Tang & Biscuit Shuffleboard Social Club has abruptly closed at 3406 W. Moore St. in Scott’s Addition.

The company announced the closure Wednesday evening, just hours after BizSense reported that its building, as well as the neighboring, former Dairy Bar building at 1600 Roseneath Road, are being eyed by local firm Capital Square for residential redevelopment.

Named for the equipment needed to play shuffleboard, Tang & Biscuit was owned by a group including Dominion Payroll co-founders Dave Gallagher and David Fratkin, who did not respond to multiple requests for comment Thursday.

Fratkin and Gallagher also were behind Biscuits & Gravy, a diner that opened in the former Dairy Bar space last year. That, too, suddenly closed in recent weeks.

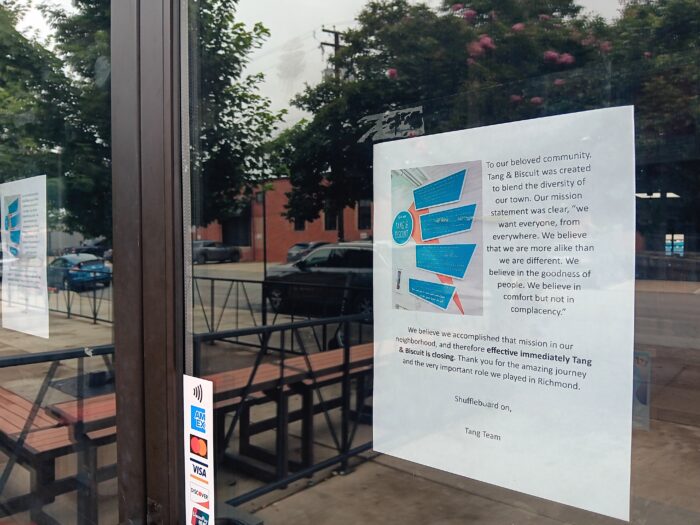

On Thursday, Tang & Biscuit posted a message on social media in which it tried to explain its reason for closing, stating that the business was “created to blend the diversity of our town” and that “we believe we accomplished that mission in our neighborhood, and therefore effective immediately Tang & Biscuit is closing.”

However, an operations manager for Tang & Biscuit told CBS6 Thursday that the reports of the property’s future redevelopment contributed to the owners’ decision to close down.

Fratkin and Gallagher’s group still owns Tang & Biscuit’s real estate, and it’s unclear whether they’re under contract to sell the site to Capital Square or if they’d be equity partners in the planned redevelopment of the sites.

Capital Square spokespeople declined to comment for this story.

Details around what the redevelopment of the sites might look like are scant, and it’s unclear who still has a stake in Tang & Biscuit’s real estate, however there may be overlap between the group that owns Tang & Biscuit’s building and land and the entity that bought the Dairy Bar building last year for $7 million.

In addition to Fratkin and Gallagher, the group that bought Tang & Biscuit’s real estate for $1.7 million in 2017 and opened the concept a year later included real estate broker Clint Greene and developer Henry Shield.

Shield is a partner at Stanley Shield Partnership, a local development firm that has completed both office and mixed-use projects in recent years. The entity that bought the Dairy Bar building at 1600 Roseneath Road last year was tied to Jimmy Stanley, a partner at Stanley Shield.

Henry Shield declined to comment, and Jimmy Stanley wasn’t available for comment by press time.

Tang & Biscuit opened in 2018 amid a swath of new businesses that combined food-and-drink concepts with entertainment venues.

Others to open in the late 2010s include River City Roll, Bingo Beer Co., Slingshot Social Game Club, and The Circuit Arcade Bar, the last of which faces an unclear future as The Circuit’s building recently sold to a local development firm for nearly $4 million.

Tang & Biscuit Shuffleboard Social Club has abruptly closed at 3406 W. Moore St. in Scott’s Addition.

The company announced the closure Wednesday evening, just hours after BizSense reported that its building, as well as the neighboring, former Dairy Bar building at 1600 Roseneath Road, are being eyed by local firm Capital Square for residential redevelopment.

Named for the equipment needed to play shuffleboard, Tang & Biscuit was owned by a group including Dominion Payroll co-founders Dave Gallagher and David Fratkin, who did not respond to multiple requests for comment Thursday.

Fratkin and Gallagher also were behind Biscuits & Gravy, a diner that opened in the former Dairy Bar space last year. That, too, suddenly closed in recent weeks.

On Thursday, Tang & Biscuit posted a message on social media in which it tried to explain its reason for closing, stating that the business was “created to blend the diversity of our town” and that “we believe we accomplished that mission in our neighborhood, and therefore effective immediately Tang & Biscuit is closing.”

However, an operations manager for Tang & Biscuit told CBS6 Thursday that the reports of the property’s future redevelopment contributed to the owners’ decision to close down.

Fratkin and Gallagher’s group still owns Tang & Biscuit’s real estate, and it’s unclear whether they’re under contract to sell the site to Capital Square or if they’d be equity partners in the planned redevelopment of the sites.

Capital Square spokespeople declined to comment for this story.

Details around what the redevelopment of the sites might look like are scant, and it’s unclear who still has a stake in Tang & Biscuit’s real estate, however there may be overlap between the group that owns Tang & Biscuit’s building and land and the entity that bought the Dairy Bar building last year for $7 million.

In addition to Fratkin and Gallagher, the group that bought Tang & Biscuit’s real estate for $1.7 million in 2017 and opened the concept a year later included real estate broker Clint Greene and developer Henry Shield.

