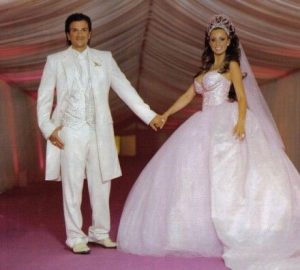

Markel now insures weddings – except for the cold feet.

Markel now insures weddings – except for the cold feet.

The Richmond-based specialty insurer last week rolled out two new lines: wedding insurance and special event insurance.

Markel’s wedding line offers two types of coverage: wedding cancellation/postponement insurance and wedding liability insurance.

It helps wedding parties get reimbursed for lost deposits, lost jewelry or gifts, damage to wedding attire or venues, or if someone is injured at a wedding.

Here are some of the examples that Markel lists as coverable wedding instances: “Hurricanes hit. Pipes break in reception halls. Vendors go out of business. Mothers of the bride need emergency appendectomies. Brides and grooms in the military get deployed. Equipment gets damaged.”

Those ideas inspired BizSense to wonder whether these other wedding blunders would be covered:

What if you get left at the altar?

Or how about when, given the choice of chicken or fish, every wedding guest who chose fish falls violently ill?

Or when the priest/rabbi asks whether there are any objections, and an old fling, not willing to forever hold his or her peace, stands up and objects, causing the bridge or groom to run off?

Or what if one of your distant cousins, who is only there for the free booze anyway, gets caught swiping wallets from the coat check?

Or how about if a drunken bridesmaid spills red wine on the bride’s wedding gown?

“The possibilities are endless,” Markel says on its website, though the company did say it doesn’t cover cold feet or change of heart.

“The possibilities are endless,” Markel says on its website, though the company did say it doesn’t cover cold feet or change of heart.

Markel’s special events line covers cancellation/postponement and liability for private events such as bar mitzvahs, house warming parties and memorial services; and business/corporate events such as fund-raising dinners and company Christmas parties.

There are just more examples of the interesting types of niche coverage from a company that insures everything from oil rigs to horses.

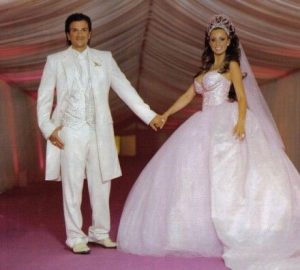

Markel now insures weddings – except for the cold feet.

Markel now insures weddings – except for the cold feet.

The Richmond-based specialty insurer last week rolled out two new lines: wedding insurance and special event insurance.

Markel’s wedding line offers two types of coverage: wedding cancellation/postponement insurance and wedding liability insurance.

It helps wedding parties get reimbursed for lost deposits, lost jewelry or gifts, damage to wedding attire or venues, or if someone is injured at a wedding.

Here are some of the examples that Markel lists as coverable wedding instances: “Hurricanes hit. Pipes break in reception halls. Vendors go out of business. Mothers of the bride need emergency appendectomies. Brides and grooms in the military get deployed. Equipment gets damaged.”

Those ideas inspired BizSense to wonder whether these other wedding blunders would be covered:

What if you get left at the altar?

Or how about when, given the choice of chicken or fish, every wedding guest who chose fish falls violently ill?

Or when the priest/rabbi asks whether there are any objections, and an old fling, not willing to forever hold his or her peace, stands up and objects, causing the bridge or groom to run off?

Or what if one of your distant cousins, who is only there for the free booze anyway, gets caught swiping wallets from the coat check?

Or how about if a drunken bridesmaid spills red wine on the bride’s wedding gown?

“The possibilities are endless,” Markel says on its website, though the company did say it doesn’t cover cold feet or change of heart.

“The possibilities are endless,” Markel says on its website, though the company did say it doesn’t cover cold feet or change of heart.

Markel’s special events line covers cancellation/postponement and liability for private events such as bar mitzvahs, house warming parties and memorial services; and business/corporate events such as fund-raising dinners and company Christmas parties.

There are just more examples of the interesting types of niche coverage from a company that insures everything from oil rigs to horses.