What happened in Vegas may have stayed in Vegas.

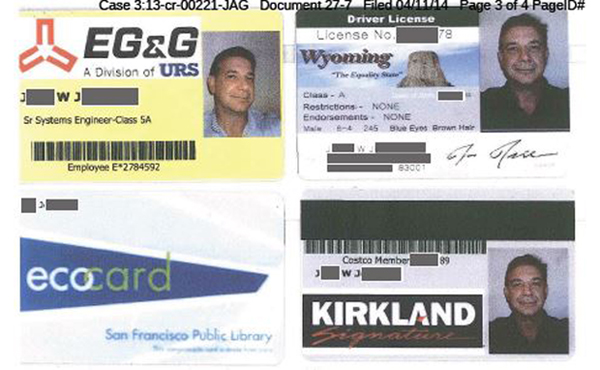

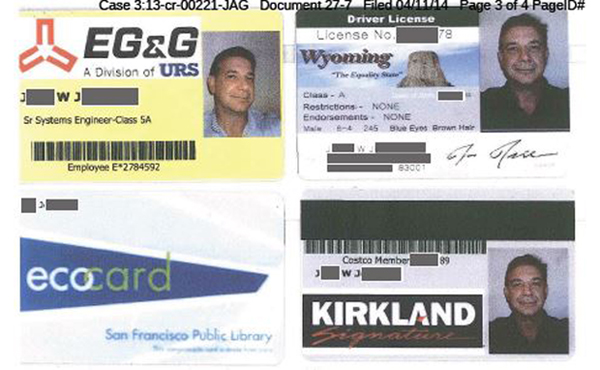

Allegedly false ID’s that Jefferson had created to escape to England (photos from the criminal complaint)

That’s one of the arguments made Monday by attorneys defending embattled Richmond landlord Billy G. Jefferson Jr. as he faces potential new charges and more prison time for an alleged tale of hidden cash, Vegas high rolling, fake IDs and a plot to flee to England.

In firing back against the U.S. Attorney’s Office, Jefferson’s lawyers on Monday argued that he did not breach his federal guilty plea agreement and made no attempt to hide money as prosecutors alleged earlier this month. They also claim that the government “ultimately has no idea ‘what happened in Vegas,’” related to Jefferson’s trips there leading up to his guilty plea.

The defense claims that Jefferson has made a good faith effort to liquidate his real estate holdings to cover restitution payments for his tax credit fraud and last year hired commercial real estate firm CBRE to assess 29 of his properties. That resulted in a presented total value of $44.9 million for the properties, though many of his properties are now managed by receivers and will likely be liquidated out of his control by those third parties.

Jefferson has meanwhile directed his brother to hire Motley’s Asset Disposition Group to liquidate his personal effects. Court documents did not list specific details of what possessions that may be.

He also put his personal residence up for sale, the defense claims, only to have the home taken off the market after the prosecution objected to the appointed real estate agent entering the home. He had retained Historic Richmond Homes to try and sell the 6,400-square-foot home at the corner of Boulevard and Monument Avenue.

Jefferson’s defense team presented these new facts and arguments Monday in response to the U.S. Attorney’s allegations that the developer orchestrated a “breathtaking campaign” to shuffle around and hide money leading up to and in the aftermath of his guilty plea in December. Jefferson is represented by John Martin of Hunton & Williams and Chuck James of Williams Mullen.

Prosecutors argued last month that Jefferson’s alleged actions violated the plea agreement that called for a 6.5-year prison sentence. They asked for release from that initial agreement to seek the maximum 20-year sentence.

Jefferson’s defense claims that a majority of those alleged actions, including a planned charter flight to England and $400,000 in bonuses paid to business associates, happened before the plea agreement was in place and therefore cannot be used as grounds for terminating the deal.

His lawyers defended questions about at least three Las Vegas trips Jefferson allegedly took before the December plea hearing and whether he gambled away loads of money or lied by telling the IRS he did.

Both sides agree Jefferson withdrew about $2.1 million in cash while in Las Vegas. Prosecutors, in their search for assets, allege that he took home a considerable amount of that cash. They further allege that Jefferson later told an IRS agent that he gambled away or spent all of his Vegas money.

Jefferson’s camp claims prosecutors still haven’t seen records from one of at least three casinos he allegedly visited during that time and haven’t accounted for potential meals and other entertainment Jefferson may have dropped money on in Vegas. Without those records, his attorneys said it’s reasonable to infer that he could have lost or spent hundreds of thousands more elsewhere in Las Vegas, leaving him with no money to take home and hide.

