Some call it the “Trump Effect.” Others prefer the “Trump Bump.”

No matter the name, local bankers are soaking up the fact that, since Election Day on Nov. 8, their companies’ stocks have been on the community banking sector’s equivalent of a tear, thanks to expectations that Donald Trump’s presidency will bring favorable changes for the financial industry.

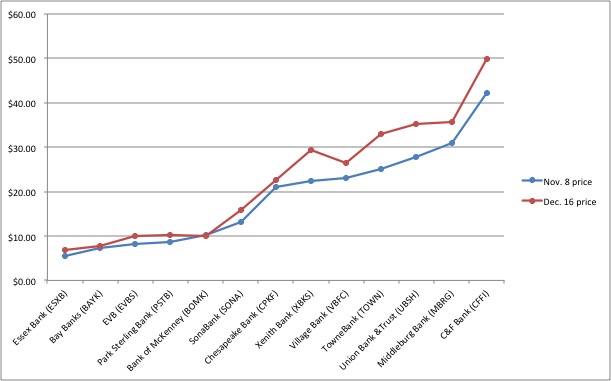

The share prices of locally based and regional community banks with a sizable presence in the Richmond market are up an average of 17.96 percent in the weeks since the election, as of the closing bell on Friday.

While much of the rest of the U.S. stock market also has picked up some added shine during that time, the bump for community bank stocks is a particularly welcome sign in a sector that largely has yet to see its share prices fully bounce back after the recession.

“We all feel like we’ve been toiling in the basement since the downturn,” said Gaylon Layfield, CEO of Richmond-based Xenith Bank. “We are as bankers delighted to see the sector catch up some.”

Shares of Xenith Bank, which recently completed a larger merger with a Hampton Roads-based competitor and a reverse stock split, have jumped 30.6 percent since the election.

Xenith’s headquarters is downtown at the James Center. Its share price is up 30 percent since the election.

Xenith is joined at the top of the recent stock price growth chart by Union Bank and TowneBank, which are up 27 percent and 30 percent, respectively.

The shares of many regional community banks, such as Union, have hit all-time highs during the recent run.

Even Village Bank, the Midlothian-based institution that has required extra lag time to get caught up after the downturn, is up nearly 15 percent during this stretch.

“For whatever reason, right or wrong, we seem to have unleashed the animal spirits,” Layfield said.

Most bankers agree that the recent rise in prices is tied to factors that the market seems to have latched onto – that a Trump administration is expected to be business-friendly, bringing potential changes such as a drop in the corporate tax rate.

“I think some of it is clearly related to the expectation that corporate tax rates will drop,” said Union CEO Billy Beale. “If we drop from 35 (percent tax rate) to 15 or 20, that’s significant.

“Whatever that number is, it’s going to drop somewhere between 40 to 50 percent, which increases earnings, which gives a better return to shareholders.”

But Trump’s pending presidency has brought reason for an extra dash of optimism among bankers on the belief that his administration will dial back what banks see as an overly burdensome financial regulatory regime.

That includes the hope that he’ll roll back certain provisions of the Dodd-Frank Act and curtail some of the Consumer Financial Protection Bureau’s power.

“I just think we will be in a better regulatory environment and there is optimism that will create a better, more profitable banking environment,” Beale said. “It’s just the attitude that the regulatory environment may not be as oppressive.”

Beale, Layfield and others remain cautious about getting their expectations too high.

Rex Smith, CEO of Essex Bank, said he’s being cautious about the rise in some banks’ stock prices growing out of balance with what the companies can achieve financially.

“It’s nice to get some lift, no question,” said Smith. “You just hope that it’s not outpacing itself.”

Shares in Essex’s parent company have risen nearly 24 percent since the election. Smith noted that many bank stocks had begun to inch up leading up to the election, with institutions like Essex settling into a steady stream of quarterly profits.

“We were creeping up anyway. People began to realize that on an earnings-per-share basis we were trading lower than our peers,” he said.

Smith said a lower corporate tax rate likely would have a trickle-down effect into the economy, which would be good for banks.

But he’s skeptical about what real, near-term effects may come from rolling back financial regulations.

“As far as banks go, even if they totally start to repeal Dodd-Frank, it’s not going to change my expense base dramatically in the next two years.”

He said it wouldn’t be prudent to simply eliminate some of the added compliance and regulatory measures banks have put in place since the recession.

“We still need compliance people,” he said. “If you’re a bank and you start doing that you’re foolish. It’s a complex banking world and compliance is still a major part of keeping it safe for your shareholders. The risks are still there.”

