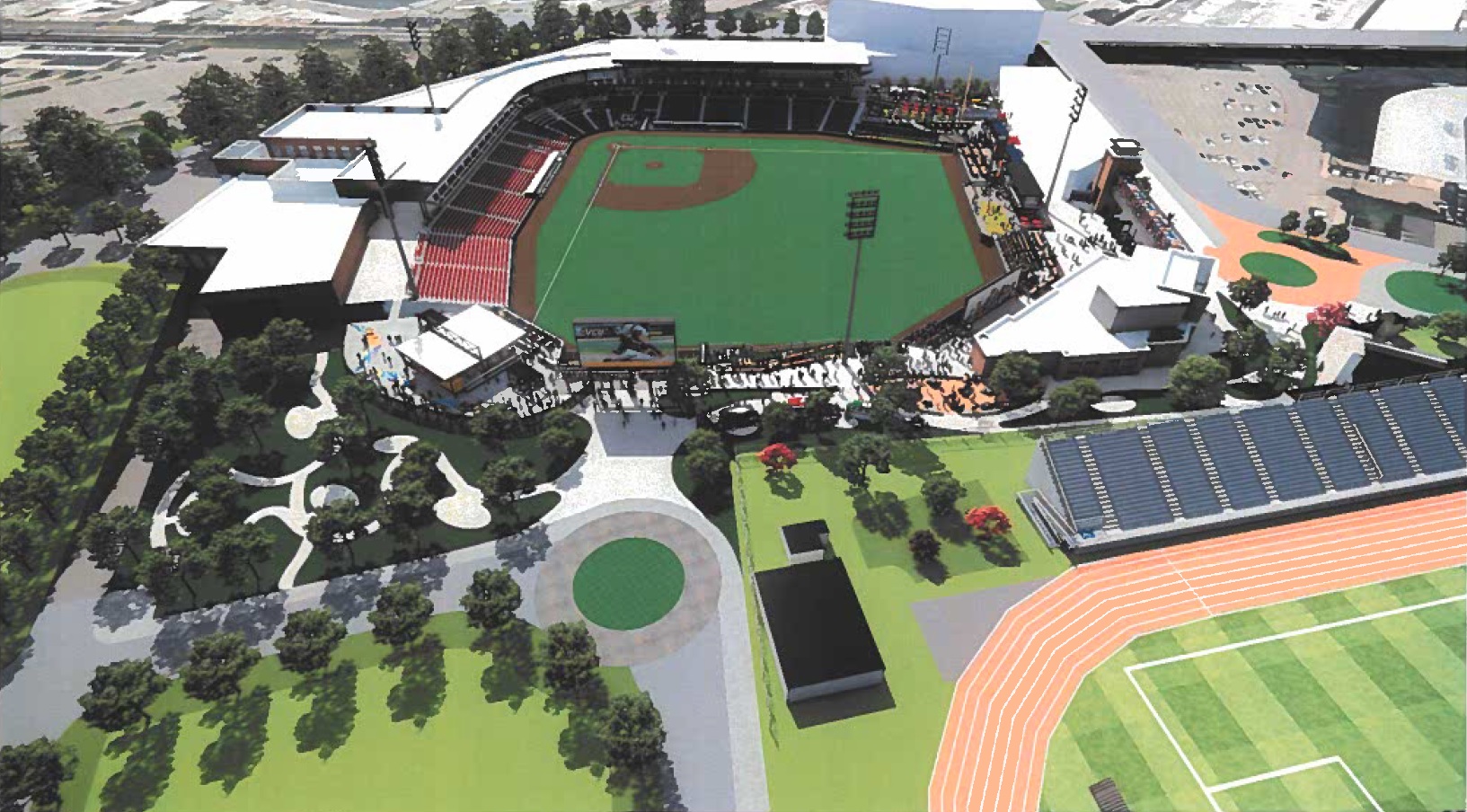

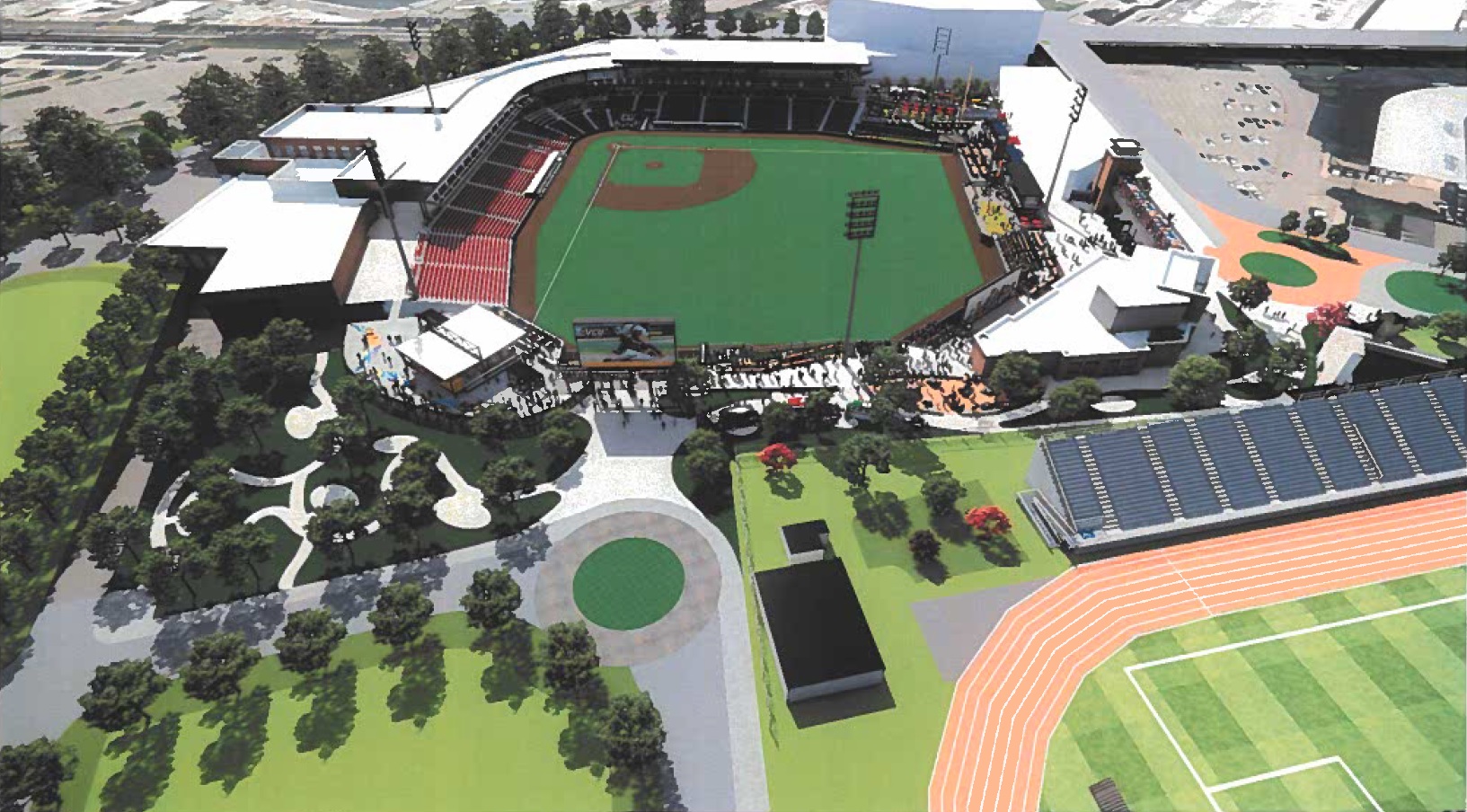

A rendering of the new stadium planned along Arthur Ashe Boulevard south of The Diamond. (BizSense file)

The City of Richmond says it will miss its chance at $24 million in expiring state sales tax incentives that it planned to use to help finance the Diamond District development – and it’s placing blame for losing out on the money squarely on a recent lawsuit.

But Chief Administrative Officer Lincoln Saunders said he’s optimistic that the funds could be recaptured through lobbying of state legislators to reinstate the incentive program in next year’s General Assembly session.

Saunders said this week that the city’s hands are tied from being able to advertise and sell the bonds for a new baseball stadium in time for the program’s June 30 deadline. That’s due to the still-lingering appeal period stemming from the lawsuit filed by Paul Goldman that challenged the city’s ballpark financing pivot.

