Three years after filing for demolition permits for the site, a local developer’s assemblage of derelict buildings in the Museum District may finally see the wrecking ball before year’s end.

Steve Leibovic says he’s moving ahead with razing the vacant, graffiti-covered buildings at 2901-2923 W. Broad St.

The buildings, most of which were one-time home to Gusti Restaurant Equipment & Supply, have sat dormant since the Gusti family relocated their business a few miles west in 2019. The structures have fallen into disrepair in the years since.

Shortly after Gusti moved out, Leibovic bought the roughly 2-acre plot for $5 million, and in 2021 he began planning to redevelop the site. But work never got underway.

Now, Leibovic said he’s planning to finally have the buildings razed by the end of the year. S.B. Cox Inc. is the demolition contractor for the project.

“I think getting the buildings demoed will be a real plus for the community,” Leibovic said.

Once demolition is complete, the lot is likely to lay fallow for a bit longer as Leibovic said he’s still working on redevelopment plans for the site, which will likely involve a mix of uses, including apartments.

“We’re waiting, number one, for interest rates to come down and number two, for all of the many, many apartments going up in the area to be filled up so we don’t open up into a saturated market,” he said. “Those are really the two big considerations that we are looking at right now which will impose somewhat of a delay.”

Leibovic said high interest rates and inflation were what initially delayed the site’s redevelopment. He said he thinks things are getting better on that front, but that the incoming Trump administration’s policies may change that.

“We’re certainly going in the right direction with inflation (but) I’m skeptical about the inflationary pressures that are going to be added with increasing deficits and tariffs under the incoming administration,” he said. “But we’ll have to wait and see how that plays out.”

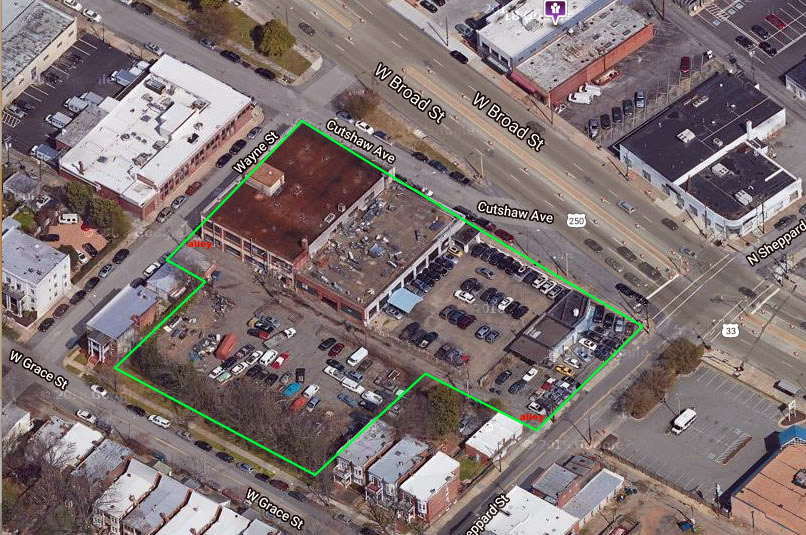

Leibovic is working with Poole & Poole Architecture on planning the development. The plot, which is spread across nearly a dozen individual parcels and has frontage along Grace, Sheppard, Wayne and Broad streets, is zoned TOD-1, which allows for mixed-use buildings up to 12 stories.

Catty-corner to the Leibovic parcel is the recently completed Soda Flats building. The seven-story building from Bank Street Advisors has 89 apartments plus commercial space.

A few blocks west along Broad Street is another vacant building, 3501 W. Broad St., which was once a Wells Fargo branch. That parcel, which also sits on nearly two acres, sold in recent weeks to Thalhimer Realty Partners for $4 million.

Three years after filing for demolition permits for the site, a local developer’s assemblage of derelict buildings in the Museum District may finally see the wrecking ball before year’s end.

Steve Leibovic says he’s moving ahead with razing the vacant, graffiti-covered buildings at 2901-2923 W. Broad St.

The buildings, most of which were one-time home to Gusti Restaurant Equipment & Supply, have sat dormant since the Gusti family relocated their business a few miles west in 2019. The structures have fallen into disrepair in the years since.

Shortly after Gusti moved out, Leibovic bought the roughly 2-acre plot for $5 million, and in 2021 he began planning to redevelop the site. But work never got underway.

Now, Leibovic said he’s planning to finally have the buildings razed by the end of the year. S.B. Cox Inc. is the demolition contractor for the project.

“I think getting the buildings demoed will be a real plus for the community,” Leibovic said.

Once demolition is complete, the lot is likely to lay fallow for a bit longer as Leibovic said he’s still working on redevelopment plans for the site, which will likely involve a mix of uses, including apartments.

“We’re waiting, number one, for interest rates to come down and number two, for all of the many, many apartments going up in the area to be filled up so we don’t open up into a saturated market,” he said. “Those are really the two big considerations that we are looking at right now which will impose somewhat of a delay.”

