The Sunday night bankruptcy filings by Health Diagnostic Laboratory illustrate a once fast-rising local company that has been scrambling in the face of recently declining revenues, mounting legal fees and pressure from its largest lender.

Court documents also give a glimpse of how the downtown-based blood testing company’s bottom line was impacted by a change to its business practices, fallout from a federal investigation, subsequent media attention and its efforts to try to right the ship.

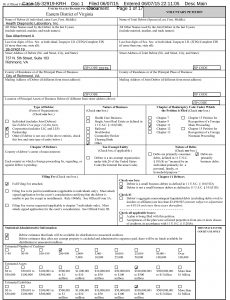

The company’s retreat into Chapter 11 protection will allow it to continue to operate and buy it time to work with its more than 200 creditors, who are owed between $100 million and $500 million, court filings show.

On Monday, a federal bankruptcy judge agreed to allow HDL access to its cash collateral to continue operating the business for at least 22 days, until its next hearing on June 30. The company was also allowed to continue paying employees’ wages and benefits, utilities, insurance and taxes. That ruling kept lender BB&T from preventing HDL’s access to the funds after its deteriorated financial performance caused it to default on a loan with the bank. The bank cut HDL off from its line of working capital in late May, court records show.

“We’re starved of cash,” HDL’s attorney Tyler Brown of Hunton & Williams said during a hearing on Monday.

Brown told Judge Kevin Huennekens on Monday that the company has several options on the table, including securing a new lender, starting a reorganization process or even potentially selling the company. He said buyers have expressed interest in the 6-year-old firm.

Brown said during the hearing that HDL will attempt to secure debtor-in-possession financing.

HDL President and CEO Joseph McConnell said in a prepared statement Monday that Chapter 11 was “the right path for us to take.”

“The fundamentals of our business model remain solid, and we are confident these actions will enable us to quickly restructure and emerge better positioned for continued growth and success,” the statement reads. “HDL, Inc.’s operations are strong and demand for our high-quality diagnostic test products and services will continue to grow.”

But that demand isn’t as strong as it once was, according to the company’s bankruptcy filings.

In 2013, HDL, which runs lab tests on blood samples to help predict heart disease and other ailments, processed on average about 3,600 samples per day, court records show. That translated to $375 million in revenue and $45.2 million in earnings.

But in the summer of 2014, HDL stopped paying so-called processing and handling fees to physicians for running its tests. That change came after the federal government issued an alert about the practice potentially being a violation of kickback laws. The Wall Street Journal eventually published a scathing article about a federal investigation into the practice and HDL’s reliance on such fees.

As a result, the company said in court filings that average daily sample volume fell by nearly 2o percent in the third quarter of 2014 and an additional 5.5 percent in the fourth quarter. Its net revenue dropped 47 percent during that period.

HDL’s revenue for 2014 fell to $320 million and earnings were down to $15.3 million. That decline continued into the first quarter of this year, when sample volume declined to half of what it was in 2013.

“Since the first quarter of 2015, average daily sample volumes have stabilized; however, the significant drop in revenue, and certain other non-recurring costs … have contributed to the liquidity crisis the debtors now face,” court documents state.

The decline in its financial performance caused HDL to fall out of compliance with provisions of its loan agreements with BB&T, court records state, and the resulting default ultimately forced HDL’s hand on choosing the path of Chapter 11. The bank on May 28 discontinued HDL’s ability to borrow money through its line of credit. The bank also initially refused to allow the company access to its accounts.

The U.S. Department of Justice is HDL’s largest unsecured creditor after the two agreed to settle the federal investigation earlier this year. The DOJ is owed $49.5 million from the laboratory company, a fee that HDL cannot avoid by filing for bankruptcy, according to the terms of the settlement.

According to the settlement’s fixed payment schedule, HDL should have paid the federal and state governments almost $1 million on April 30 in the first of the payment installments that will last until January of 2020.

A DOJ representative did not return requests to confirm if that first installment was paid.

Marc Raspanti, an attorney who represented two of the whistleblowers that sparked the federal investigation, said HDL made it clear to the DOJ that it was able to pay that fee when it signed the settlement.

Adding to its potential debt rolls, HDL is currently facing at least three multimillion-dollar lawsuits, one from its former sales contractor and two from large national insurance companies.

According to its bankruptcy filings, at least six of HDL’s unsecured creditors are law firms, to which the company owes more than $3 million combined. Those firms include Richmond-based LeClairRyan, as well as Raspanti’s firm, Pietragallo Gordon Alfano Bosick & Raspanti.

John Galese, an attorney with Galese & Ingram who is representing sales contractor BlueWave Healthcare Consultants in its case against HDL, said the bankruptcy process puts an automatic, temporary stay on any active lawsuits.

“I’m not surprised,” Galese said of the filing. “They’ve had a number of lawsuits pending against them, and you know, when a company like HDL or any other company has more debts than they can pay out of current resources, they don’t have much choice.”

HDL’s initial bankruptcy filing only lists unsecured creditors. On that list are former CEO and co-founder Tonya Mallory, who is owed $2.4 million, and the Washington Redskins, which is owed $250,000.

The bankruptcy filings show that HDL hired Alvarez & Marsal, a firm that specializes in helping “operationally and financially challenged organizations.” It has been working with HDL since November, according to court documents.