Lacking crystal balls, most local bankers aren’t sure how long this run might last. It depends largely on how quickly expected changes occur after Inauguration Day, if at all.

And while the actual changes in dollars and cents per share aren’t huge – as these sorts of community bank stocks don’t carry huge share prices – local bankers are enjoying the Trump Bump while it lasts.

“It does feel good,” Beale said. “I would say there is a little more pep in the step as we go through this.”

Some call it the “Trump Effect.” Others prefer the “Trump Bump.”

No matter the name, local bankers are soaking up the fact that, since Election Day on Nov. 8, their companies’ stocks have been on the community banking sector’s equivalent of a tear, thanks to expectations that Donald Trump’s presidency will bring favorable changes for the financial industry.

The share prices of locally based and regional community banks with a sizable presence in the Richmond market are up an average of 17.96 percent in the weeks since the election, as of the closing bell on Friday.

While much of the rest of the U.S. stock market also has picked up some added shine during that time, the bump for community bank stocks is a particularly welcome sign in a sector that largely has yet to see its share prices fully bounce back after the recession.

“We all feel like we’ve been toiling in the basement since the downturn,” said Gaylon Layfield, CEO of Richmond-based Xenith Bank. “We are as bankers delighted to see the sector catch up some.”

Shares of Xenith Bank, which recently completed a larger merger with a Hampton Roads-based competitor and a reverse stock split, have jumped 30.6 percent since the election.

Xenith’s headquarters is downtown at the James Center. Its share price is up 30 percent since the election.

Xenith is joined at the top of the recent stock price growth chart by Union Bank and TowneBank, which are up 27 percent and 30 percent, respectively.

The shares of many regional community banks, such as Union, have hit all-time highs during the recent run.

Even Village Bank, the Midlothian-based institution that has required extra lag time to get caught up after the downturn, is up nearly 15 percent during this stretch.

“For whatever reason, right or wrong, we seem to have unleashed the animal spirits,” Layfield said.

Most bankers agree that the recent rise in prices is tied to factors that the market seems to have latched onto – that a Trump administration is expected to be business-friendly, bringing potential changes such as a drop in the corporate tax rate.

“I think some of it is clearly related to the expectation that corporate tax rates will drop,” said Union CEO Billy Beale. “If we drop from 35 (percent tax rate) to 15 or 20, that’s significant.

“Whatever that number is, it’s going to drop somewhere between 40 to 50 percent, which increases earnings, which gives a better return to shareholders.”

But Trump’s pending presidency has brought reason for an extra dash of optimism among bankers on the belief that his administration will dial back what banks see as an overly burdensome financial regulatory regime.

That includes the hope that he’ll roll back certain provisions of the Dodd-Frank Act and curtail some of the Consumer Financial Protection Bureau’s power.

“I just think we will be in a better regulatory environment and there is optimism that will create a better, more profitable banking environment,” Beale said. “It’s just the attitude that the regulatory environment may not be as oppressive.”

Beale, Layfield and others remain cautious about getting their expectations too high.

Rex Smith, CEO of Essex Bank, said he’s being cautious about the rise in some banks’ stock prices growing out of balance with what the companies can achieve financially.

“It’s nice to get some lift, no question,” said Smith. “You just hope that it’s not outpacing itself.”

Shares in Essex’s parent company have risen nearly 24 percent since the election. Smith noted that many bank stocks had begun to inch up leading up to the election, with institutions like Essex settling into a steady stream of quarterly profits.

“We were creeping up anyway. People began to realize that on an earnings-per-share basis we were trading lower than our peers,” he said.

Smith said a lower corporate tax rate likely would have a trickle-down effect into the economy, which would be good for banks.

But he’s skeptical about what real, near-term effects may come from rolling back financial regulations.

“As far as banks go, even if they totally start to repeal Dodd-Frank, it’s not going to change my expense base dramatically in the next two years.”

He said it wouldn’t be prudent to simply eliminate some of the added compliance and regulatory measures banks have put in place since the recession.

“We still need compliance people,” he said. “If you’re a bank and you start doing that you’re foolish. It’s a complex banking world and compliance is still a major part of keeping it safe for your shareholders. The risks are still there.”

Lacking crystal balls, most local bankers aren’t sure how long this run might last. It depends largely on how quickly expected changes occur after Inauguration Day, if at all.

And while the actual changes in dollars and cents per share aren’t huge – as these sorts of community bank stocks don’t carry huge share prices – local bankers are enjoying the Trump Bump while it lasts.

“It does feel good,” Beale said. “I would say there is a little more pep in the step as we go through this.”

Good to see community bank stocks come back into favor with investors (both individuals as well as institutions). Been down and out for way too long, IMHO.