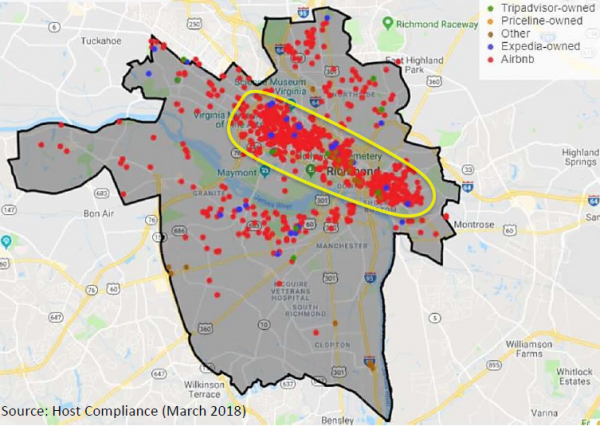

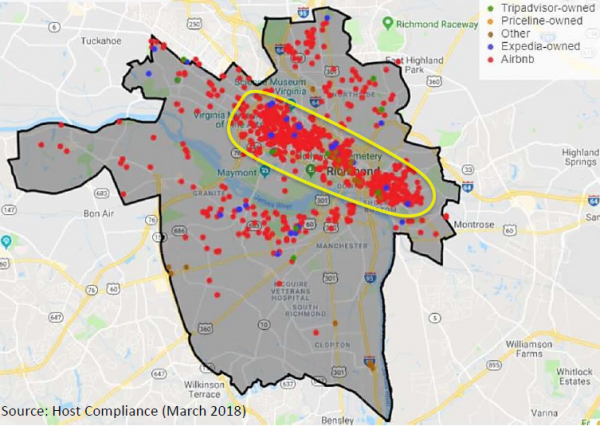

A map showing short-term rental operations in March 2018. (Courtesy Richmond Planning & Development Review)

Correction: The City of Richmond’s policy does not include a transient occupancy tax on any short-term rentals as currently proposed. The latest version of the proposal notes that transient occupancy and other local taxes will be considered after the policy is implemented, potentially taking effect Jan. 1, 2021.

As the City of Richmond prepares to adopt rules regulating Airbnb-style rentals within its boundaries, neighboring Henrico County is following suit with its own proposal.

Last week, Henrico supervisors introduced a policy that would require operators to register short-term residential rentals in the county and pay the county’s transient occupancy tax, at the same 8 percent rate charged for hotel and motel room stays.

Registration would come with a $200 annual fee, and the tax would be 8 percent of the rental charge for a room or residence occupied 30 or fewer consecutive days.

The policy would take effect July 1, with operators allowed to register before then. A public hearing on the regulations is scheduled Feb. 25.

Henrico’s rules have been months in the making, with the Planning Commission holding a series of work sessions and a pair of public hearings before recommending the policy. Planning worked with the county finance department, which had a hand in crafting the registry and tax provisions, said Joe Emerson, Henrico’s planning director.

“The county currently doesn’t allow short-term rentals, so this is an effort to allow (them),” Emerson said, adding that the proposal was shaped with input from neighborhood associations and lodging industry groups.

“One of the things that we heard pretty consistently from the bed-and-breakfast operators and the travel and tourism industries is that they wanted everyone to be on an equal footing, in regards to fees and charges that are implemented by the locality,” he said.

The registry component stems from state legislation passed in 2017 allowing localities to use them to track short-term rentals, Emerson noted.

“It also provides some regulation to them so we can make sure that the public in general has some protection, both the neighborhoods and the traveling public,” he said. “It gives us an opportunity to review them, make sure that they’re meeting some basic operational criteria, and also, it’s an enforcement arm. If you’re not on the registry, you’re not operating legally.”

City rules up for a vote

The county policy coincides with similar rules for Richmond that are slated to go before City Council for potential adoption Monday.

The city’s policy, first rolled out last spring, would require anyone looking to rent out a property for less than 30 days at a time to obtain a biennial permit, at a cost of $300.

Unlike Henrico, the city’s policy would not impose a transient occupancy tax on rentals, though the latest version of the proposal notes that transient occupancy and other local taxes will be considered at a later date, potentially taking effect Jan. 1, 2021.

The city had previously proposed charging an 8 percent transient occupancy tax on some rentals, with only operators of properties with four or more bedrooms required to remit the tax. That proposal was taken out as the policy was tweaked. Business licenses and personal property taxes would not apply to the rentals.

City planning director Mark Olinger fields questions at last year’s meeting on proposed short-term home rental rules. (BizSense file photo)

Revised in recent months with public input from surveys and community meetings, the proposal no longer includes a restriction on the number of nights a dwelling could be rented per year – previously proposed at 180 nights a year. The rules would restrict short-term home rentals to operators’ primary residences, meaning the property where an operator resides at least half the year.

The primary residency requirement is intended to reduce speculative use of private residences as hotels, the policy states, as well as to prevent absentee landlords from converting long-term rental properties for short-term rental use. An overarching goal is to preserve the residential character of a neighborhood and limit effects of businesses operating there, the policy states.

Operators would be required to reside on the lot where the rental is located, not in the specific dwelling to be rented. The policy would prohibit existing renters from subleasing their unit as a short-term rental, removing the number of dwelling units that can operate as rentals in multifamily residential and mixed-use zoning districts.

The city Planning Commission reviewed the rules last month, adding a provision requiring that it would review the policy a year after implementation. Members appeared divided on the proposal, though, according to meeting minutes.

