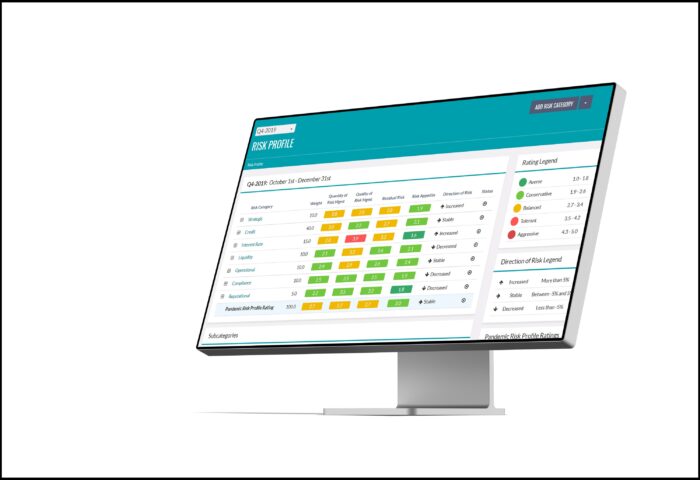

SRA’s Watchtower program monitors risk for banks and other institutions. (Image courtesy Strategic Risk Associates)

It was the year of the Great Recession, 2008, when Strategic Risk Associates was founded in Richmond to help banks and other financial institutions manage risk.

Nearly 15 years later, and with predictions of another recession floating about, the firm is taking a calculated risk of its own to continue its growth.

The firm recently completed a $12 million capital raise to fund the ongoing expansion of SRA Watchtower, a software program it began developing a few years ago to help automate the process of identifying and tracking certain risk indicators, such as the number of past-due loans on the books or amount of on-hand cash and liquidity.

The software then produces reports for a bank’s executives and board to use in decision-making.

While a previous $4 million capital raise in 2019 helped the firm make its initial software push into the market, SRA co-founder and CEO Michael Glotz said this latest larger cash pool will be used to add products to its software suite and fund a larger sales force to peddle them.

“The last (capital raise) really helped us build out the capabilities of our product and hire a national sales force,” Glotz said. “Now we have six major products.”

Glotz said about 25 percent of the newly raised funds will go toward building new products and another 25 percent will pay for a doubling of SRA’s sales and marketing team.

Among the new offerings is a software tool that measures the risk of suppliers to banks, especially technology companies used by those institutions.

“We’re not only risk-rating the banks – we’re now risk-rating the suppliers,” Glotz said, adding that there are about 200 such fintech suppliers that do business with SRA’s main bank clients and it hopes to monitor most of those.

Monitoring risk related to crypto and digital assets is another new tool on Watchtower, Glotz said. It’s a topic that’s been brought to the forefront in a major way in recent weeks with the high-profile collapse of crypto exchange FTX and the scrutiny faced by its founder, Sam Bankman-Fried.

Glotz, half tongue-in-cheek, said FTX could have benefitted from some better risk monitoring.

“It’s too bad Sam Bankman-Fried didn’t believe in risk management,” Glotz said.

SRA had around 30 clients using its software at the time of its last capital raise three years ago. That count is now up to 90, Glotz said, and the clients range from small community banks to large national players, as well as credit unions and insurance companies.

Among them is Richmond-based Atlantic Union Bank, which is not only an SRA client but also invested around $1 million in the firm’s latest capital round.

The round was led by an affiliate of EJF Capital, along with JAM FINTOP, FINTOP Capital, and other existing investors.

SRA’s employee headcount has more than doubled since 2019 to 50 full-timers and 25 contractors, Glotz said. The company also recently appointed its chief strategy officer David Dean with a new title, chief revenue officer, to help lead the Watchtower push.

He said the firm expects to end the year with $9 million in revenue, which is up 100 percent from last year and up from $4 million in 2019 when it last raised capital. He said software now accounts for about half its revenue. The other half comes from consulting and M&A advisory work.

For a company that trades in risk management, Glotz said SRA recognizes the big bet it’s taking in bringing on such a large investment. But even as a recession may be looming, Glotz said he has good reason to be confident.

“There’s always risk in expansion but because the banking markets are planning for a recession, they invest more in risk management tools in a down market. So, we’re counter-cyclical in that the worse the economy gets, the more they need us,” he said.

And just to be on the safe side and true to its name, Glotz said the other half of SRA’s $12 million raise is being put to a practical internal use.

“It’s for safety capital,” he said, “for cash on hand for safety purposes given we may be headed into a recession.”

