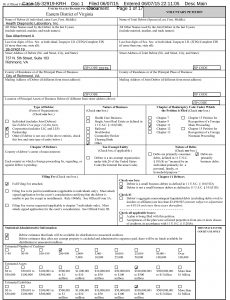

With tens of millions of dollars in debt and under pressure by one of its lenders, Health Diagnostic Laboratory filed for Chapter 11 bankruptcy late Sunday.

The initial filings indicate that HDL has more than 200 creditors, 30 of which were named in the documents. The company lists assets worth between $100 million and $500 million, and liabilities of the same range, bankruptcy court documents show.

Its largest listed creditor is the U.S. Department of Justice, which HDL owes at least $49.5 million after it settled a federal investigation earlier this year. The other listed creditors include several laboratory companies, the Washington Redskins and former HDL chief executive and co-founder Tonya Mallory.

The Chapter 11 filing, aimed at allowing the company to operate while it works to restructure and find a plan to work with creditors, was in part prompted by a notice of default on a BB&T credit agreement, court records show.

The downtown-based laboratory company placed two other entities under Chapter 11 bankruptcy. They are Central Medical Laboratory LLC and Integrated Health Leaders LLC, both affiliates of HDL, court documents show. The company filed a motion for joint administration to combine all three filings into one case.

The filing is signed on behalf of HDL by Martin McGahan, listed as the company’s chief restructuring officer.

Attorney Tyler Brown of Hunton & Williams is representing HDL in its bankruptcy case.

Stay tuned to BizSense for more on this story.

With tens of millions of dollars in debt and under pressure by one of its lenders, Health Diagnostic Laboratory filed for Chapter 11 bankruptcy late Sunday.

The initial filings indicate that HDL has more than 200 creditors, 30 of which were named in the documents. The company lists assets worth between $100 million and $500 million, and liabilities of the same range, bankruptcy court documents show.

Its largest listed creditor is the U.S. Department of Justice, which HDL owes at least $49.5 million after it settled a federal investigation earlier this year. The other listed creditors include several laboratory companies, the Washington Redskins and former HDL chief executive and co-founder Tonya Mallory.

The Chapter 11 filing, aimed at allowing the company to operate while it works to restructure and find a plan to work with creditors, was in part prompted by a notice of default on a BB&T credit agreement, court records show.

The downtown-based laboratory company placed two other entities under Chapter 11 bankruptcy. They are Central Medical Laboratory LLC and Integrated Health Leaders LLC, both affiliates of HDL, court documents show. The company filed a motion for joint administration to combine all three filings into one case.

The filing is signed on behalf of HDL by Martin McGahan, listed as the company’s chief restructuring officer.

Attorney Tyler Brown of Hunton & Williams is representing HDL in its bankruptcy case.

Stay tuned to BizSense for more on this story.