Atlanta-based DC Blox has developed data centers in Tennessee, South Carolina and Alabama. The Henrico project would be its first in Virginia. (County documents)

The site of a long-running weekly flea market is being pitched for development by a new-to-market data center developer and a firm tied to the family that once ran Richmond Raceway.

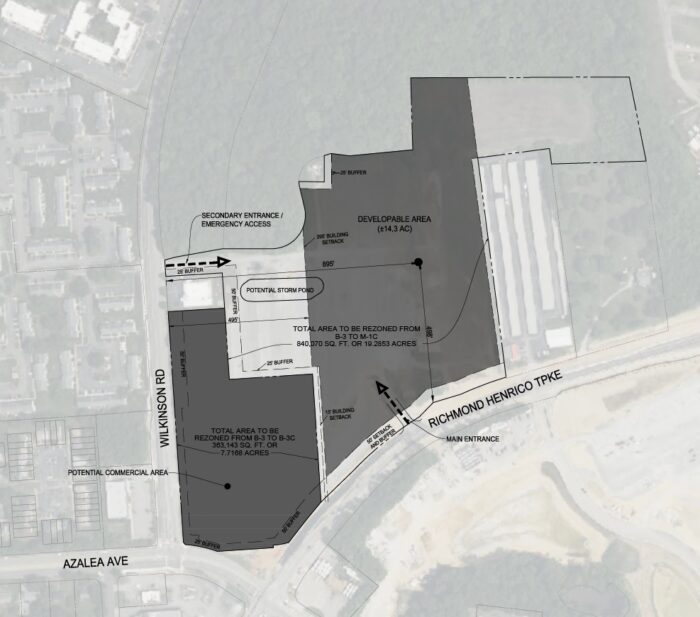

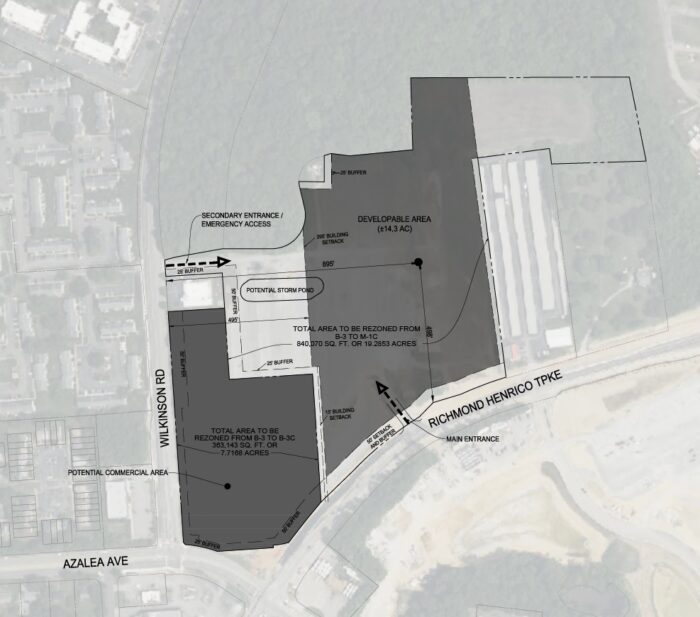

Richmond-based BWS Enterprises is working with DC Blox, a data center developer out of Atlanta, on a potentially two-building project on part of a 27-acre site north of Azalea Avenue and Richmond Henrico Turnpike.

The land, between the turnpike and Wilkinson Road, includes the site of the Azalea Flea Market and makes up the bulk of a 30-acre parcel that BWS has owned since 1998.

The land is across the turnpike from the massive Amazon distribution center that opened this spring. Where that facility was built on land previously owned by Richmond Raceway, the data center site is owned by BWS, an entity led by the Sawyer family that once owned what was then called Richmond International Raceway before selling it in 1999.

BWS is seeking a rezoning from Henrico County for the project, which Sean Sawyer said fits with the county’s designation of that area as an industrial corridor. Sean is a grandson of the late Paul Sawyer, who led the racetrack’s transformation from a dirt track to the present-day raceway complex.

“The property is located within an industrial corridor, and everything in and around that has been zoned either office or some type of light industrial. We’re just following suit with what Henrico County has planned within the corridor,” Sean Sawyer said.

The project would be the first in Virginia for DC Blox, which has developed data centers in Tennessee, South Carolina and Alabama, and has others in the works in North Carolina and Georgia.

Chris Gatch, executive vice president and chief revenue officer for DC Blox, said the company zeroed in on the Henrico site through a standard property search and reached out to BWS. He said the company likes the site for its connectivity to Dominion Energy’s power grid and its separation from other parts of the county where data center development has been more prevalent.