While that lawsuit was dismissed June 7, Saunders said that so long as Goldman’s appeal window remained open, the city was advised that it could not go forward with issuing the stadium bonds.

“Based on our bond counsel’s advice, we are not going to be able to legally advertise and sell the bonds while the lawsuit is still subject to appeal,” Saunders said.

The city’s bond counsel is Richmond-based Davenport & Co.

“It was certainly our hope and intention to be able to sell the bonds for the stadium by mid-June so that we could be guaranteed to take full advantage of the sales tax recapture, but the lawsuit has definitely jeopardized that as well as the potential savings,” Saunders said.

Goldman, however, said his lawsuit is not to blame for the city missing the deadline. He argued that the city could have started the process long before now and questioned whether it even could have secured bonds with a 4 percent interest rate as it said it could. Goldman also suggested the stadium bonds would be taxable and therefore require a higher interest rate.

“The 4 percent is the tax-exempt rate. The stadium bonds are going to be taxable bonds,” Goldman said. “You can’t block something that nobody could do. If you can’t do that, I’m not delaying anything.”

Saunders said the stadium bonds will not be taxable.

Goldman reiterated his belief that city voters should get to weigh in on the $170 million Diamond District bond issuance via a referendum, which state law requires of counties but not cities. A referendum was the ultimate goal of his lawsuit.

“Why am I such a bad guy because I want to exercise my constitutional rights?” he said. “It’s not on me. I’m offended that people think that because I exercised my First Amendment rights that I’m at fault. I should have just let it happen?”

State law allows Goldman 15 calendar days from the date his lawsuit was dismissed to file a notice of appeal. The dismissal order was recorded in Richmond Circuit Court on June 14, putting the end of the 15-day window on June 29. Goldman had yet to file an appeal as of Tuesday.

But for the lawsuit and the appeal window it triggered, Saunders said the city would have been able to issue the $130 million in stadium bonds in time to meet the June 30 deadline and capture the $24 million in incentives. He said the city’s ability to do so is proven by its scheduled closing this week of a separate $40 million bond issuance for infrastructure improvements for the larger Diamond District development.

The infrastructure bonds were not subject to the lawsuit the way the stadium bonds were, Saunders said. The stadium bonds are general obligation bonds to be paid using tax revenue generated by the development, while the infrastructure bonds are lease revenue bonds to be paid by the leases for the stadium.

He said the city was able to sell the infrastructure bonds with an interest rate below 4 percent, the rate that it expected to secure by issuing its own bonds instead of its previous plan of having them issued through a newly formed community development authority.

That change in financing approach was projected to save the city $215 million in debt costs over the 30-year length of the debt, but also means the city assumes the risk on the $170 million in bonds. That puts it on the hook for repaying them if the stadium isn’t built or the larger development doesn’t pay for itself through incremental tax revenue.

Saunders said the loss of the $24 million in state sales tax incentives cuts into those savings but does not jeopardize the stadium or the project overall. He said the project remains scheduled to break ground next month and deliver the stadium in time for the targeted 2026 baseball season.

“It doesn’t change our ability to deliver the stadium on time as long as we are moving forward with the infrastructure and starting that work. The delay singularly impacts just the state sales tax conversation,” Saunders said.

“This $24 million essentially will reduce our savings from our financing plan. It doesn’t require the city to put in more funding; it just would have been funds that otherwise were going to the state that would have been used to pay down our bonds faster.”

Saunders said the city is hopeful that the $24 million can be applied to the project retroactively through a reinstatement of the incentive program. The program was removed from the General Assembly’s budget this year as opponents sought to block funding for a controversial arena-anchored project in Alexandria that was championed by Gov. Glenn Youngkin.

Saunders said the city will lobby legislators to reinstate the program in next year’s session with language that could put the $24 million toward the Diamond District.

“We’re optimistic that a program that has for a long time existed in the state to support improvement projects like this” could be reinstated, Saunders said. “I think it’s a very good chance they bring it back when it’s no longer caught up in the Northern Virginia debate about the arena.

