In the continued domino effect of a local contractor’s legal troubles, a Henrico masonry company has filed bankruptcy.

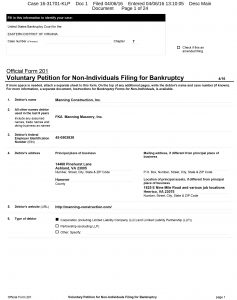

Manning Construction, owned by Michael Manning, was placed into Chapter 7 bankruptcy on Wednesday. It comes just weeks after Manning pleaded guilty to deliberately not collecting or paying more than $800,000 in employment taxes from the masonry company to the IRS.

The federal case also revealed that Manning lied on loan documents to banks over several years in order to keep money flowing to his businesses.

At least one of Manning’s lenders, Bank of Lancaster, has shown in court and regulatory filings the hit it took from Manning’s actions.

Bank of Lancaster is listed among the more than 100 creditors mentioned in Manning Construction’s initial Chapter 7 filing. Other lenders on the list include EVB, Wells Fargo, Bank of the West, BB&T and M&T Bank.

The filing shows that creditors are owed a total of $1 million to $10 million, the same value range listed for the company’s assets.

The initial filing doesn’t list specific amounts owed to creditors, nor does it list descriptions of the company’s assets, which are likely to include large amount of construction equipment.

One asset that’s already out of reach is the Manning Construction office 1825 E. Nine Mile Road in eastern Henrico. It was foreclosed on by Bank of Lancaster, which has several civil lawsuits pending against Manning, his wife and Manning Construction.

The bank also won court approval to have Manning Construction put into receivership. That process, along with any pending civil suits against the company, is now frozen by the bankruptcy.

Other local creditors listed in the filing include The City of Richmond, Henrico County, the state Department of Taxation, Hanover County.

One asset that will likely be fought over is Manning’s personal home, a 5,700-square-foot property in the Country Club Hills neighborhood surrounding Hanover Country Club.

There are also several bonding and surety companies jockeying for position for the rights to Manning’s business assets. Those companies were brought on to take over Manning Construction’s various jobs that were ongoing. Bonding companies typically step in in such instances to take over construction jobs gone awry.

The company did high-end masonry work on public and private sector sites and had about 20 jobs ongoing when the legal troubles began. Only a handful of those jobs were bonded.

Manning Construction is represented in its Chapter 7 case by attorney Karen Crowley of the Norfolk law firm Crowley, Liberatore, Ryan & Brogan.

Messages left for Crowley were not returned by press time.

Manning now awaits a May 31 sentencing hearing where he’ll face the potential for up to five years in prison, restitution and fines. He is allowed to remain free until sentencing.

In the continued domino effect of a local contractor’s legal troubles, a Henrico masonry company has filed bankruptcy.

Manning Construction, owned by Michael Manning, was placed into Chapter 7 bankruptcy on Wednesday. It comes just weeks after Manning pleaded guilty to deliberately not collecting or paying more than $800,000 in employment taxes from the masonry company to the IRS.

The federal case also revealed that Manning lied on loan documents to banks over several years in order to keep money flowing to his businesses.

At least one of Manning’s lenders, Bank of Lancaster, has shown in court and regulatory filings the hit it took from Manning’s actions.

Bank of Lancaster is listed among the more than 100 creditors mentioned in Manning Construction’s initial Chapter 7 filing. Other lenders on the list include EVB, Wells Fargo, Bank of the West, BB&T and M&T Bank.

The filing shows that creditors are owed a total of $1 million to $10 million, the same value range listed for the company’s assets.

The initial filing doesn’t list specific amounts owed to creditors, nor does it list descriptions of the company’s assets, which are likely to include large amount of construction equipment.

One asset that’s already out of reach is the Manning Construction office 1825 E. Nine Mile Road in eastern Henrico. It was foreclosed on by Bank of Lancaster, which has several civil lawsuits pending against Manning, his wife and Manning Construction.

The bank also won court approval to have Manning Construction put into receivership. That process, along with any pending civil suits against the company, is now frozen by the bankruptcy.

Other local creditors listed in the filing include The City of Richmond, Henrico County, the state Department of Taxation, Hanover County.

One asset that will likely be fought over is Manning’s personal home, a 5,700-square-foot property in the Country Club Hills neighborhood surrounding Hanover Country Club.

There are also several bonding and surety companies jockeying for position for the rights to Manning’s business assets. Those companies were brought on to take over Manning Construction’s various jobs that were ongoing. Bonding companies typically step in in such instances to take over construction jobs gone awry.

The company did high-end masonry work on public and private sector sites and had about 20 jobs ongoing when the legal troubles began. Only a handful of those jobs were bonded.

Manning Construction is represented in its Chapter 7 case by attorney Karen Crowley of the Norfolk law firm Crowley, Liberatore, Ryan & Brogan.

Messages left for Crowley were not returned by press time.

Manning now awaits a May 31 sentencing hearing where he’ll face the potential for up to five years in prison, restitution and fines. He is allowed to remain free until sentencing.