The Hallsley community has seen trends favoring more customized and higher-priced homes. Photos by Jonathan Spiers.

Sales of pre-owned houses helped drive an increase in the number of homes sold in the Richmond region this year compared to last, while new home sales are showing their own trends, including increased demand for higher-priced homes.

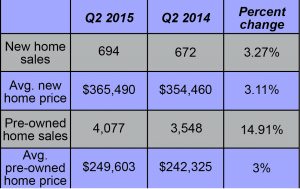

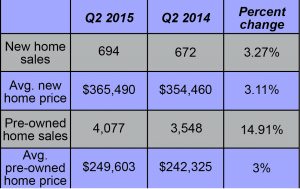

During the second quarter, pre-owned sales were up 15 percent compared to the same period in 2014, with 4,077 sales this year compared to 3,548 last year, according to the latest quarterly analysis by Integra Realty Resources-Richmond.

That continues the pace seen in the first quarter, when pre-owned home sales totaled 2,463, up 18 percent from the same time period the previous year.

And in the new home market, there were 694 home sales locally from April to June, up 3 percent from 672 sold in the second quarter of last year.

The average price of new homes sold in the second quarter was $365,490, up 3 percent from the same time last year. And sale prices of pre-owned homes in the second quarter likewise went up 3 percent, averaging $249,603.

The numbers are based on Integra’s analysis of home sales in the city of Richmond and seven surrounding counties: Caroline, Chesterfield, Goochland, Hanover, Henrico, New Kent and Powhatan. They do not reflect an additional eight jurisdictions included in quarterly reports by the Central Virginia Regional Multiple Listing Service, which reported its second-quarter numbers in July.

The lag in Integra’s report is due to its analysis of pre-owned versus new home sales, which are not differentiated by CVRMLS.

Also of note from the report: New home sales in Powhatan doubled last year’s numbers – from 15 in Q2 last year to 30 this year. Hanover, New Kent and Chesterfield counties also saw increases – of 19, 18 and 12 percent, respectively – while Caroline, Goochland and Henrico counties and Richmond saw decreases, Henrico by about 21 percent.

Integra’s analysis further shows that new home sales in the first six months of 2015 trended lower for properties priced below $250,000 compared to the same time five years ago, while higher-priced homes have trended higher this year compared to the first six months of 2010.

According to the report, new homes priced below $250,000 represented 44.2 percent of the market share the first half of 2010, while the same price range amounts for 25.2 percent of new homes sold in the first half of this year.

At the same time, the market share of homes priced between $250,000 and $499,999 has increased from 48.3 percent the first half of 2010 to 57.3 percent so far this year. Sales of homes priced between $500,000 and $749,999 have more than doubled – from 6.1 percent the first half of 2010 to 14.9 percent this year. And sales of homes priced $750,000 and up have also nearly doubled – from 1.5 percent in 2010 to 2.7 percent this year.

Over the first and second quarters, this year’s new home sale prices have averaged $368,928, compared to $299,110 five years ago.

The analysis – conducted by Tom Tyler, director of housing markets at Integra’s Richmond office – notes several factors for the trends.

“The decline in supply is due, in part, to the sellout of several affordably priced townhouse and condominium communities and the inventory of lower-priced homes that builders opted to construct in the wake of the financial crisis,” the report states.

New home sale numbers and prices both increased by about 3 percent, comparing Q2 last year to Q2 this year.

“Because of increasing construction costs and the competition from the pre-owned segment of the market, it is becoming less common for homebuilders to offer product at the most affordable price ranges.”

One neighborhood where such trends are shaping building decisions is Hallsley, a Midlothian-area community that has built about one-third of its approved 740 homes. While the community is targeted to the more affluent homebuyer – homes are priced between $450,000 and $1 million – it has nonetheless seen its highest-priced homes outpace its lower-priced offerings. Hallsely developer East West Communities is adjusting to that, Project Manager Daniel Jones said.

“What we’ve found is the higher-end discerning buyer is really focused on the more custom, ‘pick 101 options,’” Jones said. “We’re listening to the residents and the real estate market and saying, ‘If this is what they want, this is what we’re going to try to give them,’ in creating that unique, non-cookie-cutter atmosphere.”

As a result, the developer has asked the 13 “preferred builders” it works with in Hallsley to tailor their offerings to meet that demand.

Jones said the effort has resulted in builders providing more variety in home elevations and styles. Where Hallsley started out with four or five unique home styles, Jones said, builders have introduced more styles showcased in events such as this year’s Massey Street of Hope and the currently underway Parade of Homes.

Hallsley is also slated to host next year’s Homearama, which will feature nine homes priced above $800,000.

Jones said home sales in Hallsley have reflected the demand for higher-priced homes. Of about 250 homes built in Hallsley so far, he said 103 were sold last year, while this year’s sales have already surpassed that amount – 108 homes had been sold as of Friday.

“That’s a 150 percent increase from this time last year,” Jones said.

Jones attributed the increase in higher-priced home sales to a pent-up demand that resulted from the recent economic downturn and low interest rates.

“Across all boards, you can afford to buy more of a home,” he said. “Whether you’re a $250,000 buyer, all of a sudden you’re a $300,000 buyer. If you’re a $500,000 buyer, all of a sudden you’re a $600,000 buyer.”

