Richmond’s local banks are slowly regaining their health.

Richmond’s local banks are slowly regaining their health.

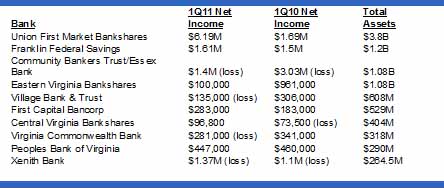

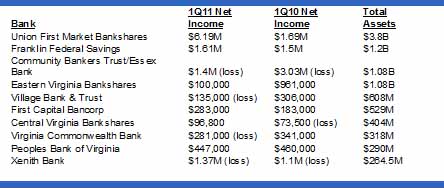

Eight of the 13 community banks in the region had a better first quarter in 2011 than in 2010, according to financial reports from regulators.

About half of the community banks headquartered in the Richmond region reported a loss during the first quarter. But that means about half were profitable, giving local bankers reason for both optimism tempered with caution.

“It is still a tough economy,” said Tom Winfree, CEO of Village Bank & Trust. “It’s still one of those things where you’re taking two steps forward and one step back.”

The most profitable local community bank, by far, was Union First Market Bank, whose holding company reported $6.19 million in first quarter net income.

“For 2011, the first quarter seems good,” said Billy Beale, Union First Market’s CEO. “If this was 2005, I would tell you it was a lousy quarter.”

The biggest loss — $1.7 million — was at Bank of Virginia. The Midlothian-based bank is now working under CEO Jack Zoeller, who along with a team of investors brought in fresh capital to the bank.

Two of the seven that were in the red as of the end of March, Xenith Bank and New Horizon Bank, are startups still working through the losses that are expected for a few years.

Most community banks in the region are still plagued with high levels of non-performing assets made up of loans that have gone sour.

The 13 banks combined for $342.2 million in non-performing assets as of the end of March.

Union, the largest bank in the region with $3.8 billion in total assets, had the largest level of non-performing assets: $101.3 million.

But many of Union’s smaller peers have higher levels of problem loans as a percentage of their total assets.

“We’re starting to see a little bit of positive in the marketplace,” Beale said. “Maybe we’re at or near the top of our problem-loan levels.”

New Horizon Bank, a startup bank in Powhatan, is still the only local bank that can boast that it has not a cent in non-performing loans.

Village Bank, which would have been profitable if not for having to pay its TARP dividend, is proof that borrower instability seems to be stabilizing. Its non-performing assets were $31 million at quarter’s end, the lowest level it has seen since June 2009.

“I can tell you one thing: We’ve got a heck of a lot of it behind us,” said Winfree. “We’re making new loans. We’re not doing it to the extent that we really want, but we don’t want to grow out of our well-capitalized position.”

Another positive sign came out of Central Virginia Bank. It fought losses throughout 2009 and 2010 and turned a bit of a corner with a $96,800 profit in the first three months of 2011.

“It’s certainly an improvement from where we’ve been,” said Herb Marth, CVB’s CEO.

Marth and his peers still caution that loan demand is only inching along and that real estate values must stabilize for banks to truly rebound.

“Loan demand is very slow, there’s no question,” said Marth. “But I think we’ve hit bottom. We’ve seen signs of that.”

Community banks will continue to set aside reserves against more potential bad loans.

Local bank CEOs also said that there is some buzz in the market about potential consolidation among the weaker banks in town.

“I would be shocked if there is not some consolidation in the banking industry at large,” Beale said. “There’s going to be some. I don’t know who it’s going to be. But it’s going to happen.”

Michael Schwartz covers banking for BizSense. Please send news tips to [email protected].

Richmond’s local banks are slowly regaining their health.

Richmond’s local banks are slowly regaining their health.

Eight of the 13 community banks in the region had a better first quarter in 2011 than in 2010, according to financial reports from regulators.

About half of the community banks headquartered in the Richmond region reported a loss during the first quarter. But that means about half were profitable, giving local bankers reason for both optimism tempered with caution.

“It is still a tough economy,” said Tom Winfree, CEO of Village Bank & Trust. “It’s still one of those things where you’re taking two steps forward and one step back.”

The most profitable local community bank, by far, was Union First Market Bank, whose holding company reported $6.19 million in first quarter net income.

“For 2011, the first quarter seems good,” said Billy Beale, Union First Market’s CEO. “If this was 2005, I would tell you it was a lousy quarter.”

The biggest loss — $1.7 million — was at Bank of Virginia. The Midlothian-based bank is now working under CEO Jack Zoeller, who along with a team of investors brought in fresh capital to the bank.

Two of the seven that were in the red as of the end of March, Xenith Bank and New Horizon Bank, are startups still working through the losses that are expected for a few years.

Most community banks in the region are still plagued with high levels of non-performing assets made up of loans that have gone sour.

The 13 banks combined for $342.2 million in non-performing assets as of the end of March.

Union, the largest bank in the region with $3.8 billion in total assets, had the largest level of non-performing assets: $101.3 million.

But many of Union’s smaller peers have higher levels of problem loans as a percentage of their total assets.

“We’re starting to see a little bit of positive in the marketplace,” Beale said. “Maybe we’re at or near the top of our problem-loan levels.”

New Horizon Bank, a startup bank in Powhatan, is still the only local bank that can boast that it has not a cent in non-performing loans.

Village Bank, which would have been profitable if not for having to pay its TARP dividend, is proof that borrower instability seems to be stabilizing. Its non-performing assets were $31 million at quarter’s end, the lowest level it has seen since June 2009.

“I can tell you one thing: We’ve got a heck of a lot of it behind us,” said Winfree. “We’re making new loans. We’re not doing it to the extent that we really want, but we don’t want to grow out of our well-capitalized position.”

Another positive sign came out of Central Virginia Bank. It fought losses throughout 2009 and 2010 and turned a bit of a corner with a $96,800 profit in the first three months of 2011.

“It’s certainly an improvement from where we’ve been,” said Herb Marth, CVB’s CEO.

Marth and his peers still caution that loan demand is only inching along and that real estate values must stabilize for banks to truly rebound.

“Loan demand is very slow, there’s no question,” said Marth. “But I think we’ve hit bottom. We’ve seen signs of that.”

Community banks will continue to set aside reserves against more potential bad loans.

Local bank CEOs also said that there is some buzz in the market about potential consolidation among the weaker banks in town.

“I would be shocked if there is not some consolidation in the banking industry at large,” Beale said. “There’s going to be some. I don’t know who it’s going to be. But it’s going to happen.”

Michael Schwartz covers banking for BizSense. Please send news tips to [email protected].