“If the General Assembly sees fit to reinstate the program, I would think that we would be able to make a strong case that the city’s project should qualify,” he said. “We’re years away from the taxes being generated related to the site, so if we can get the General Assembly to reinstate it, we should be able to get that full $24 million that was projected from the state sales tax.”

Noting the infrastructure bonds are set to close before July 1, Saunders added, “We believe that will give us a further case to make that we should be able to participate in the full state sales tax capture.”

The deadline miss had been announced two weeks earlier at a June 12 constituent meeting for the Second District, where the Diamond District is located. Deputy Chief Administrative Officer Sharon Ebert told attendees that the city would miss the deadline due to the appeal window, but then walked back those comments following the meeting after receiving a call from Saunders.

Ebert said she was told that the 15-day window would still allow enough time for the city to issue the bonds. Saunders this week attributed the back-and-forth to a lack of clarity on the dismissal judgment’s recording date and how that affected the start of the appeal window.

Site work on the ballpark cannot start until development and lease agreements are signed between the city’s Economic Development Authority board and Navigators Baseball LP, the ownership group of the Richmond Flying Squirrels. Saunders said those agreements could be finalized in a matter of days. The EDA has a board meeting scheduled Thursday.

Note: This story has been updated.

A rendering of the new stadium planned along Arthur Ashe Boulevard south of The Diamond. (BizSense file)

The City of Richmond says it will miss its chance at $24 million in expiring state sales tax incentives that it planned to use to help finance the Diamond District development – and it’s placing blame for losing out on the money squarely on a recent lawsuit.

But Chief Administrative Officer Lincoln Saunders said he’s optimistic that the funds could be recaptured through lobbying of state legislators to reinstate the incentive program in next year’s General Assembly session.

Saunders said this week that the city’s hands are tied from being able to advertise and sell the bonds for a new baseball stadium in time for the program’s June 30 deadline. That’s due to the still-lingering appeal period stemming from the lawsuit filed by Paul Goldman that challenged the city’s ballpark financing pivot.

While that lawsuit was dismissed June 7, Saunders said that so long as Goldman’s appeal window remained open, the city was advised that it could not go forward with issuing the stadium bonds.

“Based on our bond counsel’s advice, we are not going to be able to legally advertise and sell the bonds while the lawsuit is still subject to appeal,” Saunders said.

The city’s bond counsel is Richmond-based Davenport & Co.

“It was certainly our hope and intention to be able to sell the bonds for the stadium by mid-June so that we could be guaranteed to take full advantage of the sales tax recapture, but the lawsuit has definitely jeopardized that as well as the potential savings,” Saunders said.

Goldman, however, said his lawsuit is not to blame for the city missing the deadline. He argued that the city could have started the process long before now and questioned whether it even could have secured bonds with a 4 percent interest rate as it said it could. Goldman also suggested the stadium bonds would be taxable and therefore require a higher interest rate.

“The 4 percent is the tax-exempt rate. The stadium bonds are going to be taxable bonds,” Goldman said. “You can’t block something that nobody could do. If you can’t do that, I’m not delaying anything.”

Saunders said the stadium bonds will not be taxable.

Goldman reiterated his belief that city voters should get to weigh in on the $170 million Diamond District bond issuance via a referendum, which state law requires of counties but not cities. A referendum was the ultimate goal of his lawsuit.

“Why am I such a bad guy because I want to exercise my constitutional rights?” he said. “It’s not on me. I’m offended that people think that because I exercised my First Amendment rights that I’m at fault. I should have just let it happen?”

State law allows Goldman 15 calendar days from the date his lawsuit was dismissed to file a notice of appeal. The dismissal order was recorded in Richmond Circuit Court on June 14, putting the end of the 15-day window on June 29. Goldman had yet to file an appeal as of Tuesday.

But for the lawsuit and the appeal window it triggered, Saunders said the city would have been able to issue the $130 million in stadium bonds in time to meet the June 30 deadline and capture the $24 million in incentives. He said the city’s ability to do so is proven by its scheduled closing this week of a separate $40 million bond issuance for infrastructure improvements for the larger Diamond District development.

The infrastructure bonds were not subject to the lawsuit the way the stadium bonds were, Saunders said. The stadium bonds are general obligation bonds to be paid using tax revenue generated by the development, while the infrastructure bonds are lease revenue bonds to be paid by the leases for the stadium.