Martin McGahan, a managing director of Alvarez & Marsal, signed off on HDL’s bankruptcy filing as its chief restructuring officer.

The Sunday night bankruptcy filings by Health Diagnostic Laboratory illustrate a once fast-rising local company that has been scrambling in the face of recently declining revenues, mounting legal fees and pressure from its largest lender.

Court documents also give a glimpse of how the downtown-based blood testing company’s bottom line was impacted by a change to its business practices, fallout from a federal investigation, subsequent media attention and its efforts to try to right the ship.

The company’s retreat into Chapter 11 protection will allow it to continue to operate and buy it time to work with its more than 200 creditors, who are owed between $100 million and $500 million, court filings show.

On Monday, a federal bankruptcy judge agreed to allow HDL access to its cash collateral to continue operating the business for at least 22 days, until its next hearing on June 30. The company was also allowed to continue paying employees’ wages and benefits, utilities, insurance and taxes. That ruling kept lender BB&T from preventing HDL’s access to the funds after its deteriorated financial performance caused it to default on a loan with the bank. The bank cut HDL off from its line of working capital in late May, court records show.

“We’re starved of cash,” HDL’s attorney Tyler Brown of Hunton & Williams said during a hearing on Monday.

Brown told Judge Kevin Huennekens on Monday that the company has several options on the table, including securing a new lender, starting a reorganization process or even potentially selling the company. He said buyers have expressed interest in the 6-year-old firm.

Brown said during the hearing that HDL will attempt to secure debtor-in-possession financing.

HDL President and CEO Joseph McConnell said in a prepared statement Monday that Chapter 11 was “the right path for us to take.”

“The fundamentals of our business model remain solid, and we are confident these actions will enable us to quickly restructure and emerge better positioned for continued growth and success,” the statement reads. “HDL, Inc.’s operations are strong and demand for our high-quality diagnostic test products and services will continue to grow.”

But that demand isn’t as strong as it once was, according to the company’s bankruptcy filings.

In 2013, HDL, which runs lab tests on blood samples to help predict heart disease and other ailments, processed on average about 3,600 samples per day, court records show. That translated to $375 million in revenue and $45.2 million in earnings.

But in the summer of 2014, HDL stopped paying so-called processing and handling fees to physicians for running its tests. That change came after the federal government issued an alert about the practice potentially being a violation of kickback laws. The Wall Street Journal eventually published a scathing article about a federal investigation into the practice and HDL’s reliance on such fees.

As a result, the company said in court filings that average daily sample volume fell by nearly 2o percent in the third quarter of 2014 and an additional 5.5 percent in the fourth quarter. Its net revenue dropped 47 percent during that period.

HDL’s revenue for 2014 fell to $320 million and earnings were down to $15.3 million. That decline continued into the first quarter of this year, when sample volume declined to half of what it was in 2013.

“Since the first quarter of 2015, average daily sample volumes have stabilized; however, the significant drop in revenue, and certain other non-recurring costs … have contributed to the liquidity crisis the debtors now face,” court documents state.

The decline in its financial performance caused HDL to fall out of compliance with provisions of its loan agreements with BB&T, court records state, and the resulting default ultimately forced HDL’s hand on choosing the path of Chapter 11. The bank on May 28 discontinued HDL’s ability to borrow money through its line of credit. The bank also initially refused to allow the company access to its accounts.

The U.S. Department of Justice is HDL’s largest unsecured creditor after the two agreed to settle the federal investigation earlier this year. The DOJ is owed $49.5 million from the laboratory company, a fee that HDL cannot avoid by filing for bankruptcy, according to the terms of the settlement.

According to the settlement’s fixed payment schedule, HDL should have paid the federal and state governments almost $1 million on April 30 in the first of the payment installments that will last until January of 2020.

A DOJ representative did not return requests to confirm if that first installment was paid.

Marc Raspanti, an attorney who represented two of the whistleblowers that sparked the federal investigation, said HDL made it clear to the DOJ that it was able to pay that fee when it signed the settlement.

Adding to its potential debt rolls, HDL is currently facing at least three multimillion-dollar lawsuits, one from its former sales contractor and two from large national insurance companies.

According to its bankruptcy filings, at least six of HDL’s unsecured creditors are law firms, to which the company owes more than $3 million combined. Those firms include Richmond-based LeClairRyan, as well as Raspanti’s firm, Pietragallo Gordon Alfano Bosick & Raspanti.

John Galese, an attorney with Galese & Ingram who is representing sales contractor BlueWave Healthcare Consultants in its case against HDL, said the bankruptcy process puts an automatic, temporary stay on any active lawsuits.

“I’m not surprised,” Galese said of the filing. “They’ve had a number of lawsuits pending against them, and you know, when a company like HDL or any other company has more debts than they can pay out of current resources, they don’t have much choice.”

HDL’s initial bankruptcy filing only lists unsecured creditors. On that list are former CEO and co-founder Tonya Mallory, who is owed $2.4 million, and the Washington Redskins, which is owed $250,000.

The bankruptcy filings show that HDL hired Alvarez & Marsal, a firm that specializes in helping “operationally and financially challenged organizations.” It has been working with HDL since November, according to court documents.

Martin McGahan, a managing director of Alvarez & Marsal, signed off on HDL’s bankruptcy filing as its chief restructuring officer.