“It would take about five minutes for someone willing to gamble away $437,000 in one casino to lose 10 times that in another casino,” their response reads. “And the government apparently is not even bothering to investigate whether or not defendant lost money in any private poker games or at other casinos.”

After the December plea agreement, prosecutors claim that Jefferson flouted a provision that required him to report any cash or real estate transfer in excess of $25,000. Since Dec. 19, Jefferson moved $1.6 million between his own foreign accounts, sent his ex-wife $375,000 and made several transactions valued at just less than the $25,000 reporting threshold.

The defense did not dispute that any of those cash movements occurred but argued that none of them violated the plea agreement.

First, the defense lawyers said 16 separate $100,000 transactions, which went from a Jefferson bank account in the United Arab Emirates to another in Hong Kong, did not constitute a “transfer” of funds because a transfer “implies conveyance from one party to another.”

The moving of cash between those accounts, they argue, was traceable and the cash is equally available for restitution payment in one account as it is in another. They compared the moves to Jefferson carrying physical cash from one room in his home to another.

The defense further claimed Jefferson has made $1 million of a previously agreed upon $13 million restitution requirement out of those repatriated funds.

Next, they said the money Jefferson sent to his ex-wife was part of a series of transfers ordered by the court in 2011 between him and his now ex-wife.

For the transfers that were “just under” the $25,000 threshold, the defense claims they were just that – below the amount Jefferson was required to report.

“At its core, the government wishes to assert that because he complied with the court’s order, the court should conclude that the defendant violated the court’s order,” the response reads.

Jefferson’s response made no reference to the prosecution’s claims of fake IDs featuring his photo and his brother’s personal information, which he allegedly created leading up to his plea.

In a separate memorandum filed Monday, Jefferson’s defense argued that the federal government didn’t hold up its end of the plea agreement.

His attorneys claim the government is unlawfully profiting by taking back nearly $2 million in tax credits from the West Coast firm Jefferson sold them to. That’s in addition to the already agreed upon $12.9 million Jefferson must pay in restitution.

Jefferson sold the tax credits from multiple projects to a firm listed in the court records as CUSA, which is in San Francisco.

His defense states that the IRS has sought to recapture $1.9 million in tax credits tied to rehab expenses initially deemed legitimate by IRS agents in Richmond but later found to be invalid by agents on the West Coast.

The amount of illegitimate and legitimate tax credit-qualified expenses was used in the calculation of Jefferson’s restitution total. Now, CUSA will likely seek to recover that $1.9 million from Jefferson himself, the defense said.

“In short, because of the wildly differing positions of the IRS, if the Court’s Restitution Order remains in place, defendant will have to pay $1,928,646 twice, once to the Court and once to CUSA, so that the United States can keep for itself the same amount,” the memo reads.

A hearing to determine which side, if either, is guilty of breaching the plea agreement is scheduled for May 7. Jefferson is scheduled to be sentenced on May 9, though that date may be pushed back in light of new charges the U.S. Attorney’s Office said it intends to file.

What happened in Vegas may have stayed in Vegas.

Allegedly false ID’s that Jefferson had created to escape to England (photos from the criminal complaint)

That’s one of the arguments made Monday by attorneys defending embattled Richmond landlord Billy G. Jefferson Jr. as he faces potential new charges and more prison time for an alleged tale of hidden cash, Vegas high rolling, fake IDs and a plot to flee to England.

In firing back against the U.S. Attorney’s Office, Jefferson’s lawyers on Monday argued that he did not breach his federal guilty plea agreement and made no attempt to hide money as prosecutors alleged earlier this month. They also claim that the government “ultimately has no idea ‘what happened in Vegas,’” related to Jefferson’s trips there leading up to his guilty plea.

The defense claims that Jefferson has made a good faith effort to liquidate his real estate holdings to cover restitution payments for his tax credit fraud and last year hired commercial real estate firm CBRE to assess 29 of his properties. That resulted in a presented total value of $44.9 million for the properties, though many of his properties are now managed by receivers and will likely be liquidated out of his control by those third parties.

Jefferson has meanwhile directed his brother to hire Motley’s Asset Disposition Group to liquidate his personal effects. Court documents did not list specific details of what possessions that may be.

He also put his personal residence up for sale, the defense claims, only to have the home taken off the market after the prosecution objected to the appointed real estate agent entering the home. He had retained Historic Richmond Homes to try and sell the 6,400-square-foot home at the corner of Boulevard and Monument Avenue.