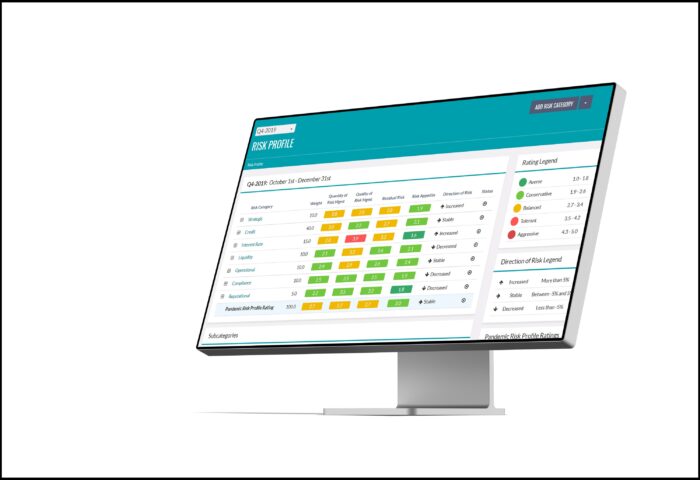

SRA’s Watchtower program monitors risk for banks and other institutions. (Image courtesy Strategic Risk Associates)

It was the year of the Great Recession, 2008, when Strategic Risk Associates was founded in Richmond to help banks and other financial institutions manage risk.

Nearly 15 years later, and with predictions of another recession floating about, the firm is taking a calculated risk of its own to continue its growth.

The firm recently completed a $12 million capital raise to fund the ongoing expansion of SRA Watchtower, a software program it began developing a few years ago to help automate the process of identifying and tracking certain risk indicators, such as the number of past-due loans on the books or amount of on-hand cash and liquidity.

The software then produces reports for a bank’s executives and board to use in decision-making.

While a previous $4 million capital raise in 2019 helped the firm make its initial software push into the market, SRA co-founder and CEO Michael Glotz said this latest larger cash pool will be used to add products to its software suite and fund a larger sales force to peddle them.

“The last (capital raise) really helped us build out the capabilities of our product and hire a national sales force,” Glotz said. “Now we have six major products.”

Glotz said about 25 percent of the newly raised funds will go toward building new products and another 25 percent will pay for a doubling of SRA’s sales and marketing team.

Among the new offerings is a software tool that measures the risk of suppliers to banks, especially technology companies used by those institutions.

“We’re not only risk-rating the banks – we’re now risk-rating the suppliers,” Glotz said, adding that there are about 200 such fintech suppliers that do business with SRA’s main bank clients and it hopes to monitor most of those.

Monitoring risk related to crypto and digital assets is another new tool on Watchtower, Glotz said. It’s a topic that’s been brought to the forefront in a major way in recent weeks with the high-profile collapse of crypto exchange FTX and the scrutiny faced by its founder, Sam Bankman-Fried.

Glotz, half tongue-in-cheek, said FTX could have benefitted from some better risk monitoring.

“It’s too bad Sam Bankman-Fried didn’t believe in risk management,” Glotz said.

SRA had around 30 clients using its software at the time of its last capital raise three years ago. That count is now up to 90, Glotz said, and the clients range from small community banks to large national players, as well as credit unions and insurance companies.

Among them is Richmond-based Atlantic Union Bank, which is not only an SRA client but also invested around $1 million in the firm’s latest capital round.

The round was led by an affiliate of EJF Capital, along with JAM FINTOP, FINTOP Capital, and other existing investors.

SRA’s employee headcount has more than doubled since 2019 to 50 full-timers and 25 contractors, Glotz said. The company also recently appointed its chief strategy officer David Dean with a new title, chief revenue officer, to help lead the Watchtower push.

He said the firm expects to end the year with $9 million in revenue, which is up 100 percent from last year and up from $4 million in 2019 when it last raised capital. He said software now accounts for about half its revenue. The other half comes from consulting and M&A advisory work.

For a company that trades in risk management, Glotz said SRA recognizes the big bet it’s taking in bringing on such a large investment. But even as a recession may be looming, Glotz said he has good reason to be confident.

“There’s always risk in expansion but because the banking markets are planning for a recession, they invest more in risk management tools in a down market. So, we’re counter-cyclical in that the worse the economy gets, the more they need us,” he said.

And just to be on the safe side and true to its name, Glotz said the other half of SRA’s $12 million raise is being put to a practical internal use.

“It’s for safety capital,” he said, “for cash on hand for safety purposes given we may be headed into a recession.”