Less than a month after falling into bankruptcy and laying off a portion of its 300 workers in downtown Richmond, a Texas-based blood-testing company is setting itself up to be sold.

True Health Diagnostics, which operates a large laboratory at 737 N. Fifth St. in the Virginia Biotech Park, has begun the process of finding a buyer for the bulk of its assets while it continues its Chapter 11 bankruptcy process.

The company filed for bankruptcy protection in late July, after it said it was cut off for the second time in two years from Medicare reimbursements, which account for about 30 percent of its business and tens of millions of dollars.

The Chapter 11 filing coincided with the company laying off about 80 of its 300 employees, including several dozen in Richmond. It since has been operating as usual with the help of a temporary financing round to keep it afloat until it can find a buyer.

Cliff Zucker, the company’s chief restructuring officer, said the move toward a sale looks to be the best way forward for the company in lieu of additional financing to keep it operating long enough to emerge from bankruptcy and beyond.

“Bid procedures were filed in order to market the company and the goal is to sell it as a going concern,” Zucker said. “Without funding, there’s no other option.”

The company has hired investment banking firm SSG Capital Advisors to handle the sale.

The deadline for bids to purchase the company’s assets is 4 p.m. Sept. 13. Bids must be submitted to SSG.

The company’s Richmond operations continue as is and no further layoffs have occurred, though Zucker said there has been some attrition caused by the company’s uncertain future.