Jefferson’s defense team presented these new facts and arguments Monday in response to the U.S. Attorney’s allegations that the developer orchestrated a “breathtaking campaign” to shuffle around and hide money leading up to and in the aftermath of his guilty plea in December. Jefferson is represented by John Martin of Hunton & Williams and Chuck James of Williams Mullen.

Prosecutors argued last month that Jefferson’s alleged actions violated the plea agreement that called for a 6.5-year prison sentence. They asked for release from that initial agreement to seek the maximum 20-year sentence.

Jefferson’s defense claims that a majority of those alleged actions, including a planned charter flight to England and $400,000 in bonuses paid to business associates, happened before the plea agreement was in place and therefore cannot be used as grounds for terminating the deal.

His lawyers defended questions about at least three Las Vegas trips Jefferson allegedly took before the December plea hearing and whether he gambled away loads of money or lied by telling the IRS he did.

Both sides agree Jefferson withdrew about $2.1 million in cash while in Las Vegas. Prosecutors, in their search for assets, allege that he took home a considerable amount of that cash. They further allege that Jefferson later told an IRS agent that he gambled away or spent all of his Vegas money.

Jefferson’s camp claims prosecutors still haven’t seen records from one of at least three casinos he allegedly visited during that time and haven’t accounted for potential meals and other entertainment Jefferson may have dropped money on in Vegas. Without those records, his attorneys said it’s reasonable to infer that he could have lost or spent hundreds of thousands more elsewhere in Las Vegas, leaving him with no money to take home and hide.

“It would take about five minutes for someone willing to gamble away $437,000 in one casino to lose 10 times that in another casino,” their response reads. “And the government apparently is not even bothering to investigate whether or not defendant lost money in any private poker games or at other casinos.”

After the December plea agreement, prosecutors claim that Jefferson flouted a provision that required him to report any cash or real estate transfer in excess of $25,000. Since Dec. 19, Jefferson moved $1.6 million between his own foreign accounts, sent his ex-wife $375,000 and made several transactions valued at just less than the $25,000 reporting threshold.

The defense did not dispute that any of those cash movements occurred but argued that none of them violated the plea agreement.

First, the defense lawyers said 16 separate $100,000 transactions, which went from a Jefferson bank account in the United Arab Emirates to another in Hong Kong, did not constitute a “transfer” of funds because a transfer “implies conveyance from one party to another.”

The moving of cash between those accounts, they argue, was traceable and the cash is equally available for restitution payment in one account as it is in another. They compared the moves to Jefferson carrying physical cash from one room in his home to another.

The defense further claimed Jefferson has made $1 million of a previously agreed upon $13 million restitution requirement out of those repatriated funds.

Next, they said the money Jefferson sent to his ex-wife was part of a series of transfers ordered by the court in 2011 between him and his now ex-wife.

For the transfers that were “just under” the $25,000 threshold, the defense claims they were just that – below the amount Jefferson was required to report.

“At its core, the government wishes to assert that because he complied with the court’s order, the court should conclude that the defendant violated the court’s order,” the response reads.

Jefferson’s response made no reference to the prosecution’s claims of fake IDs featuring his photo and his brother’s personal information, which he allegedly created leading up to his plea.

In a separate memorandum filed Monday, Jefferson’s defense argued that the federal government didn’t hold up its end of the plea agreement.

His attorneys claim the government is unlawfully profiting by taking back nearly $2 million in tax credits from the West Coast firm Jefferson sold them to. That’s in addition to the already agreed upon $12.9 million Jefferson must pay in restitution.

Jefferson sold the tax credits from multiple projects to a firm listed in the court records as CUSA, which is in San Francisco.

His defense states that the IRS has sought to recapture $1.9 million in tax credits tied to rehab expenses initially deemed legitimate by IRS agents in Richmond but later found to be invalid by agents on the West Coast.

The amount of illegitimate and legitimate tax credit-qualified expenses was used in the calculation of Jefferson’s restitution total. Now, CUSA will likely seek to recover that $1.9 million from Jefferson himself, the defense said.

“In short, because of the wildly differing positions of the IRS, if the Court’s Restitution Order remains in place, defendant will have to pay $1,928,646 twice, once to the Court and once to CUSA, so that the United States can keep for itself the same amount,” the memo reads.

A hearing to determine which side, if either, is guilty of breaching the plea agreement is scheduled for May 7. Jefferson is scheduled to be sentenced on May 9, though that date may be pushed back in light of new charges the U.S. Attorney’s Office said it intends to file.