He said the city was able to sell the infrastructure bonds with an interest rate below 4 percent, the rate that it expected to secure by issuing its own bonds instead of its previous plan of having them issued through a newly formed community development authority.

That change in financing approach was projected to save the city $215 million in debt costs over the 30-year length of the debt, but also means the city assumes the risk on the $170 million in bonds. That puts it on the hook for repaying them if the stadium isn’t built or the larger development doesn’t pay for itself through incremental tax revenue.

Saunders said the loss of the $24 million in state sales tax incentives cuts into those savings but does not jeopardize the stadium or the project overall. He said the project remains scheduled to break ground next month and deliver the stadium in time for the targeted 2026 baseball season.

“It doesn’t change our ability to deliver the stadium on time as long as we are moving forward with the infrastructure and starting that work. The delay singularly impacts just the state sales tax conversation,” Saunders said.

“This $24 million essentially will reduce our savings from our financing plan. It doesn’t require the city to put in more funding; it just would have been funds that otherwise were going to the state that would have been used to pay down our bonds faster.”

Saunders said the city is hopeful that the $24 million can be applied to the project retroactively through a reinstatement of the incentive program. The program was removed from the General Assembly’s budget this year as opponents sought to block funding for a controversial arena-anchored project in Alexandria that was championed by Gov. Glenn Youngkin.

Saunders said the city will lobby legislators to reinstate the program in next year’s session with language that could put the $24 million toward the Diamond District.

“We’re optimistic that a program that has for a long time existed in the state to support improvement projects like this” could be reinstated, Saunders said. “I think it’s a very good chance they bring it back when it’s no longer caught up in the Northern Virginia debate about the arena.

“If the General Assembly sees fit to reinstate the program, I would think that we would be able to make a strong case that the city’s project should qualify,” he said. “We’re years away from the taxes being generated related to the site, so if we can get the General Assembly to reinstate it, we should be able to get that full $24 million that was projected from the state sales tax.”

Noting the infrastructure bonds are set to close before July 1, Saunders added, “We believe that will give us a further case to make that we should be able to participate in the full state sales tax capture.”

The deadline miss had been announced two weeks earlier at a June 12 constituent meeting for the Second District, where the Diamond District is located. Deputy Chief Administrative Officer Sharon Ebert told attendees that the city would miss the deadline due to the appeal window, but then walked back those comments following the meeting after receiving a call from Saunders.

Ebert said she was told that the 15-day window would still allow enough time for the city to issue the bonds. Saunders this week attributed the back-and-forth to a lack of clarity on the dismissal judgment’s recording date and how that affected the start of the appeal window.

Site work on the ballpark cannot start until development and lease agreements are signed between the city’s Economic Development Authority board and Navigators Baseball LP, the ownership group of the Richmond Flying Squirrels. Saunders said those agreements could be finalized in a matter of days. The EDA has a board meeting scheduled Thursday.

Note: This story has been updated.

The only thing about this mess that I believe is that I don’t believe anything the City tells us.

Bout time more people started being the guy who says this.

It’s alright, won’t effect timeline.lol

“I’m shocked — shocked, I tell you!!!” LoL

The CoR is inept at anything financial. The screw up their own tax collection from businesses and won’t give them any relief, yet they will now beg the GA for a redo on the tax incentive that they themselves missed.

I think it’s best to continue to stay skeptical about this project. Richmond doesn’t have the best track record with projects like this, and yes you can’t blame the current administration for the mistakes of previous administrations but we need to see results. Financial benefits from projects like this are usually overstated throughout the US so it’s not just a Richmond thing. I really wish we would have replaced the Diamond years ago when the Braves were here and then let the area naturally improve around it as the Scotts Addition rebirth spread instead of trying to do one large… Read more »

We need to start electing competent people instead of people who are mostly interested in patronage.

That’s an issue from the top of government in DC on down unfortunately.

It’s not true everywhere in the country though.

Wait till they find the old graves in right field and have to call in the arcologacal dig team.

Beware of the ghost of Sixth Street Marketplace. haha

Maybe the ghosts of the old Richmond Arena.

Forgot about the Arena. I went there as a kid in the early 80s to see the circus and took a ride on an elephant.

Used to go to see the Va Squires bball and car shows.

