StellarOne Bank wants a piece of the action in Richmond.

StellarOne Bank wants a piece of the action in Richmond.

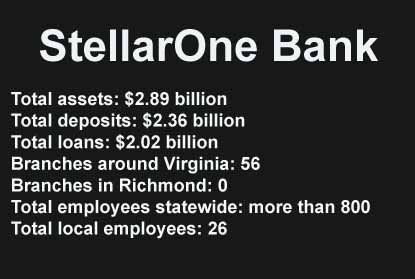

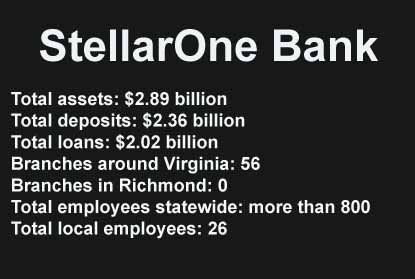

One of the biggest banks in the state, Christiansburg-based StellarOne has been quietly increasing its presence in Richmond since putting boots on the ground locally in 2007. And in a move that would add a major player to an already crowded and competitive local banking scene, the bank has its sights set on adding branches in the market, likely through acquisition.

StellarOne has 26 employees in Richmond working out of its office in Western Henrico, and it’s itching to increase visibility. In the banking world, visibility equals branches.

“We basically have almost every area of the bank represented here in Richmond except our retail consumer presence,” said Pat Collins, director of StellarOne’s commercial banking unit in Richmond.

Retail consumer presence is bank-speak for branches, of which StellarOne has 56 spread across the Virginia.

“It doesn’t take a rocket scientist to figure out that with this many people we have a major commitment to the Richmond market,” Collins said.

StellarOne has been dropping hints that it wants a piece of the Richmond market.

In July 2010, the nearly $3 billion bank made Richmond the home of its wealth management division, giving it a chance to get its name out to wealthy Richmonders.

Richmond even got a shout-out in StellarOne’s first-quarter earnings release, with its CEO commenting that its local personnel additions were making an impact.

StellarOne recently had a reception at the Country Club of Virginia to schmooze clients and potential customers, according to CFO Jeff Farrar.

Farrar recently spoke with BizSense about the bank’s options for a Richmond expansion, which would likely involve leasing vacant bank branches, acquiring individual branches of existing local banks (which would come with those branches’ customers and deposits) or acquiring a competitor altogether.

“We feel like we’ve gotten a good start,” Farrar said. “We’re figuring out what strategy will best leverage what [the bank’s local employees] have gotten started there and what makes the most sense in terms of a retail presence. M&A is certainly a part of that.”

StellarOne controls just $23.98 million in deposits locally, or 0.04 percent of all deposits in the Richmond market, according to the most recent figures from the FDIC. But that figure is nearly a year old and has likely increased.

Its local staff has also been working to get its share of the local commercial lending scene, keeping a particular eye on non-real estate commercial loans, Farrar said.

As the bank works to get the word out and make the StellarOne name better known about town, Farrar said there is a consistent question that comes up.

“The first thing out of peoples’ mouths is, ‘When are you going to get us a branch?’”

But the brand is only a few years old. It was created in 2007 through the merger of Virginia Financial Group and the parent of First National Bank of Harrisonburg. Today, StellarOne Bank is still headquartered in Harrisonburg, while its holding company, StellarOne Corp., calls Charlottesville home.

But the brand is only a few years old. It was created in 2007 through the merger of Virginia Financial Group and the parent of First National Bank of Harrisonburg. Today, StellarOne Bank is still headquartered in Harrisonburg, while its holding company, StellarOne Corp., calls Charlottesville home.

Banks with similar growth ambitions have lately forgone the traditional practice of building a branch from scratch and instead have been acquiring branches of other banks.

Tom Tullidge, a partner at Cary Street Partners who works bank M&A deals, said the wheels are turning on potential bank expansions.

“There are a number of people focused on finding a vehicle to enter the market,” Tullidge said.

Some banks are doing so by hiring teams of bankers away from the competition, as StellarOne has done up until now.

But cracking a new market takes more than that to make real push, Tullidge said.

“Usually if they want to have a more meaningful presence in the market, acquisition is the way to do it,” he said. “But finding the right candidate is more difficult.”

There are a handful of likely targets: banks that have been weakened by the recession and have soured loan portfolios.

However, Tullidge said those weaker banks probably aren’t prime targets for a bank like StellarOne.

“They’re probably looking at either a fairly strong financial results type of bank or one with a little more size,” Tullidge said. “It’s not going to be in the $100 million to $150 million in assets range, but more in the $400 million to $600 million range.”

Farrar said that the biggest challenge when looking at potentially acquiring a bank is judging the true health of the company. That’s because the recession has battered both borrowers and the loans that are already on the books.

“Loan portfolios right now are tough to assess, and it’s just very difficult to know what you’re buying,” Farrar said.

For that reason, a less risky and quicker alternative to a full-on acquisition could be to just buy individual branches from a bank, whether those branches are active or just sitting vacant.

As it plans its expansion, StellarOne also has to take into account the future of the branch banking business. More and more consumers are using the Internet to handle the sort of transactions that used to require a trip to a branch.

“Maybe we need to look at what the customer of the future wants,” Farrar said, adding that he envisions having six to eight branches in Richmond.

“I see us being able to cover that market with fewer branches. And it wouldn’t be a traditional franchise where you’re strategically located on every hot street corner.”

But the corners that it does choose for new branches will also likely include other markets around the state.

StellarOne, in addition to Richmond, has its eyes on M&A deals in Hampton Roads and Northern Virginia.

