Bank of Lancaster made its debut on the FDIC’s local market share report this year. Photos by Michael Schwartz.

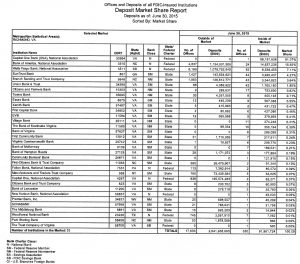

Four banking giants lost some of their grip on the Richmond market over the last year.

Bank of America, Wells Fargo, SunTrust and BB&T now control 30.9 percent of local deposits, according to the annual deposit market share report released last month by the FDIC. That’s down 7 percent from a year ago.

The annual list gives a glimpse of how successful banks were at attracting local deposits during the 12-month period starting June 30, 2014.

There are at least two reasons for the percentage decline seen among the big four. One is the arrival of a few smaller out-of-town banks that have been methodically adding market share.

The most noticeable new addition to the list is Bank of Lancaster, which ventured from the Northern Neck to set up a pair of branches in Richmond last year and has quickly gathered $56 million in local deposits, as of June 30. Its CEO recently said Richmond now accounts for about 17 percent of the bank’s total deposits. While it controls only 0.06 percent of the overall local market share, its quick rise helped it jump ahead of seven other banks in its first appearance on the list locally.

Also new to the list is Charlotte-based Park Sterling Bank, which had picked up $866,000 in local deposits as of June 30. That number is set to skyrocket as the company has a deal in the works to acquire Glen Allen-based First Capital Bank, which stands at No. 11 on the list with $427 million in local deposits, up $35.6 million over last year.

The other reason for the decline in the big four’s market share is the presence of Capital One Bank, which is a major caveat in the Richmond numbers on the FDIC rankings each year.

The bank has no major branch operations in the area but is technically headquartered here, and on paper it keeps its $56.1 billion in deposits in the local market. That’s up $20 billion from last year, and Capital One Bank now accounts for 61 percent of all deposits that are considered held in the Richmond market. Capital One’s hold on the market increased by nearly 9 percent since last year, driving down the percent share of most other banks in the area, despite the fact that many actually increased their deposits dollar-wise.

Excluding Capital One’s increases, the 32 other banks in the market added a combined $3.4 billion in deposits over the 12-month period.

Other notable ups and downs on the list included Xenith Bank leapfrogging First Capital and Village Bank into the top 10 in market share. It added $72 million in local deposits over the 12 months and had $431.72 million as of June 30. It controls 0.47 percent of the deposit market.

Essex Bank added $106 million in deposits to hold onto the No. 9 spot in the rankings. Its $507 million in local deposits gave it a 0.55 percent market share. EVB overtook Village Bank and Bank of Southside Virginia by $29 million in local deposits to reach $379 million at the No. 12 spot with 0.41 percent market share.

And Midlothian-based Bank of Virginia jumped up a spot to No. 15 with the addition of $40 million in local deposits. It had a total of $286 million in local deposits for a 0.31 percent market share.

There were some banks that saw their total local deposits decline over the 12 months: Bank of Hampton Roads (operating here as Gateway Bank), Bank of McKenney, First Community Bank, Fulton Bank, M&T Bank, Premier Bank and Village Bank.

First Community’s $42.9 million drop in deposits over the year comes as it is in the midst of a shift of its strategy in Richmond to focus more on commercial banking.

And despite the decline in percentage market share for Wells Fargo, Bank of America, SunTrust and BB&T, each of the big four saw their total local deposits rise over the 12 months by a combined $3 billion, to a total of $28.44 billion and a combined 30.9 percent market share. Of that total, BofA outpaced the foursome with $14.63 billion, up $2.1 billion, and a 15.92 percent market share.

As usual, the largest market share held by a Richmond-based institution was Union Bank & Trust, which held 1.85 percent share thanks to $1.7 billion in local deposits.

Bank of Lancaster made its debut on the FDIC’s local market share report this year. Photos by Michael Schwartz.

Four banking giants lost some of their grip on the Richmond market over the last year.

Bank of America, Wells Fargo, SunTrust and BB&T now control 30.9 percent of local deposits, according to the annual deposit market share report released last month by the FDIC. That’s down 7 percent from a year ago.

The annual list gives a glimpse of how successful banks were at attracting local deposits during the 12-month period starting June 30, 2014.

There are at least two reasons for the percentage decline seen among the big four. One is the arrival of a few smaller out-of-town banks that have been methodically adding market share.

The most noticeable new addition to the list is Bank of Lancaster, which ventured from the Northern Neck to set up a pair of branches in Richmond last year and has quickly gathered $56 million in local deposits, as of June 30. Its CEO recently said Richmond now accounts for about 17 percent of the bank’s total deposits. While it controls only 0.06 percent of the overall local market share, its quick rise helped it jump ahead of seven other banks in its first appearance on the list locally.

Also new to the list is Charlotte-based Park Sterling Bank, which had picked up $866,000 in local deposits as of June 30. That number is set to skyrocket as the company has a deal in the works to acquire Glen Allen-based First Capital Bank, which stands at No. 11 on the list with $427 million in local deposits, up $35.6 million over last year.

The other reason for the decline in the big four’s market share is the presence of Capital One Bank, which is a major caveat in the Richmond numbers on the FDIC rankings each year.

The bank has no major branch operations in the area but is technically headquartered here, and on paper it keeps its $56.1 billion in deposits in the local market. That’s up $20 billion from last year, and Capital One Bank now accounts for 61 percent of all deposits that are considered held in the Richmond market. Capital One’s hold on the market increased by nearly 9 percent since last year, driving down the percent share of most other banks in the area, despite the fact that many actually increased their deposits dollar-wise.

Excluding Capital One’s increases, the 32 other banks in the market added a combined $3.4 billion in deposits over the 12-month period.

Other notable ups and downs on the list included Xenith Bank leapfrogging First Capital and Village Bank into the top 10 in market share. It added $72 million in local deposits over the 12 months and had $431.72 million as of June 30. It controls 0.47 percent of the deposit market.

Essex Bank added $106 million in deposits to hold onto the No. 9 spot in the rankings. Its $507 million in local deposits gave it a 0.55 percent market share. EVB overtook Village Bank and Bank of Southside Virginia by $29 million in local deposits to reach $379 million at the No. 12 spot with 0.41 percent market share.

And Midlothian-based Bank of Virginia jumped up a spot to No. 15 with the addition of $40 million in local deposits. It had a total of $286 million in local deposits for a 0.31 percent market share.

There were some banks that saw their total local deposits decline over the 12 months: Bank of Hampton Roads (operating here as Gateway Bank), Bank of McKenney, First Community Bank, Fulton Bank, M&T Bank, Premier Bank and Village Bank.

First Community’s $42.9 million drop in deposits over the year comes as it is in the midst of a shift of its strategy in Richmond to focus more on commercial banking.

And despite the decline in percentage market share for Wells Fargo, Bank of America, SunTrust and BB&T, each of the big four saw their total local deposits rise over the 12 months by a combined $3 billion, to a total of $28.44 billion and a combined 30.9 percent market share. Of that total, BofA outpaced the foursome with $14.63 billion, up $2.1 billion, and a 15.92 percent market share.

As usual, the largest market share held by a Richmond-based institution was Union Bank & Trust, which held 1.85 percent share thanks to $1.7 billion in local deposits.