After a public hearing that saw two speakers voice support for the proposal and 13 speak in opposition, primarily taking exception to the 185-day residency requirement, Commissioner Jack Thompson motioned to remove the residency requirement, as well as the restriction prohibiting tenants from operating rentals.

He also motioned to allow licensed real estate brokers to serve as rental operators, and to include the year-after review provision. Those two amendments found support from commissioners, while the residency and tenant-operator removals were voted down.

Ultimately, commissioners voted to recommend the policy with the year-after review provision. The amended proposal now goes to City Council, which is scheduled to vote on the rules at its Feb. 10 meeting.

According to AirDNA, a short-term rental analytics site, Richmond had 763 active rentals listed on sites such as Airbnb and Vrbo as of Wednesday, with an average daily rate of $129 and a 67 percent occupancy rate. Henrico had 185 active rentals, with the same occupancy rate and an average daily rate of $130.

A map showing short-term rental operations in March 2018. (Courtesy Richmond Planning & Development Review)

Correction: The City of Richmond’s policy does not include a transient occupancy tax on any short-term rentals as currently proposed. The latest version of the proposal notes that transient occupancy and other local taxes will be considered after the policy is implemented, potentially taking effect Jan. 1, 2021.

As the City of Richmond prepares to adopt rules regulating Airbnb-style rentals within its boundaries, neighboring Henrico County is following suit with its own proposal.

Last week, Henrico supervisors introduced a policy that would require operators to register short-term residential rentals in the county and pay the county’s transient occupancy tax, at the same 8 percent rate charged for hotel and motel room stays.

Registration would come with a $200 annual fee, and the tax would be 8 percent of the rental charge for a room or residence occupied 30 or fewer consecutive days.

The policy would take effect July 1, with operators allowed to register before then. A public hearing on the regulations is scheduled Feb. 25.

Henrico’s rules have been months in the making, with the Planning Commission holding a series of work sessions and a pair of public hearings before recommending the policy. Planning worked with the county finance department, which had a hand in crafting the registry and tax provisions, said Joe Emerson, Henrico’s planning director.

“The county currently doesn’t allow short-term rentals, so this is an effort to allow (them),” Emerson said, adding that the proposal was shaped with input from neighborhood associations and lodging industry groups.

“One of the things that we heard pretty consistently from the bed-and-breakfast operators and the travel and tourism industries is that they wanted everyone to be on an equal footing, in regards to fees and charges that are implemented by the locality,” he said.

The registry component stems from state legislation passed in 2017 allowing localities to use them to track short-term rentals, Emerson noted.

“It also provides some regulation to them so we can make sure that the public in general has some protection, both the neighborhoods and the traveling public,” he said. “It gives us an opportunity to review them, make sure that they’re meeting some basic operational criteria, and also, it’s an enforcement arm. If you’re not on the registry, you’re not operating legally.”

City rules up for a vote

The county policy coincides with similar rules for Richmond that are slated to go before City Council for potential adoption Monday.

The city’s policy, first rolled out last spring, would require anyone looking to rent out a property for less than 30 days at a time to obtain a biennial permit, at a cost of $300.

Unlike Henrico, the city’s policy would not impose a transient occupancy tax on rentals, though the latest version of the proposal notes that transient occupancy and other local taxes will be considered at a later date, potentially taking effect Jan. 1, 2021.

The city had previously proposed charging an 8 percent transient occupancy tax on some rentals, with only operators of properties with four or more bedrooms required to remit the tax. That proposal was taken out as the policy was tweaked. Business licenses and personal property taxes would not apply to the rentals.

City planning director Mark Olinger fields questions at last year’s meeting on proposed short-term home rental rules. (BizSense file photo)

Revised in recent months with public input from surveys and community meetings, the proposal no longer includes a restriction on the number of nights a dwelling could be rented per year – previously proposed at 180 nights a year. The rules would restrict short-term home rentals to operators’ primary residences, meaning the property where an operator resides at least half the year.

The primary residency requirement is intended to reduce speculative use of private residences as hotels, the policy states, as well as to prevent absentee landlords from converting long-term rental properties for short-term rental use. An overarching goal is to preserve the residential character of a neighborhood and limit effects of businesses operating there, the policy states.

Operators would be required to reside on the lot where the rental is located, not in the specific dwelling to be rented. The policy would prohibit existing renters from subleasing their unit as a short-term rental, removing the number of dwelling units that can operate as rentals in multifamily residential and mixed-use zoning districts.

The city Planning Commission reviewed the rules last month, adding a provision requiring that it would review the policy a year after implementation. Members appeared divided on the proposal, though, according to meeting minutes.

After a public hearing that saw two speakers voice support for the proposal and 13 speak in opposition, primarily taking exception to the 185-day residency requirement, Commissioner Jack Thompson motioned to remove the residency requirement, as well as the restriction prohibiting tenants from operating rentals.

He also motioned to allow licensed real estate brokers to serve as rental operators, and to include the year-after review provision. Those two amendments found support from commissioners, while the residency and tenant-operator removals were voted down.

Ultimately, commissioners voted to recommend the policy with the year-after review provision. The amended proposal now goes to City Council, which is scheduled to vote on the rules at its Feb. 10 meeting.

According to AirDNA, a short-term rental analytics site, Richmond had 763 active rentals listed on sites such as Airbnb and Vrbo as of Wednesday, with an average daily rate of $129 and a 67 percent occupancy rate. Henrico had 185 active rentals, with the same occupancy rate and an average daily rate of $130.