The Hallsley community has seen trends favoring more customized and higher-priced homes. Photos by Jonathan Spiers.

Sales of pre-owned houses helped drive an increase in the number of homes sold in the Richmond region this year compared to last, while new home sales are showing their own trends, including increased demand for higher-priced homes.

During the second quarter, pre-owned sales were up 15 percent compared to the same period in 2014, with 4,077 sales this year compared to 3,548 last year, according to the latest quarterly analysis by Integra Realty Resources-Richmond.

That continues the pace seen in the first quarter, when pre-owned home sales totaled 2,463, up 18 percent from the same time period the previous year.

And in the new home market, there were 694 home sales locally from April to June, up 3 percent from 672 sold in the second quarter of last year.

The average price of new homes sold in the second quarter was $365,490, up 3 percent from the same time last year. And sale prices of pre-owned homes in the second quarter likewise went up 3 percent, averaging $249,603.

The numbers are based on Integra’s analysis of home sales in the city of Richmond and seven surrounding counties: Caroline, Chesterfield, Goochland, Hanover, Henrico, New Kent and Powhatan. They do not reflect an additional eight jurisdictions included in quarterly reports by the Central Virginia Regional Multiple Listing Service, which reported its second-quarter numbers in July.

The lag in Integra’s report is due to its analysis of pre-owned versus new home sales, which are not differentiated by CVRMLS.

Also of note from the report: New home sales in Powhatan doubled last year’s numbers – from 15 in Q2 last year to 30 this year. Hanover, New Kent and Chesterfield counties also saw increases – of 19, 18 and 12 percent, respectively – while Caroline, Goochland and Henrico counties and Richmond saw decreases, Henrico by about 21 percent.

Integra’s analysis further shows that new home sales in the first six months of 2015 trended lower for properties priced below $250,000 compared to the same time five years ago, while higher-priced homes have trended higher this year compared to the first six months of 2010.

According to the report, new homes priced below $250,000 represented 44.2 percent of the market share the first half of 2010, while the same price range amounts for 25.2 percent of new homes sold in the first half of this year.

At the same time, the market share of homes priced between $250,000 and $499,999 has increased from 48.3 percent the first half of 2010 to 57.3 percent so far this year. Sales of homes priced between $500,000 and $749,999 have more than doubled – from 6.1 percent the first half of 2010 to 14.9 percent this year. And sales of homes priced $750,000 and up have also nearly doubled – from 1.5 percent in 2010 to 2.7 percent this year.

Over the first and second quarters, this year’s new home sale prices have averaged $368,928, compared to $299,110 five years ago.

The analysis – conducted by Tom Tyler, director of housing markets at Integra’s Richmond office – notes several factors for the trends.

“The decline in supply is due, in part, to the sellout of several affordably priced townhouse and condominium communities and the inventory of lower-priced homes that builders opted to construct in the wake of the financial crisis,” the report states.

New home sale numbers and prices both increased by about 3 percent, comparing Q2 last year to Q2 this year.

“Because of increasing construction costs and the competition from the pre-owned segment of the market, it is becoming less common for homebuilders to offer product at the most affordable price ranges.”

One neighborhood where such trends are shaping building decisions is Hallsley, a Midlothian-area community that has built about one-third of its approved 740 homes. While the community is targeted to the more affluent homebuyer – homes are priced between $450,000 and $1 million – it has nonetheless seen its highest-priced homes outpace its lower-priced offerings. Hallsely developer East West Communities is adjusting to that, Project Manager Daniel Jones said.

“What we’ve found is the higher-end discerning buyer is really focused on the more custom, ‘pick 101 options,’” Jones said. “We’re listening to the residents and the real estate market and saying, ‘If this is what they want, this is what we’re going to try to give them,’ in creating that unique, non-cookie-cutter atmosphere.”

As a result, the developer has asked the 13 “preferred builders” it works with in Hallsley to tailor their offerings to meet that demand.

Jones said the effort has resulted in builders providing more variety in home elevations and styles. Where Hallsley started out with four or five unique home styles, Jones said, builders have introduced more styles showcased in events such as this year’s Massey Street of Hope and the currently underway Parade of Homes.

Hallsley is also slated to host next year’s Homearama, which will feature nine homes priced above $800,000.

Jones said home sales in Hallsley have reflected the demand for higher-priced homes. Of about 250 homes built in Hallsley so far, he said 103 were sold last year, while this year’s sales have already surpassed that amount – 108 homes had been sold as of Friday.

“That’s a 150 percent increase from this time last year,” Jones said.

Jones attributed the increase in higher-priced home sales to a pent-up demand that resulted from the recent economic downturn and low interest rates.

“Across all boards, you can afford to buy more of a home,” he said. “Whether you’re a $250,000 buyer, all of a sudden you’re a $300,000 buyer. If you’re a $500,000 buyer, all of a sudden you’re a $600,000 buyer.”

Strike up the band! Cue the cheerleaders! Pardon me for leaving my pompoms at home. Great report from Inegrity Realty Resources and very timely. Wherein lies my reservations? It is with the lag time new construction ‘trends’ to have with the overall stability and performance of the resale housing market. New construction sales and prices up, resale volume slowly trending down.

The Richmond housing market indeed continues to recover nicely. There are many other ares in Virginia that may follow the Richmond housing trends soon. It is great to see this taking place.