Shield is a partner at Stanley Shield Partnership, a local development firm that has completed both office and mixed-use projects in recent years. The entity that bought the Dairy Bar building at 1600 Roseneath Road last year was tied to Jimmy Stanley, a partner at Stanley Shield.

Henry Shield declined to comment, and Jimmy Stanley wasn’t available for comment by press time.

Tang & Biscuit opened in 2018 amid a swath of new businesses that combined food-and-drink concepts with entertainment venues.

Others to open in the late 2010s include River City Roll, Bingo Beer Co., Slingshot Social Game Club, and The Circuit Arcade Bar, the last of which faces an unclear future as The Circuit’s building recently sold to a local development firm for nearly $4 million.

It’s a shame they closed up so fast given redevelopment has to be many months down the road. I always enjoyed playing shuffleboard at Tang and Biscuit, and they seemed well run.

Something smells odd here. Any future development would be many months in the future. This seems like a convenient excuse to close, not a reason. I’d be interested to hear an explanation from the establishments ownership, given the adverse effects on staff and those who had planned events scheduled for the near future.

I agree with Justin, I thought the place was well run. I read in another article’s posts about it being common practice for bar owners to abruptly close due to the risk of theft and reduce possible property destruction. It is rather mean from an employee standpoint, but I understand the reasoning from an employer POV. At least the employees will be able to find other similar employment at will.

People don’t like your theory. Let’s see if they like THIS theory: The business owners got bought out of their lease.

A guy I went to school with owns a business in Brooklyn called Heights Chiropractic — he rented a floor in a smallish build in a neighborhood that attracted a LOT of re-development higher and the owner made him an offer he couldn’t refuse and he reopened in a better space nearby.

It sounds like someone offered the owners more money than they could pass up. I don’t have any data to support what I’m about to say but I assume that housing development is worth more in the immediate future than perhaps running a bar? The money the owners will receive for that property from housing developers probably far exceeds what they expected to earn over the next several years to a decade. I’m sure they were placed in a situation where the buyer wanted the business closed immediately instead of renting it back to the Tang & Biscuit owners. All… Read more »

Jay—That’s unrelated to the topic of: why close now? Most new owners would attempt keeping around existing businesses with a lower rental rate simply to keep money coming in the door while they get ducks in a row for redevelopment. Instead, For the next several months we will have over half a block of vacant space that was 100% utilized. It’s possible Tang and Biscuit and Biscuits and Gravy were not very profitable and the owners were operating them at small profit margins until they could sell the property.

Justin-read my first line and my last line. It’s absolutely related. If some housing developer came in and offered an amount of money the current owners didn’t foresee making through a bar/entertainment venue then that is why they could have chosen to abruptly close. A housing developer would not be interested in maintaining an entertainment venture. A stipulation of the sale was likely to close down the business. This entity was clearly not sold for the business but for the property/location.

It feels like the ratio of housing to commerce is skewing toward housing. There are over ~2,500 apartment or condo units under construction or in the planning phase in Scott’s Addition over to Hardywood (on top of what has already been completed). To swap another business for yet more housing seems to further throw the ecosystem out of balance.

Agreed. Waiting to hear about a grocery store. They are going to need one. It’s overdue.

For now Aldi right there on Boulevard fills the grocery spot. Manchester is in much more dire need of a grocery store than Scott’s Addition.

It’s on the books for 1000 Semmes. Coming soon the most important mixed use campus in Richmond history!

There is a Whole Foods, two Krogers, an Aldi and a Lidl all within a few miles. It may not get better than that. I think the convenience markets (Stellas and Scott’s Provisions) will be it for immediate shopping within the neighborhood, although technically, the Aldi and Whole Foods are in Scott’s Addition now. I’m sure something will come to the Diamond property as well.

Perhaps there’ll be one in the Diamond District but within a 1.5 mile radius of Roseneath and Broad, there are five grocers: Kroger, Publics, Elwood Thompsons, Fresh market and Whole Foods. Markets like Stella’s fill the void for the hungry who cannot drive that distance. Find me another area with so many food choices! ( I just looked at comments below and had forgotten Aldis and Lidle.)

Thank you for countering this extra crazy example of the Food Desert trope. There may not be a supermarket you can accidentally trip into in Scotts’ but there are many that are a bike ride away, like almost ALL neighborhoods if they are lucky — Scotts is adjacent to the most OVER grocered neighborhood in one of the most over grocered metros in the USA. Yet people have been taught to complain here — somehow, if an area is “urban” (Which I learned even means suburban in this context) there must be a grocery story in walking distance for some… Read more »

Most people shop online now and Scott’s Addition doesn’t exist within a vacuum—there are hundreds of businesses up and down West Broad St. We also have more restaurants per capita than most localities in Virginia. Keep in mind Richmond once had a population well above what it is now so to suggest we are at max capacity for housing vs. businesses is pretty far fetched.

I hope that they are able to work out something where they can recreate the use or a similar use as part of the new development. Maybe if they can get in at the ground floor (pun intended) of the development the space they get can be even better than the one they have.

Well, even though I am not “hoping” for anything (except maybe for some more greenspace in Scotts) I agree that it very well COULD be that in Scotts it MIGHT benefit them to build some kind of flex space that would be a cool use like this, but able to be made into residential if it eventually becomes hard to rent as commercial. Many developers do this these days. I taught my daughter, who likes Carytown (she thinks Scotts looks like a dangerous neighborhood) that that those blocks were some of many worldwide that were originally residential and at some… Read more »