“Richmond’s had a lot of upward trends as a data center market,” Gatch said. “Our anchor customer that we’re building the initial building for, their application is more of a network application, so part of what took us up in that direction and away from a lot of the data center development that is more south near the airport is achieving some diversification from that area.”

Gatch wouldn’t identify the project’s anchor tenant but said it would fill a 10-megawatt data center to be housed in an initial 70,000-square-foot building.

A second, 40-megawatt data center could follow, though Gatch said that part of the project is to be determined.

“It ultimately will depend on what fits on the site and what we can get power for,” he said.

If built, the second building could total about 125,000 square feet, Gatch said. He projected the cost of the first building at $100 million and the second building at $400 million, for a total potential development value of $500 million.

A site plan shows 14 acres designated for data center development and 8 acres near the intersection designated for commercial use.

The one- or two-story structures would be built on a 14-acre portion of the site, on the west side of the adjacent CubeSmart self-storage facility. If the rezoning is approved, DC Blox would purchase the site and start the first building in two years, Gatch said. Building heights would be restricted to 75 feet.

Roughly 8 acres closer to Azalea and Wilkinson are planned for commercial development, which Gatch said would provide a transitional buffer between the data center use and residential neighborhoods across Wilkinson.

“We’ve been working with the county to leave part of that site at the intersection as B-3 and put it back on the market for commercial development,” Gatch said. The rest of the land would be left undeveloped.

It isn’t clear what would happen with the flea market if the project goes forward. Sawyer, who said the market has been held there since the 1980s, said any decision on continued use of the property would be up to DC Blox once it owns it. Gatch said he did not know of any discussions about the fate of the market.

The rezoning would change the site from B-3 Business District to B-3C Conditional Business District for the 8-acre portion and M-1C Light Industrial District Conditional for about 19 acres. The group is working with local attorney Andy Condlin with Roth Jackson Gibbons Condlin on the request.

Gatch said the existing B-3 zoning allows data centers but the light industrial zoning would be preferable for the project.

“Both of those zoning designations allow for data centers by right, but the B-3 has some restrictions on development methodology that creates challenges with economics. That’s why we were trying to rezone part of the site to M-1, to be consistent with the bulk of the property that is around that location,” he said.

The Henrico Planning Commission was scheduled to consider the request at its meeting Thursday (today), but Condlin said they are requesting a deferral to next month’s meeting. He said the time would allow them to respond to neighbors’ comments.

Data center development has picked up in Henrico and across the state in recent years.

In May, Henrico supervisors approved zoning for a 600-acre development southeast of the Interstate 64-295 interchange, and launched a $60 million housing trust fund to be supported by revenues from data center projects. QTS Data Centers purchased the acreage last month from local development firm Hourigan for nearly $119 million.

Meanwhile, in Chesterfield County, BWS continues to work on Midlothian West, a years-in-the-making mixed-use development proposed for land it owns along Otterdale Road south of Midlothian Turnpike.

BWS has proposed up to 445 residential units, including apartments and townhomes, and a retail area. Main Street Homes has signed on to build the townhomes.

Sawyer said the firm continues to work with Chesterfield planning staff and the Virginia Department of Transportation to finish plans for the project, a timeframe for which has not been provided.

Atlanta-based DC Blox has developed data centers in Tennessee, South Carolina and Alabama. The Henrico project would be its first in Virginia. (County documents)

The site of a long-running weekly flea market is being pitched for development by a new-to-market data center developer and a firm tied to the family that once ran Richmond Raceway.

Richmond-based BWS Enterprises is working with DC Blox, a data center developer out of Atlanta, on a potentially two-building project on part of a 27-acre site north of Azalea Avenue and Richmond Henrico Turnpike.

The land, between the turnpike and Wilkinson Road, includes the site of the Azalea Flea Market and makes up the bulk of a 30-acre parcel that BWS has owned since 1998.

The land is across the turnpike from the massive Amazon distribution center that opened this spring. Where that facility was built on land previously owned by Richmond Raceway, the data center site is owned by BWS, an entity led by the Sawyer family that once owned what was then called Richmond International Raceway before selling it in 1999.

BWS is seeking a rezoning from Henrico County for the project, which Sean Sawyer said fits with the county’s designation of that area as an industrial corridor. Sean is a grandson of the late Paul Sawyer, who led the racetrack’s transformation from a dirt track to the present-day raceway complex.

“The property is located within an industrial corridor, and everything in and around that has been zoned either office or some type of light industrial. We’re just following suit with what Henrico County has planned within the corridor,” Sean Sawyer said.

The project would be the first in Virginia for DC Blox, which has developed data centers in Tennessee, South Carolina and Alabama, and has others in the works in North Carolina and Georgia.