Leibovic said high interest rates and inflation were what initially delayed the site’s redevelopment. He said he thinks things are getting better on that front, but that the incoming Trump administration’s policies may change that.

“We’re certainly going in the right direction with inflation (but) I’m skeptical about the inflationary pressures that are going to be added with increasing deficits and tariffs under the incoming administration,” he said. “But we’ll have to wait and see how that plays out.”

Leibovic is working with Poole & Poole Architecture on planning the development. The plot, which is spread across nearly a dozen individual parcels and has frontage along Grace, Sheppard, Wayne and Broad streets, is zoned TOD-1, which allows for mixed-use buildings up to 12 stories.

Catty-corner to the Leibovic parcel is the recently completed Soda Flats building. The seven-story building from Bank Street Advisors has 89 apartments plus commercial space.

A few blocks west along Broad Street is another vacant building, 3501 W. Broad St., which was once a Wells Fargo branch. That parcel, which also sits on nearly two acres, sold in recent weeks to Thalhimer Realty Partners for $4 million.

No doubt, Steve, the community will appreciate the removal of that eyesore. There could be some pressures on inflation if Trump pushes forward his promise of tariffs, as well on labor availability if he deports vast numbers of illegal construction workers. I look forward to seeing you build there.

Respectfully, that is not inflation. Inflation the result of monetary policy that expands the money supply via printing or credit. The Fed lowering interest rates is more “inflationary” than the fiscal policy of deporting undocumented workers or placing tariffs on goods we import. Trump’s stated fiscal policy of higher tariffs and aggressive deportations could drive prices higher and that would look the same to end users. The possible silver lining is that tariffs are designed to offset tax cuts which should cap the impact. Additionally, tariffs can be avoided by moving production back to the USA. Like most parts of… Read more »

Inflation is people paying more for things than they used to – this is the way most people think and vote.

Thank you for the nuance and also admitting that this is complicated territory even for economists.

The idea that tariffs will somehow “force” companies to move production back to the U.S. looks good on paper – but in reality, it is anything but a sure thing. I was reading recently that one manufacturer (I forget the company and product(s)) has a plan in place to get around the higher, punitive tariffs on their items produced in China. They will simply move production of those products intended for export to the U.S. over to facilities in either Mexico, Brazil or India, where even if across-the-board tariffs are put in place, they will be significantly lower that what… Read more »

Listen to Bruce. He has a stellar track record.

I’m glad this is finally coming down, it’s really become an eyesore

I wouldn’t trust anyone doing the right thing that has let this property linger so long in this condition while blaming others for his lack of executing a plan when his attempt to time the markets is the real reason for inaction. By the way- market timing often doesn’t succeed.

How much do you think the City has made the owner pay in fines for lack of upkeep? Broken windows, unsecured doors, graffiti, trash, unhoused encampments with open fires, assaults nearby. It’s enabled with lax enforcement. Lack of action enabled by the City.

I get the waiting for interest rates, but as for the other apartments I think the best way to resolve this is to set your product apart. If you are putting the same thing on the market as everything else then sure wait for the absorption to catch up, but chances are if you wait there will still be projects you need to compete with. So, make your project stand out from the rest and you should have much less of a problem no matter when you go forward.

The Otis is proof of your point. It stands out and the rents there are the highest in the area. A three bedroom two story unit nets $4700 per month! Remember hearing that Tax Opportunity Zones would produce affordable housing? The Otis is in such a zone. It proves an axiom that there is always room at the top!

““I think getting the buildings demoed will be a real plus for the community” Uhh, ya think? Glad to hear about the demolition moving forward but this owner should be shamed for allowing this eyesore on a prominent corner to continue to deteriorate over the past fews years.

Not sure what the excitement is about it will go from a derelict, graffiti, covered building with trash blown vacant block to an overgrown, weed filled (probably see some car dumping) trash blown vacant lot. I wonder if like the Dominion site it will sit fenced off, sidewalks blocked, for a couple of years.

Almost every developer is waiting for rates to fall, and when (if) they do, they will all rush to start at the same time – causing a potential spike in construction costs, which could make any interest rate deduction mute. Those that do get started will be competing with each other to lease up at the same time.

On the other hand, any developer starting construction on apartments now will basically have the market to themselves when their units open up.

We’re already seeing this rapid ramp-up in stalled development taking place in Manchester where several large projects have started moving forward more-or-less simultaneously. Particularly with new federal economic policies potentially looming, developers looking to get a jump on the competition are getting out there as quickly as possible with their projects before increased costs, supply problems, labor shortages, etc., make it extremely difficult — if not impossible — to get rolling.

So many of these new apartments are not full,young kids will jump from one apartment to another,for the life of me I can’t understand why they are building so many apartments, could be wrong but this will be interesting to see in 5 years..

Maybe, just maybe, they will need these apts. for their citizens living in public housing when they demolish the projects for redevelopment. Just a guess.

they aren’t empty. The vacancy rate is really low. That’s why they are building more.

Where do you think people will live if they can’t afford a home? The majority of the population cannot afford to buy and it won’t get better any time soon.

the solution is to relax zoning, improve the permitting process, and make it legal to build more housing.