A bank from the northern part of the state is making its second acquisition in less than three years in part to expand its presence in the greater Richmond market.

Strasburg-based First Bank on Tuesday announced its pending deal to absorb Touchstone Bank, which is headquartered in Prince George and has branches around the southern edges of the region.

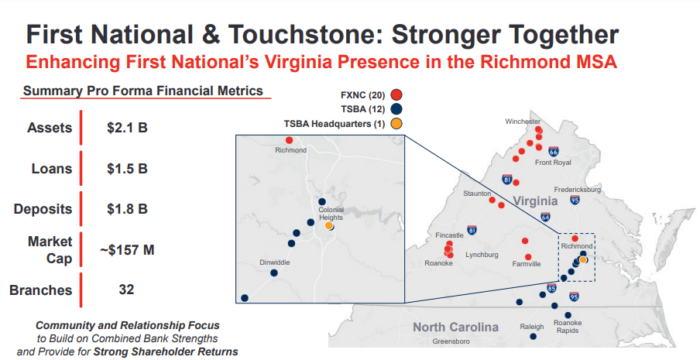

The deal is expected to close in the fourth quarter and would create a $2.1 billion institution with 32 branches.

Touchstone is the smaller of the two with $658 million in total assets and 12 branches, seven of which are in the Richmond metro area.

First Bank has $1.4 billion in total assets and 20 branches, including a location in Richmond’s West End on Patterson Avenue and a loan office in Innsbrook.

Scott Harvard, a veteran Virginia banker who’s helmed First Bank for 12 years, said Touchstone’s footprint in the Richmond metro area was a big driver of the deal.

“It really is a nice jump start for us to expand our footprint across Richmond and not just in the West End where we’ve been,” Harvard said.

The combined bank expects to have $350 million in deposits in the Richmond market and eight local branches.

The deal would mark the end of a relatively short life for the Touchstone Bank brand, as the First Bank name is expected to be used for the combined company.

Touchstone was created in 2018 after the merger of Prince George-based Bank of McKenney and Citizens Community Bank in South Hill. Touchstone was founded as The Bank of Dinwiddie in 1906.

Harvard said the deal was brought to First Bank in January by investment bankers that had been shopping Touchstone. He said Touchstone was one of about a dozen banks that First Bank has had its eye on over the years for a potential deal.

“We’ve had a strategic plan that’s always contemplated organic growth and building a bank that’s strong enough to be opportunistic when opportunities present themselves,” Harvard said.

The bank stayed on the hunt after closing its most recent acquisition in 2021, when it took on Bank of Fincastle in the western part of the state. That same year it beefed up its Richmond presence by buying an $83 million local loan portfolio and a team of seven bankers from Tennessee-based SmartBank.

The bank had also previously grown by acquiring six Bank of America branches and their $200 million in deposits in various markets in Virginia like Waynesboro, Staunton and Woodstock in 2016.

“In this business now it’s all about scale and efficiency,” Harvard said of the bank’s continued appetite for growth. “Margins get squeezed and you can’t afford to be fat and you have to pay for technology and the regulatory burden.”

Harvard will remain on as CEO of the combined company once the Touchstone deal closes. Touchstone CEO James Black will also remain with the company, taking on the role of president of the First Bank’s southern region operations.

“It was a great opportunity to partner with another community bank to continue to leverage resources to be even more competitive,” Black said of the deal when reached Tuesday afternoon.

As part of the deal, shareholders of Touchstone’s publicly traded parent company Touchstone Bankshares will receive 0.81 shares of First Bank’s parent, First National Corp.

The all-stock transaction is valued at approximately $47 million based on First National’s closing share price of $17.55 as of March 22.

It amounts to $14.25 per share of Touchstone stock. The bank’s stock was up nearly 29 percent after the deal was announced on Tuesday, closing at $12.60 per share. First National’s stock dropped 7.5 percent to close at $16.33 per share on Tuesday.

The deal has already received unanimous approval from the boards of both banks but must still earn regulatory and shareholder approval. Three Touchstone directors will join the First National board.

Piper Sandler is Touchstone’s financial advisor in the deal. Williams Mullen is its legal counsel. First National is represented by financial advisor Hovde Group and law firm Nelson Mullins Riley & Scarborough.

Harvard said banks of all sorts are having conversations about scale and combinations as they continue to navigate a world of tightened margins due to the recent increase in interest rates.