Chris Gatch, executive vice president and chief revenue officer for DC Blox, said the company zeroed in on the Henrico site through a standard property search and reached out to BWS. He said the company likes the site for its connectivity to Dominion Energy’s power grid and its separation from other parts of the county where data center development has been more prevalent.

“Richmond’s had a lot of upward trends as a data center market,” Gatch said. “Our anchor customer that we’re building the initial building for, their application is more of a network application, so part of what took us up in that direction and away from a lot of the data center development that is more south near the airport is achieving some diversification from that area.”

Gatch wouldn’t identify the project’s anchor tenant but said it would fill a 10-megawatt data center to be housed in an initial 70,000-square-foot building.

A second, 40-megawatt data center could follow, though Gatch said that part of the project is to be determined.

“It ultimately will depend on what fits on the site and what we can get power for,” he said.

If built, the second building could total about 125,000 square feet, Gatch said. He projected the cost of the first building at $100 million and the second building at $400 million, for a total potential development value of $500 million.

A site plan shows 14 acres designated for data center development and 8 acres near the intersection designated for commercial use.

The one- or two-story structures would be built on a 14-acre portion of the site, on the west side of the adjacent CubeSmart self-storage facility. If the rezoning is approved, DC Blox would purchase the site and start the first building in two years, Gatch said. Building heights would be restricted to 75 feet.

Roughly 8 acres closer to Azalea and Wilkinson are planned for commercial development, which Gatch said would provide a transitional buffer between the data center use and residential neighborhoods across Wilkinson.

“We’ve been working with the county to leave part of that site at the intersection as B-3 and put it back on the market for commercial development,” Gatch said. The rest of the land would be left undeveloped.

It isn’t clear what would happen with the flea market if the project goes forward. Sawyer, who said the market has been held there since the 1980s, said any decision on continued use of the property would be up to DC Blox once it owns it. Gatch said he did not know of any discussions about the fate of the market.

The rezoning would change the site from B-3 Business District to B-3C Conditional Business District for the 8-acre portion and M-1C Light Industrial District Conditional for about 19 acres. The group is working with local attorney Andy Condlin with Roth Jackson Gibbons Condlin on the request.

Gatch said the existing B-3 zoning allows data centers but the light industrial zoning would be preferable for the project.

“Both of those zoning designations allow for data centers by right, but the B-3 has some restrictions on development methodology that creates challenges with economics. That’s why we were trying to rezone part of the site to M-1, to be consistent with the bulk of the property that is around that location,” he said.

The Henrico Planning Commission was scheduled to consider the request at its meeting Thursday (today), but Condlin said they are requesting a deferral to next month’s meeting. He said the time would allow them to respond to neighbors’ comments.

Data center development has picked up in Henrico and across the state in recent years.

In May, Henrico supervisors approved zoning for a 600-acre development southeast of the Interstate 64-295 interchange, and launched a $60 million housing trust fund to be supported by revenues from data center projects. QTS Data Centers purchased the acreage last month from local development firm Hourigan for nearly $119 million.

Meanwhile, in Chesterfield County, BWS continues to work on Midlothian West, a years-in-the-making mixed-use development proposed for land it owns along Otterdale Road south of Midlothian Turnpike.

BWS has proposed up to 445 residential units, including apartments and townhomes, and a retail area. Main Street Homes has signed on to build the townhomes.

Sawyer said the firm continues to work with Chesterfield planning staff and the Virginia Department of Transportation to finish plans for the project, a timeframe for which has not been provided.

Hope it fails. I love that flea market.

That’s likely. Demand for data centers is really tanking.

Really, that’sinteresting. I’d like to read up on this. Can you post some sources?

Everything I have seen shows the opposite that Data Centers are growing at a 10-15% rate year over year and with it the demand for power to run them.

Sources: CBRE

https://www.cbre.com/insights/books/us-real-estate-market-outlook-2024/data-centers

Forbes

https://www.forbes.com/councils/forbestechcouncil/2024/01/22/five-trends-driving-the-booming-data-center-economy-in-2024-and-why-investors-are-taking-notice/

Goldmansachs

https://www.goldmansachs.com/insights/articles/AI-poised-to-drive-160-increase-in-power-demand

Would love the source showing the Demand for data center tanking?

I believe that “tanking” comment was sarcasm.

Yeah, that sounds very interesting if true, or a lie if it isn’t.

Sarcasm kids, Sarcasm.

I didn’t think I needed to state the reality of data centers compared to flea markets in 2024.

All that these data centers manage to do is vacuum up water and energy/electricity. Time to start forcing them to pay exorbitant rates.

Or forcing them to make solar roofs- I dont’ know why there’re not doin that already.

because it’s not clear it’s a good idea? The track record of this kind of micro management is exceedingly awful, and we need to recognize that as a society