“In order for us to be the bank we want to be in Virginia, we need to have a statewide presence, and we need to be in the higher-growth markets,” Farrar said.

The asset size that he envisions will likely be in the range of $7 billion to $10 billion.

“We all realize we’re going to have to move to a higher level to generate the kind of returns that are needed.”

Michael Schwartz covers banking for BizSense. Please send news tips to [email protected].

StellarOne Bank wants a piece of the action in Richmond.

StellarOne Bank wants a piece of the action in Richmond.

One of the biggest banks in the state, Christiansburg-based StellarOne has been quietly increasing its presence in Richmond since putting boots on the ground locally in 2007. And in a move that would add a major player to an already crowded and competitive local banking scene, the bank has its sights set on adding branches in the market, likely through acquisition.

StellarOne has 26 employees in Richmond working out of its office in Western Henrico, and it’s itching to increase visibility. In the banking world, visibility equals branches.

“We basically have almost every area of the bank represented here in Richmond except our retail consumer presence,” said Pat Collins, director of StellarOne’s commercial banking unit in Richmond.

Retail consumer presence is bank-speak for branches, of which StellarOne has 56 spread across the Virginia.

“It doesn’t take a rocket scientist to figure out that with this many people we have a major commitment to the Richmond market,” Collins said.

StellarOne has been dropping hints that it wants a piece of the Richmond market.

In July 2010, the nearly $3 billion bank made Richmond the home of its wealth management division, giving it a chance to get its name out to wealthy Richmonders.

Richmond even got a shout-out in StellarOne’s first-quarter earnings release, with its CEO commenting that its local personnel additions were making an impact.

StellarOne recently had a reception at the Country Club of Virginia to schmooze clients and potential customers, according to CFO Jeff Farrar.

Farrar recently spoke with BizSense about the bank’s options for a Richmond expansion, which would likely involve leasing vacant bank branches, acquiring individual branches of existing local banks (which would come with those branches’ customers and deposits) or acquiring a competitor altogether.

“We feel like we’ve gotten a good start,” Farrar said. “We’re figuring out what strategy will best leverage what [the bank’s local employees] have gotten started there and what makes the most sense in terms of a retail presence. M&A is certainly a part of that.”

StellarOne controls just $23.98 million in deposits locally, or 0.04 percent of all deposits in the Richmond market, according to the most recent figures from the FDIC. But that figure is nearly a year old and has likely increased.

Its local staff has also been working to get its share of the local commercial lending scene, keeping a particular eye on non-real estate commercial loans, Farrar said.

As the bank works to get the word out and make the StellarOne name better known about town, Farrar said there is a consistent question that comes up.

“The first thing out of peoples’ mouths is, ‘When are you going to get us a branch?’”

But the brand is only a few years old. It was created in 2007 through the merger of Virginia Financial Group and the parent of First National Bank of Harrisonburg. Today, StellarOne Bank is still headquartered in Harrisonburg, while its holding company, StellarOne Corp., calls Charlottesville home.

But the brand is only a few years old. It was created in 2007 through the merger of Virginia Financial Group and the parent of First National Bank of Harrisonburg. Today, StellarOne Bank is still headquartered in Harrisonburg, while its holding company, StellarOne Corp., calls Charlottesville home.

Banks with similar growth ambitions have lately forgone the traditional practice of building a branch from scratch and instead have been acquiring branches of other banks.

Tom Tullidge, a partner at Cary Street Partners who works bank M&A deals, said the wheels are turning on potential bank expansions.

“There are a number of people focused on finding a vehicle to enter the market,” Tullidge said.

Some banks are doing so by hiring teams of bankers away from the competition, as StellarOne has done up until now.

But cracking a new market takes more than that to make real push, Tullidge said.

“Usually if they want to have a more meaningful presence in the market, acquisition is the way to do it,” he said. “But finding the right candidate is more difficult.”

There are a handful of likely targets: banks that have been weakened by the recession and have soured loan portfolios.

However, Tullidge said those weaker banks probably aren’t prime targets for a bank like StellarOne.

“They’re probably looking at either a fairly strong financial results type of bank or one with a little more size,” Tullidge said. “It’s not going to be in the $100 million to $150 million in assets range, but more in the $400 million to $600 million range.”

Farrar said that the biggest challenge when looking at potentially acquiring a bank is judging the true health of the company. That’s because the recession has battered both borrowers and the loans that are already on the books.

“Loan portfolios right now are tough to assess, and it’s just very difficult to know what you’re buying,” Farrar said.

For that reason, a less risky and quicker alternative to a full-on acquisition could be to just buy individual branches from a bank, whether those branches are active or just sitting vacant.

As it plans its expansion, StellarOne also has to take into account the future of the branch banking business. More and more consumers are using the Internet to handle the sort of transactions that used to require a trip to a branch.

“Maybe we need to look at what the customer of the future wants,” Farrar said, adding that he envisions having six to eight branches in Richmond.

“I see us being able to cover that market with fewer branches. And it wouldn’t be a traditional franchise where you’re strategically located on every hot street corner.”

But the corners that it does choose for new branches will also likely include other markets around the state.

StellarOne, in addition to Richmond, has its eyes on M&A deals in Hampton Roads and Northern Virginia.

“In order for us to be the bank we want to be in Virginia, we need to have a statewide presence, and we need to be in the higher-growth markets,” Farrar said.

The asset size that he envisions will likely be in the range of $7 billion to $10 billion.

“We all realize we’re going to have to move to a higher level to generate the kind of returns that are needed.”

Michael Schwartz covers banking for BizSense. Please send news tips to [email protected].