History repeats

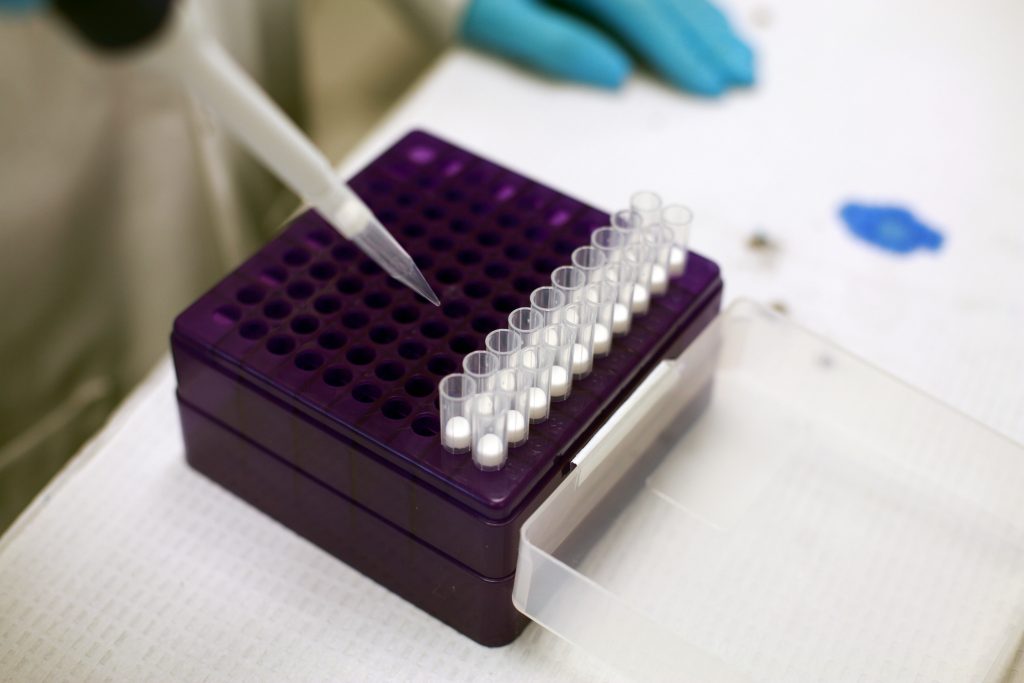

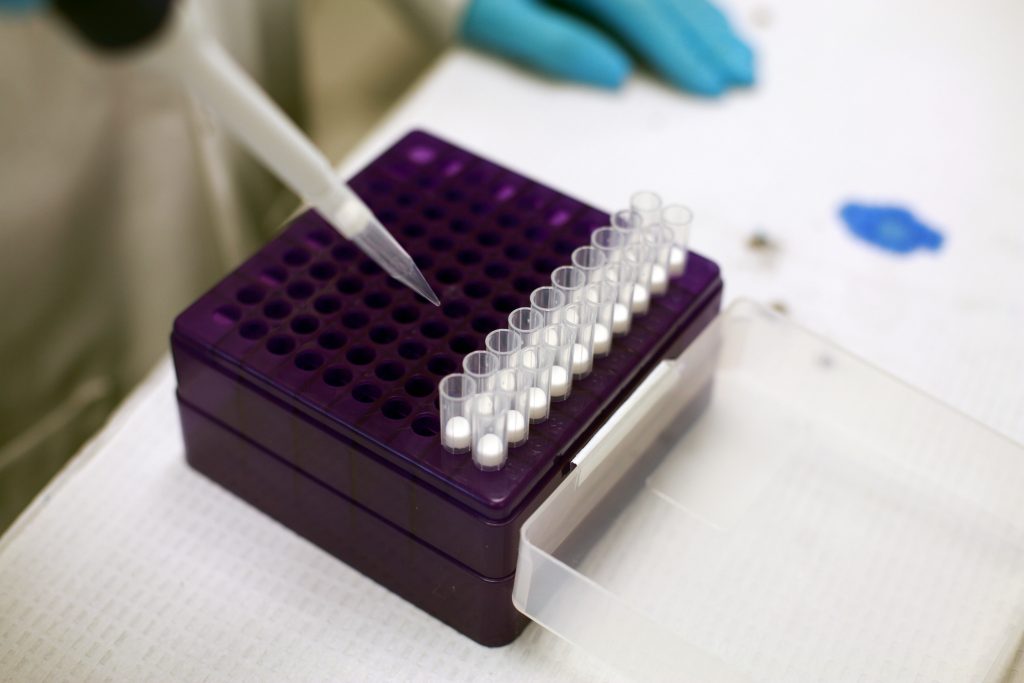

True Health processes blood tests aimed at early detection of illness such as heart disease, diabetes and cancer. (Submitted)

The potential sale of the company would mark the second time in four years that the operations of the 100,000-square-foot Fifth Street lab would have been sold out of bankruptcy.

True Health took over the facility in 2015 when it paid $37 million to acquire the bulk of the assets of Health Diagnostic Laboratory, a once fast-growing Richmond-based firm that collapsed into bankruptcy in the thick of a kickback scandal.

True Health’s bankruptcy, the company has stated in court filings, was prompted by it getting cut off from reimbursements by the Centers of Medicare and Medicaid Services for alleged fraud and overpayment of tens of millions of dollars of Medicare reimbursements. True Health argues the allegations are unfounded and in part related to errors not of its own doing, but errors made by physicians’ offices.

Despite taking what it calls substantial steps to address the issues and fighting the government in court this summer, the company said it has missed out on $21 million in Medicare reimbursements in the last two years, while it’s saddled with $174 million in debt.

A trustee has not yet been appointed and the company hasn’t yet filed its detailed list of assets and liabilities.

It listed in its initial Chapter 11 filing between $100 million and $500 million owed to untold hundreds of creditors. It listed assets of $10 million to $50 million.

Delaware law firm Morris, Nichols, Arsht & Tunnell represents the company in its bankruptcy.

Less than a month after falling into bankruptcy and laying off a portion of its 300 workers in downtown Richmond, a Texas-based blood-testing company is setting itself up to be sold.

True Health Diagnostics, which operates a large laboratory at 737 N. Fifth St. in the Virginia Biotech Park, has begun the process of finding a buyer for the bulk of its assets while it continues its Chapter 11 bankruptcy process.

The company filed for bankruptcy protection in late July, after it said it was cut off for the second time in two years from Medicare reimbursements, which account for about 30 percent of its business and tens of millions of dollars.

The Chapter 11 filing coincided with the company laying off about 80 of its 300 employees, including several dozen in Richmond. It since has been operating as usual with the help of a temporary financing round to keep it afloat until it can find a buyer.

Cliff Zucker, the company’s chief restructuring officer, said the move toward a sale looks to be the best way forward for the company in lieu of additional financing to keep it operating long enough to emerge from bankruptcy and beyond.

“Bid procedures were filed in order to market the company and the goal is to sell it as a going concern,” Zucker said. “Without funding, there’s no other option.”

The company has hired investment banking firm SSG Capital Advisors to handle the sale.

The deadline for bids to purchase the company’s assets is 4 p.m. Sept. 13. Bids must be submitted to SSG.

The company’s Richmond operations continue as is and no further layoffs have occurred, though Zucker said there has been some attrition caused by the company’s uncertain future.

History repeats

True Health processes blood tests aimed at early detection of illness such as heart disease, diabetes and cancer. (Submitted)

The potential sale of the company would mark the second time in four years that the operations of the 100,000-square-foot Fifth Street lab would have been sold out of bankruptcy.

True Health took over the facility in 2015 when it paid $37 million to acquire the bulk of the assets of Health Diagnostic Laboratory, a once fast-growing Richmond-based firm that collapsed into bankruptcy in the thick of a kickback scandal.

True Health’s bankruptcy, the company has stated in court filings, was prompted by it getting cut off from reimbursements by the Centers of Medicare and Medicaid Services for alleged fraud and overpayment of tens of millions of dollars of Medicare reimbursements. True Health argues the allegations are unfounded and in part related to errors not of its own doing, but errors made by physicians’ offices.

Despite taking what it calls substantial steps to address the issues and fighting the government in court this summer, the company said it has missed out on $21 million in Medicare reimbursements in the last two years, while it’s saddled with $174 million in debt.

A trustee has not yet been appointed and the company hasn’t yet filed its detailed list of assets and liabilities.

It listed in its initial Chapter 11 filing between $100 million and $500 million owed to untold hundreds of creditors. It listed assets of $10 million to $50 million.

Delaware law firm Morris, Nichols, Arsht & Tunnell represents the company in its bankruptcy.