A New Kent County development heading toward foreclosure filed last week for bankruptcy.

A New Kent County development heading toward foreclosure filed last week for bankruptcy.

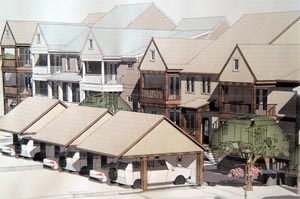

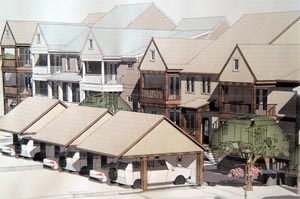

New Kent Courthouse Village, a partially-built $30 million mixed-use development modeled after a traditional English village, filed for Chapter 11 bankruptcy protection to prevent a foreclosure auction that was set for Friday.

A lender was foreclosing on the main 70-lot residential piece of the development, which stalled as the project fell behind.

“The economy just slowed us down,” said Grosjean “John” Crump, 59. “We are repositioning the project so that we can move forward. We just needed to reorganize.”

New Kent Courthouse Village is the brainchild of Crump, New Kent County’s former commissioner of the revenue. He started working on the venture eight years ago.

He conceived the development in line with what he calls “new ruralism”: a low-impact, small-scale, town-center type of project.

But Crump, whose family has been in New Kent County since the 1700s, took his plan to another level by fashioning it after an English village, with a church, government building, school and green space all within walking distance.

The project is 21 acres broken into two sections, Preservation Park (the commercial center of the village that has seen some success in luring businesses) and Maidstone, which is to consist of about 70 yet-to-be-built homes and was facing foreclosure.

The project is 21 acres broken into two sections, Preservation Park (the commercial center of the village that has seen some success in luring businesses) and Maidstone, which is to consist of about 70 yet-to-be-built homes and was facing foreclosure.

The bankruptcy will buy Crump some time to work with the project’s initial creditors. If and when that plan is put in place, Crump said other investors would be more likely to pony up.

“We’re hoping we’re going to come out of the Chapter 11 fairly quickly,” Crump said. “At no time did we think about stopping the project. We just stalled.”

“We’ve had some support from the banks,” he said. “The banks are just in a difficult position now, too.”

According to bankruptcy filings, the banks on the project are EVB, Essex Bank and Colonial Virginia Bank.

The entity lists assets of $1 million to $10 million and liabilities between $10 million and $50 million.

The initial bankruptcy filing shows the development owes $1 million to Colonial Virginia Bank and hundreds of thousands to individuals, including Crump.

The LLC is owned 50/50 by Crump and his uncle L. Drexel Crump, who lives in Florida.

EVB and Essex Bank are listed as secured creditors, although the amount owed to them has not been filed.

About $9 million has been spent on construction of the first phase of the village, Crump said. About $3.5 million of that was spent on the infrastructure.

There is about 26,000 square feet of commercial space that is built and occupied. The tenants include a bank, a fitness center, medical offices and restaurants.

An additional four commercial buildings have leases signed — there’s just no financing in place to finish building them.

Finding financing, Crump said, is difficult, but “at the same time we have several private investors and groups of investors. … They just needed it stabilized before we could move forward.”

Roy Terry, an attorney with DurretteCrump, is handling the development’s bankruptcy.

Terry, who has worked on behalf of plenty of troubled developers, said New Kent Courthouse Village isn’t far off from reaching its potential.

“This project really does have an opportunity to do well,” Terry said. “They need a little more capital to complete some construction.

They have tenants waiting to go in.”

Should it ever come to fruition, Crump said he wants the development to become a haven for traditional craftspeople.

Crump is so set on the English village theme that he took the development’s staff to towns and hamlets in England to get a feel for what he had in mind.

Michael Schwartz is a BizSense reporter. Please send news tips to [email protected].

A New Kent County development heading toward foreclosure filed last week for bankruptcy.

A New Kent County development heading toward foreclosure filed last week for bankruptcy.

New Kent Courthouse Village, a partially-built $30 million mixed-use development modeled after a traditional English village, filed for Chapter 11 bankruptcy protection to prevent a foreclosure auction that was set for Friday.

A lender was foreclosing on the main 70-lot residential piece of the development, which stalled as the project fell behind.

“The economy just slowed us down,” said Grosjean “John” Crump, 59. “We are repositioning the project so that we can move forward. We just needed to reorganize.”

New Kent Courthouse Village is the brainchild of Crump, New Kent County’s former commissioner of the revenue. He started working on the venture eight years ago.

He conceived the development in line with what he calls “new ruralism”: a low-impact, small-scale, town-center type of project.

But Crump, whose family has been in New Kent County since the 1700s, took his plan to another level by fashioning it after an English village, with a church, government building, school and green space all within walking distance.

The project is 21 acres broken into two sections, Preservation Park (the commercial center of the village that has seen some success in luring businesses) and Maidstone, which is to consist of about 70 yet-to-be-built homes and was facing foreclosure.

The project is 21 acres broken into two sections, Preservation Park (the commercial center of the village that has seen some success in luring businesses) and Maidstone, which is to consist of about 70 yet-to-be-built homes and was facing foreclosure.

The bankruptcy will buy Crump some time to work with the project’s initial creditors. If and when that plan is put in place, Crump said other investors would be more likely to pony up.

“We’re hoping we’re going to come out of the Chapter 11 fairly quickly,” Crump said. “At no time did we think about stopping the project. We just stalled.”

“We’ve had some support from the banks,” he said. “The banks are just in a difficult position now, too.”

According to bankruptcy filings, the banks on the project are EVB, Essex Bank and Colonial Virginia Bank.

The entity lists assets of $1 million to $10 million and liabilities between $10 million and $50 million.

The initial bankruptcy filing shows the development owes $1 million to Colonial Virginia Bank and hundreds of thousands to individuals, including Crump.

The LLC is owned 50/50 by Crump and his uncle L. Drexel Crump, who lives in Florida.

EVB and Essex Bank are listed as secured creditors, although the amount owed to them has not been filed.

About $9 million has been spent on construction of the first phase of the village, Crump said. About $3.5 million of that was spent on the infrastructure.

There is about 26,000 square feet of commercial space that is built and occupied. The tenants include a bank, a fitness center, medical offices and restaurants.

An additional four commercial buildings have leases signed — there’s just no financing in place to finish building them.

Finding financing, Crump said, is difficult, but “at the same time we have several private investors and groups of investors. … They just needed it stabilized before we could move forward.”

Roy Terry, an attorney with DurretteCrump, is handling the development’s bankruptcy.

Terry, who has worked on behalf of plenty of troubled developers, said New Kent Courthouse Village isn’t far off from reaching its potential.

“This project really does have an opportunity to do well,” Terry said. “They need a little more capital to complete some construction.

They have tenants waiting to go in.”

Should it ever come to fruition, Crump said he wants the development to become a haven for traditional craftspeople.

Crump is so set on the English village theme that he took the development’s staff to towns and hamlets in England to get a feel for what he had in mind.

Michael Schwartz is a BizSense reporter. Please send news tips to [email protected].

If you’ve never been out there you should go and see what has been completed. It really is a terrific concept and what’s more, it’s needed in New Kent. It’s a shame the economy has taken another victim.