“It’s been a really tough environment for all banks because of the interest rate environment,” he said. “When the Fed increases rates by 400 basis points in a year it’s dramatic.”

“That’s driven up our costs. And consumers have been chasing those deposit yields, which frankly they deserve because they haven’t been paid in a long time,” he said. “A lot of that is what stirs these kinds of conversations. It’s ‘man this business is getting really hard right now.’”

A bank from the northern part of the state is making its second acquisition in less than three years in part to expand its presence in the greater Richmond market.

Strasburg-based First Bank on Tuesday announced its pending deal to absorb Touchstone Bank, which is headquartered in Prince George and has branches around the southern edges of the region.

The deal is expected to close in the fourth quarter and would create a $2.1 billion institution with 32 branches.

Touchstone is the smaller of the two with $658 million in total assets and 12 branches, seven of which are in the Richmond metro area.

First Bank has $1.4 billion in total assets and 20 branches, including a location in Richmond’s West End on Patterson Avenue and a loan office in Innsbrook.

Scott Harvard, a veteran Virginia banker who’s helmed First Bank for 12 years, said Touchstone’s footprint in the Richmond metro area was a big driver of the deal.

“It really is a nice jump start for us to expand our footprint across Richmond and not just in the West End where we’ve been,” Harvard said.

The combined bank expects to have $350 million in deposits in the Richmond market and eight local branches.

The deal would mark the end of a relatively short life for the Touchstone Bank brand, as the First Bank name is expected to be used for the combined company.

Touchstone was created in 2018 after the merger of Prince George-based Bank of McKenney and Citizens Community Bank in South Hill. Touchstone was founded as The Bank of Dinwiddie in 1906.

Harvard said the deal was brought to First Bank in January by investment bankers that had been shopping Touchstone. He said Touchstone was one of about a dozen banks that First Bank has had its eye on over the years for a potential deal.

“We’ve had a strategic plan that’s always contemplated organic growth and building a bank that’s strong enough to be opportunistic when opportunities present themselves,” Harvard said.

The bank stayed on the hunt after closing its most recent acquisition in 2021, when it took on Bank of Fincastle in the western part of the state. That same year it beefed up its Richmond presence by buying an $83 million local loan portfolio and a team of seven bankers from Tennessee-based SmartBank.

The bank had also previously grown by acquiring six Bank of America branches and their $200 million in deposits in various markets in Virginia like Waynesboro, Staunton and Woodstock in 2016.

“In this business now it’s all about scale and efficiency,” Harvard said of the bank’s continued appetite for growth. “Margins get squeezed and you can’t afford to be fat and you have to pay for technology and the regulatory burden.”

Harvard will remain on as CEO of the combined company once the Touchstone deal closes. Touchstone CEO James Black will also remain with the company, taking on the role of president of the First Bank’s southern region operations.

“It was a great opportunity to partner with another community bank to continue to leverage resources to be even more competitive,” Black said of the deal when reached Tuesday afternoon.

As part of the deal, shareholders of Touchstone’s publicly traded parent company Touchstone Bankshares will receive 0.81 shares of First Bank’s parent, First National Corp.

The all-stock transaction is valued at approximately $47 million based on First National’s closing share price of $17.55 as of March 22.

It amounts to $14.25 per share of Touchstone stock. The bank’s stock was up nearly 29 percent after the deal was announced on Tuesday, closing at $12.60 per share. First National’s stock dropped 7.5 percent to close at $16.33 per share on Tuesday.

The deal has already received unanimous approval from the boards of both banks but must still earn regulatory and shareholder approval. Three Touchstone directors will join the First National board.

Piper Sandler is Touchstone’s financial advisor in the deal. Williams Mullen is its legal counsel. First National is represented by financial advisor Hovde Group and law firm Nelson Mullins Riley & Scarborough.

Harvard said banks of all sorts are having conversations about scale and combinations as they continue to navigate a world of tightened margins due to the recent increase in interest rates.

“It’s been a really tough environment for all banks because of the interest rate environment,” he said. “When the Fed increases rates by 400 basis points in a year it’s dramatic.”

“That’s driven up our costs. And consumers have been chasing those deposit yields, which frankly they deserve because they haven’t been paid in a long time,” he said. “A lot of that is what stirs these kinds of conversations. It’s ‘man this business is getting really hard right now.’”

Congratulations to the team at FirstBank. This is a well managed institution with an excellent group of banking professionals. They bring much appreciated stability and strength to the community banking market.