More likely a Tomahawk little Kenny lost at the 1985 opening that they will find, cause confusion, and be responsible for a 2 month construction delay.

The concept of cities and counties comes from 2,000 years ago from Vikings seperated by fiords.

Most “local” actions should be done by service districts.

i qdon’t expect the redneck General Assemply, or Vlad or Chi to give up their power.

What the heck are you talking about?

The City is too incompetant to keep it’s charter, but dividing it’s territory to Chesterfield and Henrico is not smart.

Perhaps the first question, is why are both of these gentlemen so afraid of a comb?

I was thinking the same thing. If I was gonna have my picture took I’d try to look as un goofy as possible.

Instead of the “buck stops here” I am assuming in the 2nd floor Mayor’s office the desk plaque says “if we fail at something it is always someone else’s fault”

YES!

This should have been done privately. That’s the way they did it in Fredericksburg and they’ve had a new stadium going on 4 years now.

Instead it’s a mess now!

Private funds???? It was on land the City put up for a Museum that was never built and their PUBLIC revenue bonds were issued for it through the City’s EDA. And revenue is not covering bonds at this time. Sound familiar. Their bonds started at BBB+ rating, downgraded to CCC by Fitch and I think are back up but per 2024 report says the ‘City financial obligation is limited to fixed annual payment, which represents a very modest budgetary commitment that is likely to be partially or fully offset by stadium-related taxes.” RVA annual contributions if revenues do not meet… Read more »

Richmond is so behind compare to other cities lol

Behind how and compared tow what other cities?

I mean, maybe…

Grifters.

Lol literally evey Capital City on the East Coast.

Certainly Albany and Trenton are worse….

Oooh you’re the ” I take everything literal type of person “. You got the point

This is a personality jab? I see. Bravo!

It” literally is” great job lol

And you are one of those people who put lol in a lot of your communications, as if you are terribly self-amused by your own wit, but it actually implies something else, I have found.

The audacity of this administration, at the very least should be recorded and remembered for ever. They haven’t done ANYTHING correctly. This project should, even with the white elephant stadium, have been done years ago if they ONLY picked the best proposal by the deepest pocketed bidder, and if they just kept the new stadium out of it Richmond would be rolling in more revenues and Richmond would be more prosperous from all the new investment here. But no. Everything they have a hand in they make worse — maybe they can fire another police chief for doing his job… Read more »

Is it even really a story about the City of Richmond unless Shawn Harper comes in and spam posts about how much the city sucks? With all the armchair municipal administrators in these comments, seems like a lot of folks should be applying to the City for jobs so they can put their apparently superior skills to work.

The focus here is that Paul Goldman is killing baseball which he’s been doing for seems like 20 years. Regardless of the legitimate issues with the meals taxes or anything else, the City is the victim here.

Stoney could care less about a baseball stadium.Travel elsewhere to watch baseball live. Baseballs dead in Richmond just like tourism.

Hmm? Not sure either is true. I think we get a fair amount of tourism, and COULD get more — but very few people would travel here to see a minor league baseball team.

I could be wrong, but I see a lot more enthusiasm for Baseball in the more Western part of VA — I grew up in a town that had a HUGE amount of enthusiasm for Baseball — mostly the Yankees and Red Sox. Also Hockey, so I am sensitive to it.

Craig, please stop lumping me in with the Richmond Haters — I am pointing to what everyone actually realizes about CITY HALL by this time, and the ideologues and grifters that keep the status quo. I want a city that has a govt that MANAGES well and spends for the greatest COMMON good, is that so horrible??

And, BTW, I would NEVER be hired by the people who run city hall in Richmond — certainly you understand this.

It doesn’t take much “superiority” — it takes a different mindset, a mindset to do a good job and not be political.

How many hundreds of millions is this costing the city? Make the developers pay for the shortfall or yank the project. The city seems desperate how do you negotiate like that? This is already a total boondoggle and nothings been built yet. Every deal in Richmond now is give the developers everything and pay a fortune no matter what outcome.

Screw that, Make Goldman pay for the shortfall. Maybe a real consequence would finally put an end to his fruitless crusade of wasting taxpayer money and time.

WOW — you are blaming Goldman for City Hall?? How are you able?